AQUMON 2020 Semi Annual Report

Written by AQUMON Team on 2020-07-06

Market Review

It’s been a very turbulent 2020 thus far, with the start of July marking almost six months since COVID-19 casted an impressionable shadow on the global markets. The first half of 2020 marked a stark contrast from last year’s bull market, which saw indices like the S&P 500 surging to record highs.

In January of this year, the Chinese stock markets began to fall as the number of domestic COVID-19 cases reached an inflection point in the central Chinese city of Wuhan. With the epidemic escalating on a national scale by the Chinese New Year holidays, China’s financial markets continued to fall sharply. Shortly thereafter, global markets began to feel the economic impact of COVID-19 with the S&P 500 dropping more than 20% by mid February.

In late February and early March, the stock markets of the United States and other developed nations continued to plummet affirming the global scale of COVID-19’s economic damage. Catering, entertainment, tourism and hospitality were among the industries most heavily impacted by the virus. as mandatory quarantines, social distancing and immigration controls were introduced worldwide. The Low-end manufacturing industry was also affected by movement controls, with many manufacturing facilities worldwide shutting down production in February and March.

Despite the raging bear market, worldwide government responses to COVID-19 were swift. From March, governments and central banks implemented bailout policies, grants and other measures of economic stimulus to mitigate COVID-19’s economic impact. MostThese policies have resulted in most developed markets witnessing the era of zero or negative interest rates.

The first half of 2020 also saw many first-time investors making their way into the financial markets. As the cost of leverage fell, the U.S. market became flooded with retail investors who added additional leverage by purchasing options and other financial instruments.

AQUMON portfolios’ performance

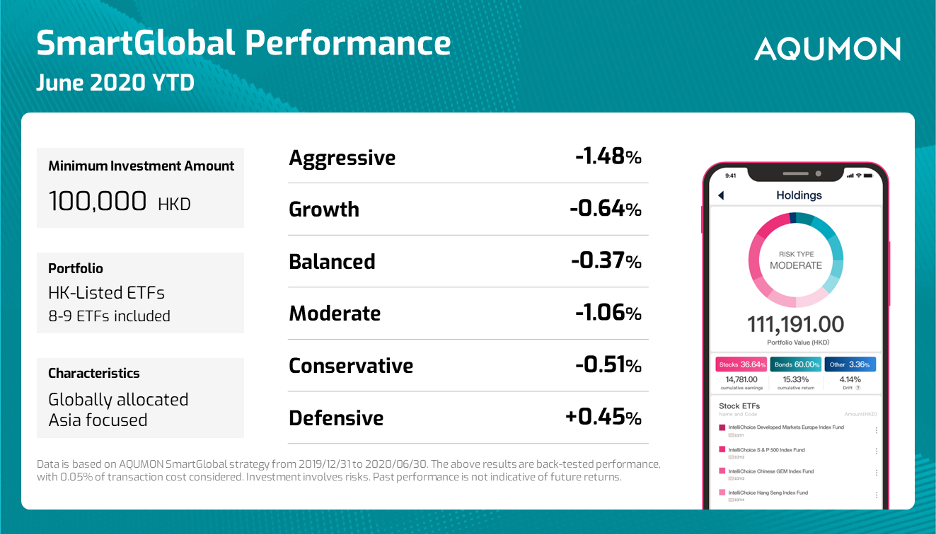

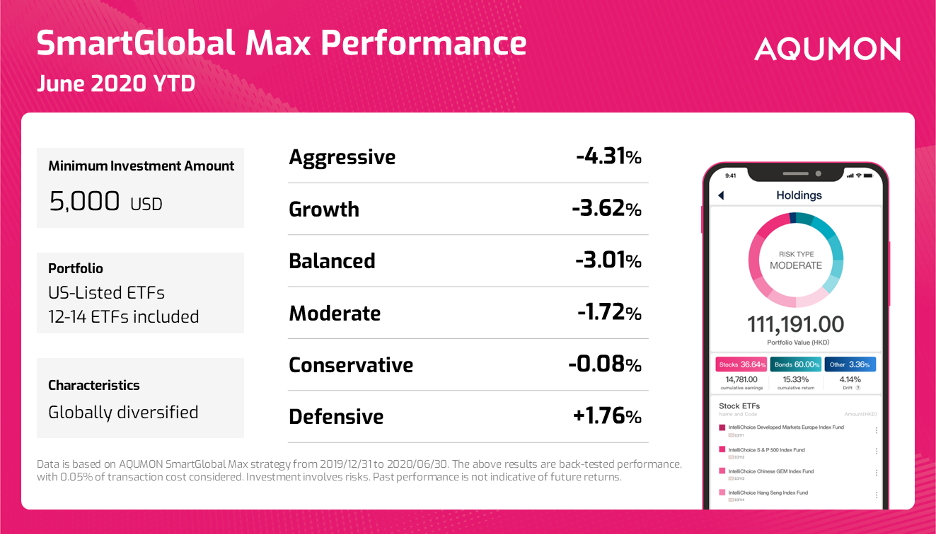

From the start of 2020 to June 30, AQUMON’s flagship product SmartGlobal® Max (Composed of US-listed ETF portfolios) realised returns of +1.76% to -4.31% across its low to high risk profiles. Additionally, the SmartGlobal® portfolios (composed of HK-listed ETF portfolios) experienced returns of +0.45% to -1.48% across all its risk profiles.

In the coming months, COVID-19 will continue to play an influential role in the global markets. Additionally, events such as the US-China trade war and the US presidential elections will be deterministic of market outcomes.

As a long-term investor, your primary point of decision-making should be yourself; prioritise your personal financial condition, risk preference, and risk tolerance over news headlines when making investment-related decisions. As the old saying goes, don't waste your time forecasting the market!

Feel free to reach out to our team if you have any questions or concerns; we are always happy to help. Once again, thank you for your continued support for AQUMON. Stay safe and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.