Why and How to Stay Invested in the Current Market

Written by Ken on 2020-08-13

Stock markets worldwide advanced this past week on signs of economic recovery in Europe, China and the US. The US’ S&P 500 was +2.45% last week and +3.73% year to date. The Euro Stoxx 50 also showed a strong rebound +2.47% last week and -13.15% year to date. Hong Kong/China markets were relatively more quiet last week with the Hang Seng Index and CSI 300 -0.26% and +1.93% last week.

AQUMON’s diversified ETF portfolios were +0.01% (defensive) to +2.07% (aggressive) last week and +2.39% (defensive) to +2.73% (aggressive) year to date. Portfolio drivers last week were US small caps (+3.69%), US technology (+2.47%). Safe assets like gold continued to shine +3.02%. Almost all asset classes were up last week.

We’ve had investors ask us if our views are still positive on the market and if they should stay invested. So this week, beyond our weekly Market Insights we also wanted to address some investing fundamentals about why and how to “staying invested” particularly when markets are volatile.

Markets are risk-on from COVID-19 optimism but rotations happening

US markets are rallying on the back of rosier COVID outlooks given the US government has inked 3 deals in the past week to deliver at least 300 million doses of COVID-19 vaccines from American biotechnology company Moderna Therapeutics, Johnson & Johnson and Pfizer Inc. As a reference, as of 2019, the US population is 328 million so this could technically cover everyone. In terms of a timeline, Pfizer’s announced they plan to seek regulatory review as early as October, manufacture globally up to 100 million doses by the end of 2020 and potentially more than 1.3 billion doses by the end of 2021. Couple this with Russian President Vladimir Putin claiming on Tuesday this week that Russia has registered the world’s first coronavirus vaccine, this sent a stronger risk-on message to investors fueling the S&P 500 to continue its August rally.

As a result, safe assets like gold suffered a flash crash this Tuesday of -5.66% (worst single-day drop in 7 years) and US treasuries yields also spiked higher (as investors are driven away seeking more risky assets). Below you can see gold’s recent pullback while the S&P 500’s continues to rally:

As we asked investors to watch out last week, we are starting to see a rotation out from US technology into more value sectors like US financials. When doing a return comparison between the 2 sectors (US technology vs US Financials) in August it is +0.30% vs +4.02%. An outperformance of +3.72% in just 7 trading days. We see this as a healthy rotation with previous lagging sectors playing catch up. With the US stimulus program missing last Friday’s deadline still in limbo, trade tensions brewing along with potential COVID-19 setbacks ahead (which we are experiencing firsthand in Hong Kong) we continue to be ‘cautiously optimistic’ seeing upside but also keeping well diversified in this current market environment.

Why financial experts suggest “stay invested” even in volatile markets

Having worked in the financial industry for 15+ years many industry professionals always communicate to investors or their clients to “stay invested” whether through a bull or bear markets due to the benefits of long term investing. Oftentimes as investors this is not clearly explained ‘why’ and we also wonder about the hidden motives of the person suggesting this. Particularly if we look at how much markets have rallied since late March coupled with not so positive outlook on the global economy given COVID-19, it is natural for a number of investors to ask “should they still be invested”?

The short answer is still “yes” but there’s nuance to that answer that investors should understand. Let us explain.

Success while ‘staying invested’ should not purely be about chasing returns

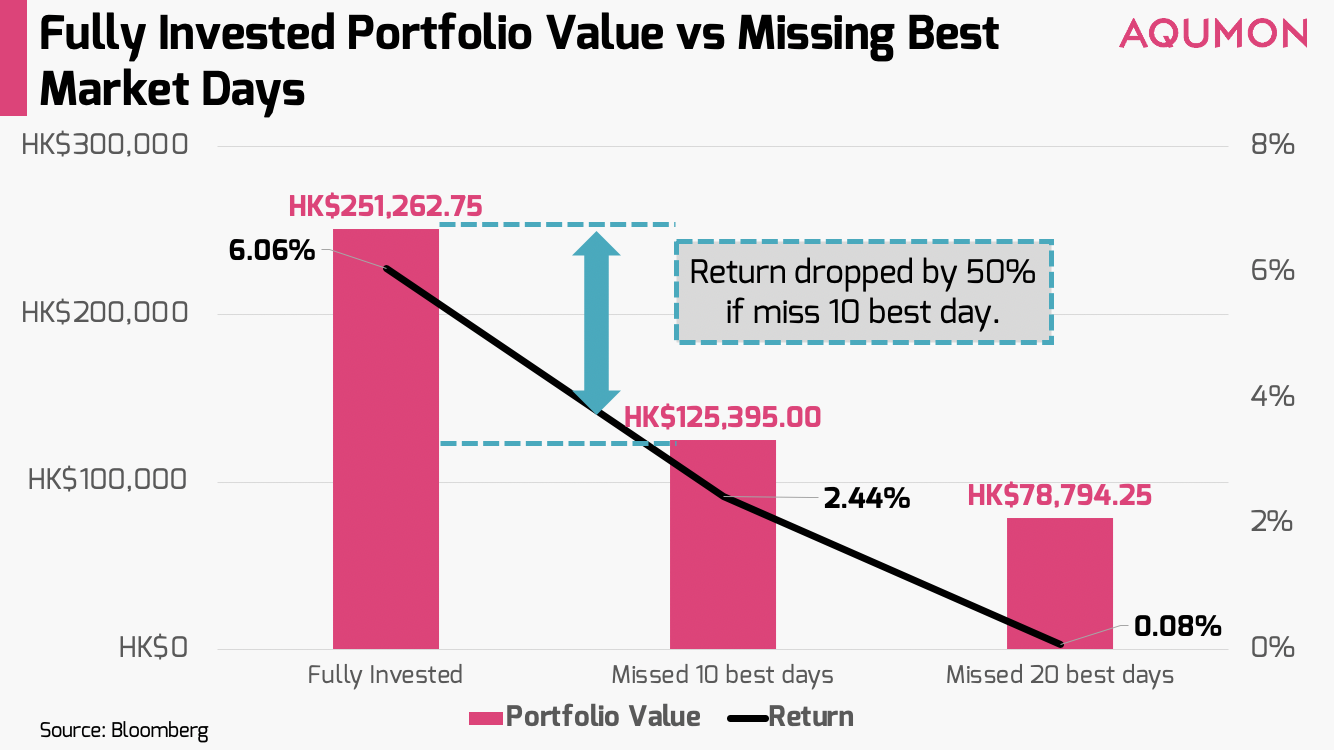

So if you google “long term investing” or “stay invested” chances are you will run into a lot of articles and experts highlighting that you are missing out on a sizable amount of your return potential if you don’t stay invested long term. Investors we feel should also carefully factor in risk. For example, many people reference the ‘10 best days’ argument where they state if you try to time the market and miss the 10 days where the market delivered its best returns your portfolio after 20 years would be close to 50% less than if you “stayed invested” (we’ve converted this and subsequent charts/tables to HK$ to make it easier to understand):

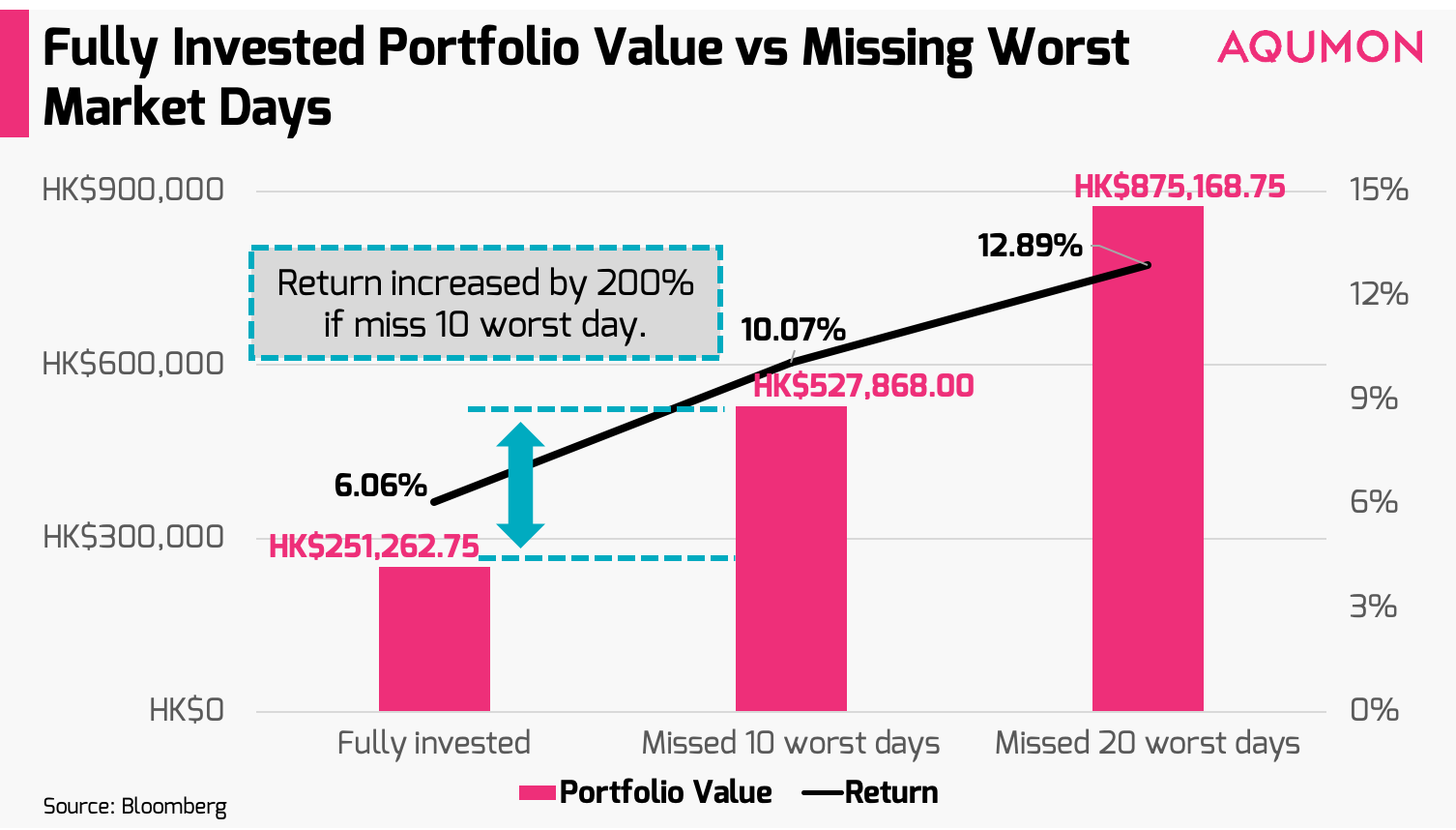

The assumption is that a person will invest US$10,000 (~HK$77,509) into the S&P 500 from 2000-2019 using a buy-and-hold strategy. There is truth to this argument but we find the counter-argument to this of missing the ‘10 worst days’ is much needed but is rarely mentioned. Let’s honestly have a look at what would happen if we invested the same US$10,000 (~HK$77,509) into the S&P 500 for 20 years and missed the 10 worst performance days:

What is the end result? Our portfolio would drop by 50% in value if we missed the 10 best days but our portfolio would increase by 200% in value if we missed the 10 worst days! So the worst days have a bigger impact on our portfolios than the best days. The next logical argument would be why don’t we just try to miss the worst days? It’s easier said than done.

Market timing is really difficult (even for investment professionals)

Why? Because the worst and best days occur typically very close together in time and often during a bear market so it is very hard to avoid 1 without avoiding the other. As a reference here are the 10 best and 10 worst days for the S&P 500 Index from 1999-2019 and their respective returns:

See how close the days are clustered together? Let's highlight this point more visually. During the height of the Global FInancial Crisis we can see during October to November of 2008 the 5 best days along with 3 worst days (in the past 20 years) all fall within the same 60 day period (blue denotes the worst day and pink denotes the best day):

How many investors would be willing to invest more during the height of a financial crisis? So it is extremely hard for individual investors to try to avoid the worst days while not giving up benefits of accessing the best days. This is particularly true when emotions are high during a bear market and investors are scared off seeing markets drop 6-11% daily. This is why timing the market is so tough for all non professional/even professional investors and it is likely easier to stay invested instead.

Now that we answered ‘why’ you should stay invested let's talk about the ‘how’.

So ‘how’ should investors approach the current investment environment? Before any investor accepts any financial advice you need first be comfortable with your investment amount and what you are invested into. If the amount and solution you invest into is keeping you up at night then you need to reassess your investment situation. We highly recommend you can seek out a financial advisor or talk to one of our investment consultants at AQUMON.

Once comfortable, we can offer 3 practical tips that will systematically improve your investment experience:

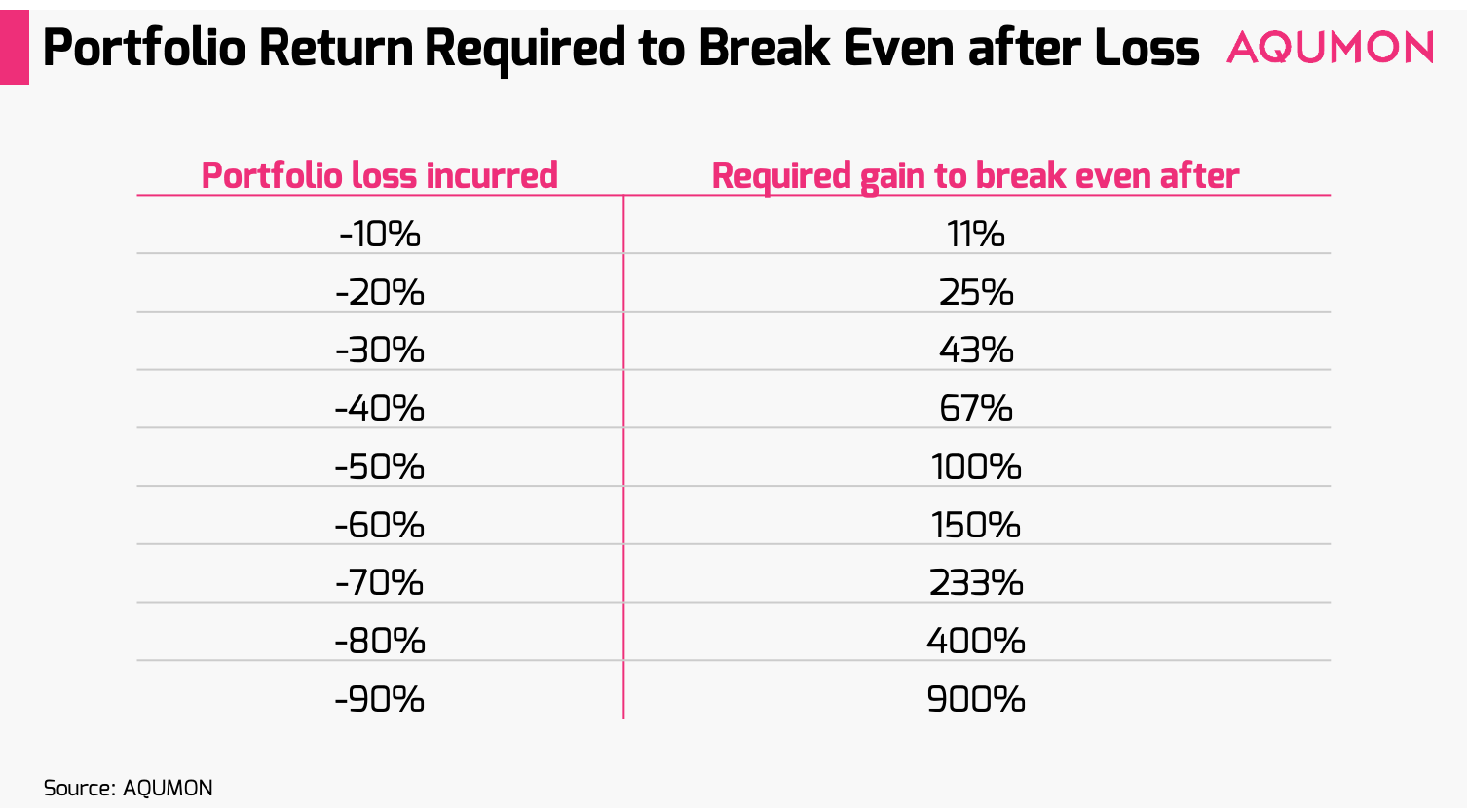

1) Minimizing your portfolios’ risk while investing: Without managing your portfolios’ downside risk it will be extremely tough for any investor to see positive and outsized returns. Remember #1 and #2 rule of investing by the world’s most famous investor Warren Buffet? When he says both his top investing rules are “don’t lose money” he means exactly that. So if you are unable to minimize your losses it will be extremely tough for you to get meaningful gains after because most of it is just helping you break even. In a simplified example if your HK$10,000 portfolio lost 20% (meaning HK$2,000) you’ll need approximately a 25% return (HK$2,000/HK$8,000 = 25%) just to break even. Here’s a more detailed breakdown:

So whether you are investing into safer assets (if you have a strong market view) or more simply diversifying your portfolio (which is helpful in multiple market conditions) these are ways you can manage your portfolio’s downside risk which in turn will help your overall returns. Don’t only be lured by returns when minimizing your risk (even though there is upside) is more important during more volatile investment climates.

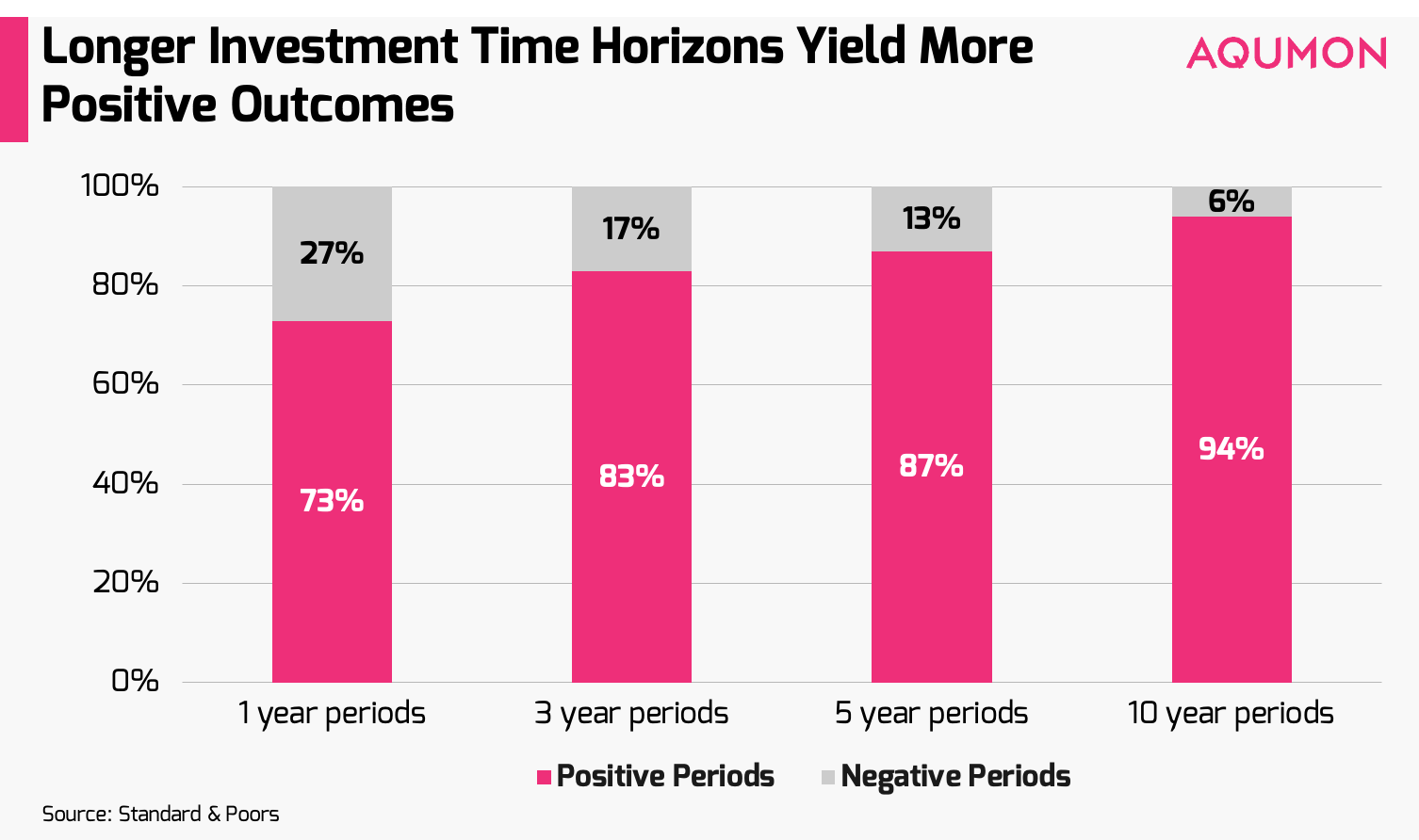

2) Extend your investment horizon: Markets are cyclical and it has shown time and time again that as you extend out your investment horizon your initial investment will likely see more chance of positive growth in your portfolio than negative. The numbers don’t lie. When looking at the past 91-year history of the S&P 500 Index (until December 2018) only 27% of the time (25 individual 1-year periods) has delivered negative returns for an investor who is using a buy-and-hold strategy for 1-year for their investments:

If that 1-year investor extends out their investment horizon by just 2 more extra years, the probability of experiencing negative returns for a 3-year period almost halves and decreases to 17% (15 individual 3-year periods). Those are much better odds and puts you in a more ideal place to achieve success with your investment portfolio. As the saying goes... “good things take time”, so a little patience with your investment also goes a long way.

3) Regular contributions will help you minimize the impact of timing: In a more volatile investment environment if you are only investing at the start using a buy-and-hold strategy the timing of the initial investment will dictate a good amount of your overall returns. So give yourself more chances to be successful by contributing regularly to your investment portfolio.

How can regular contributions help? In the example below we look at a more extreme situation between 2 investors who both invest US$10,000 (~HK$77,509) and contribute US$10,000 once per year for 20 years into the S&P 500. The only difference is the investor on the left has a crystal ball and only invests on the 1 best day per year (market low) and the investor on the right has the worst luck in the world and only invests on the 1 worst day of the year (market high), skip below the chart if you want to just look at the results:

When you compare the 2 investors how did their total US$200,000 (~HK$1,550,191) contributions do over time? The investor with the crystal ball (left side) definitely came out ahead but not by as much as you would imagine with annualized returns of 9.16% vs 6.19% per year. Wait...so the person who invested at the worst times possible every single year still earned 6.19% return per year? Yes! Might I add that they both experience multiple stock market crashes including the Dot-com Bubble (1999), Global FInancial Crisis (2008-2009) and at least 10+ other sizable market selloffs. By contributing yearly to their portfolio both investors spread out the value of their portfolio at risk at a given time.

As an experienced investor obviously we may have our own market views but we also understand that to be a successful investor, especially when markets are volatile, you need to focus on variables you can control such understanding to minimize your risk, extending out your investment horizon and increasing the frequency of your investment contributions.

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.