Market Outlook & Manage Your Portfolio Risk

Written by Ken on 2019-09-30

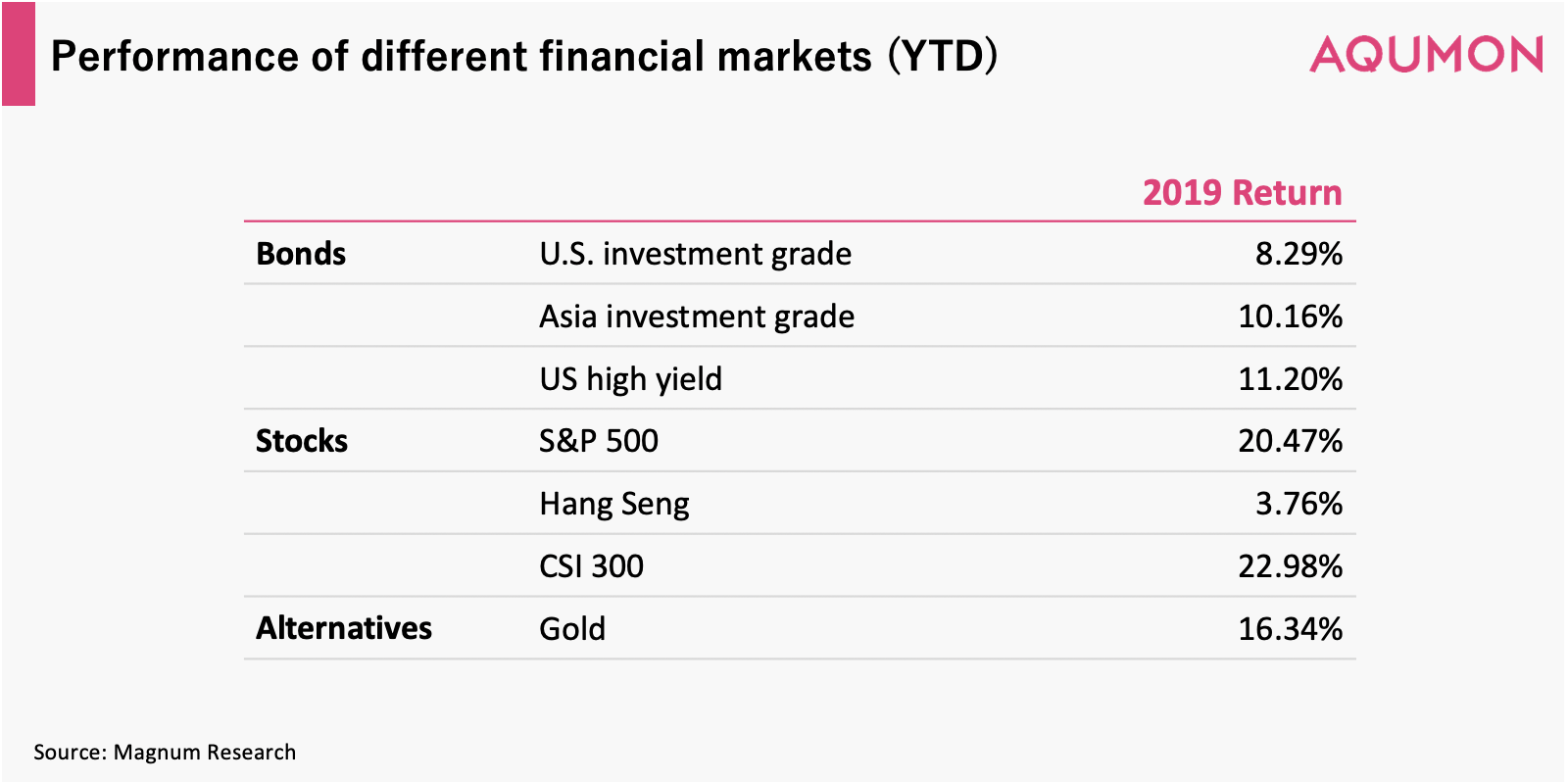

Financial markets in September continued to exhibit heightened levels of volatility due to a combination of the ongoing U.S.-China trade war, policy changes by the US Federal Reserve and a weakening global growth outlook. Investors as such has flocked to more secure assets such as U.S. investment grade bonds and gold both up 8.29% and 16.34% respectively year to date (as of September 27th) as a result.

Here is a brief breakdown of how financial markets look like year to date:

What is the outlook for the market?

Although global growth is slowing most market analysts agree that risk of a major global recession is unlikely at this point. On the rates front, after the US Federal Reserves’ 0.25% rate cut in mid September (its 2nd this year) there is a lot of market chatter that there may be no more policy changes for the rest of 2019. We will keep a close eye on this heading into the final months of the year. With that said, what is certain is that the low interest rate environment along with the other market unknowns (such as the U.S.-China trade tensions) are here to stay so market volatility will continue to stay elevated for investors.

So what should investors do?

Especially with the elevated market noise, AQUMON encourages our clients to:

-

Invest in a systematic and globally diversified manner (both in terms of region and asset class): Due to the divergence in risk and return exhibited by our local Hong Kong market versus overseas markets. Year to date Hong Kong stocks have had a roller coaster ride with a peak to trough maximum drawdown of over 16% (reverting back to year end 2018 levels) while U.S. stocks continued to perform strongly up over 20% in 2019. Not being home biased continues to drive more favorable returns for many local investors.

-

Don’t forget bonds and alternatives: Even though bonds and alternatives such as gold has appreciated a sizable amount this year having them in your portfolio given the market volatility would be a wise move.

-

Be careful about holding cash in this market environment: Lastly, although investors may want to sit on cash, rates are extremely low and they would be better served finding more attractive yields in short maturity fixed bonds versus holding cash.

As such AQUMON is pleased to announce we will be launching new features in late October that allows our clients to manage their portfolio risk even easier. This update comes in 2 parts.

-

Reducing your risk type easier: Now clients can reduce their risk type with just a few simple clicks. For example for clients who are assigned a ‘growth’ risk type after completing our risk assessment can lower their risk type easily to ‘balanced’, ‘moderate’ or ‘conservative’. Although we don’t recommend clients change their risk type frequently we understand the option to reduce, particularly in the current investment climate, should be painless and straight forward. AQUMON’s clients will have this going forward.

-

Defensive all bond exchange traded fund (ETF) portfolio offering: Numerous clients have feedbacked that they would like to reduce their equity exposure in this current market environment and as a result we will be offering an all bond ETF portfolio investing into a number of short maturity bond ETFs and U.S. investment grade bond ETFs. Estimated return is around 3% before fees. Advisory fees will be less (0.4% per year) than our multi-asset portfolios given returns are lower. The thinking behind this is how to offer our clients something more defensive while keeping their portfolio’s sensitivity to changing interest rates low. Traditionally the shorter the maturity/duration a bond has the lower its price volatility is when interest rates change. So having a defensive, short duration and ultra liquid bond portfolio we think is a winning combination in this investment environment.

If you have interest in this all-bond ETF portfolio please add your name to the waitlist here. We’ll notify you directly as soon as this becomes available.

More exciting upgrades and news are coming after and we can’t wait to share this with you. Hope you enjoy this new update from AQUMON and happy investing!

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.