GameStop’s Wild Rise: Explaining the Squeeze

Written by Catherine & Jobie on 2021-02-08

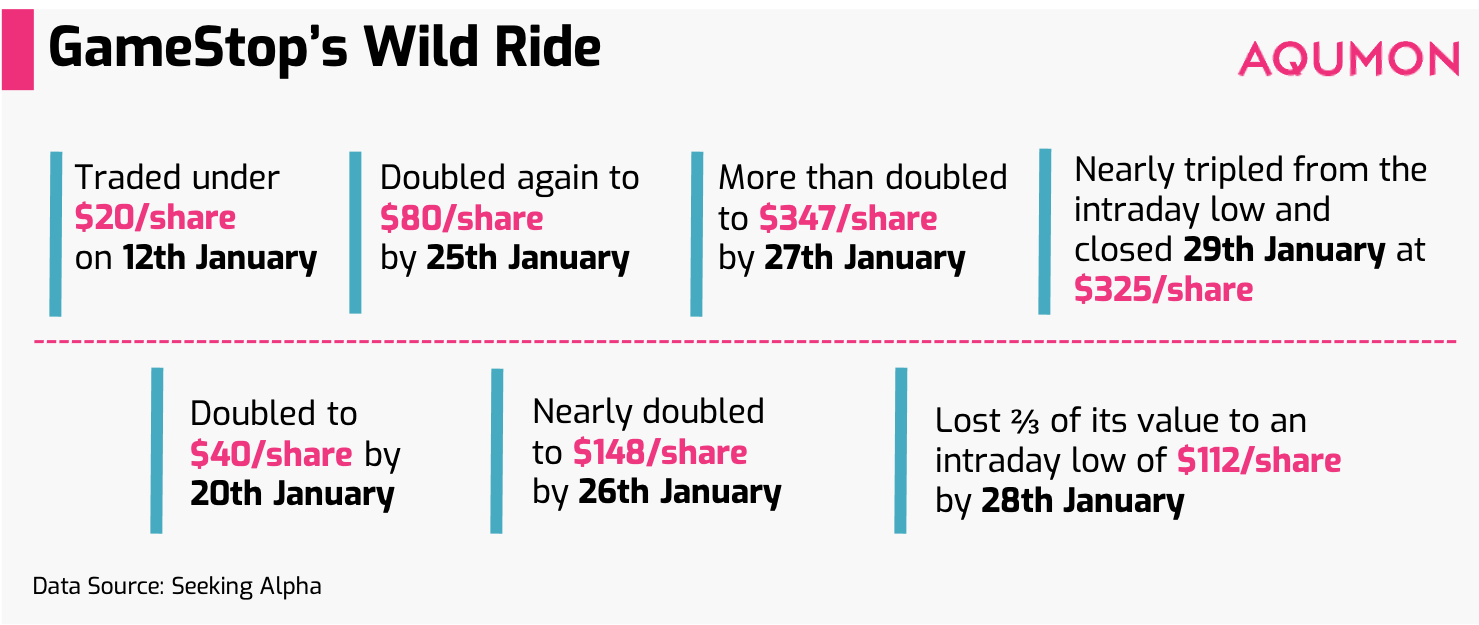

Whether you follow the market or not, by now, there’s a good chance you’ve heard of what’s been happening with the video game retailer, GameStop (GME). The internet and stock market are aflamed over GME over the past few weeks -- the meteoric rise in the price of GME has left many investors in awe.

The unprecedented rally is a result of an army of individual investors wielding growing influence across the globe on Reddit to push up GME’s stock price. And as the prices jumped, it forced short sellers in the stock to go for a “short squeeze”, leading to the surge in share prices.

What is short selling? *source: Investopedia

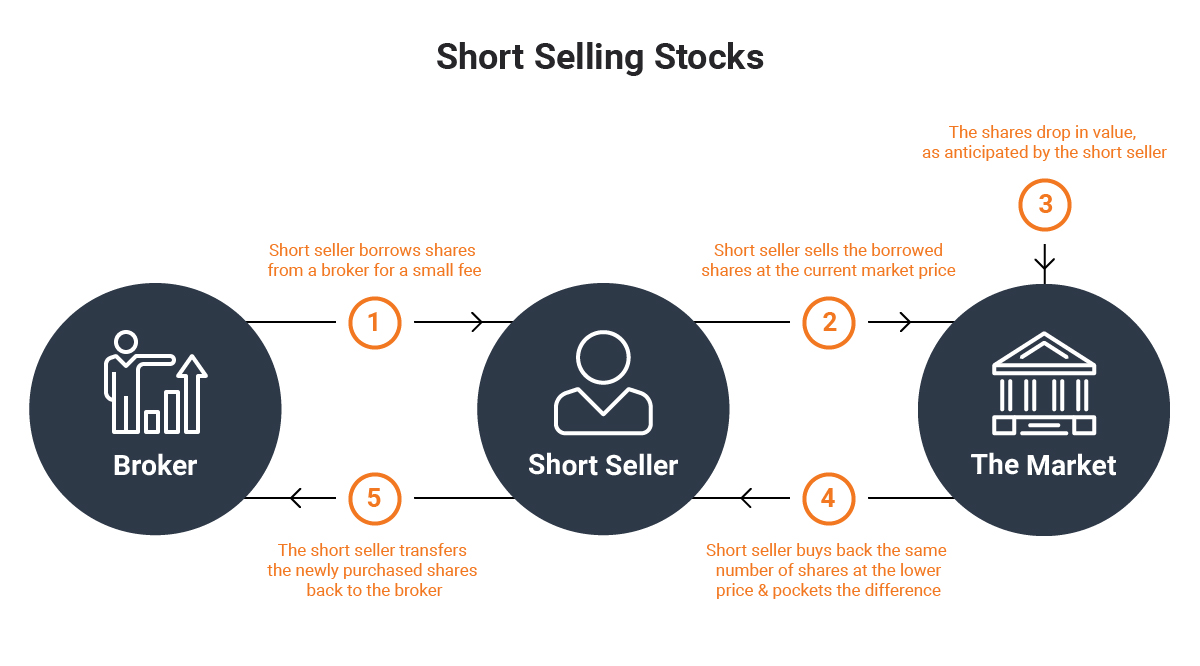

Short selling is an investment strategy that speculates on the decline in a stock price. Short selling occurs when an investor borrows shares of a stock, believing that it’ll decline in price by a set future day (the expiration date); then sells these borrowed shares on the open market.

Before the expiration date, the short seller is betting that the share price will continue to go down and they can purchase them at a lower cost.

Short selling has a high risk, high reward ratio: if short sellers are right, then they pocket the difference between the price when they initiated the short and the actual sale price. However, they can lose big if the stock’s price rises.

*source: DailyFX

What is a short squeeze? *source: Investopedia

Essentially, a short squeeze means short sellers are being squeezed out of their positions, usually at a loss.

If someone tries to push up the price by buying lots of shares, even when the company isn’t doing exceptionally well -- that is the squeeze.

A short squeeze forces short sellers to close their short position: buy up the shares they owe their brokers and return them before the expiration date to forestall greater losses.

This, however, only adds to the upward pressure of the stock’s price and ticks up demand in the market -- every buying traction by a short-seller sends the stock’s price higher, forcing another short-seller to buy. This cycle ultimately continues as short-sellers struggle to cover their positions.

This has happened before: Volkswagen Edition *source: Seeking Alpha

In the middle of the financial crisis, many automakers were viewed as bankruptcy risks -- a rather lucrative time to be a short seller as there was a higher than normal short interest (~15%) in Volkswagen.

Knowing Volkswagen’s available float was much lower than most realised, Porsche (which owned a ~30% stake in Volkswagen at the time) started buying enough call options to give it an effective 74.1% stake in the entity, just 0.9% below the level where financials would be consolidated. They then announced to the world, on a Sunday, its intention to "raise this target to 75% in 2009 as long as economic conditions permit."

This set off an incredible squeeze in which Porsche made ~$10 billion and hedge funds lost $30 billion. This even briefly vaulted Volkswagen to become the most valuable company in the world.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.