2024 年第一季度組合投資表現回顧

由 AQUMON Team 撰寫於 2024-05-02

2024年第一季全球金融市場重點

2024年第一季度全球金融市場出現了重大發展。以下是主要亮點:

2024年初,美國股市持續上漲。即使利率長期保持較高的威脅並未擾亂其穩健表現。儘管預計2024年聯邦儲備系統不會再進行利率削減,但股市在第一季度表現出色,獲得了超過10%的回報。科技股引領了市場上漲,特別是那些被認為最有可能從人工智能繁榮中受益的公司。價值股也參與了上漲行情。與此同時,由於聯邦儲備系統可能將利率削減推遲到年中,債券市場的表現受到了打擊。

2024年第一季度,中國國內生產總值達到29.63萬億人民幣,同比增長5.3%,經過恆定價格調整,環比增長1.6%。這種增長超出了預期,可以歸因於關鍵制造業和服務業的強勁產出和活動。因此,中國有望實現年度經濟增長目標。值得注意的是,經濟的各個領域,如外貿和外資、民營企業的增加值輸出,在1月至3月期間持續恢復,經歷了長時間的低增長期後。

香港股市經歷了波動,恒生指數下跌了3%。市場在3月份出現了回升的跡象,交易活躍度增加,重要公司公布了年度業績報告。原材料板塊表現良好,而醫療保健和房地產板塊表現較弱。

AQUMON的投資組合表現如何?

受益於美國股市良好的狀態,我們的投資組合「美好未來」成功地利用了市場的上漲。在2024年第一季度,儘管標普500指數增長了10.16%,我們的投資組合表現更出色,增長了10.73%,超越市場0.57%。

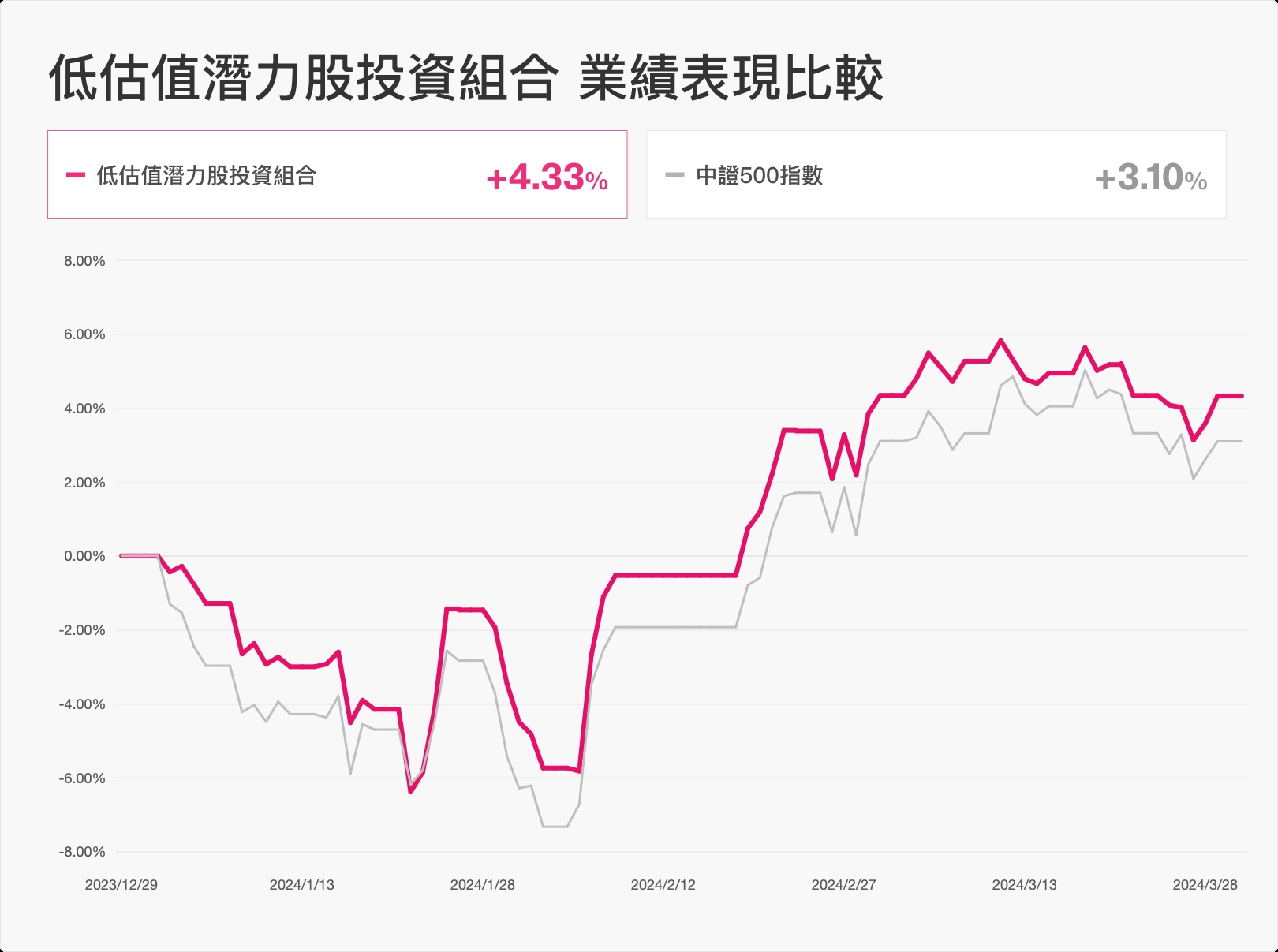

同樣地,在中國市場上,我們的「低估值潛力股」投資組合也超越了中證500指數。在2024年第一季度,儘管中證500指數增長了3.10%,我們的投資組合卻實現了卓越的4.33%增長,超越市場1.23%。

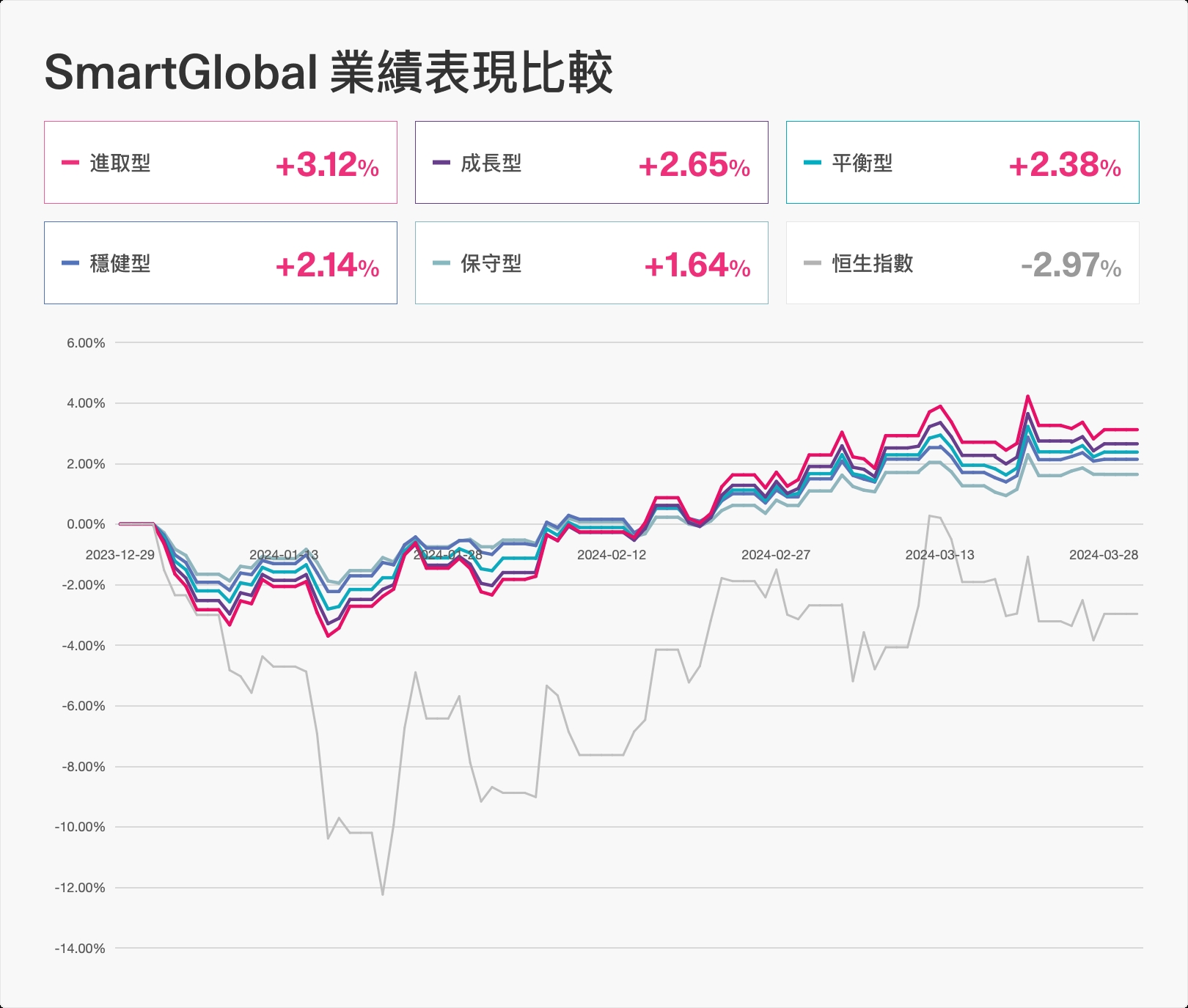

儘管香港股市面臨著嚴峻的挑戰,我們的旗艦投資組合SmartGlobal 始終能夠穩定地實現卓越的收益。在2024年第一季度,儘管恒生指數下跌了-2.97%,我們的投資組合,在選定的風險水平下,始終表現優於市場,實現了正向收益。

第二季市場展望

出人意料的是,經濟在第一季度不僅成功避免了衰退,而且表現比最初預期的更強勁。然而,對通脹的擔憂仍然存在。展望第二季度,由於聯邦儲備系統準備進行即將到來的降息,人們對前景更加樂觀。市場參與者對這些降息的時間和節奏有了更現實的預期。

聯邦儲備系統降息的預期時間表已延後至至少六月。最初,投資者預計2024年可能有五次降息,但目前的預期表明,最多只有三次降息。

中國今年確定了約5%的經濟增長目標。然而,對於應對房地產危機和刺激消費的具體措施,目前掌握的信息有限,引發了批評。儘管如此,越來越多的投資者認為中國的刺激措施開始對實際經濟表現產生積極影響。在第二季度,由於中國經濟數據預計進一步改善,以及對美國降息預期的增加,恒生指數有可能測試18000點的水平。

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximize their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.