Your Top Covid-19 Investing Questions Answered

Written by Ken on 2020-09-14

The continued volatility in US technology stocks has resulted in diverging regional returns last week. The US’ S&P 500 retreated -2.51% last week and is +3.41% year to date. The Nasdaq continued to see pressure -4.06% last week but is still up +20.96% this year. European stocks surprisingly fared well with the Euro Stoxx 50 +1.69% last week but is down -11.46% in 2020. Hong Kong stocks were fairly muted last week -0.78% and -13.08%.

AQUMON’s diversified ETF portfolios were +0.03% (defensive) to -2.10% (aggressive) last week and +2.38% (defensive) to +2.47% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio with more regional exposure to Hong Kong/China is +1.18% (defensive) to +7.22% (aggressive) year to date. Safe assets like bonds and gold (+0.45%) were relatively flat last week. Beyond Europe we saw selective markets drive positive performance like India (+1.38%) while most other regional markets were down 1-2% last week.

We think everyone can agree the pressure from COVID-19 has caused many of us to look long and hard at both preserving and growing our finances. Market data also confirms this. A Standard Chartered Bank survey done in July 2020 shows 35-40% of Hong Kong people feel financial stress due to COVID-19 in the form of reduced pay or job redundancy. Within the month of July, 28% surveyed said their income had decreased in the past month. With the outlook of less income and job stability, 68% of Hong Kongers said they would like to be better at managing their finances amid the pandemic.

As a result, we have also received quite a lot of money and related questions from investors and readers and we thought we would change it up a little this week to address some of these questions.

What should be my goal (money wise) for my retirement in Hong Kong?

This is a common question we hear since most individuals do not know what is the goal they are saving or investing towards. Without a goal, we empathize that it can feel paralzying to start. Let us help you.

This is obviously quite a subjective answer but having a money goal along with taking action we feel is quite key to any individual reaching their money goals. According to FWD Hong Kong’s survey conducted in December of 2018, most Hong Kong respondents think HK$19,000/month in retirement savings sounds about right. Assuming you retire at 65 years old and the life expectancy of Hong Kong people are 85 years old for men and 90 years old for women according to the United Nations, that means your retirement money goal should be about HK$4.56 million (for men) and HK$5.70 million (for women). So for men in Hong Kong, the math is loosely HK$19,000 retirement savings per month x 12 months per year x 20 years of retirement = HK$4.56 million (not adjusted for inflation).

It is important to point out that most Hong Kong people underestimate the amount they need for retirement and when they will retire. This is more apparent in young people. JP Morgan did a study in October of 2019 where it shows Hong Kong people aged 30-40 on average expected to retire at age 61 and felt HK$3.6 million was sufficient for retirement, while people aged 51-60 felt the appropriate age to retire was 64 with HK$4.3 million. The estimated money goal gap between the 2 age groups was HK$700,000!

Source from: jpmorgan (https://am.jpmorgan.com/hk/en/asset-management/adv/insights/investment-ideas/long-term-investing/#)

Furthermore, when asked what age do Hong Kong people start to save for retirement? On average, it was at the age of 40 which makes it particularly hard for individuals to reach this goal as they have less than 25 years to accumulate this HK$4.5 million nest egg.

For our readers, half the battle is identifying the problem/goal then taking action. So be smart with your money and retire comfortably by both starting saving and investing early.

I heard interest rates are likely to remain at zero for some time, how does this impact me?

Actually more than you think. The US’ Federal Reserve (Fed) just announced Wednesday that it intends to keep interest rate policy at near 0% until the end of 2023. By keeping interest rates near zero, this in turn makes overall borrowing costs close to ‘free’ and encourages further economic and investment activities. Given how Hong Kong dollar is pegged to the US dollar, the Hong Kong Monetary Authority (HKMA) also slashed its base interest rate to 0.86% back in mid-March. So what does this mean for you? You need to make your cash work harder.

When interest rates are low or close to zero, the most immediate impact is your cash in a typical savings account will also earn close to zero in interest. Here is the most updated basic savings interest rate from HSBC as of Thursday September 17th:

If you put HK$10,000 in a bank as a regular customer, you will earn 10 cents after an entire year! So as a smart individual, you will need to put your cash to work and here are a few options:

1) Find a bank that pays more interest:

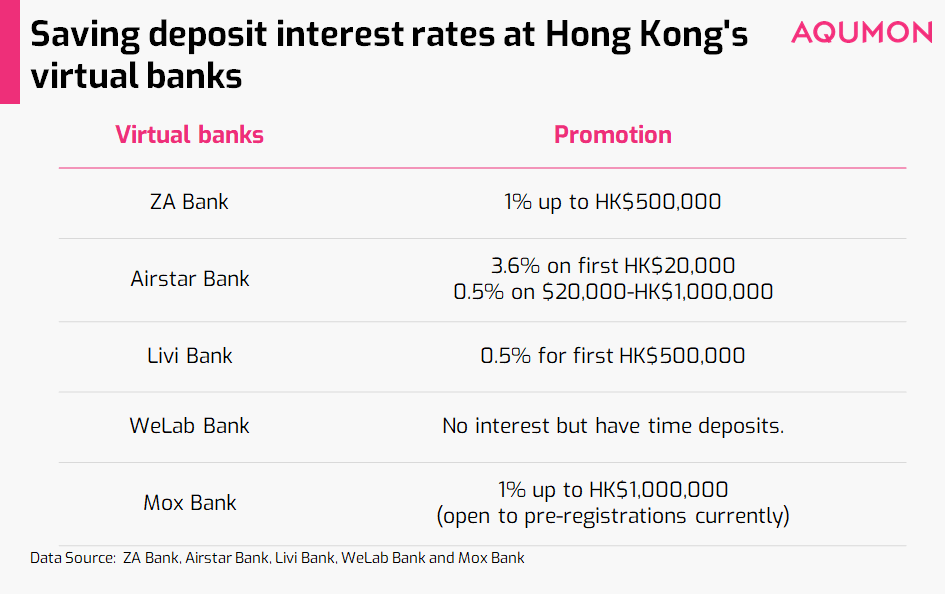

There are a number of savings accounts that offer 1% or more interest through the newer virtual banks (can open an account within 10 minutes via your smartphone) or via new account opening promotions at traditional banks:

1% interest does not sound like a lot but that means you would earn HK$100 in interest on the same HK$10,000. That is a 1000x difference that you should take advantage of with close to zero risk involved! These virtual banks, although new, are protected up to HK$500,000 by the same Deposit Protection Scheme offered to all licensed banks in Hong Kong.

2) Look into a time deposit:

If you don’t need the money immediately, you should definitely look into another close to zero risk option - a time deposit which means locking up a part of your savings for 1 week to 24 months and you would earn somewhere from 0.02% to 1%. Normally you cannot exit midway unless you pay a penalty. This is a favorite amongst many Hong Kong savers but unless you are getting a new account opening promotion (which may offer above 1% interest) getting 1%+ on a liquid savings account (which we mentioned earlier) seems a bit more attractive.

3) Start investing:

A low or zero interest rate environment also naturally encourages people to invest. The reason is because honestly for individuals they have limited options if they want to earn decent returns beyond 1% per year (that will at least beat inflation). If you are unable to beat inflation then basically your assets are losing value over time. Zero level rates along with massive central bank asset buying are the key reasons why financial markets have rebounded so strongly since late March. Interest on bonds (which is a favorite for many Hong Kong investors) have been compressed, so with the exception of investment grade bonds (or riskier bonds) in such an environment, individuals have little choice but to take on more risk (than normal) by buying stocks.

As mentioned on our blog multiple times, the key to you starting and continuing on your investment journey is you must first feel comfortable with the risk you are taking. You can control this by how much you invest and also by what you invest into. Once you have an amount you are comfortable to invest into something more diversified like a mutual fund or exchange traded fund (ETF) portfolio is a good starting point for many investors. Looking at the past 10-15 years investing into a more stable 60% stocks 40% bonds global portfolio can yield on average +6.4-7.7% return annually. This is a relatively stable way to earn higher returns beyond having your cash sit in a bank account.

Is now a good time to invest?

We clearly understand the sensationalist news headlines, the economic outlook and the ongoing pandemic can make investing a bit scary right now so our honest answer is majority of the time, when you invest is less important than how long you invest. There is further nuance which also applies to how much you invest. This is why we ask investors who feel nervous to start small or control how much they invest so they can sleep comfortably at night.

Let us explain why time in the market is so important.

Assuming you start investing with HK$10,000 along with a 6% annual return (we mentioned earlier a balanced and globally diversified portfolio of 60% stocks 40% bonds has delivered 6.4-7.7% in the past 10-15 years), with an HK$1,000 monthly periodic top up (quite reasonable) for 30 years would earn you approximately HK$1,031,948 (of which $370,000 comes from your contributions and HK$661,948 comes from additional return earned).

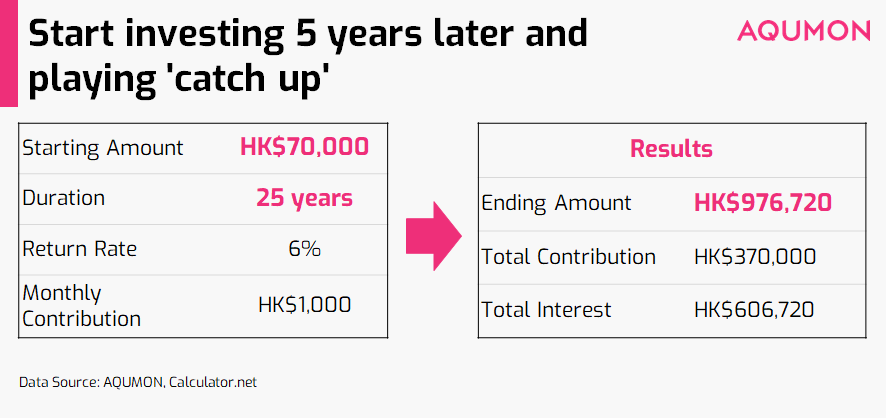

Let’s say in comparison you waited 5 extra years to invest. Even if you contributed the exact same HK$370,000 (but starting with HK$70,000 to ‘catch up’), contributing HK$1,000 monthly and assumed 6% return you would only receive HK$976,720 (of which $370,000 comes from your contributions and HK$606,720 comes from additional return earned):

So even investing the exact same amount but just assuming 5 less years in the market you would earn HK$55,228 less. Don’t leave this ‘free money’ on the table.

We clearly understand markets aren’t so black and white in reality (there could be scenarios where you could have potentially avoided a bear market during those 5 years) but logically the math makes sense and investing for a longer term has proved time and time again to be beneficial for investors.

Why we mentioned the nuance of how much you invest also plays a part is because there is also a psychological aspect to consider. If you start early at HK$10,000 versus start later at HK$70,000 the vast majority of people will likely to be more comfortable to start investing at the lower amount of HK$10,000. So the longer you wait, the more you need to ‘chase returns’, and the harder it is (psychologically) to take action. So even for nervous investors it makes sense to start small and just let time be you and your investment’s greatest ally.

So what about the market risks ahead?

Although there are multiple market unknowns ahead with the ongoing trade war, recent US technology selloff and upcoming US election in November, we continually want to communicate to investors that we are ‘cautiously optimistic’ when looking ahead. This means we see the upside in markets but we are also diligent in managing our portfolios’ risk. Why? Having experienced multiple bull and bear markets (especially the Global Financial Crisis of 2008) during the past 15+ years, staying calm, consistent and making micro adjustments with our investment approach we feel is what has served our portfolios best.

For investors that worry about the recent US technology selloff or the US elections (a number of our clients asked about this), we wanted to direct readers to 2 blog articles we wrote in the past 2 weeks which explains our views on these topics more extensively:

Don’t fear the tech selloff: https://www.aqumon.com/webview?content=news&id=591&lang=en

How have markets performed during past US elections: https://www.aqumon.com/webview?content=news&id=579&lang=en

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.