Invest with a Buddhist-Style Mindset

Written by Catherine on 2020-04-27

With Buddah’s Birthday coming up (Thursday), you probably can’t wait to relax and enjoy your long weekend? It’s definitely time to take a break from the hustle-and bustle of your work life and recharge.

This got us thinking, can we take a ‘Buddist-style’ approach with our investments as well?

Sze Sing Fai (施昇輝), a best-selling author of "Buddhist-style Asset Management (佛系理財)" in Taiwan said, "In life, investment and financial management should be as simple as possible, because you have too many other problems to handle in life."

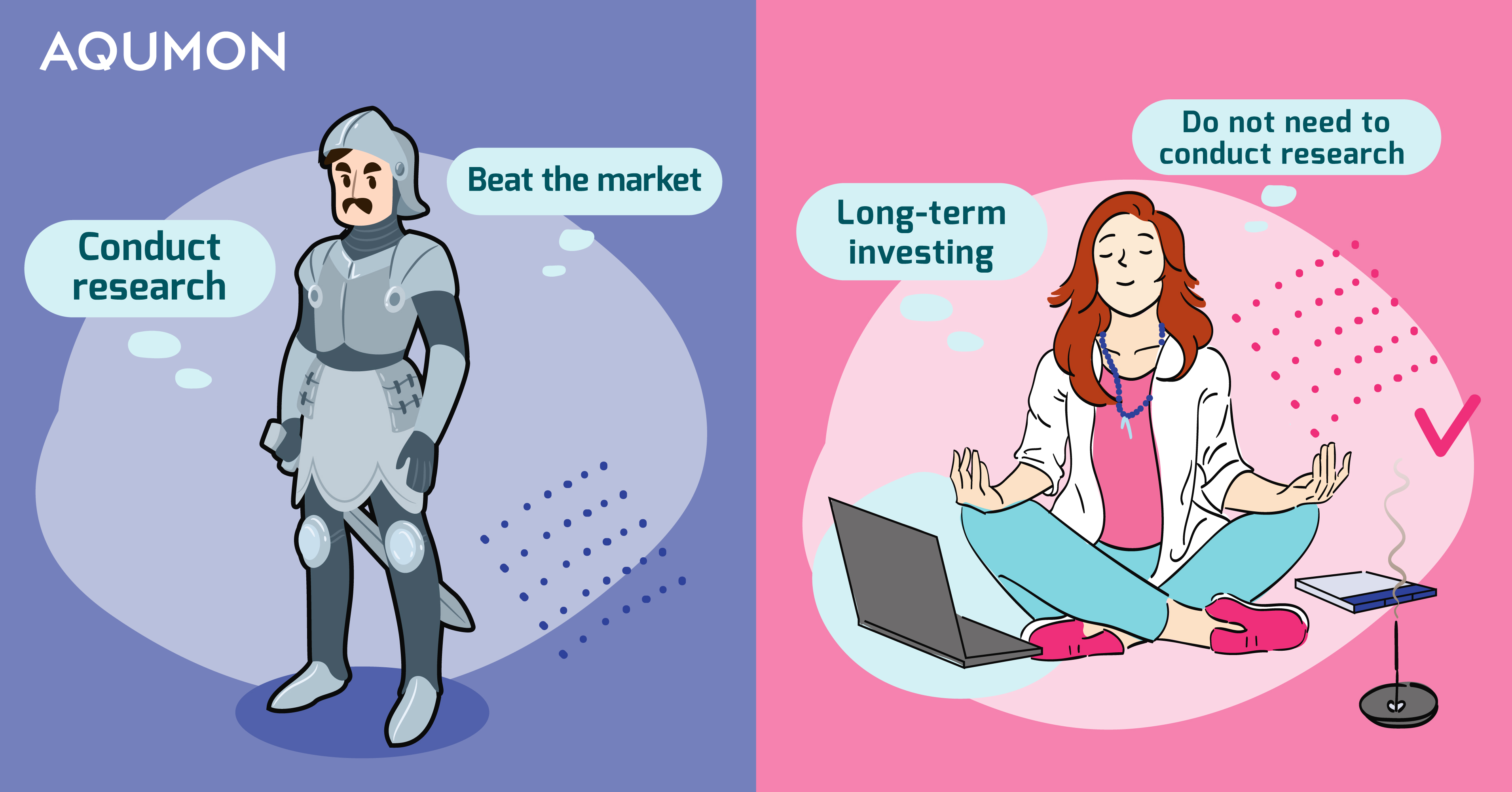

Are you eager to adopt an approach which gives you the greatest cost vs return benefits? When it comes to investing, which type of investor are you? Active or passive investing?

Let’s take a look into this together.

Sometimes, it is wise to remain unchanged

We saw an interesting article on the Wall Street Journal titled:

"What does a US$35 billion fund manager do every day? The answer is nothing"

Steve Edmundson, an Investment Officer at the Public Employees’ Retirement System of Nevada in the United States. As a one-man team, he oversees all aspects of the system’s US$34.9 billion (as of 2016) investment program.

The funds he managed in the past year, 3 years, 5 years or 10 years outperformed most of the other types of retirement funds in the United States.

What’s his secret?

The fewer transactions, the better. Most of the time, he didn’t trade at all and adjusted the portfolio only once a year.

What is "Passive Investing"?

Passive investing broadly refers to a buy-and-hold portfolio strategy with long-term investment horizons along with minimal trading. The low-cost, widely-diversified passive approach suits those who do not want to feel the daily ups and downs from financial markets.

The key essence behind is to achieve long-term asset appreciation without spending too much time actively managing your investments. The process does not require research or analysis and anyone can easily do it.

How does passive investment make money?

A diversified passive investing portfolio can reduce your portfolio risk while comfortably earning interests on your bonds or dividends on your stocks through long-term holdings. This can generate an average market return of 6%-8% from macroeconomic growth, performance improvement and inflation. What investors are doing here is benefitting off the most powerful tool in investing, the compounding returns generated over time.

Any passive investment products in the markets?

Yes! There are exchange-traded funds (ETFs). An ETF is a basket of securities that trade on an exchange, just like stock. ETFs can contain many forms of investments, including stocks, commodities, bonds, or a mixture of investment types. It offers a low expense ratio and fewer broker commissions than buying stocks individually.

Let’s think of ETFs in terms of a restaurant experience that everyone can relate to. Most of us go into a restaurant wanting to try their most tasty dishes but run into 2 problems:

1) It costs too much to order all these tasty dishes

2) We can’t finish all that food ourselves

An ETF is like the ‘tasting menu’ of the investment world. It allows you to:

1) taste all the best dishes in 1 go but in smaller sizes

2) plus the cost will also be more affordable than ordering it individually.

So if you want to ‘taste’ the best of the investment world ETFs are a great cost effective way to do so.

Is Passive Investing right for you?

Passive investing suits you if you fit either one of the following descriptions:

-

You don’t have time to stay updated with the markets;

-

You’re not very familiar with investment, and don’t want to spend too much time trying;

-

You prefer long-term investments to short-term investments

Does this sound like you?

Kick-start your passive investment journey

To be clear passive investing is not about closing your eyes and blindly investing but to invest for the long haul and use the power of diversification, time and cost control to make you a more successful investor. The end result is simplifying your investment approach (instead of looking constantly at how financial markets are doing) and trusting this tried and true process to get you to your investment goals.

There is a buddist quote that says “Greater happiness comes with simplicity than with complexity” which we feel aligns very well with the idea of passive investing.

If you feel passive investing is right for you can consider using a robo advisor to start your passive investment journey!

AQUMON’s robo advisor offers you a globally-diversified ETF investment portfolio, and monitors your portfolio performance 24/7! All the heavy lifting is automatically done for you to simplify your investment experience.

Investment should be that easy!

Why not indulge yourself with our GiveBack Rewards? From now to May 31, 2020, all new Basic ETF Series (invest as low as US$1,000) with a $0 advisory fee June 30.

Click HERE to start your investment journey now!

Count on AQUMON, your intelligent investment advisor!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.