【Product Upgrade】US Stock Trading is Live!

Written by AQUMON Team on 2021-07-15

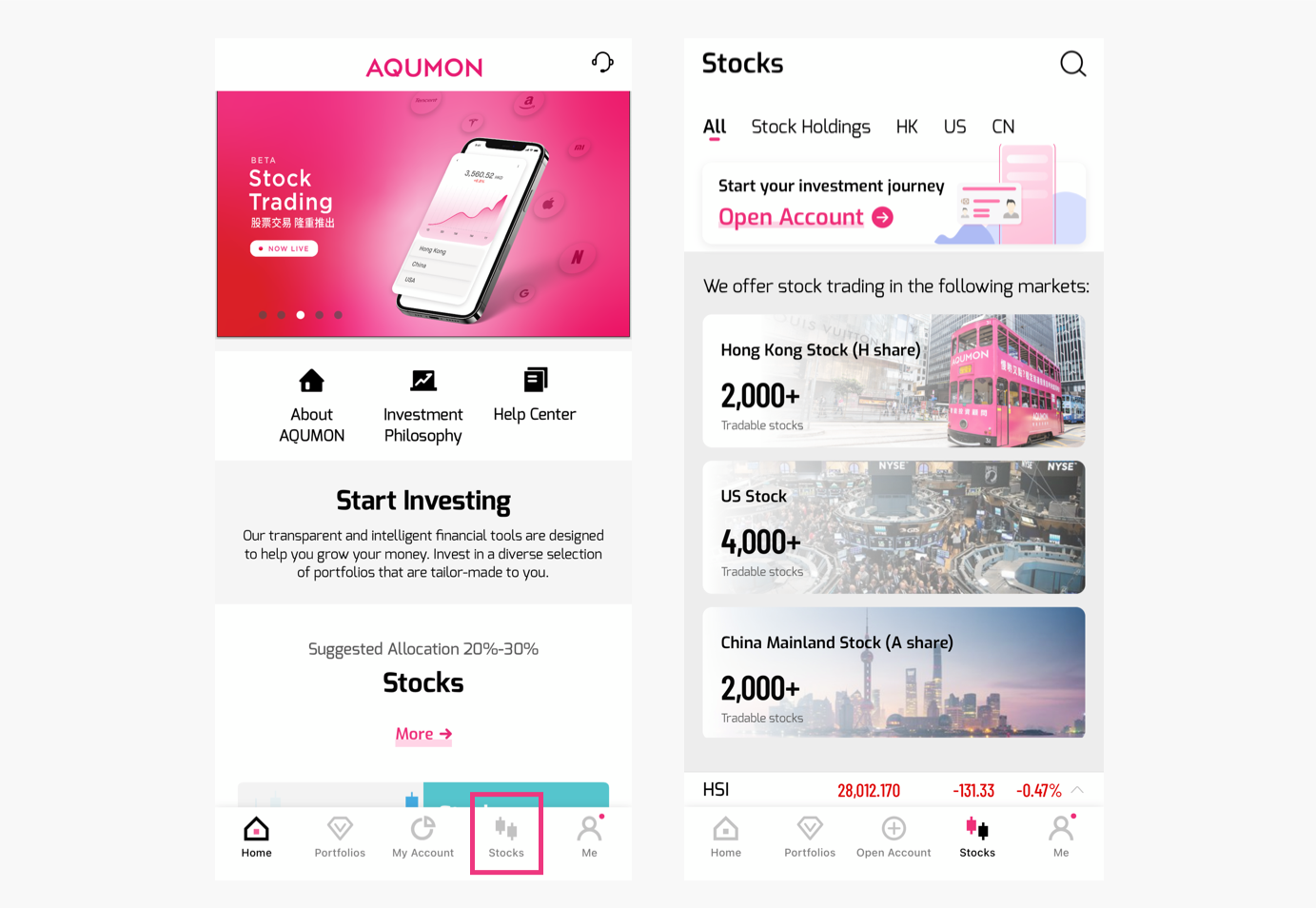

After launching our stock trading Beta upgrade on June 30th, allowing our clients to immediately invest into Hong Kong and China (A-share) stocks, we have more good news that US stock trading (Beta version) is available to all AQUMON’s clients (July 16th, Friday)!

Extended Reading: Introducing our New Stock Trading Function

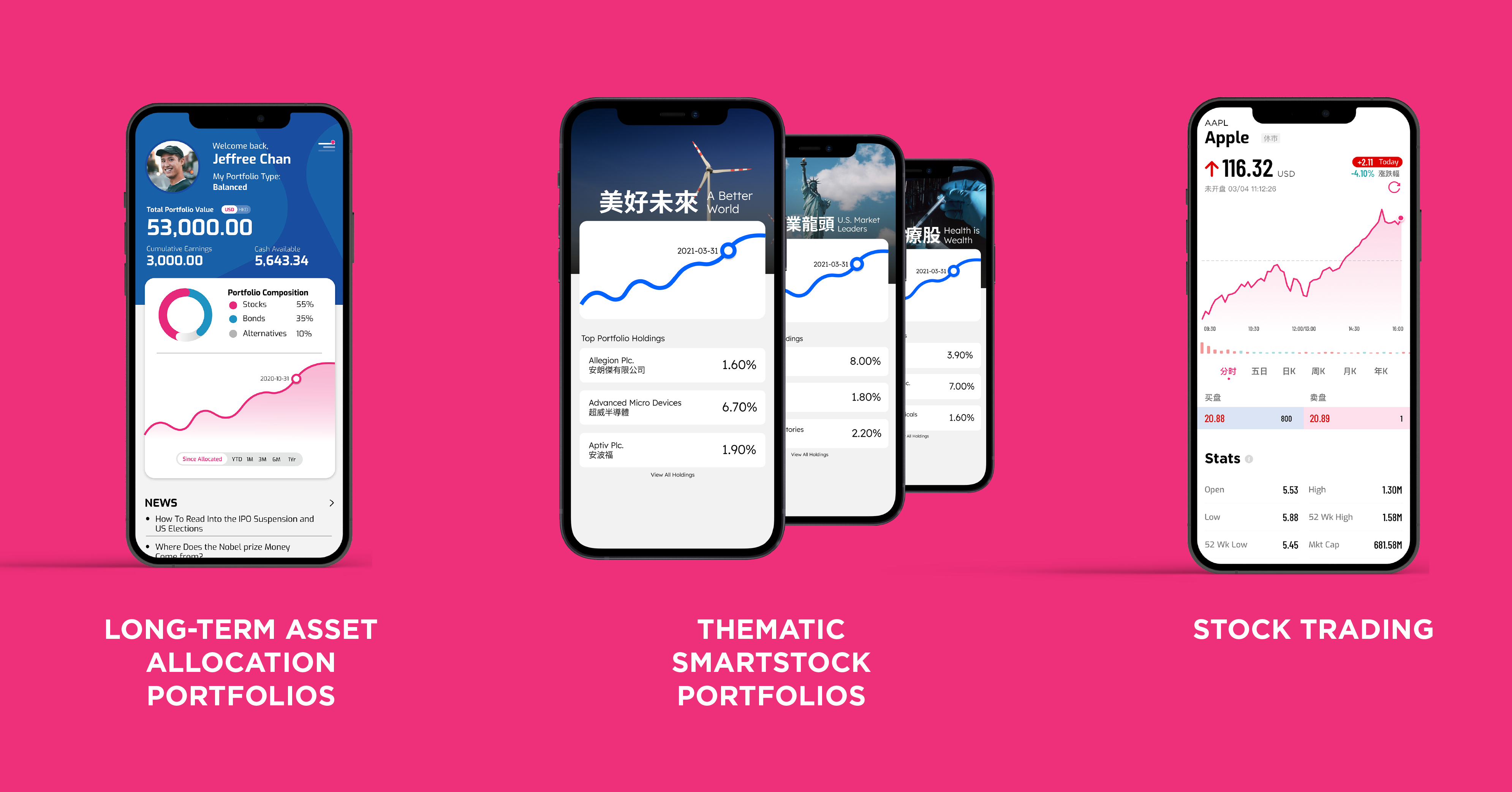

With this new stock trading feature, AQUMON is now one step closer to being Asia’s first all-in-one digital wealth management platform! From long-term asset allocations, medium-term thematic portfolio investments to short-term individual stock trades, AQUMON can cater to your entire investment journey.

Extended Reading: Diversified Investment Solutions

Why Trade US Stocks?

Lower investment minimums: Investment minimums for US stocks are much lower than Hong Kong or China (A-share stocks).

Take for example Hong Kong stock HSBC (5HK) which requires investors to trade at least a minimum lot size of 400. This means at HK$43 per share the investment minimum for HSBC shares is HK$17,200 ($43 per share x lot size of 400).

In comparison US stocks can be traded in single shares so if you wanted to invest in Apple (AAPL) the investment minimum is just US$145 (~HK$1,124).

So for as little as HK$5,000 (or less) investors can invest into highly popular stocks on AQUMON’s mobile app like Netflix (NFLX), Microsoft (MSFT), JP Morgan Chase (JPM) and many more!

More stocks to choose from: There are currently close to 6,000 stocks to choose from listed in the New York and Nasdaq Stock Exchange in comparison over 2,500 in Hong Kong Stock Exchange and over 2,700 via the Stock Connect. So using AQUMON’s mobile app you now get access to over 10,000 stocks!

More ‘flexible’ trading hours: We understand many of our clients may be busy during working hours so from a trading hours perspective US stocks are quite attractive for Hong Kong investors (you can now trade after work hours!).

Investors should be aware there is daylight savings in the US. In the summer, trading hours are between 9:30pm to 4:00am Hong Kong time. In the winter it is 1 hour later from 10:30pm to 5:00am Hong Kong time.

Exemption from US profits tax: When you declare you are foreigner in your W-8BEN form you will not be required to pay investment income tax unlike US nationals. Cha-ching!

Why Trade with AQUMON?

-

Intelligent recommendation system that auto-suggests stocks based on user preferences

-

24/7 instant foreign exchange supporting multiple currencies

-

Trade coverage over several major investment markets: Hong Kong, Chinese A-share and now US stocks!

Place a Stock Trade and Get HK$50

Your first few trades are ‘free’: Best yet, for first time investors in our AQUMON stock trading platform, we offer a HK$50 cash reward(*T&C applied) so for US stock trading your first 2-3 stock trades are on us! Offer lasts until July 31st so act fast!

At AQUMON we feel this further empowers our clients, through technology, to solve their investment needs all on one platform. There will be more platform upgrades coming ahead so keep a watch out!

What are you waiting for? Download or upgrade your AQUMON app now to use our new stock trading service (Beta)!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.