U.S. Stocks -11% This Week: the Major Drivers

Written by Ken on 2020-02-28

Global markets due to coronavirus fears and headlines have pulled back a sizable amount the past 7 trading days so we wanted to keep you well informed in terms of what is going on so you can make an informed decision in this current market.

The U.S.’ stock market (S&P 500 Index) is down 10.76% this past week and -7.80% year to date. In comparison AQUMON’s portfolios are -1.53% (conservative) to -7.61% (aggressive) this past week and +0.33% (conservative) to -6.02% (aggressive) year to date.

Our all-bond defensive portfolio is doing its job +0.0% during this extremely volatile period and +0.7% year to date.

Don’t just react to the headlines

As we’ve been talking about for a few weeks now with investors that the dramatic coronavirus headlines are driving knee jerk reactions with investor confidence but this is not particularly rational and beneficial for investors in the long term. When looking ahead as investors you’re going to see a lot of sensational headlines with scary words like “correction” or “recession” or “black swan event”. Stay calm, understand what is truly driving markets and remember your long term investment goals.

Here what we see are driving the current market pullback:

1. Coronavirus fears:

The coronavirus now has 83,045 confirmed cases globally as of Friday with Korea (2022 cases), Italy (655 cases) and Iran (275 cases) being hardest hit lately. President Donald Trump’s coronavirus news conference on Wednesday further failed to shore up much investor confidence because the U.S. talked about ‘containment’ of the virus but fell short of listing any substantial solutions. The coronavirus vaccine, according to the World Health Organization (WHO) is likely 12-18 months away. We will be closely watching its developments.

2. Bernie fever

Senator Bernie Sanders is currently the national frontrunner for the Democratic presidential nomination. Many market analysts may argue that if he wins the democratic nomination and potentially the presidency that he is negative for the U.S. businesses because he is for additional regulation of businesses and put the interests of the U.S. people over the interests of corporations (and not the other way around).

Super Tuesday, when the greatest number of U.S. states hold primary elections and caucuses, is coming up next week on March 3rd and we should have a much better idea how the candidates stand afterwards.

3. High valuations

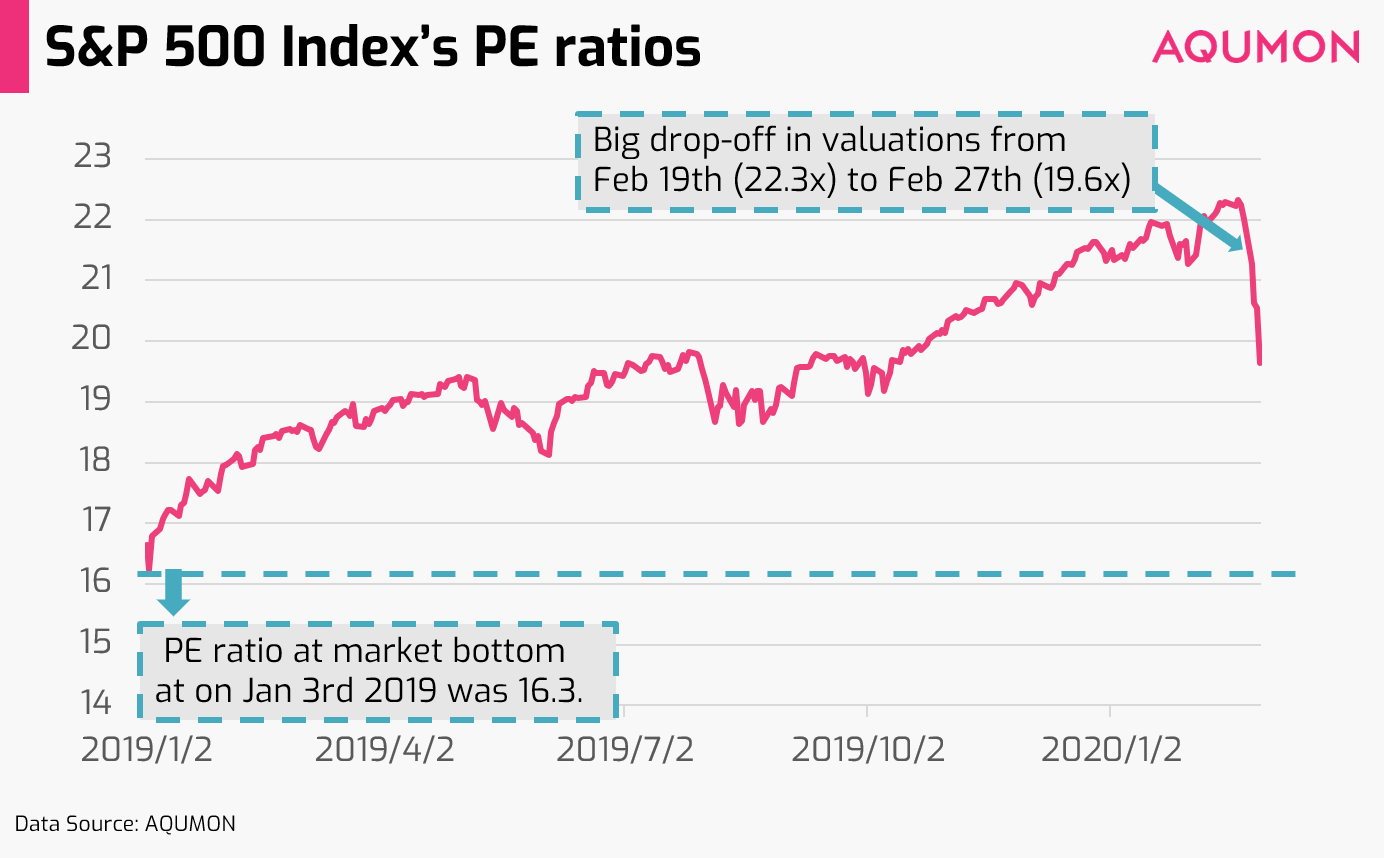

As we mentioned before market valuations last week were back at all time high levels and there was added pressure by investors to profit take during this period. Currently the S&P 500 Index’s price to earnings ratio (a measure of valuation and if it is overvalued/undervalued) stands around 19.6 down from 22.3 (market height last Wednesday). As a reference during the market bottom on the first trading day of 2019 S&P 500 Index’s PE ratios stood at 16.3. So valuations have come down a sizable amount and should reduce profit taking in this period.

What are we looking at?

We are closely monitoring the global virus transmission trend and particularly when the coronavirus officially lands on U.S. soil (right now 60 confirmed cases) and how it will impact the world’s largest economy on a human and business level. Will it be a repeat of what’s been happening in Asia with factories shutting down, businesses requiring employees to work from home and schools forced to shut down? Are their businesses prepared to handle this? Duration wise, how long will it take for the virus to become less of an impact?

Although we see many analysts already tuning down estimate earnings (Goldman Sachs says the S&P 500 Index companies will see 0% in 2020) and economic growth projections please remember this is a fluid situation. This is what we are watching and monitoring.

So what can I do as an investor?

More likely than not are we haven’t seen the market bottom yet but for those of us who are experienced, when others are acting irrationally, it is a good opportunity for us to systematically think about carefully adding to our portfolios little by little during this period and benefitting our portfolios in the long term by lowering its average cost. Just a week ago many investors complained about the markets being too high to enter. This has clearly changed in a short span of a week.

For those of us who prefer to tune down our risk (increasing bond allocation) this can also be easily done in our AQUMON app. Two things to note are:

1) bond prices are not low right now given the recent flight to safety by investors and

2) there are commission costs when adjusting your portfolios. When looking at the maximum drawdown (biggest return pullback) in 2020 for AQUMON’s portfolios it is -0.15% (defensive all-bond) and -2.20% (conservative).

Both portfolios are holding quite steady in this current investment environment.

As the markets continue to digest new information about the coronavirus we will likely see more volatility ahead so please be careful when you make portfolio adjustments. Please reach out to us if you have any questions about the market.

Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.