Interviewing Angelina Yao: How women invest differently from men

Written by AQUMON Team on 2021-09-15

As the saying goes “men are from Mars, women are from Venus”, which suggests that the thought processes of the two sexes are polar opposites. Does this adage apply when it comes to investing?

In this episode of Money Talk, fund manager and founder of Heels & Yield, Angelina Yao shares her insights on how male and female investing habits differ and what all investors can do to stay ahead of the curve.

Tell us a bit about yourself!

Hi! My name is Angelina Yao and I’m a fund manager. I am also the founder of Heels & Yield, a start up that aims to inspire women to take care of their financial well-being.

When did you start investing?

I started investing when I was in university. At that time, my boss at my part-time job told me to buy a share of a company every month. This turned out to be really great advice and I’m very grateful because I’ve been investing ever since!

What’s the best way to be financially savvy?

The best way is to build knowledge and experience. If you’re a beginner, you can start with a robo-advisor like AQUMON. However, if you don’t want to pay any fees, you can also start by investing in a few ETFs. The most important part is to monitor and track your holdings and learn from the experience.

How do you think men and women invest differently?

Anecdotally, men tend to be a bit more impulsive and my father was an example of this. However, we can't overly generalize. On the other hand, women tend to do more research and take more time. They also don't trust their gut as much. Interestingly, Fidelity reported that their female fund managers performed 1% better each year than their male counterparts over a 10 year period.

Why is it important to start investing when you’re young?

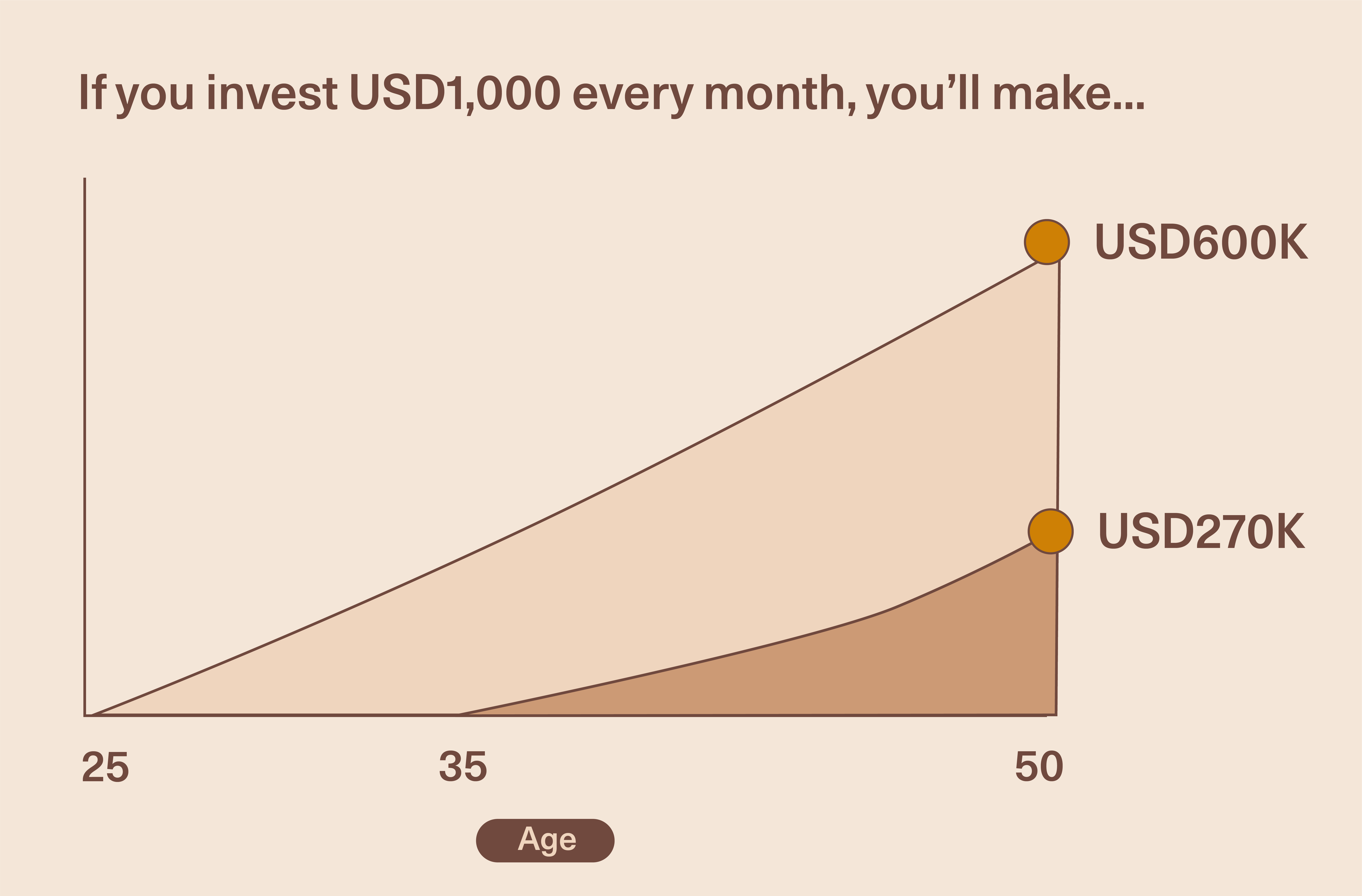

First, we have to acknowledge that we all make mistakes. If you make a mistake when you’re 25, it’s very easy to bounce back. However, if you make a mistake when you’re 50, you won’t be able to bounce back and learn from the mistake as easily. The second point comes down to simple maths.

If we start investing when we're 25, versus when we're 35, there's actually a big difference. For example, if you invest $1000 USD every month with a yield of 5% return each year, you will have approximately $600k when you’re 50. But if you start investing the same $1000 USD 10 years later when you're 35, you will have approximately $270k when you’re 50. That's a significant difference. So start young and go steady!

Can you share your secret investment strategy with us?

My secret is to invest rationally and methodically. I try not to get emotional about big investment decisions. When I make big investment decisions I consider factors such as what I want to invest in, when I want to invest in it, how much I want to invest, when I'm going to sell it, and at what price I'm going to sell it. Most importantly, how I'm going to celebrate when I make my financial goal.

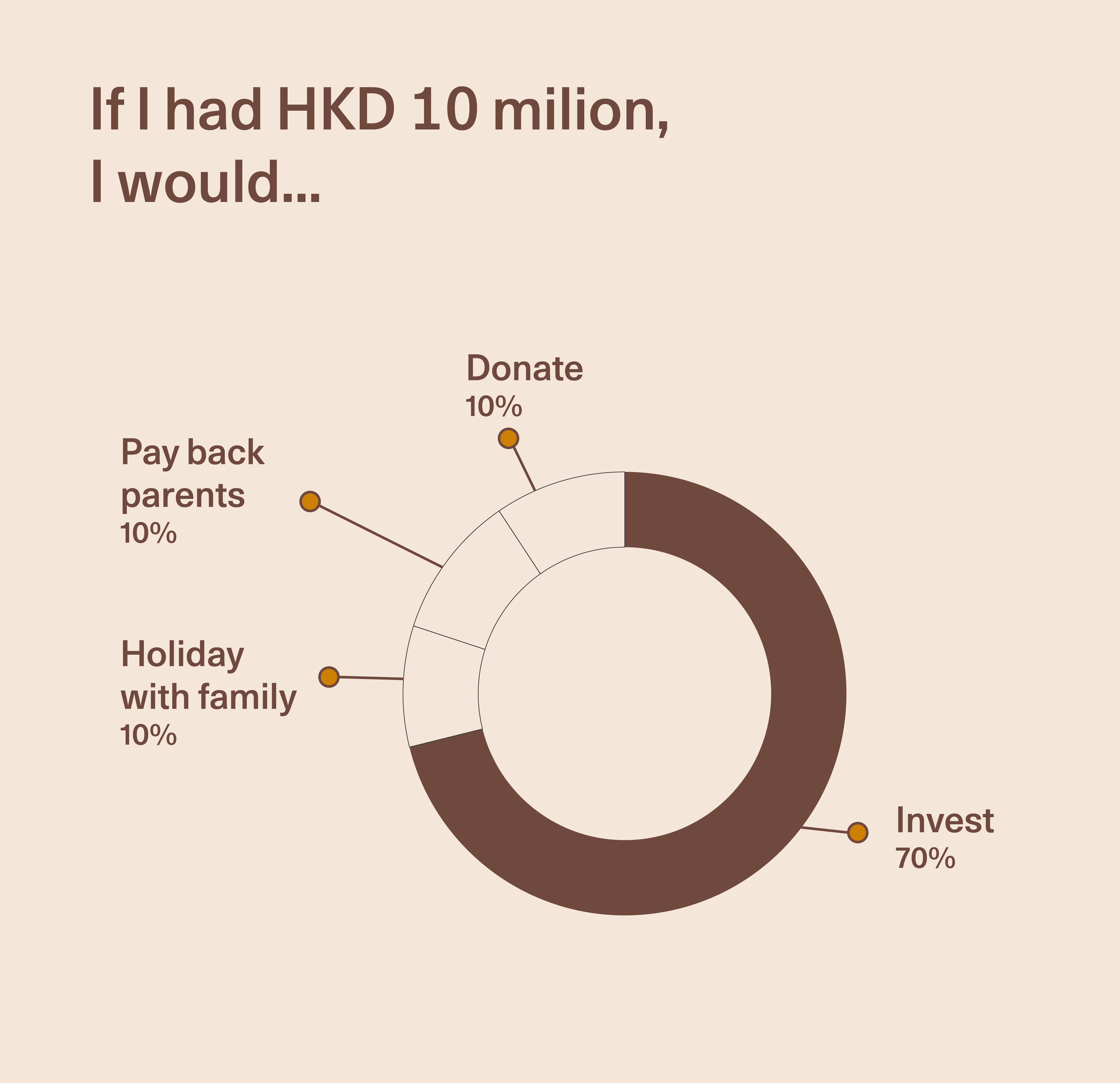

If we gave you 10 million Hong Kong dollars, what would you do with it?

If you gave me 10 million Hong Kong dollars, I'd first thank you! I would then invest 70% of it and donate 10% of it to my favorite charities. I particularly like Compassion International because they support young children's education. 10% of it I would give back to my parents and another 10% I would use to take my family on vacation.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.