How Music Lyrics Teach Us to Be Smart with Money

Written by Catherine & Jobie on 2020-09-30

Personal finance advice can sound the same everywhere online, so let’s make it fun and learn how to save from some music lyrics today! Havin’ money’s not everything, not havin’ it is (Kanye West, “Good Life”). Kanye is right – money is not everything in life, but one cannot live life without money. Do you have a habit of saving for a rainy-day fund or an emergency fund? Saving can be impossible when you live from paycheck to paycheck. That said, knowing how to properly manage your money and be financial independent is extremely important.

According to the latest HSBC FinFit Study, the average monthly savings for Hong Kong residents is HKD7,400, which is made up of around 29% of their income. The study highlighted that around 60% of the respondents have saved up enough to cover at least six months of basic living expenses.

With the ongoing pandemic, it is no doubt that the city’s businesses continue to struggle with the unemployment rate climbing up to 6.1%. Over 55% of the respondents in the FinFit Study said they had experienced money worries in the past six months. An unprecedented time like this is exactly why having an emergency fund is so important. A money tree is the perfect place for shade (Kendrick Lamar, “Money Trees”) so start growing your emergency fund for protection. Here are four healthy financial habits that we think everyone should have:

1.) Track your spending systematically

Have you got a problem with spendin’ before you get it (Kanye West, “All Falls Down”)? If that is the case, you should start tracking your spending habits. Over time, you will be surprised how often you spend eating out or getting bubble tea five times a week.

There are a lot of apps available to help you track your spending. For example, Monny is a great option, but you will have to manually enter everything. If that is too much of a hassle for you, you can consider using Gini and Planto – they automatically record all your expenses by linking the app to your credit card.

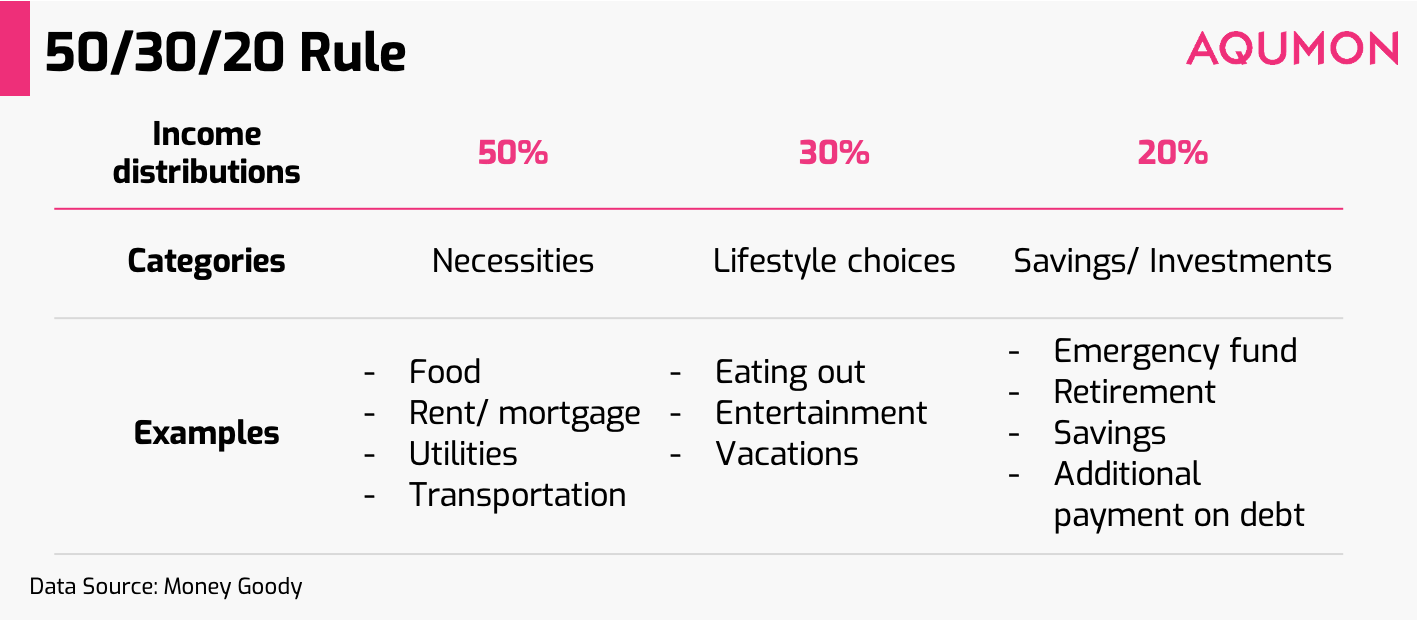

2.) Have a budget plan – 50/30/20 Rule

Having a budget plan prevents you from overspending. Not sure where to start? Try the 50/30/20 rule! This popular approach to budgeting essentially has you divide your income into three parts: 50% on necessities, 30% on lifestyle choices and 20% on saving or investment.

3.) Set a goal to encourage your saving habits

It is tempting to spend once you receive your monthly paycheck, therefore, it is good to set up some short- and long-term goals to encourage your own saving habits. For example, saving up for a trip that you have longed to go on. Give yourself motivations to start saving!

You should also invest in your future (Kendrick Lamar, “YOLO”) and start planning for retirement. You might think you are still young, and this is not something you should worry about now. However, a recent study by JP Morgan showed that most of the Hong Kong people, especially millennials, underestimated the amount they need for retirement.

Source from: jpmorgan (https://am.jpmorgan.com/hk/en/asset-management/adv/insights/investment-ideas/long-term-investing/#)

4.) Know what you need, not what you want

It is okay to have things that you desire as long as you do not spend your whole paycheck on unnecessary things. You can’t always get what you want, but if you try sometimes you might find you get what you need (The Rolling Stone, “You can’t always get what you want”).

Set something you want as your saving goal and work towards it, but make sure you will not have bills hanging over your head for things you do not need!

Follow these financial tips and start putting your mind on your money and your money on your mind (Snopp Dogg, “Gin and Juice”). Start growing your money tree today!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.