New Year Message from Kelvin, CEO of AQUMON

Written by Kelvin Lei on 2019-02-11

With the start of the new year, Mr. Kelvin Lei, founder and CEO of AQUMON, wanted to send a heartfelt message to everyone on behalf of the entire AQUMON team.

Hello all friends of AQUMON,

As we enter the Year of the Pig, I wanted to wish you all a very happy New Year and good luck to all AQUMON customers and institutional clients.

In the past few years, financial technology has been knocking at the high walls built by the traditional finance industry. A technology revolution driven by further innovation is coming.

The relationship between financial technology and regulation are inextricably linked. The earliest financial innovations originated in the weakness of supervision such as electronic payments, online lending, and even cryptocurrency. But regulation is very sensitive to investor protection, so recently there has been negative blowback to Peer to Peer (P2P) lending and Initial Coin Offerings (ICOs). The road to innovation is still going on, but more caution is required in the future.

One of the core parts of finance, investment, involves wealth management and asset management. This is a huge market represented by the trillions of dollars. Robo-advisors first originated with the goal to solve the investment and financial needs of most people.

So why hasn’t robo-advisors become as commonly used yet? There are two reasons why robo-advisors have not broken out like other FinTechs yet:

Firstly, wealth management is a highly regulated industry making this a high threshold space for those who only who have the proper licenses and play within the rules.

Second, the core of wealth management comes down to trust, and the performance of investment decisions generated by algorithms may still need the test of time before the average investor is willing to impart that trust.

However, it is precisely because of the regulation-heavy and the time needed to gain trust that we expect robo-advisors to have a steep growth curve like we see currently with electronic payment. In the next 3-5 years, our Asian society will evolve from not experiencing robo-advisors to where algorithm-driven automated wealth management becomes the norm. Machine-driven investment calculation is more precise, doesn’t require rest, has no emotion and is low in cost. I believe that more and more people will trust machines and be willing to allow their assets to be monitored by algorithms.

Forward-looking, R&D is the first priority and a ‘Do More’ attitude are the reasons why AQUMON stays ahead.

We started our journey three years ago. Born in the library of the Hong Kong University of Science and Technology, our small company, founded by two founders, has grown into an elite team of nearly 70 people. Everyone is young and energetic, and they are constantly striving to achieve our mission. The first batch of companies that understood with our philosophy were financial institutions. We visited nearly 100 domestic and foreign financial institutions in 2018 and currently have long-term partnerships with more than 30 companies. We helped these organizations by equipping and installing AQUMON’s A.I. engine, so that banks can use our robo-advisory service to better serve customers. Fund companies also used our A.I. investment algorithms to improve their stock-picking abilities (especially in the volatile market in 2018). Such funds achieved a return of 23% over their benchmark. Furthermore, we saw brokers can also use robo-advisors to help customers make more intelligent transactions.

This is all attributed to a strong R&D team. Last year, together with the Hong Kong University of Science and Technology, we received funding from the Hong Kong Government and established the A.I. Investment Lab. This was first of such laboratories in Hong Kong to be applied its core financial investment sector and will ensure Hong Kong retains its position as the leading global financial centre.

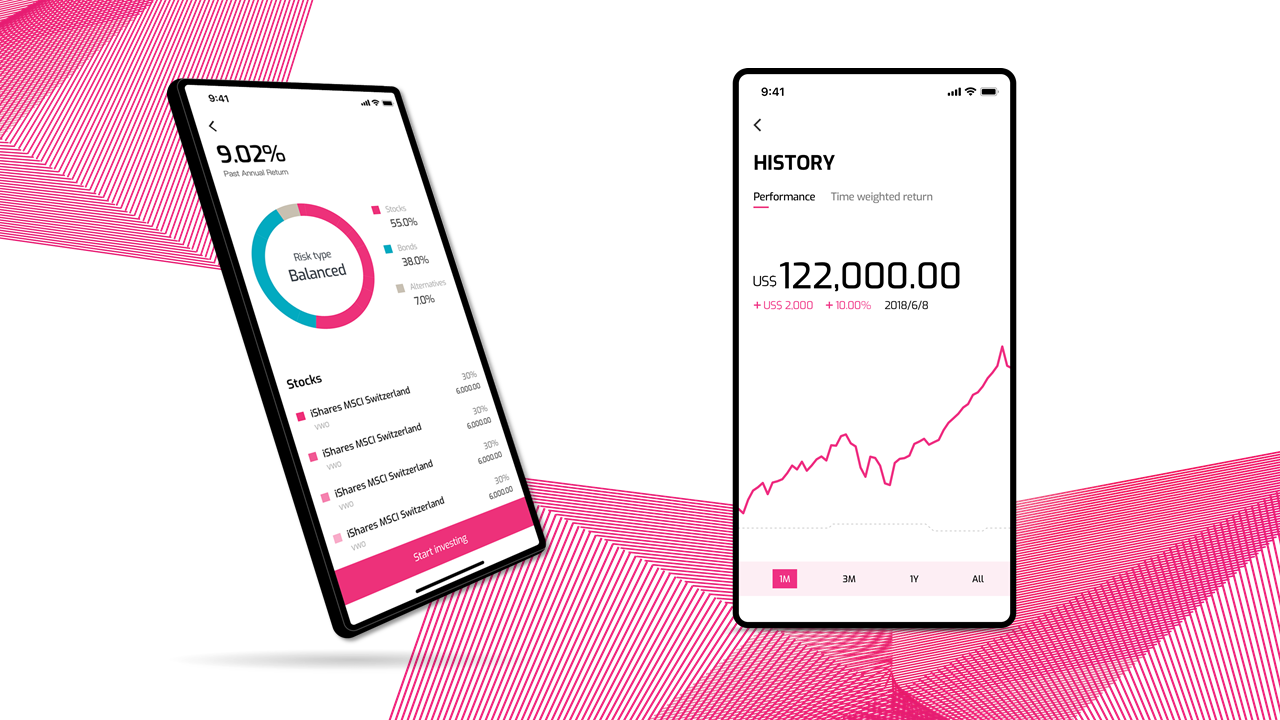

AQUMON for individual investors has also seen strong interest by the people of Hong Kong since its launch last year even though it is not easy to convince people to use robo-advisors.

Asian investors have a high savings rate, and investment is dominated by real estate, making it even more difficult to distinguish between good and bad investments. We have organized a large number of online and offline activities, preaching long-term investment concepts, the benefits of diversification of investments, introducing robo-advisors and its benefits. Tens of thousands of customers have now heard about AQUMON and experienced the convenience and solid benefits of automated wealth management. Furthermore, AQUMON is a user-driven company at heart and insists on hearing our customers’ first-hand feedback.

Robo-advisors are the future but they need to continually become smarter and think about connecting with people in a different, ‘cooler’ way.

More intelligent is needed so AQUMON will integrate more algorithms delivering better returns to make our products more dynamic. We will also become more ‘cool’ thereby breaking through the typical financial product experience. AQUMON is not a boring financial tool, we hope to be integrated into everyone’s life helping them make smarter financial planning decisions while matching the unique investment needs of the modern lifestyle.

Therefore, we even redesigned our company's logo and color matching in order to let everyone experience an improved user experience. In addition, we aim to deliver a one-click global trading platform which our IT engineers have been developing day and night. If you have any views on this we’d love to hear your feedback.

There is no easy road to entrepreneurship and in the new year this is the start of another journey. Gaining trust and building a strong reputation amongst investors is what drives us here at AQUMON. Thank you to our team, thank you to all customers and those who have supported us. Let's make history together!

Have a prosperous Year of the Pig!

Yours Truly,

Kelvin Lei

Feb.11, 2019