Bespoke: Exceptional Investments for the Professional Investor

Written by AQUMON Team on 2021-12-08

AQUMON Bespoke, a professional wealth management service launched on December 8, 2021, is ideal for those seeking comprehensive asset management services. AQUMON Bespoke allows you to pursue optimal risk-adjusted returns in a scientific and customisable manner.

AQUMON Bespoke can help you answer the following investment questions:

- What’s my optimal investment plan if I want to invest for 5-8% returns annually with low volatility and with an investment horizon of 3-5 years?

- How can I invest if I have a preference for certain geographic regions, industries or topics?

- If I’m interested in alternative investments like commodities, gold, crude oil and digital currencies, what are my investment options?

What investment services can I get with AQUMON Bespoke?

1. A comprehensive and data-driven investment strategy

Investors who are active traders often pay significant attention to short-term profits, making them prone to short-term volatility. These investors often lack “core investments” that help shield them from market fluctuations, usually leading to market losses and a poor investment experience.

Core investments should be formulated according to your own investment needs, regardless of short-term market timing. According to Nobel Prize winning financial research, AQUMON’s diversified, asset-allocation based portfolios can help investors achieve optimal risk-adjusted returns to meet their financial goals.

AQUMON’s SmartAdvice investment system helps investors generate long-term, stable wealth utilizing the “core-satellite investment principle”. In addition to a core investment portfolio comprising our flagship SmartGlobal portfolios, AQUMON also helps determine your satellite investment portfolio to help you seize key market opportunities. Your satellite portfolios will be made up of AQUMON’s thematic SmartStock portfolios and alternative alpha-seeking investment strategies.

2. Alpha-seeking alternative strategies

With AQUMON Bespoke, you will gain access to tailor-made “Alpha Allocation” investment plans, designed to provide optimal expected returns and minimal volatility. Alpha Allocation portfolios cover more complex investment strategies such as commodities, or absolute return strategies that could include futures, options, derivatives, and unconventional assets.

3. Professional Investment Team At Your Service

Our team of investment managers have a deep understanding of the financial markets and your investment needs. Our personal advisors will provide one-on-one consultations and investment tracking for each of our clients. Through a client-centric approach, our team will formulate a concise and customized investment plan to help you achieve your financial goals.

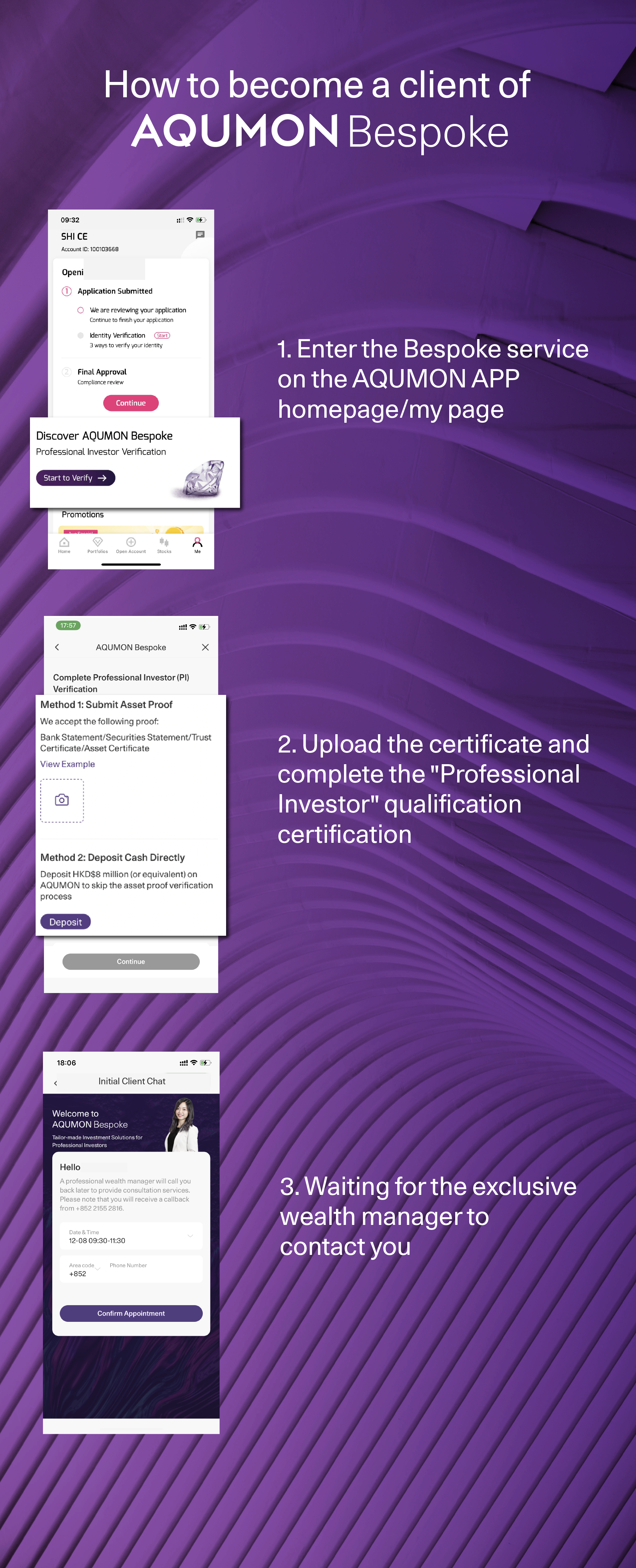

How can I become a AQUMON Bespoke Client?

A) If you are an existing AQUMON user:

Open the AQUMON app and follow the following three steps:

What is a professional investor?

If you hold at least HKD 8 million in liquid assets within the last 12 months. Liquid assets could be comprised of the following:

1. Market value of investments (including stocks, bonds, unit trust funds, stock-linked investments and other investment products)

2. Cash or Bank Deposits

Assets do not include property and insurance products. You are required to provide the relevant asset certification documents, such as a personal deposit/non-deposit financial asset certificate issued by a bank; a private equity fund subscription confirmation letter, etc.

B) If you are a new customer:

Learn more about AQUMON Bespoke or have a one-to-one consultation with an AQUMON wealth manager. You can click HERE to make an appointment.

Experience AQUMON Bespoke’s services today.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.