Defensively Position Your Investment Portfolio

Written by Ken on 2019-10-08

Note: If you are interested in our new defensive all-bond exchange traded fund (ETF) portfolio (details below) join our wait list HERE.

Markets experienced another volatile week last week with European stock markets such as the U.K.’s FTSE 100 index and Germany’s DAX index down 3.65% and 2.24% respectively. China and Hong Kong markets were generally flat due to public holidays. U.S. stock markets rebounded Friday from a mixed jobs report with the S&P 500 index finishing the week down 0.33%. U.S. payrolls and wages numbers came in short of their estimates with non-farm payroll expansion falling slightly short at 136,000 (estimate 140,000) and wages rising 2.9% versus the prior year (the weakest in more than a year). The saving grace was the US unemployment rate falling to 3.5%, the lowest since December 1969. The net result ended up boosting U.S. stock markets last Friday. Furthermore market data suggests an increase in bets that the U.S.’ Federal Reserve may cut interest rates again shortly putting more pressure on bond yields. Even though global numbers do look on the weak side we at AQUMON are not so bleak on the market outlook.

So what should investors do? Depends if you agree with our market outlook but we have solutions for both scenarios.

If you don’t have a favorable view on the market outlook we want to make dialing down your portfolio risk and allocating more to bonds easier for you. Our upcoming new AQUMON upgrade in 2 weeks time will offer our clients 2 benefits:

1) Clients can even easier tune down their risk type with just a simple swipe. It’s as simple as 1-2-3. No need to redo the risk assessment anymore. You can now be more defensively positioned for this current market in a flash.

2) If you really don’t want any equity exposure AQUMON is also offering a new defensive all-bond ETF portfolio for our clients. The estimated return is about 3% before fees and advisory fee will be lower (0.4% per year) versus our traditional multi-asset ETF portfolios (0.8% per year). This portfolio will mainly invest into short maturity bond ETFs and U.S. investment grade bond ETFs which we think are the right mix of risk/return that our clients have been asking for. Plus its sensitivity to changing interest rates will be minimal with the majority of its investments allocated to shorter dated bond ETFs. Join our wait list HERE.

Some investors may argue that bond pricing is definitely higher after the recent flight to safety the past few months (investors buying up bonds, gold and defensive stocks) but we feel that this shouldn’t deter your decision if you truly have a negative outlook on the market. The search for yield and defensive positioning will likely become more in demand when looking forward so we want to make sure our clients can easily fortify their portfolio positioning. More defensively positioned...means you can sleep more soundly at night.

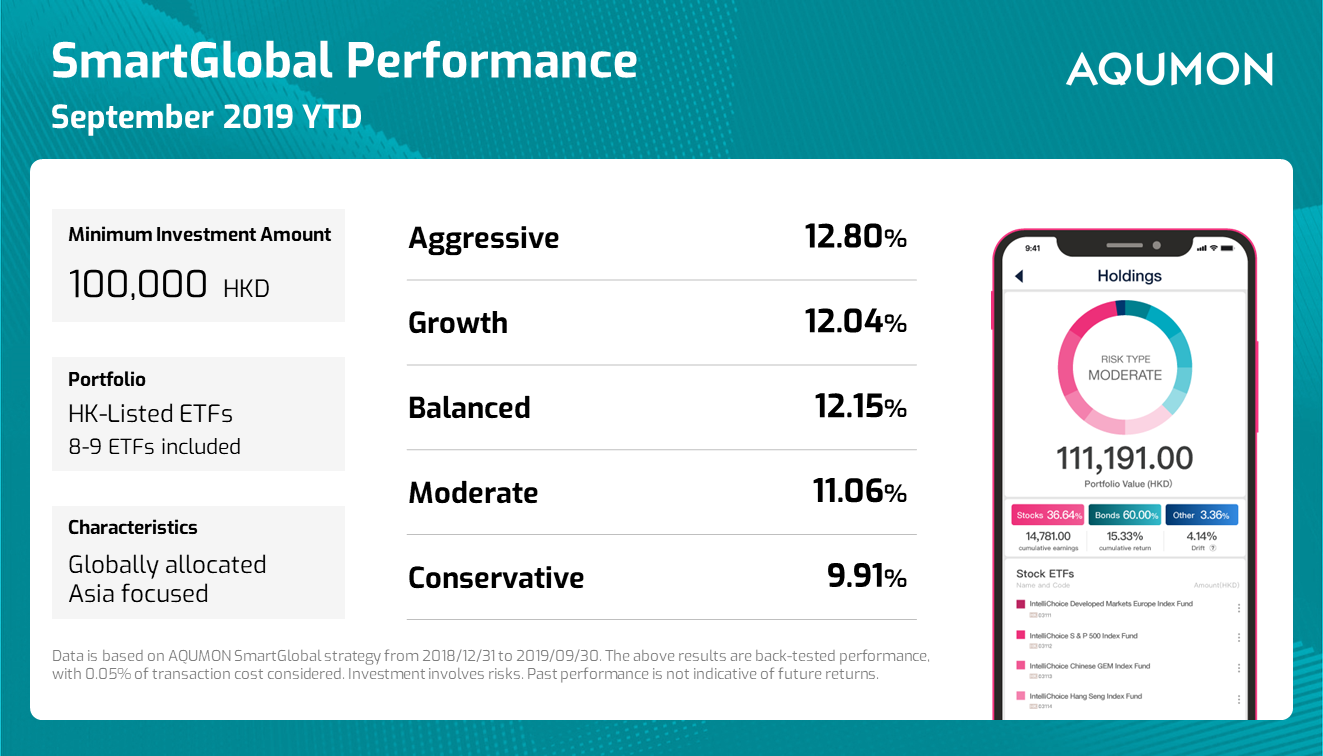

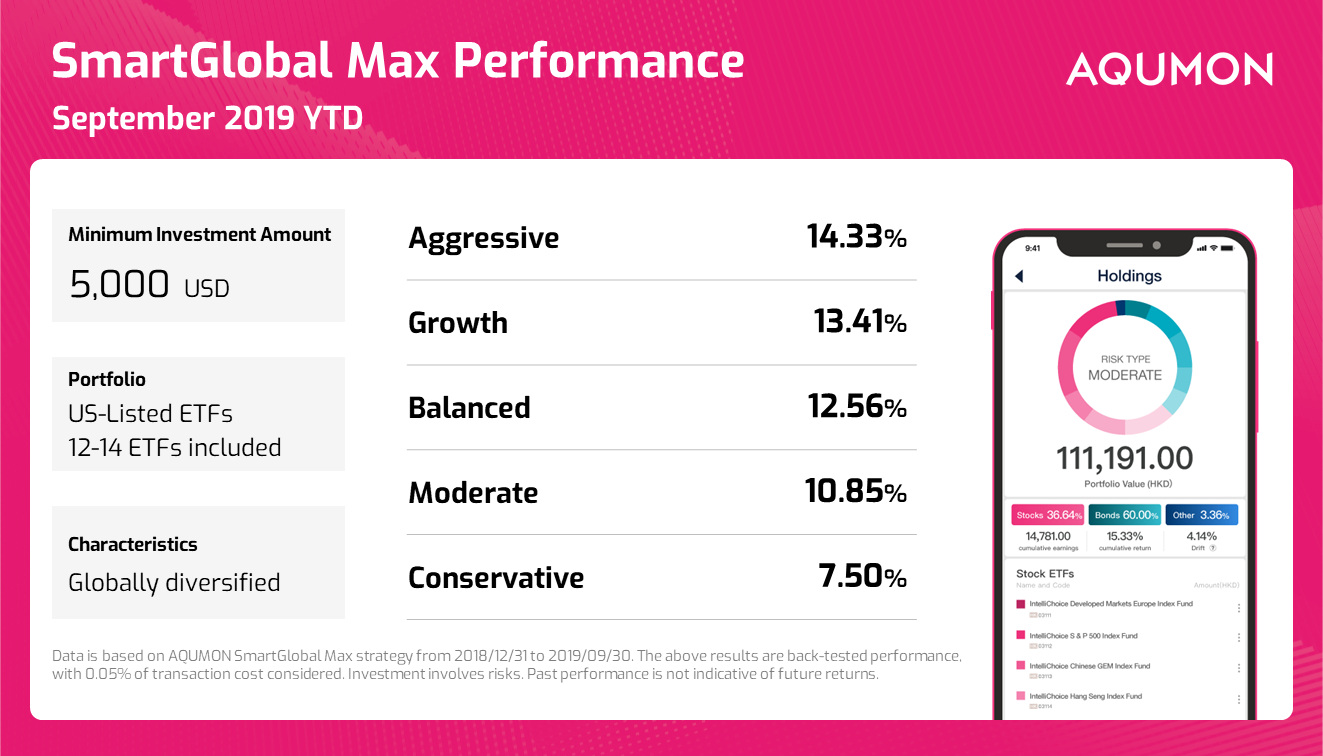

For those investors who understand that returns take time and are comfortable riding out the current volatility AQUMON’s diversified multi-asset portfolios are well positioned to weather this market. Our intelligent portfolios has allowed us to deliver to our clients remarkable return levels of 7.50% to 14.33% (most conservative to aggressive portfolios) year to date (end September). Looking at return drivers it really helped our clients to be diversified with sizable returns comings from all asset classes. Our client’s bond allocations delivered 9-14% return from U.S. investment grade, high yield and emerging market bonds while Chinese A-shares along with U.S. stocks offered 18-23% return as well. It helps to be diversified.

Below is our monthly return breakdown from our SmartGlobal (HK ETFs) and SmartGlobal Max (U.S. ETFs) portfolios.

We at AQUMON are always strong believers that success happens when opportunity meets preparation. So let AQUMON help you prepare. Happy investing.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.