Time Deposits vs Investing: How to Grow Your Money

Written by Catherine & Jobie on 2020-10-08

Savings is the first step of money management and we cannot stress enough how important it is to be financially secured. According to a recent survey conducted by Sun Life Financial Hong Kong, almost 40% of the respondents aged between 18 to 40 have worried about their financial situations in the past year. So how should we grow our wealth to achieve financial stability?

Last week, we shared four essential saving habits that we think everyone needs to know:

-

Track your savings systematically

-

Have a budget plan (50/30/20 rule)

-

Set a goal

-

Needs vs Wants

If you want to read more on this topic, you can check out the article here.

Saving money is the first step to grow your wealth, however, saving alone is not enough. According to the latest HSBC FinFit Study, though around 60% of the respondents have saving habits, only 44% of them had invested to grow wealth.

Moreover, financial planners highlighted the gradual decline in savings rate in recent years. There are countless reasons to save, but more actions need to be taken other than just putting part of your income away for emergencies. Here are some options to grow your wealth:

1) Time deposit - low risk but low returns

If you are looking for low-risk investments, time deposit could be an option for you. It is a relatively more conservative investment option but it has a guaranteed stability.

The risk is lower than investing in stock markets, though you cannot withdraw money during the agreed period. Hong Kong Deposit Protection also makes sure your funds are safe – so even if the market crashes and banks go bankrupt, you will get a compensation of up to HKD500,000.

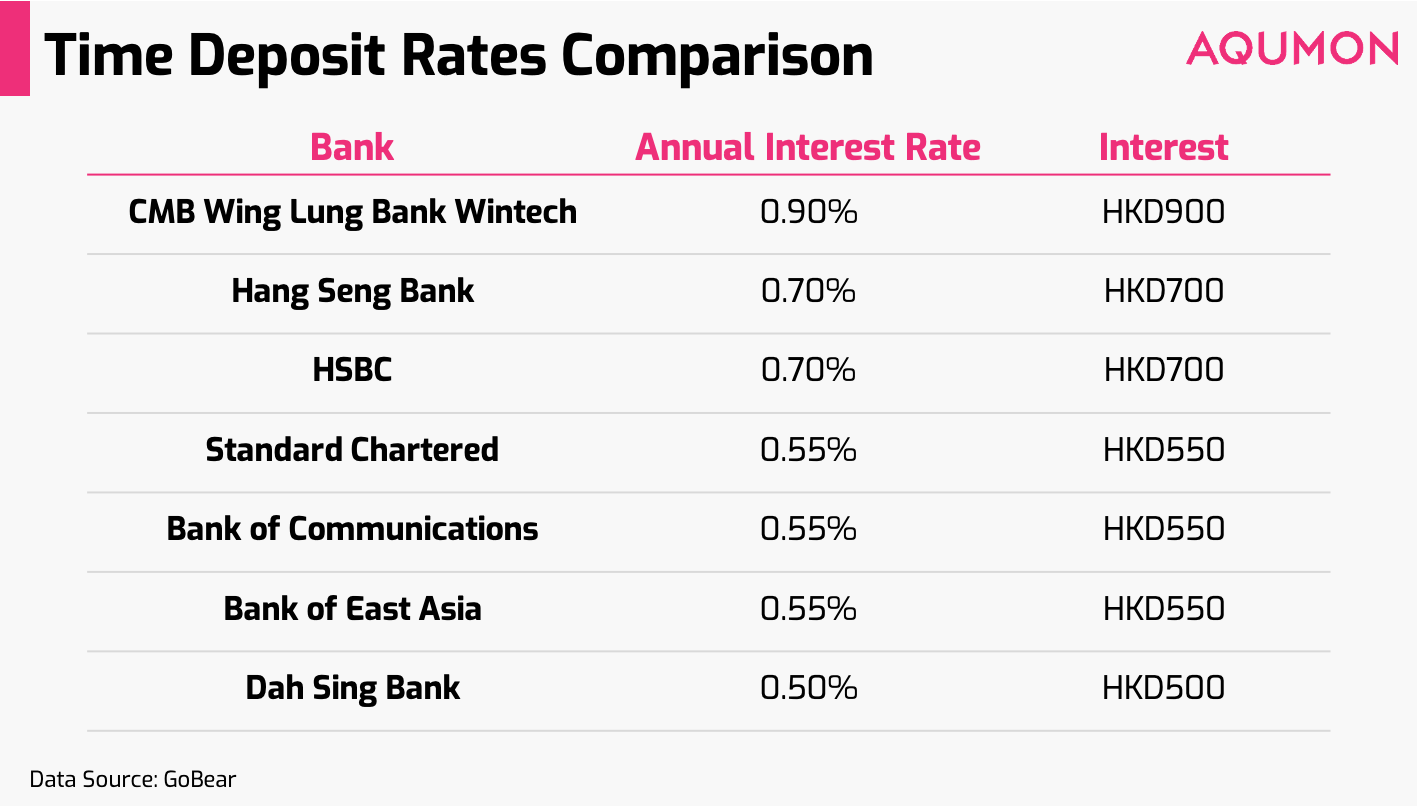

For instance, if you deposit HKD100,000 for a fixed term of 12 months, there is generally a 0.1 to 0.9% annual interest rate.

Among all the offers below, CMB Wing Lung Bank’s Wintech program by far has the highest annual interest rate of 0.9%. When you save HKD100,000 for a year, you will get HKD900 interests.

2) Virtual banks offers - more appealing annual interest rates

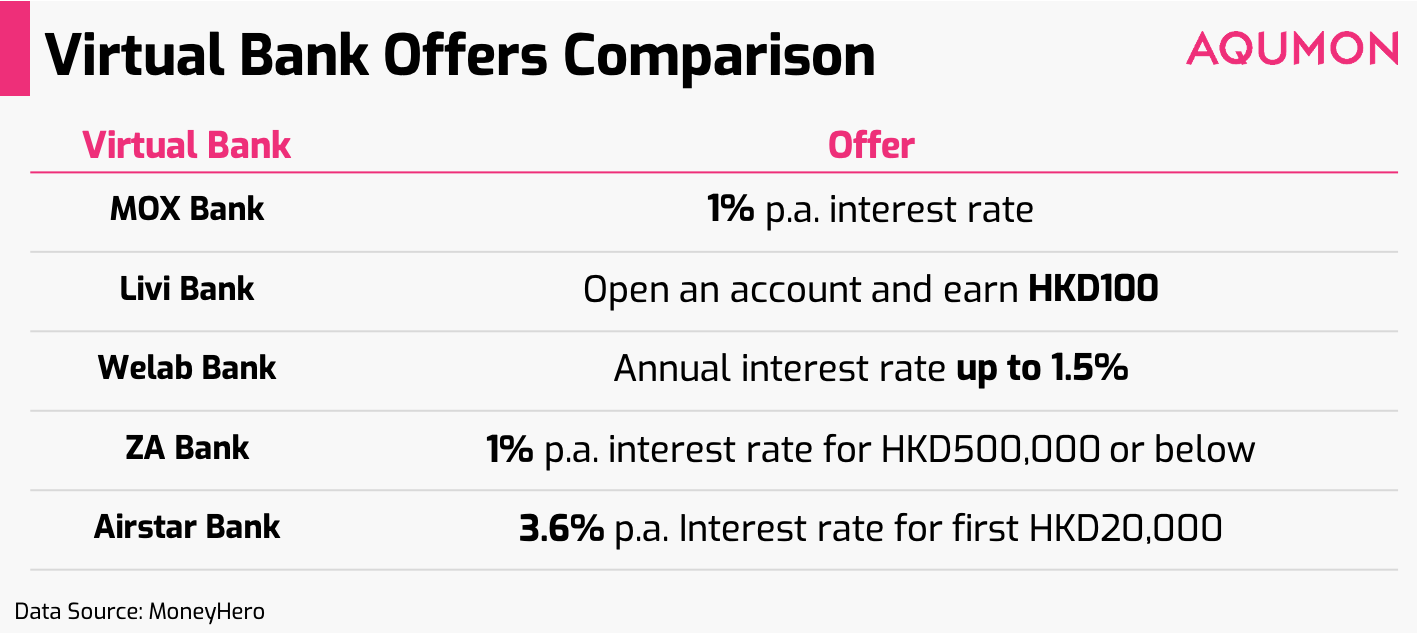

Virtual banks are on the rise. Hong Kong has eight licensed virtual banks right now, including Mox Bank, Livi Bank, Welab Bank, ZA Bank, and Airstar Bank.

Compared to traditional bank institutions, virtual banks have a more appealing annual interest rates for their current accounts:

3) Global asset allocation - diversified with higher returns

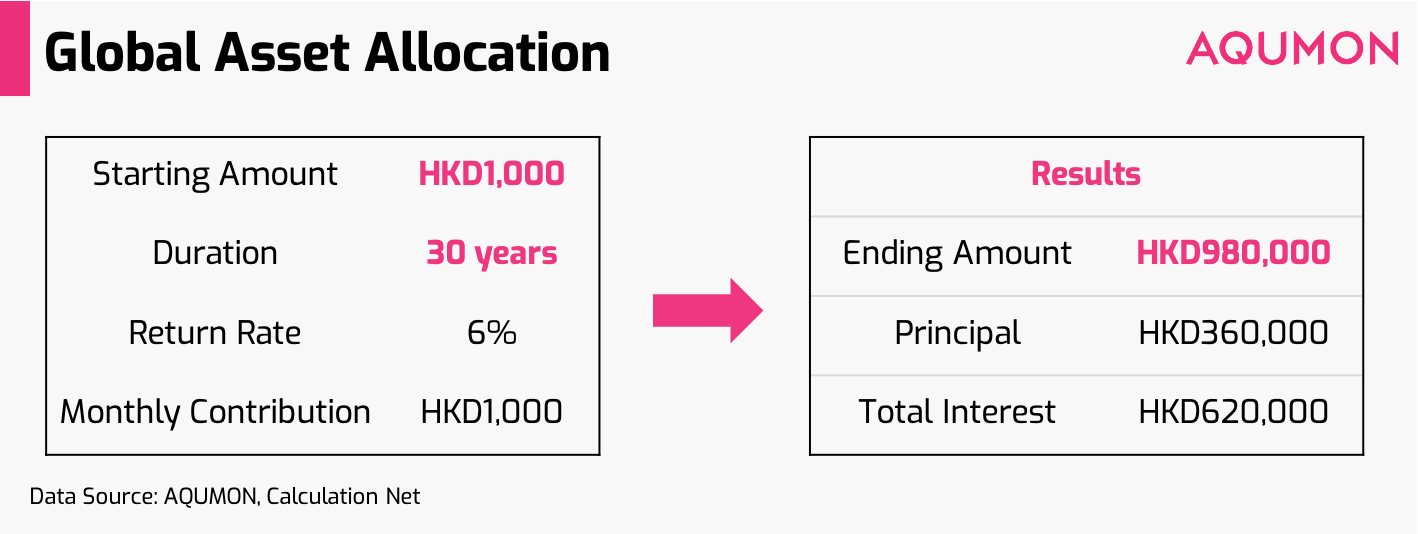

Looking for investments with higher returns? Global asset allocation would be a great option for long-term investment. It consists of 60% of stocks and 40% of bonds. The markets have had ups and downs in the past 10 years but the annual return rate is between 6.39% to 7.7% on average*.

(*Source from Lazy Portfolio ETF Stocks / Bonds 60/40 Portfolio)

For example, if you take out HK$1,000 and keep investing HK$1,000 each month with an annual return of 6%, after 30 years, you will get a total of HK$980,000. Your principal is only HK$360,000 while you get HK$620,000 interests.

Not sure how to start investing in a global asset allocation? We are here to help! AQUMON’s robo-advisor personalizes an investment portfolio for you with your best risk-adjusted returns. Our star products SmartGlobal (a portfolio consisting of HK-listed ETFs) and SmartGlobal Max (a portfolio consisting of US-listed ETFs) even allow you to start investing for as low as USD1,000. It monitors your portfolio 24/7 and triggers auto-rebalancing alerts when your portfolio drifts.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.