What to Know About Robo-Advisors & AQUMON

Written by Catherine & Jobie on 2020-10-30

Robo-advisors were first launched in 2008 during the financial crisis. However, it was not until 2010 when a 30-year old entrepreneur, Joe Stein, launched Betterment that robo-advisors increased in popularity. According to Statista, the asset under management (AUM) in the segment is projected to reach US$987,494m in 2020.

Compared to a flesh-and-blood financial advisor, this automated, algorithm-driven service is more convenient and costs much less for investors. A recent survey by PricewaterhouseCoopers highlighted that over 95% of Hong Kong people do not have access to sufficient investment tools.

Furthermore, access to a professional investment advisor is out of reach for the vast majority of people in Hong Kong according to KPMG. If you are looking to start investing yet cannot afford a professional, you should consider using these automated advice platforms as an alternative. Here are three questions that we often get asked as a Fintech startup:

What does a robo-advisor do and why should I choose it?

There are plenty of options available in the stock market. If you are not an investing geek, choosing what funds and ETFs to invest in and construct and manage a portfolio that is best for you can be overwhelming.

This is when robo-advisors come in. A robo-advisor is an automated investment platform that constructs and manages your investment portfolio for you.

AQUMON’s robo-advisor strives to make investing easier and more affordable for everyone. We build an investment portfolio that fits your needs based on your own risk tolerance and investment preferences.

As a Hong Kong based Fintech startup, we understand that not a lot of investors have the time to monitor the stock market considering the fast-paced environment we live in. Our robo-advisor not only saves you all the hassle in building a portfolio, but we also monitor it 24/7 at a low cost.

Are fintech startups employees all young and lack experience?

Startup companies do not necessarily mean employees at the firm lack the knowledge and experience to excel in their jobs.

Although the median age of our employees is 28 years, this does not mean we are not good at what we do.

In fact, our people are extremely talented and seasoned – our management team had previous experiences at some of the largest financial institutions like UBS, Deutsche Bank and DBS Bank. On top of that, our elite algorithm team is highly educated with most people holding a PHD degree.

What are the advantages of robo-advisors compared to financial advisors?

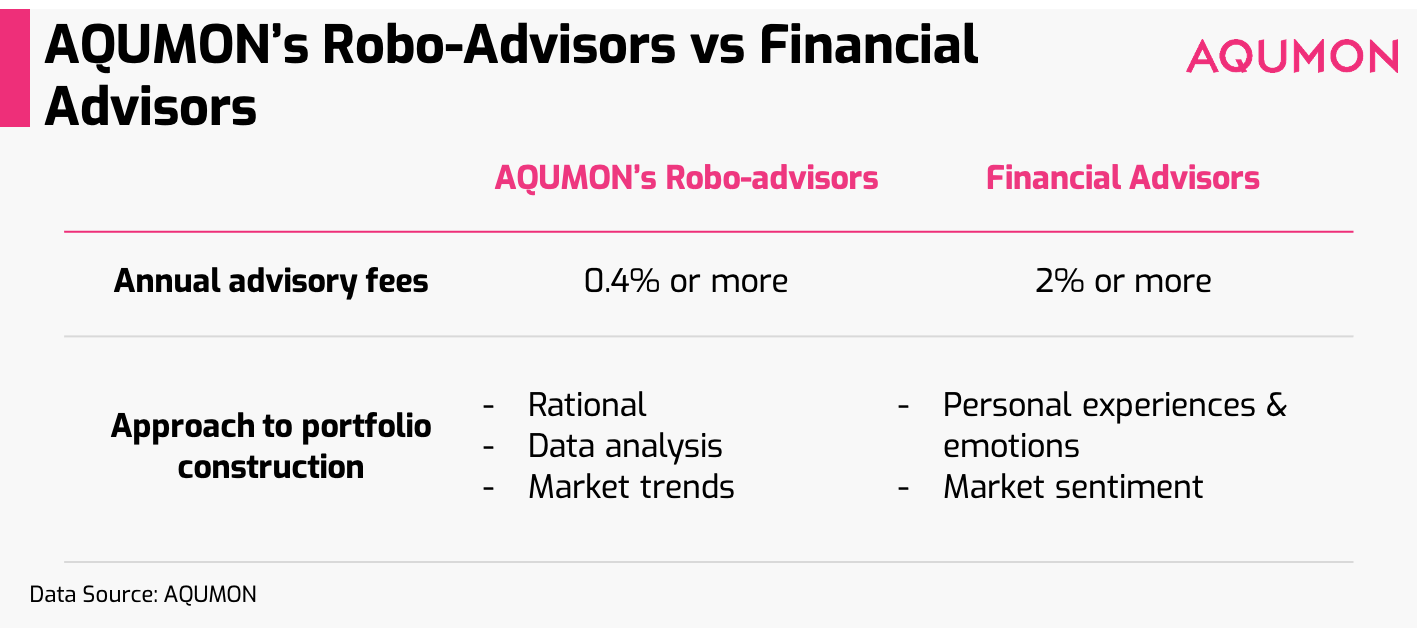

Robo-advisors and financial advisors offer similar investment services so let’s compare them to see why we think robo-advisor is a better alternative.

AQUMON’s app has a slick interface that allows users to open an account and start investing via the app.

It gives you a high quality, low cost portfolio that is tailored to your own risk appetite. Since it is algorithm-driven, it also offers automated rebalancing and takes your emotion out of the picture.

Want an invest-it-and-forget-it investment journey? Try AQUMON’s robo-advisor! Let us handle all the investing activities for you at a low cost.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.