Choose Your Investment Strategy Like a Fitness Plan

Written by Flo Li & Ria Tan on 2019-09-26

If you want to lose weight, would you choose _________?

A. Go on a diet

B. Go to the gym

Eating less and exercising more are both effective ways to lose weight. So, this may be a somewhat tricky multiple choice question.

Although your weight lost via a strict diet may be easy to rebound, the effect is quicker. Even a boxer will go on a few days of hardcore dieting to make weight before a fight. Although people going to gym may look healthier, it is slow to take effect and it is easier to stray away from your plan and lose confidence during this process.

We can't deny the quick effect of dieting, but also should see the long-term benefits from a fitness routine. Both methods are effective but ultimately suitable for the needs of different groups.

Investors often ask, should I buy or should I sell now? The answer is actually largely related to whether you want to do long-term or short-term investing.

For all investors, the rules of the game in the financial markets are the same. This includes the length of your investing cycle, your risk type, types of assets your want to invest into and different investment strategies held by investors.

In general, most short-term investors pay more attention to the mood of the market, buying and selling in just a few days or even the same day in order to earn profit. In contrast most long-term investors pay more attention to a company’s value and do not expect to turn a profit so quickly often looking at an investing horizon of one year or maybe longer.

Some people refer to short-term investors as artists, because regardless of the market's rise and fall, they always need to maintain an enthusiastic attitude towards new knowledge and information, always in a state of tension and excitement. They rely on frequency and the odds in exchange for time advantage.

The long-term investors are more like engineers, because they need to control and correct the entire investment process and may endure the ups and downs of the market during certain periods of time as well as the loneliness of the market downturn.

Therefore, the former needs passion while the latter needs rationality.

According to the " Retail Investor Survey 2018" issued by Shenzhen Stock Exchange, although the proportion of A-share long-term value investors in 2018 has increased slightly from last year, it is still less than 30%. Among them, nearly half of the respondents traded multiple times a week, more than 30% traded one or two times a month, and only 20% traded once a quarter or more. This illustrates the most common mistakes made by retail investors: blind speculation without consciousness of stopping loss in time.

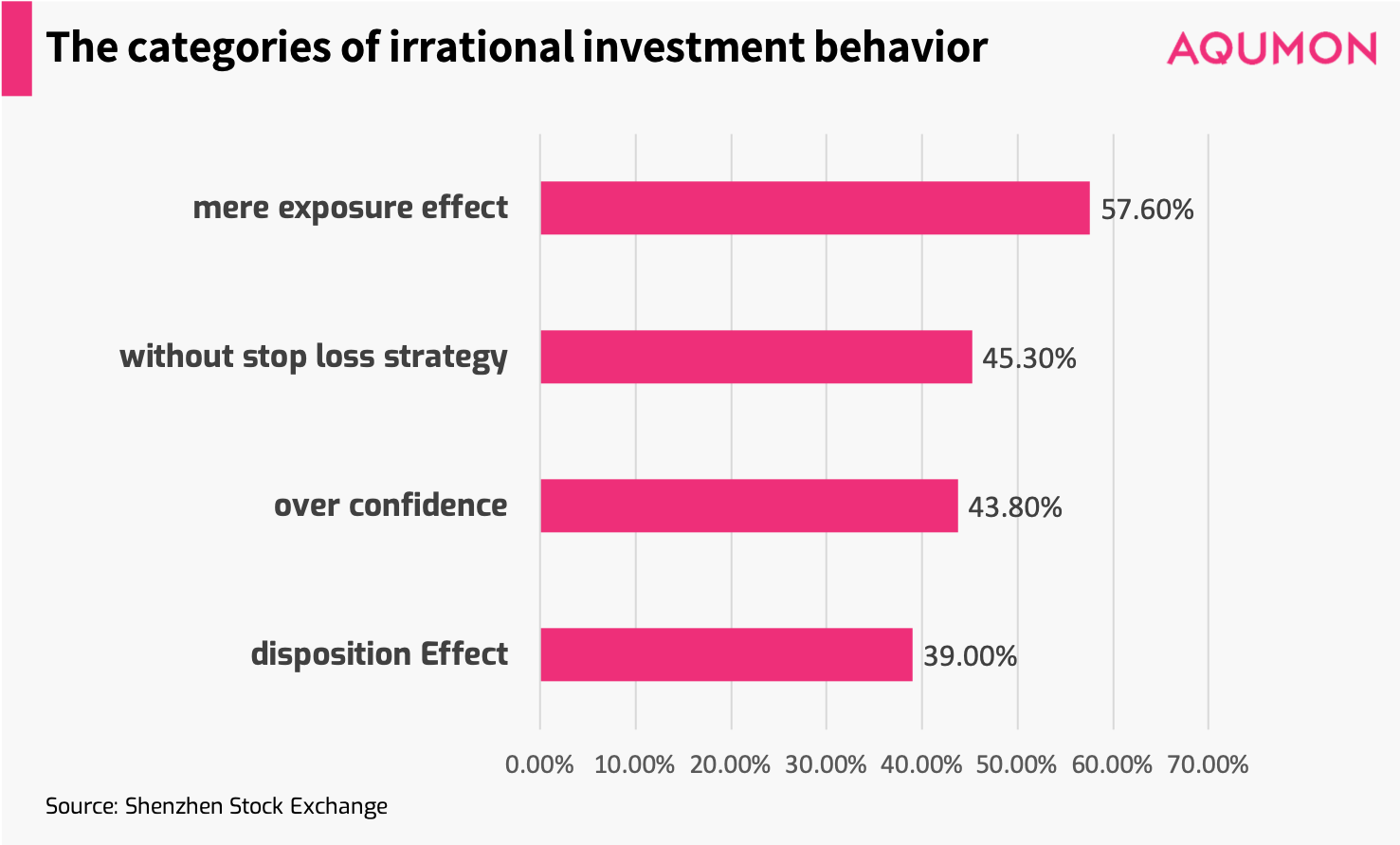

In addition, irrational investment behavior still occurs frequently amongst investors. Behaviors such as the:

- Mere-exposure effect (57.6% of investors): whereby investors tend to develop a preference to invest in stocks they bought before merely because they are familiar with them,

- Over-confidence effect (43.8% of investors): where a person's subjective confidence in his or her invesment decisions are greater than the objective accuracy of those judgements, especially when confidence is relatively high and

- Disposition effect (39.0% of investors): The tendency of investors to sell assets that have increased in value, while keeping assets that have dropped in value.

Therefore, in the case that individual investors do not have professional knowledge to analyze market conditions, we recommend they should focus on long-term investing strategies, which will minimize the impact from irrational behavior and investment fluctuations.

So what about that extra time and energy you have saved from switching from short term to long term investing? Use it to ‘invest’ in yourself.

In an interview with Forbes, legendary investor Buffett once said: “Ultimately, there’s one investment that supersedes all others: Invest in yourself, nobody can take away what you’ve got in yourself, and everybody has potential they haven’t used yet.”

No matter what kind of investment strategy you are adopting, whether long term or short term, investing in yourself is the only way to continue making ‘profits’ and improve your own value.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.