【Bespoke】Introducing SmartAdvice: Personalized Investment Advice

Written by AQUMON Team on 2021-12-15

With an overwhelming amount of information and financial products available in the market, some investors prefer doing their own research and managing their investment portfolio by themselves; while others might prefer to seek professional advice and have investment managers manage their wealth. There’s no right or wrong, what matters is the suitability.

"If you can sleep well at night after investing, you have made a good decision"

A good investment portfolio may not necessarily give you a drastic surge in returns, but it should fit your risk tolerance level and achieve your investment goals. AQUMON Bespoke, the newly launched service aims to bridge the investment needs of the mass affluent and professional investors. In particular, it incorporates the exclusive function - SmartAdvice, which provides 1-on-1 personalized investment advice to clients.

How to do your financial planning?

Step 1: Define your investment objectives and goals.

-

What do you want to achieve? [Buying a house, saving for your kids education fund or your own retirement]

-

Are you looking for a long-term or short-term investment? [1 month, 6 months, 3 years etc.]

-

What’s your expected return on investment? [Beat the inflation, 5-6%, 10% annualized returns or more]

Step 2: Examine your risk tolerance level. Whether you are risk averse or able to accept higher levels of risk.

Step 3: How much is your investable amount? How’s your asset distribution? (Are they in cash, pensions, stocks, properties or other assets?)

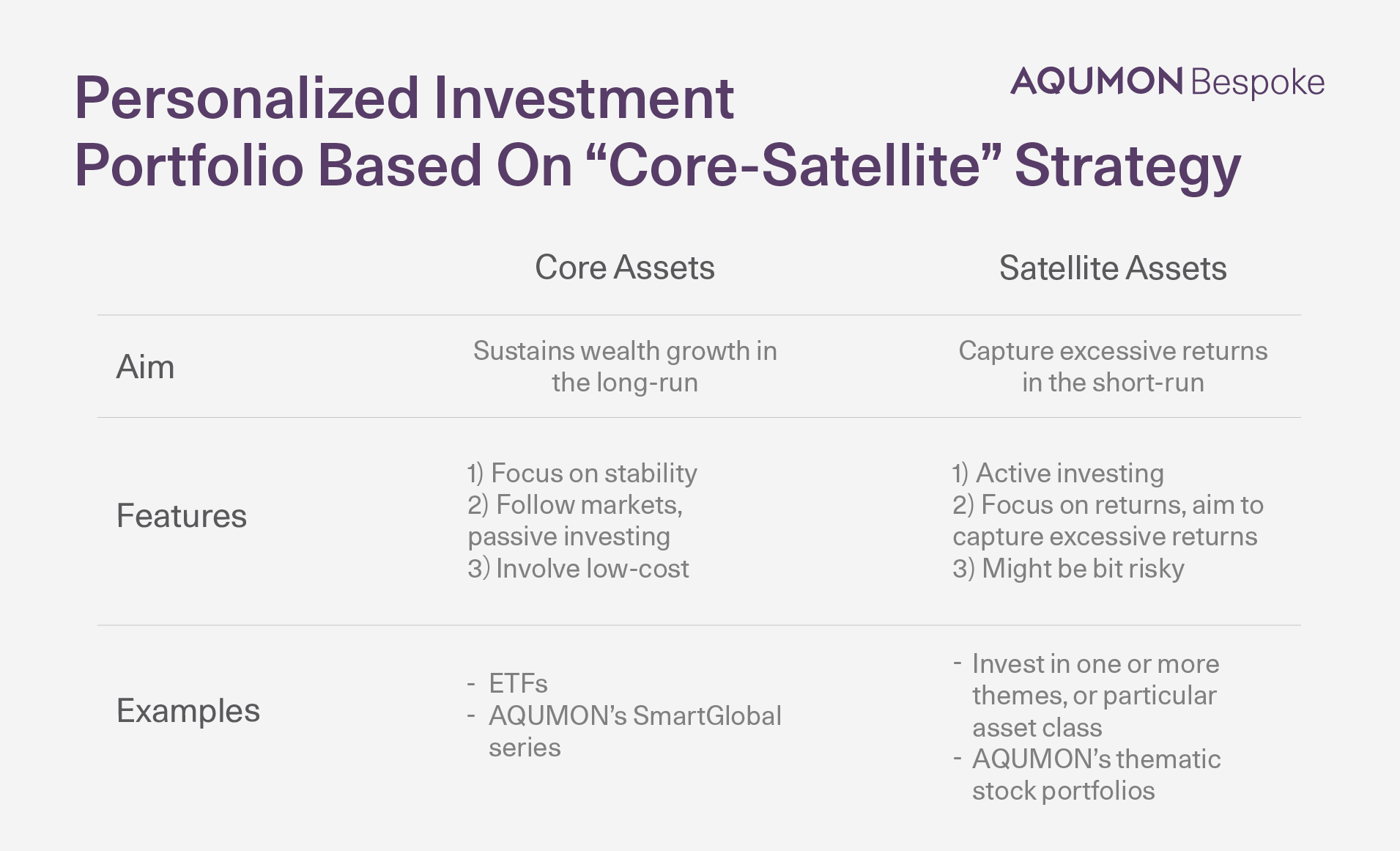

Based on the Core-Satellite strategy, AQUMON customizes investment portfolio for you

AQUMON’s SmartAdvice leverages the Core-Satellite strategy, a well-known method of portfolio construction in the wealth management industry. On top of that, we combine our strong algorithmic capabilities, extensive experience in wealth management, and investment products with strong performance to recommend personalized investment solutions for each client.

The “core” asset usually has a higher weighting in the investment plan and mainly invests in stable products that sustains wealth growth in the long-run. For example, Exchange-traded funds (ETFs), which track and capture market movements.

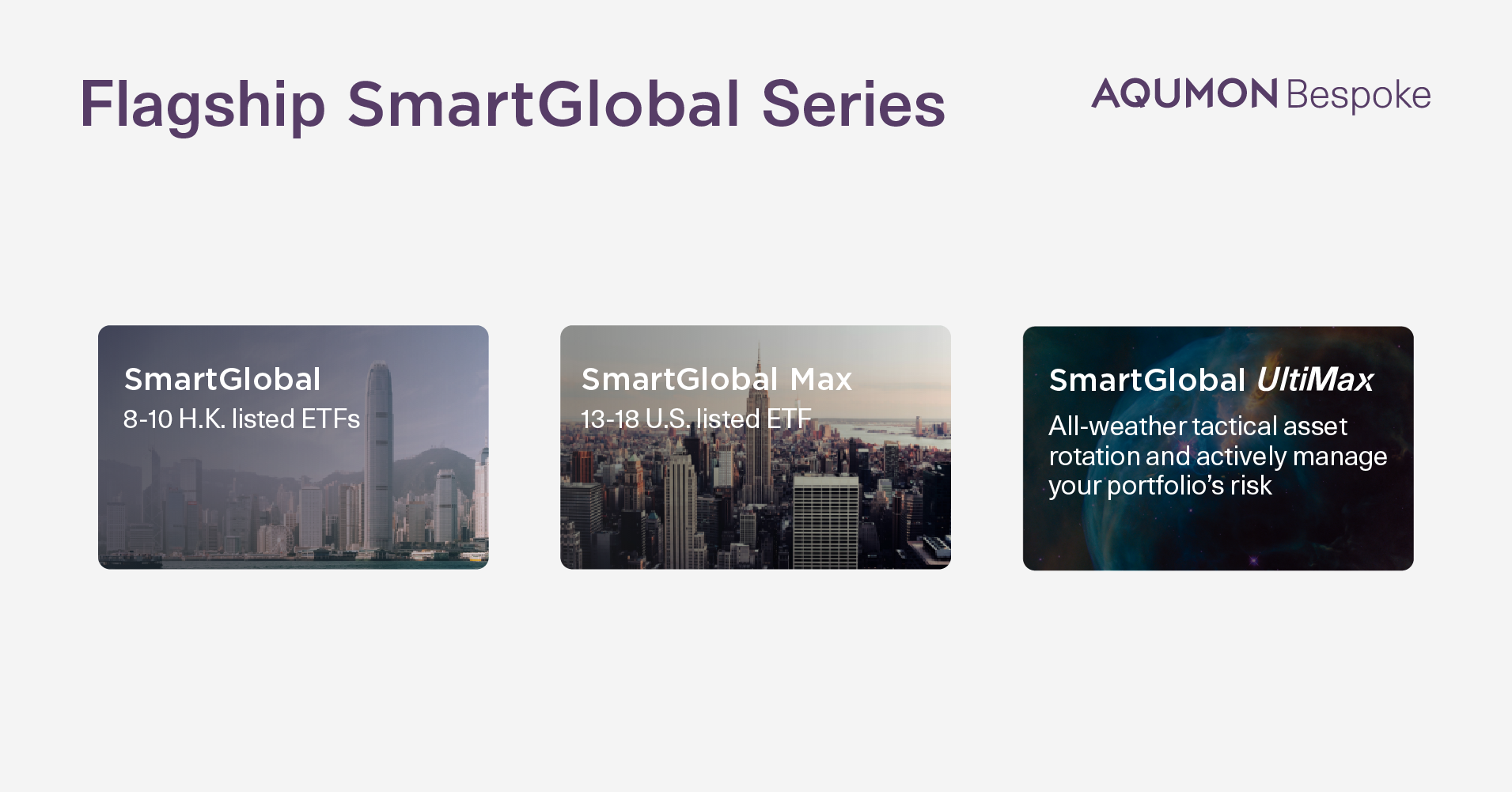

Another example is AQUMON’s SmartGlobal series, one of our flagship asset allocation portfolios. Leveraging on the Nobel Prize winning theories (Modern Portfolio Theory, Markowitz Efficient Frontier, the Black-Litterman asset allocation model of 1992) and our strong algorithm technology, these portfolios offer clients a scientific, globally-diversified investment portfolio.

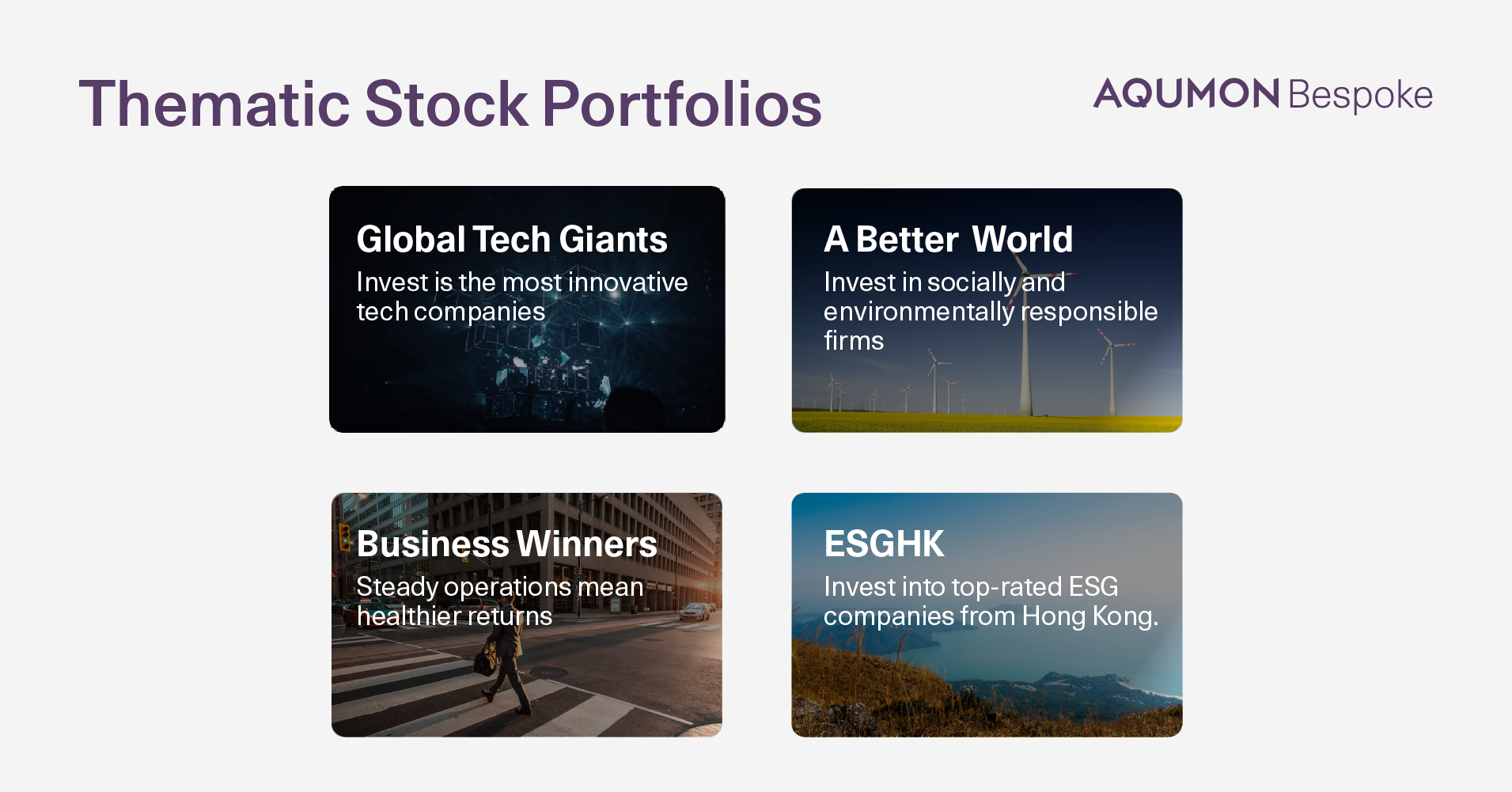

The "satellite" investments are designed to capture additional returns and diversify risk. This should take up a smaller weighting in the investment portfolio. Usually, our strategies recommend investing into one or more themes and asset classes based on your preferences.

AQUMON's thematic SmartStock portfolio is an example of "satellite" investment products. Clients can invest in particular themes or regional products that they may be drawn towards. For example, our Global Tech Giants portfolio invests in the US’s leading tech companies, while AQUMON’s ESG portfolio focuses on companies with good social and environmental rankings.

AQUMON's flagship asset allocation portfolio, SmartGlobal Series (core investment) has a 3-year proven track record. In early 2021, we launched several thematic stock portfolios (satellite investments), which fulfils different investment needs. With the launch of SmartAdvice, we are able to help clients build their core-satellite portfolio in a smarter and more scientific manner.

We believe in empowering the investor with as much information and tools as possible. However, when you no longer want to be as affected by market volatility and would like a hand from professional investment experts, SmartAdvice can offer the additional service you need. We leverage technology to empower every investor, through a hassle-free investment journey.

Case study: Investment diagnosis in SmartAdvice service

As an overview of how the SmartAdvice feature can help you. Here’s an example:

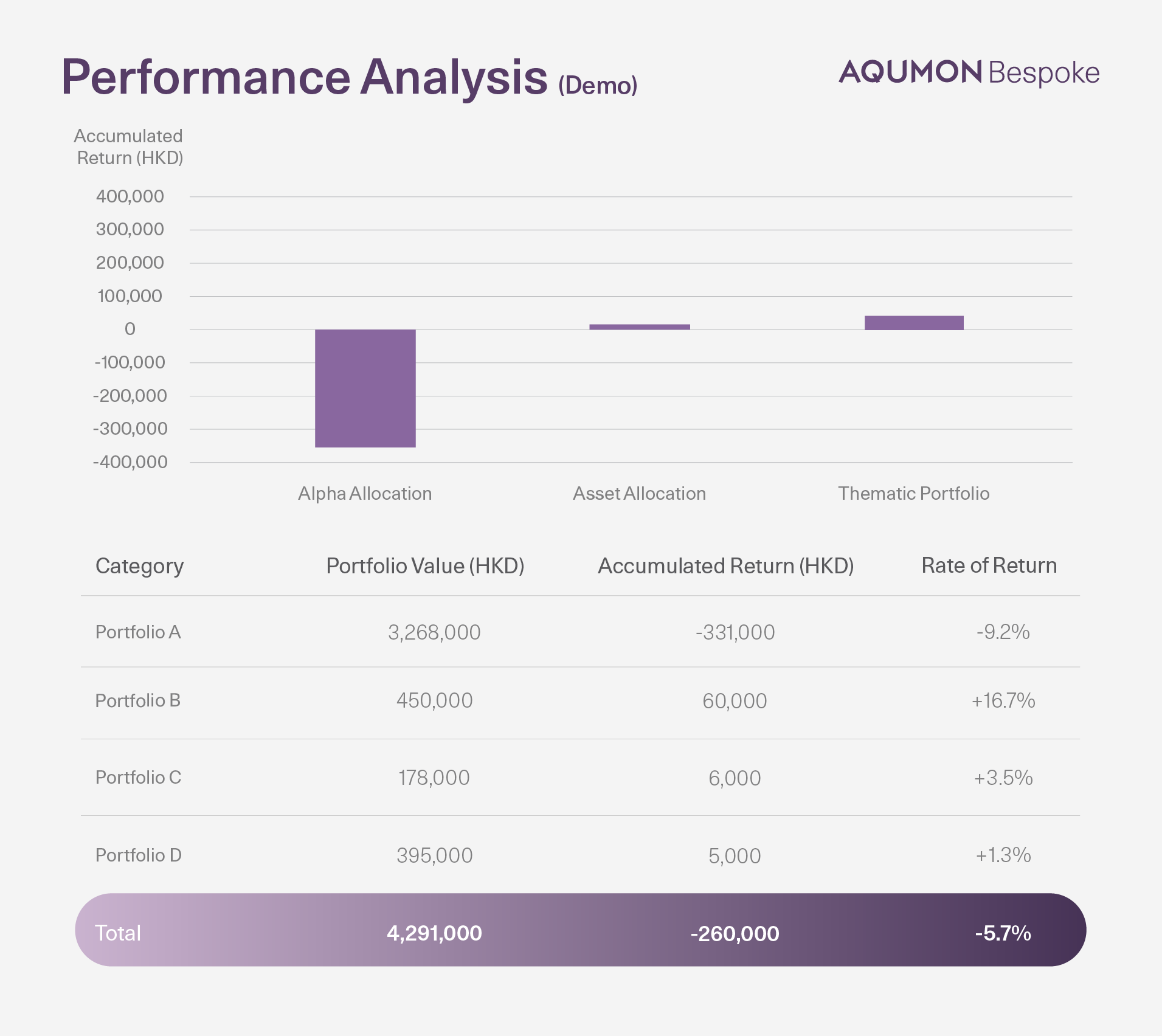

One of our clients has invested in 4 products. Performance and contribution of each portfolio are shown clearly in the following analysis report.

1. We factor in the client’s goals and preferences: the client prefers stable investment and hopes to accumulate wealth for his future retirement.

2. We analyze their existing portfolio and look for optimization opportunities.

3. As a result, we personalized an investment plan with 8% expected annualized return and 5-8% maximum drawdown to fit their needs.

Leveraging the SmartAdvice system, AQUMON’s algorithm experts and investment managers conducted multiple backtesting of the portfolio, simulating the performance under different market conditions. After the rigorous tests, the recommended portfolio is adjusted for better returns and risk control.

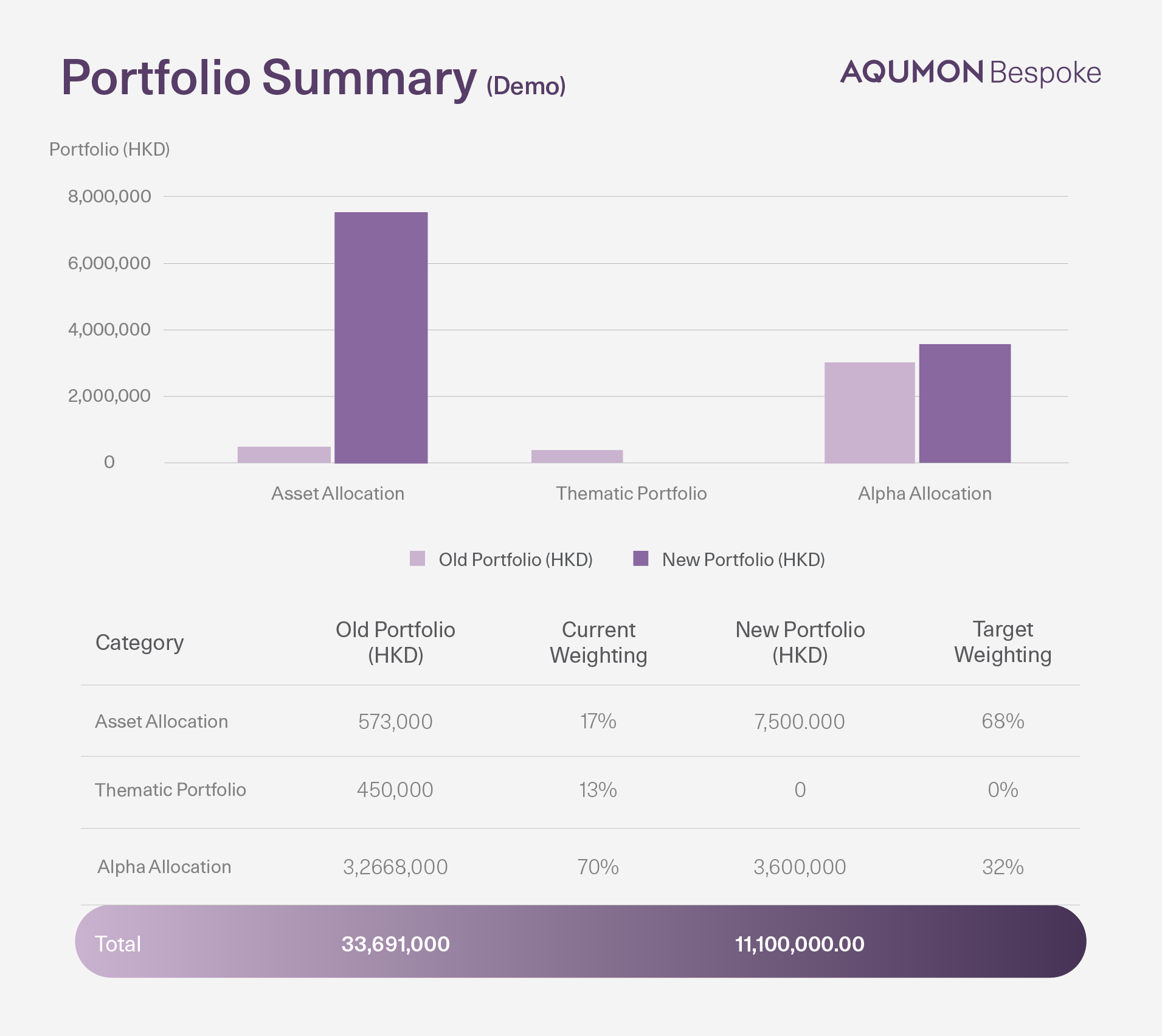

As shown in the below chart, AQUMON recommended this client to reduce exposure in current thematic portfolios, and to enhance the weighting for diversified core assets for better risk control.

"SmartAdvice is a complete upgrade of AQUMON's comprehensive and systematic investment service for mass affluent and high net worth investors.”

SmartAdvice is an exclusive feature included in AQUMON Bespoke service. For those who wish to invest HK$2,000,000 or more in AQUMON, you can now enjoy an 1-on-1 SmartAdvice service for free. Click HERE to book your appointment today.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.