US Indexes All Beginner Investors Should Know

Written by Catherine & Jobie on 2020-09-22

S&P 500. The Dow. Nasdaq. Do you feel confused when you hear about any of these terms? But when you do your research, all the articles online just make things complicated?

Investing can be complicated, especially for beginners, and all the articles online might not be the most beginner friendly. If you are not sure what a stock market index is, and want to know how they work, then you have come to the right place! AQUMON knows the struggle is real for newbies like you, so we have made an absolute beginner friendly explanation for you.

Let’s make it simple! Imagine a stock as a fruit, then a stock market index is essentially a juice blend that is made up of any chosen stocks. This week, we have chosen three main juice blends in the US stock market that we think you might like! These include:

-

Dow Jones Industrial Average

-

Standard & Poor’s 500 Index (S&P 500)

-

Nasdaq 100

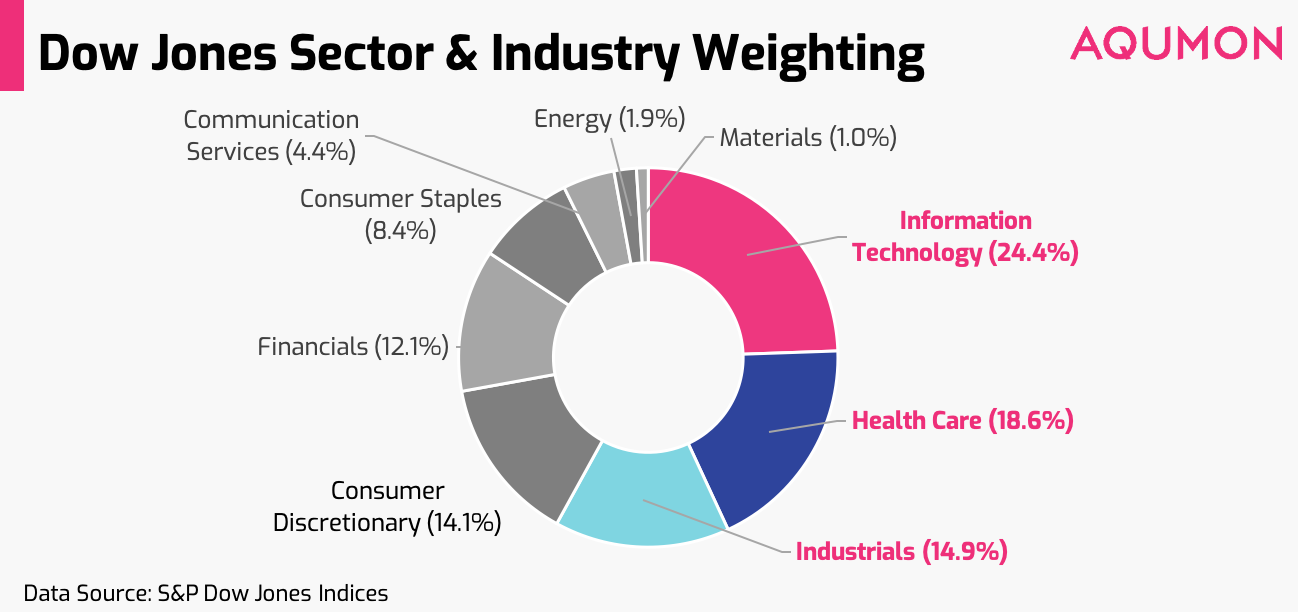

Dow Jones Industrial Average – the basic fruit juice

If you want a general outlook of the market trend, we have got the Dow for you. This basic fruit juice does not represent all US companies but will give you a taste of the US market.

Naming after journalists Charles Dow and Edward Jones, the Dow Jones Industrial Average (the Dow) is comprised of the 30 publicly owned American top-tier companies like Apple and Microsoft.

Started with 12 industrial stocks in 1896, the Dow moved along with the economy over years and it now includes companies in other sectors. Though many criticized that the Dow cannot fully represent the broad market, it is the oldest index in the US market. Unlike other indexes in the market, the Dow is a price-weighted index that shows the average price of the 30 selected companies.

Fun fact: Charles Dow, one of the founders for the Dow, was also one of the brains behind The Wall Street Journal.

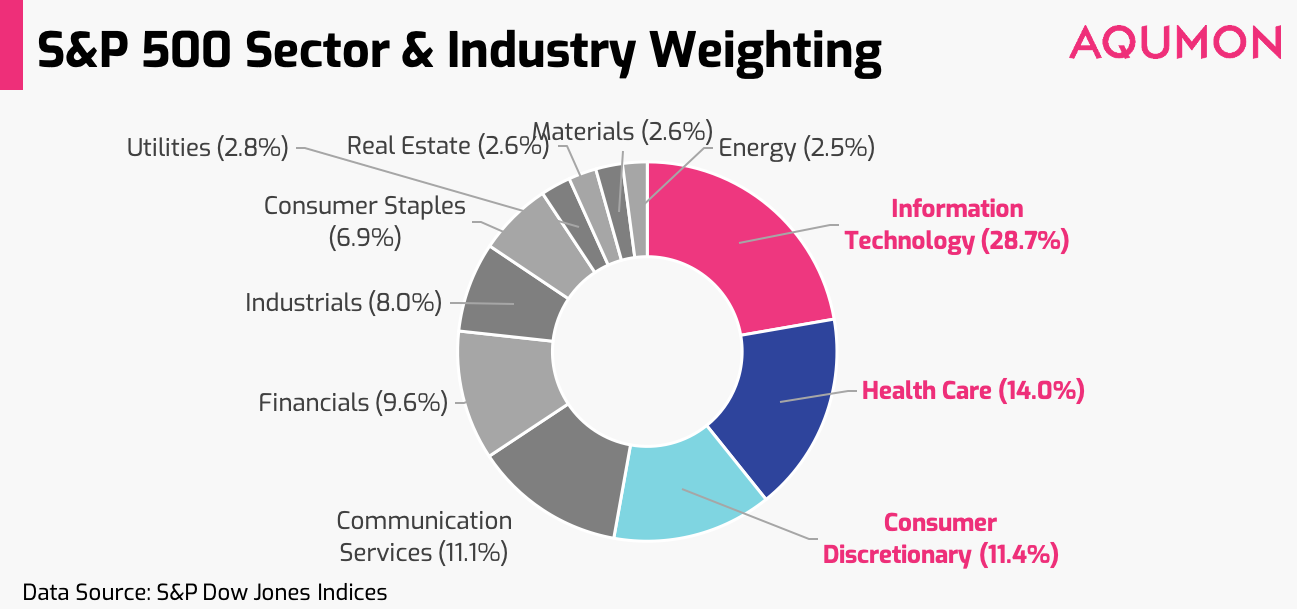

Standard & Poor’s 500 (S&P 500) Index – the ultimate juice blend

Looking for something a little bit more? Try the ultimate juice blend, S&P 500.

The Standard & Poor’s 500 Index, which is commonly known as the S&P 500, is the most widely used US stock market index. Created by Poor’s Publishing & Standards Statistics in 1957, this market-capitalisation-weighted index tracks 500 of the largest companies in the US such as Berkshire Hathaway and Johnson & Johnson, meaning bigger companies on the list have greater influence.

To put it simply, S&P 500 gives you a tiny taste of 500 different fruits and vegetables (stocks) available in the US market in one bottle!

Fun fact: Since some of the companies listed on the S&P 500 have issued more than one class of stock, the S&P 500 actually tracks 505 stocks.

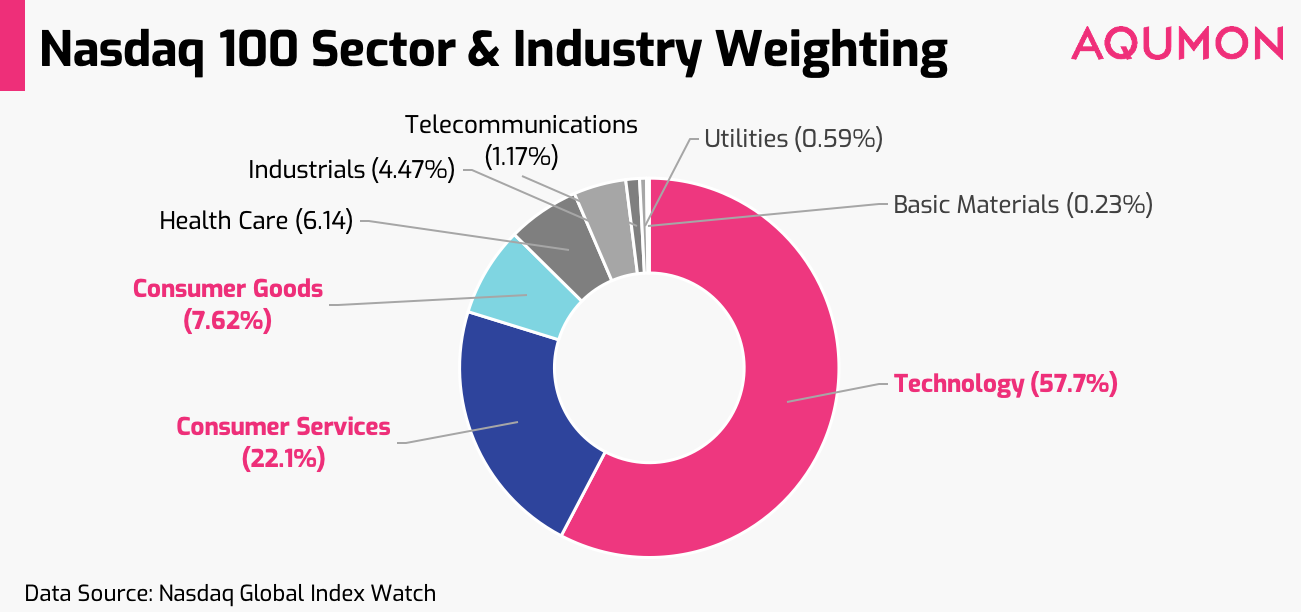

Nasdaq 100 – the superfoods juice

Next, we have the superfoods juice, the Nasdaq 100, for those who want more details on the high growth technology sector, for those who want more details on the technology sector.

The Nasdaq 100 was created by the National Association of Security Dealers in 1985. It is a market-capitalisation-weighted index that tracks the top 100 most actively traded non-financial companies that are listed on the Nasdaq Stock Exchange, including the Tech Giants (Facebook, Amazon, Apple, Netflix, and Google; commonly known as FAANG). Notably, it mainly focuses on technology stocks including small speculative technology competitors that have a relatively higher risk and reward.

Fun fact: Did you know the Nasdaq 100 has a sister index called the Nasdaq Financial 100, which follows the stocks in the monetary sector.

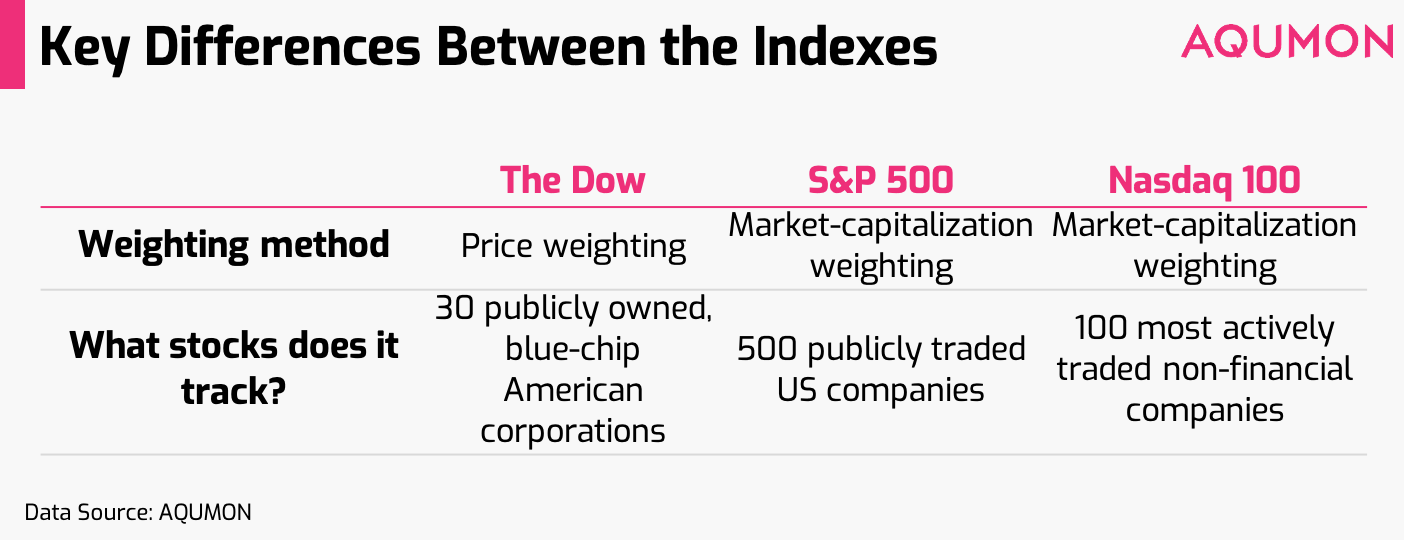

Key differences

It is worth noting that some leading American companies like Apple, Microsoft and Google are listed on all three indexes. However, they are weighted differently on each index. If you are looking to invest in the US stock market, we would recommend you to be watching all three of them together.

Can we invest in the indexes?

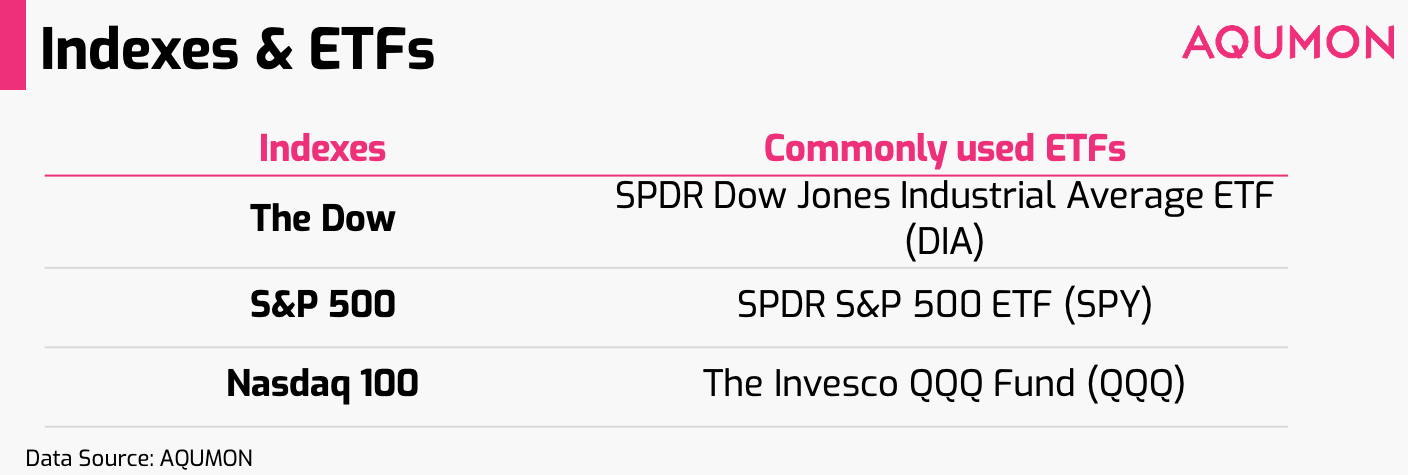

Investors cannot trade the Dow or the Nasdaq indexes because they represent the average performance of a group of stocks.

However, investors can purchase index funds or exchange-traded funds (ETFs) that track these indexes.

An ETF, which stands for Exchange Traded Fund, is a fund that can be traded like a stock. Index funds and index trading ETFs are identified as passive investing. Unlike actively-managed mutual funds, index trading ETFs are simply mirroring stock market indexes. Here are some examples that track the indexes that are mentioned above:

What to do next

For first-time investors, investing can seem a little daunting. We understand that there are a lot of fruits to choose from the market and you might not know what to pick. So if you are not sure what is the best combination for your own juice, you may try AQUMON’s robo advisor. It recommends the most suited ETF investment portfolio for you based on your risk tolerance level and investment preference. Our flagship portfolios - SmartGlobal and SmartGlobal Max series include 5-14 ETFs which help you invest globally. Kick start your investment journey with as low as US$1,000.

AQUMON also monitors your globally diversified ETF investment portfolio 24/7, making investing an effortless experience for you. Download our app to experience more!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.