COVID Update and How to Position Your Investments

Written by Ken on 2020-03-20

I’ve been monitoring the coronavirus situation very closely and have a few thoughts I wanted to share with you along with how to position your investments in the current investment environment:

Coronavirus situation around the globe:

Let’s discuss Hong Kong first. In the past 5 days majorly due to the influx of people returning back to Hong Kong from overseas we are seeing a sizable jump in new cases. In the past 5 days alone (including Friday) we’ve seen a +42% in new cases (108) for a total of 256 cases. Hong Kong may falsely feel ‘safer’ but mainly because most of us are not testing ourselves for the virus. As a rational human being (much like an experienced investor) I look at numbers, human behavior I see and human psychology that I try to understand before I plan my next move. If not addressed quickly we’re about to see another sizable spike so as investors and as fellow human beings we need to stay vigilant and continue to practice social distancing/self quarantining. This is by far the most simple and effective way to combat the coronavirus. I’ll explain a little more below why.

In Europe specifically in Italy it’s been 11 days (since March 9th) that their government has put down a country wide self-quarantine. At this point we have still yet to see a slowdown in case numbers, actually quite the opposite since yesterday we saw +5,322 new cases. Analysts from JP Morgan said Wednesday they expect the coronavirus to peak by the middle of next week. So far Italy has seen over 41,035 cases and possibly because they are the 2nd oldest population globally their death rate is unusually high at over 8% (globally closer to 4% currently).

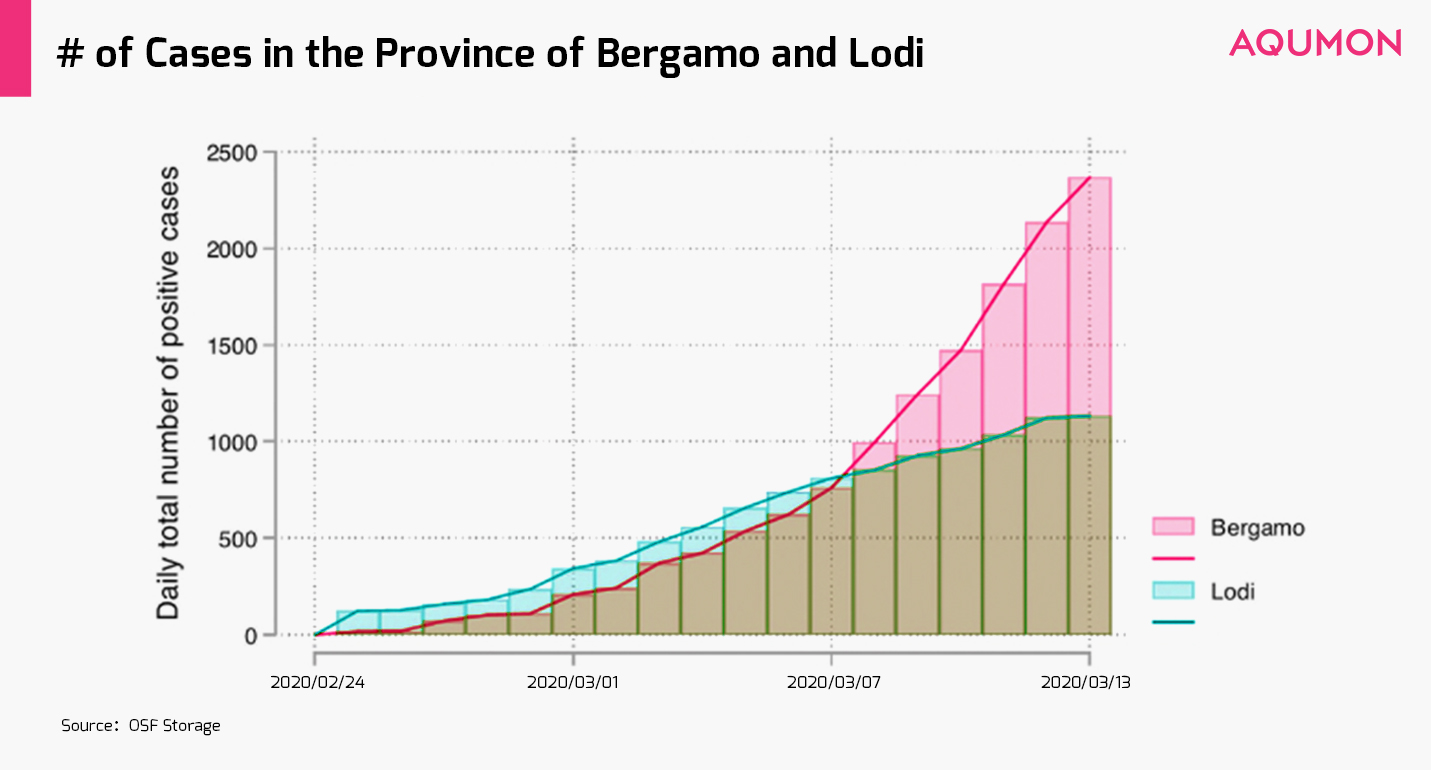

The benefits of social distancing/quarantining can be highlighted by 2 provinces in Italy here:

What this graph shows is that 2 Italian provinces and how the social distancing/quarantining early will greatly reduce the number of people infected. Lodi was quarantined on February 28th and Bergamo quarantined on March 8th. The cases halved by more than 50% by just starting 10 days early. This research was done by the University of Oxford & Nuffield College, UK last week. So considering the Italy countrywide quarantine just started March 9th, this may be an uphill battle.

One thing investors should be aware of is the infection number in the U.S. is going to spike a lot in the short term. The main reason behind this is because they are now finally conducting more wide scale testing for the coronavirus in the United States. So as you test more you’re naturally going to find more people testing positive. In the past week (March 12th to 19th) the number of infection cases in the U.S. jumped +534% from 1,694 to 10,755 cases. Overnight from Thursday (19th) as a result the U.S. cases increased +51.5% (4,876 cases). We should expect this number to increase significantly in the short term as the U.S. finds out truly how many people are infected.

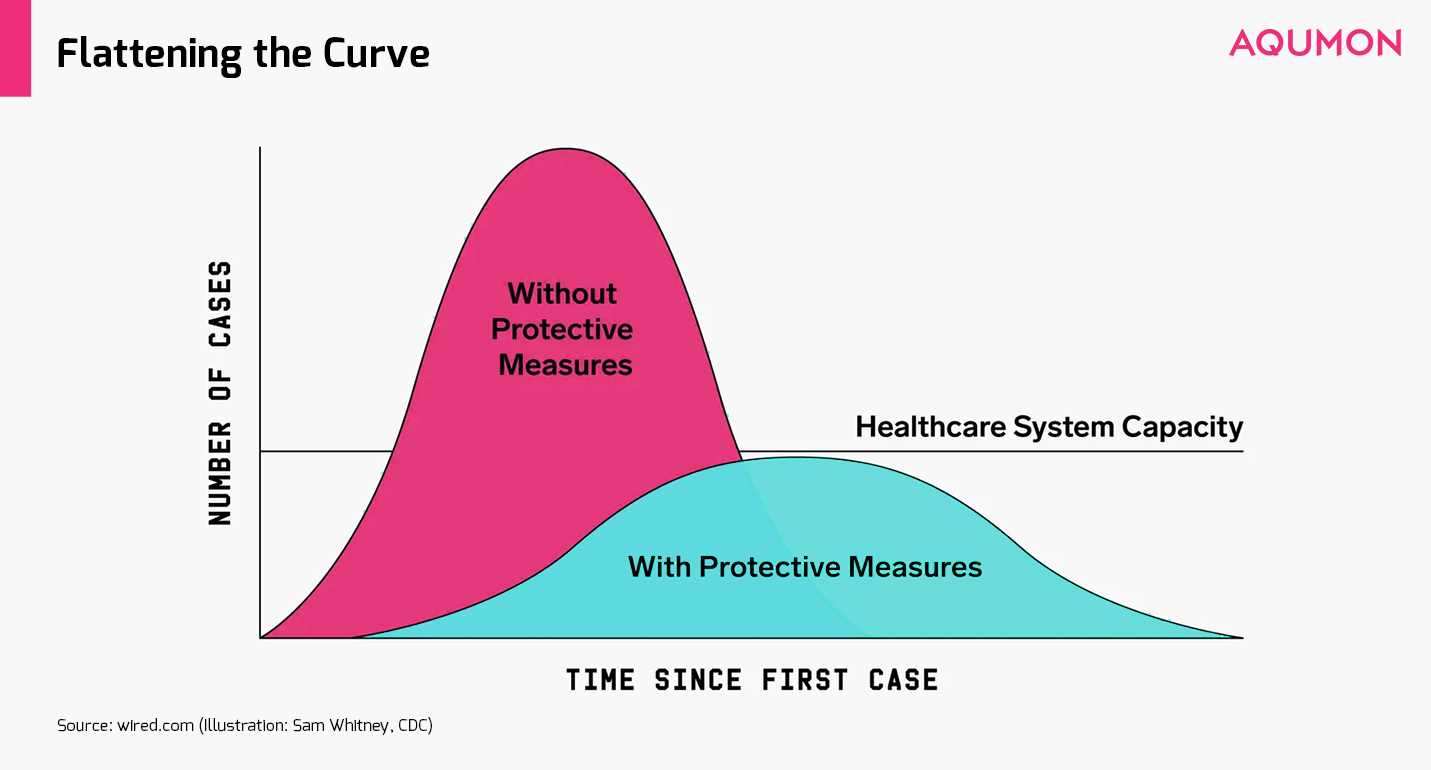

The part we should be more concerned about is what increased testing leads to. With more people testing positive it means more people will require hospitalization. Yet we mentioned 2-3 weeks ago that the U.S. currently has 924,107 staffed hospital beds with traditionally speaking 65% of them occupied. With these numbers this won’t take long for the empty hospital beds to get filled. Furthermore with multiple reports of hospitals in the U.S. running dangerously low on key medical supplies the risk we mentioned 2-3 weeks of their healthcare system, basically replaying the current situation happening in Italy, is more likely to become a reality.

You hear a lot of people in the U.S. talk about “flattening the curve”. Similar to the example in Italy it means people should quarantine themselves as soon as possible as to lower infection rates. Although the same number of people may get infected the purpose is to stretch the infection period a bit longer as to buy time and not overstress the healthcare system. This was clearly described in the chart below:

Why? Because the U.S. government can already project out problems happening on the immediate horizon. In New York state where the outbreak is most serious, New York Governor Andrew Cuomo said “the rate of the curve suggests that in 45 days we could have up to an input of people who need 110,000 beds that compares to our current capacity of 53,000 beds (and) 37,000 ICU units”. As of Wednesday 23% of New York’s 2,300 cases require hospitalization. U.S. president Donald Trump is currently deploying a navy hospital ship USNS Comfort to New York amidst the coronavirus outbreak but it only has 1,000 hospital beds onboard. More support may be on the way but given the gap is 50,000+ beds (and many may require additional isolation-specific attention) in 6 weeks time you can imagine the challenge ahead.

What does this mean from an investment perspective?

The key to riding out this current volatile market situation is:

1) First assess your financial situation: The money you invest should ideally not stress you out financially. For example you may want to trim some high/risk and illiquid investments because these may be impacted more intensely by the potential volatility ahead. The key is reducing your risk exposure by also controlling how much you invest.

2) Stay calm: Although it may look scary ahead, smart investors stay calm when others don’t. Panic selling rarely delivers returns to investors in the long term.

3) Stay liquid: In this current market where oil is trading close to US$26-30 (but many analysts may see it going lower) and treasury yields are unusually increasing in a market selloff situation (meaning investors are bypassing ‘flight to safe assets’ straight to ‘flight to cash’) this will put added stress on certain less liquid investments (even traditionally ‘safe’ investments like bonds). Staying in liquid (easier to convert to cash) investments will make you more nimble in this current environment and reduce situations where your money is locked up for an extended period of time.

Stay invested for the opportunity ahead. If your investment size doesn’t stress out your finances, you are calm and your investments are nice and liquid then history has shown us staying invested has paid off time and time again. For investors looking to buy the dip I highly suggest you assess your risk tolerance and financial situation first. For those of us who are systematically accumulating into this market weakness there are likely great rewards for us ahead. To reap these potential rewards there will be a volatile period where we will need to be patient.

If you have any questions please feel free to reach out to us at AQUMON. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.