Why Are Investors Flocking to Gold Recently?

Written by Ken on 2020-07-30

Concerns due to political tensions weighed down on global financial markets last week with European stocks like the Euro Stoxx 50 Index down -1.63% and -11.60% year to date. The US’ S&P 500 was relatively more muted -0.28% last week and -0.47% year to date. Locally both the Hang Seng Index and the CSI 300 Index retreated -1.53% and -0.86% respectively. Gold in comparison was up +5.12% last week and has performed very strongly in July. We’ll go into this topic more below.

AQUMON’s diversified ETF portfolios were +0.11% (defensive) to -0.07% (aggressive) last week and +2.13% (defensive) to -0.34% (aggressive) year to date. Largest portfolio drivers last week continued to be safe assets like gold and bonds both in emerging markets (+1.53%) and high yield (+1.29%). Energy stocks also saw uplift +2.23%. Biggest portfolio lagger was coming from rotation out of US technology stocks (-1.49%) while all other asset classes stayed relatively flat.

This week our focus will be looking at why investors have been so attracted to gold recently and also looking deeper into the recent US stimulus package news which we feel is supportive for financial markets.

Why are investors flocking to gold recently?

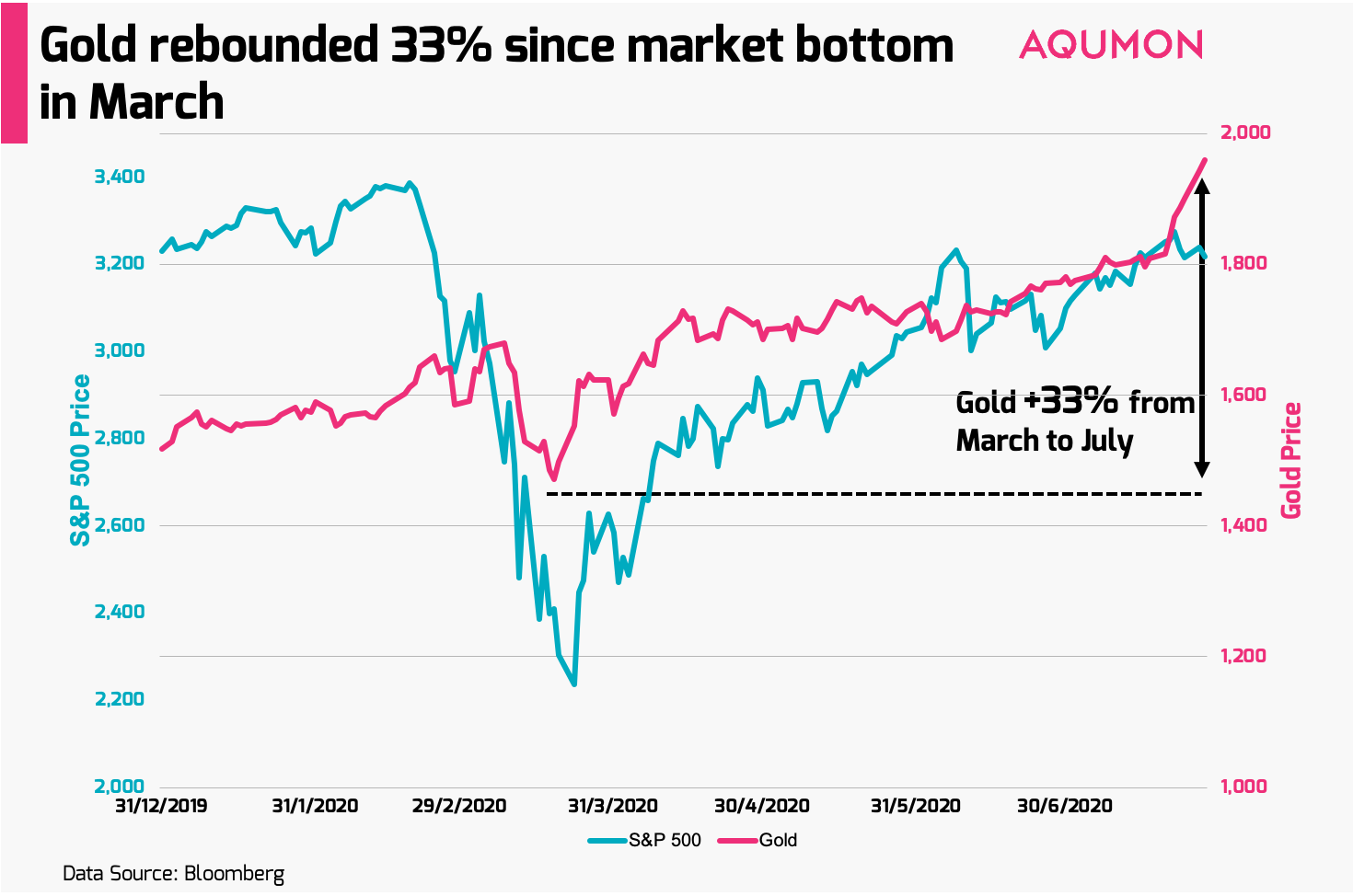

Gold prices have been on an absolute tear up +9.98% in July and +29.14% year to date making it one of the top-performing asset classes in 2020. You can see clearly it uncharacteristically matching the upward trend of US stocks since the recent market bottom on March 23rd:

So what’s been driving the recent interest in gold? Even though there are a number of factors that make gold attractive, the biggest driver for its surge comes down to lack of investment options in this zero interest rate environment particularly for larger investment managers such as pension funds and insurance companies managing billions sometimes trillions of US dollars. Let us explain. Whether it is the continued weak economic data, setbacks with economies reopening during this pandemic or political tensions this has added a lot of uncertainty in the current investment climate. In such times investment managers with a need for yield or have a negative outlook on the market traditionally gravitate towards bonds, the US dollar or gold. But there are 2 problems:

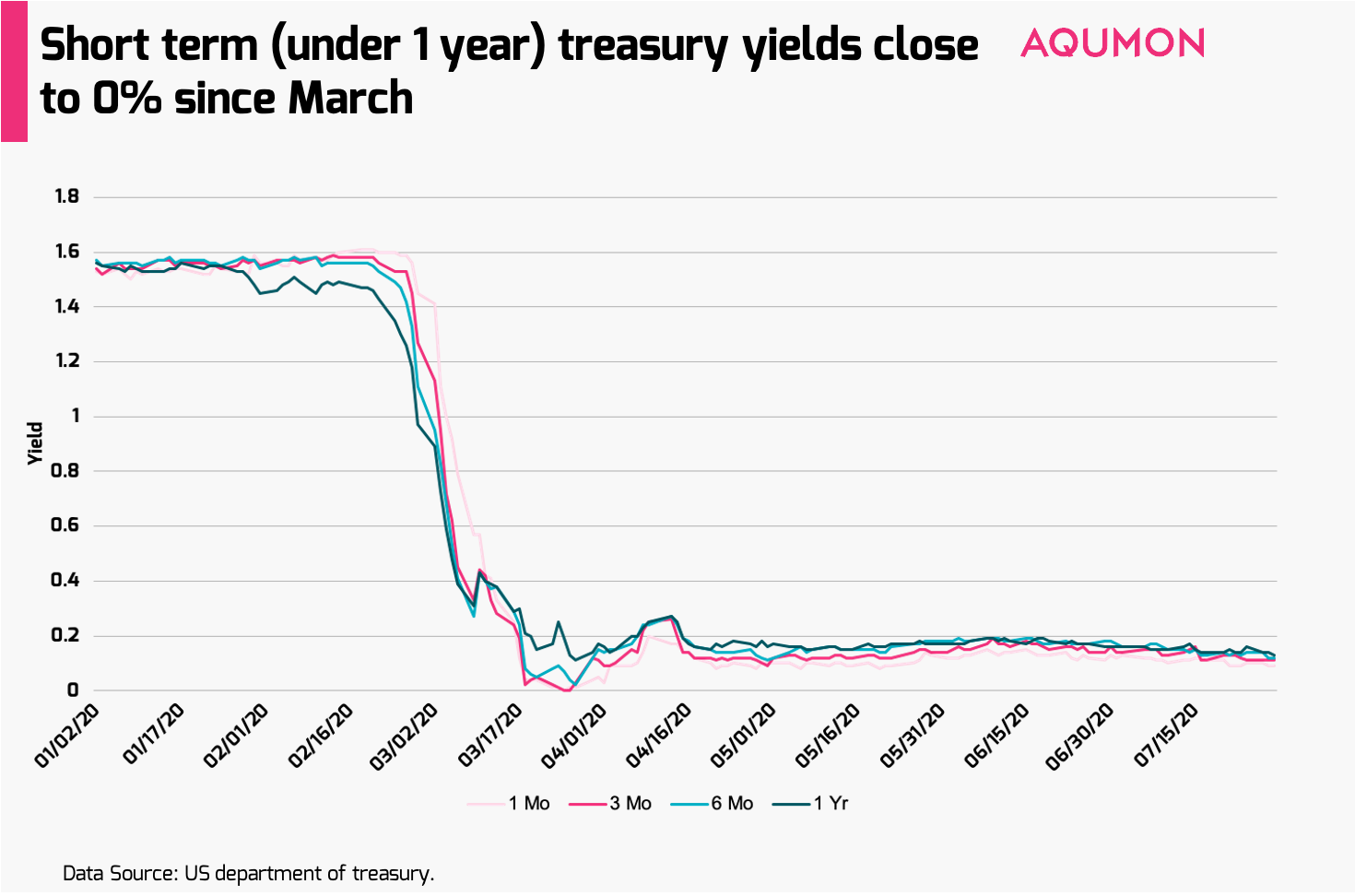

1) It’s zero interest rate environment: Traditionally larger investment managers and investors seeking yield would first look towards bonds (since it pays interest) and for more conservative investors even towards government bonds like US Treasury Bills. With the US Federal Reserve cutting rates down to 0% back in March, yields of shorter term (under 1 year) US treasuries also followed suit shrinking to under 0.11%):

So why in this yield-starved environment are investment managers now turning to gold even though it doesn’t offer any income? The main reason is as a portfolio diversifier to help them hedge against both market volatility and if there is a downturn in the stock market. During the recent selloff in March, the S&P 500 Index peak to trough fell -33.92% while in comparison gold fell -12.45%. So there is some downside dampening benefits from holding gold.

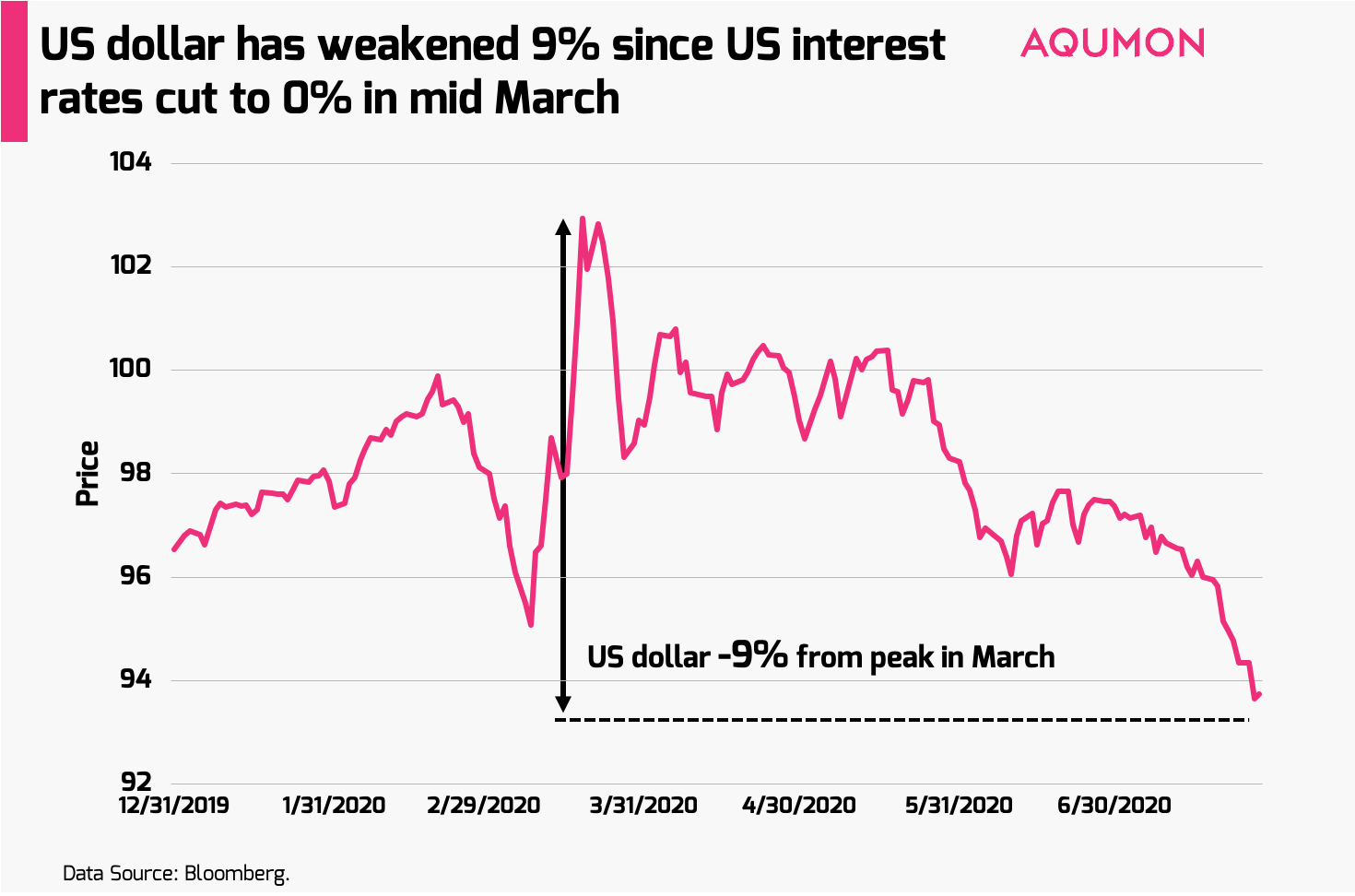

2) The US dollar is also weakening: But why? Investors need to first understand the basic relationship behind interest rates and the US dollar. As the US’ Federal Reserve lowers the interest rate, this makes US yield-related investments such as bonds (since they don’t payout as much) less attractive to investors globally. This creates less of a need for investors to buy the US dollar (since these investments are denominated in US dollars) and in turn puts downward pressure on the currency. Since the Federal Reserve has essentially cut rates to 0% since mid-March, the US dollar has weakened -8.95% since then and has not been as effective as a safe haven investment:

So investment managers with a less positive outlook on financial markets have been turning to gold which in the current environment has better ‘store of value’ properties (since it hasn’t depreciated in value unlike the US dollar). Quite the opposite, gold is up +29.14% year to date making it one of the top performing asset classes in 2020.

So what does this mean for investors? With a combination of the current zero interest rate environment, weakness of the US dollar and potential market uncertainty logically it does make it accommodative for gold to see further support even more potential upside ahead. Investors should also know:

Even though traditionally speaking, underperforming stocks is usually mirrored inversely by a stronger rally in gold, this is not always the case. A good example was during the March selloff just 4 short months ago. Why? Normally investors would switch from stocks in volatile times to safer investments like gold in a move for ‘flight to safety’ but investors in turn took a straight ‘flight to cash’ approach and gold tumbled -12.45% peak to trough from March 9th to 19th. As a reminder, during the Global Financial Crisis of 2008-2009 gold also fell in a similar manner collapsing -30%.

Furthermore from a pricing perspective, gold has already surpassed August 2011’s all time high of US$1852.85 and is currently trading at new all time high levels of US$1,959.60. We understand this also could be said of the stock market as well but it’s important to understand that due to central banks like the Federal Reserve pumping stimulus to prop up markets, it has made almost all traditional asset classes a ‘winner’ in 2020. Bank of America did a study this week looking at an “all weather portfolio” composed of 25% each in stocks, bonds, commodities and cash and found in the past 3 months it was up +18% versus a historical average of +7%. So even if you have a negative outlook on the market (we are cautious but not negative) we would still suggest rationally treating gold as a ‘diversifier’ to your portfolios over an actual ‘hedge’ against market risk.

More US stimulus coming hopefully before ‘summer break’

The US Senate Republicans has put forth a new stimulus proposal called the Health, Economic Assistance, Liability Protection, and Schools (HEALS) Act on Monday which includes another US$1,200 (~HK$9,300) check. This doesn’t mean the stimulus package is finalized yet and still needs bipartisan approval by the Democrat party. Investors should be aware of a few things:

1) Size of this stimulus plan is smaller: The Republican proposed US$1 trillion (~HK$7.75 trillion) HEALS Act is about half the size of the US$2.2 trillion (~HK$17.05 trillion) CARES Act already passed in March. This will also be a major point of discussion during negotiations between both parties as the Democrats proposed a US$3 trillion (~HK$23.25 trillion) proposal called the HEROES Act in May which provides more unemployment support and direct payments that was ultimately not taken up by the Republican led Senate.

2) There is also time sensitivity to these negotiations: The immediate goal for both parties should be to come to an agreement before August 7th. This is because this is the final date before both parties go off on a month long ‘summer break’ returning only on September 8th. So if there are delays in negotiations Americans may be receiving their stimulus checks and other unemployment support in late September versus late August. This could be a big difference maker for many Americans from a financial standpoint as certain states in the US continue to struggle with reopening their economies.

If there is a delay in coming to an agreement, this could bring unnecessary volatility back to financial markets in August so we will be closely monitoring this situation. The stimulus check and its subsequent support not only will keep many Americans afloat financially during this pandemic but also is supportive for both financial markets and the American economy. So this stimulus package getting smoothly passed and additional funds getting into the pockets of most Americans will be positive for financial markets in the subsequent months. Looking ahead there is chatter that there may be a 3rd round of stimulus before the US presidential elections in November so there may be further support ahead.

Finally, the Federal Open Market Committee (FOMC) finished their multi day meeting Wednesday and post-meeting notes suggest with the US economy likely challenged by COVID-19 for the rest of 2020, the Federal Reserve will continue to keep interest rates at 0%, extend lending programs into 2021 and generally keep policies accommodative for financial markets in 2020. Although expected, this is still ‘good’ news for markets and overnight US markets reacted positively in response.

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.