ETFs: A Beginner's Guide

Written by Catherine & Jobie on 2020-11-27

ETFs. Mutual funds. Index funds. You’ve probably heard these terms get thrown around a lot during these couple of months, and most of you might have expressed some confusion over their meanings. We understand that investing can be complicated and intimidating at times, especially for beginners, so we’ve created a beginner-friendly explanation of ETFs just for you!

In simple terms, what is an ETF?

Exchange-traded funds, ETFs for short, are one of the most popular investment vehicles in the financial markets. An ETF is an investment fund that’s similar to a large basket that holds a variety of financial instruments; think corporate shares or government and corporate bonds. Because ETFs are so diverse in their holdings, purchasing one ETF allows you to hold a large variety of financial investments with one purchase.

ETFs trade like individual stocks, so you can buy and sell ETF shares during any point in a trading day at a specific market price. When you purchase shares of an ETF, you are essentially investing in the underlying investments within that ETF. These investments typically consist of stocks, bonds, or a mixture of the two.

Think of an ETF as an investment hotpot that holds together the component ingredients of the meal. Instead of meat, lettuce, seafood, dumplings and noodles, these pots are filled with stocks or bonds. From the perspective of an investor like yourself, buying one share of an ETF is much like buying into several small portions packaged nicely together.

Why should investors look into ETFs?

One of the major advantages of buying an ETF share is the benefit of diversity. Having a diverse portfolio is one of the three golden rules of investing that we can never stress enough of. Diversification is the most important component of reaching your long-term financial goals while minimizing risks along the way.

Most ETFs are passive, which means that they track movements in the financial markets. In simple terms: if the market does well, the ETF performs well. Unlike mutual funds however, there is no active manager trying to manage these funds to beat the market. The lack of a personal touch, in turn, makes an ETF less costly.

Moreover, since ETFs are traded like individual stocks, ETF share prices change throughout the day – investors have greater flexibility in buying and selling shares. ETFs also offer more transparency as they may offer more up-to-date information about what’s in them than mutual funds. Many ETF providers disclose their public holdings every day, while mutual funds are only required to disclose their holdings quarterly.

What are the indexes that track the markets?

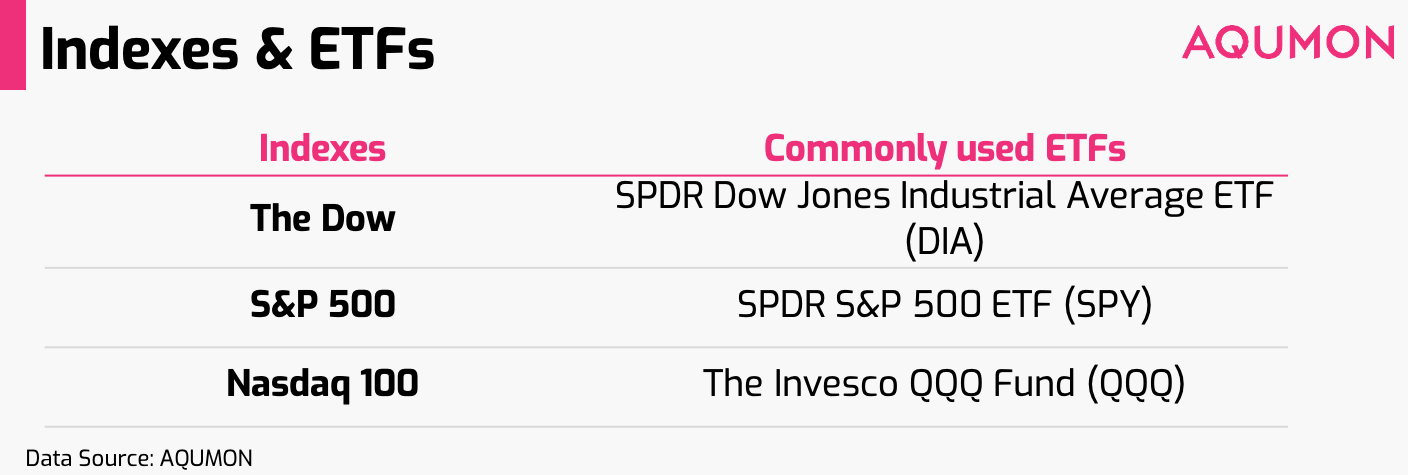

Investing can be a little daunting for first-time investors, so we have listed out three commonly purchased ETFs that track several US stock market indexes for you. These ETFs are passively-managed funds that simply mirror their respective indexes.

Not sure which ETFs to purchase? Try out AQUMON’s robo advisor! It recommends the most suitable ETF investment portfolio for you based on your risk tolerance level and investment preferences.

AQUMON also monitors your globally diversified ETF investment portfolio 24/7, making investing an effortless experience for you. Download our app to experience more!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.