Catalysts on the Horizon but Bumpy Ride in 2021

Written by Ken on 2020-12-04

Supported by the positive vaccine news that the U.S. Food and Drug Administration is likely to approve the coronavirus vaccine by the middle of December, markets rallied last week with the US’ S&P 500 index was up +2.27% last week and +12.62% year to date. Tech stocks on the Nasdaq index also saw uplift +2.96% last week. Europe and Hong Kong stocks also fared well +1.74% and +1.68% respectively.

AQUMON’s diversified ETF portfolios were +0.02% (defensive) to +1.13% (aggressive) last week and +2.44% (defensive) to +11.18% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio, with more regional exposure to Hong Kong/China, was +1.30% (defensive) to +13.38% (aggressive) year to date. The biggest drivers last week were US small caps (+3.22%), Asian ex Japan stocks (2.36%) and emerging market stocks (+1.80%). Gold was under pressure and was down -4.45%.

As we mentioned last week to our readers after a phenomenal month for global financial markets in November where we saw the MSCI World index surge +12.65% (the best monthly return on record) we feel there are still upcoming catalysts in markets heading in 2021 but investors should be aware of some shorter term risks ahead. This is the main question we will address this week:

Multiple catalysts ahead for financial markets

Although we have shied away from talking about economic data for most of this year given COVID-19 has decoupled financial markets from underlying fundamentals and caused it to be more momentum driven, we feel these 2 variables will be more aligned in 2021.

The big picture investors should be aware of is that 2021 looks to be a year of gradual rebirth for the global economy as we slowly put COVID-19 behind us. So that is why we still continue to have a positive outlook for global financial markets as we enter 2021. Furthermore there are 3 major catalysts we can see on the horizon:

1) COVID-19 vaccine rollout starting next week

On Wednesday the United Kingdom became the first country to approve Pfizer-BioNTech's COVID-19 vaccine with a rollout set to start sometime next week. Reports show American biotechnology company Moderna is also seeking US and European approval for their vaccine as well. Early indications by Pfizer suggest they aim to produce 1.3 billion doses of the vaccine while Moderna between 500 million to 1 billion doses by the end of 2021. Pfizer suffered a bit of a setback shortly after the announcement but this does not change our base case expectation that COVID-19 vaccines should be more widely available by the middle of 2021 and helping economies reopening more smoothly as a result.

2) Economic recovery ahead looking positive

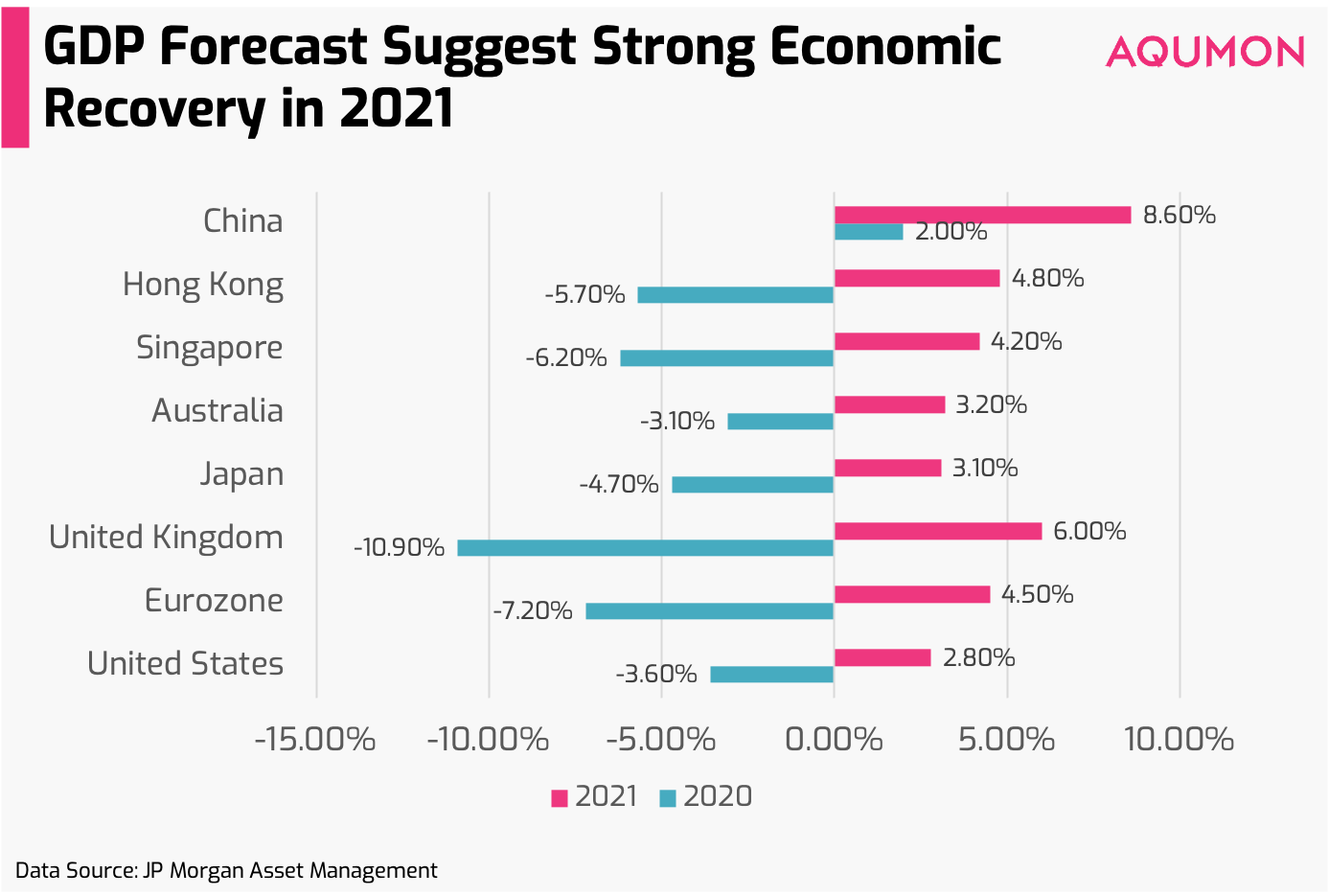

Although economies will be recovering at different speeds, likely with Asian countries leading the way, global economies are expected to rebound strongly in 2021 if we look their real Gross Domestic Product forecast (the most widely used measure for an economy’s strength):

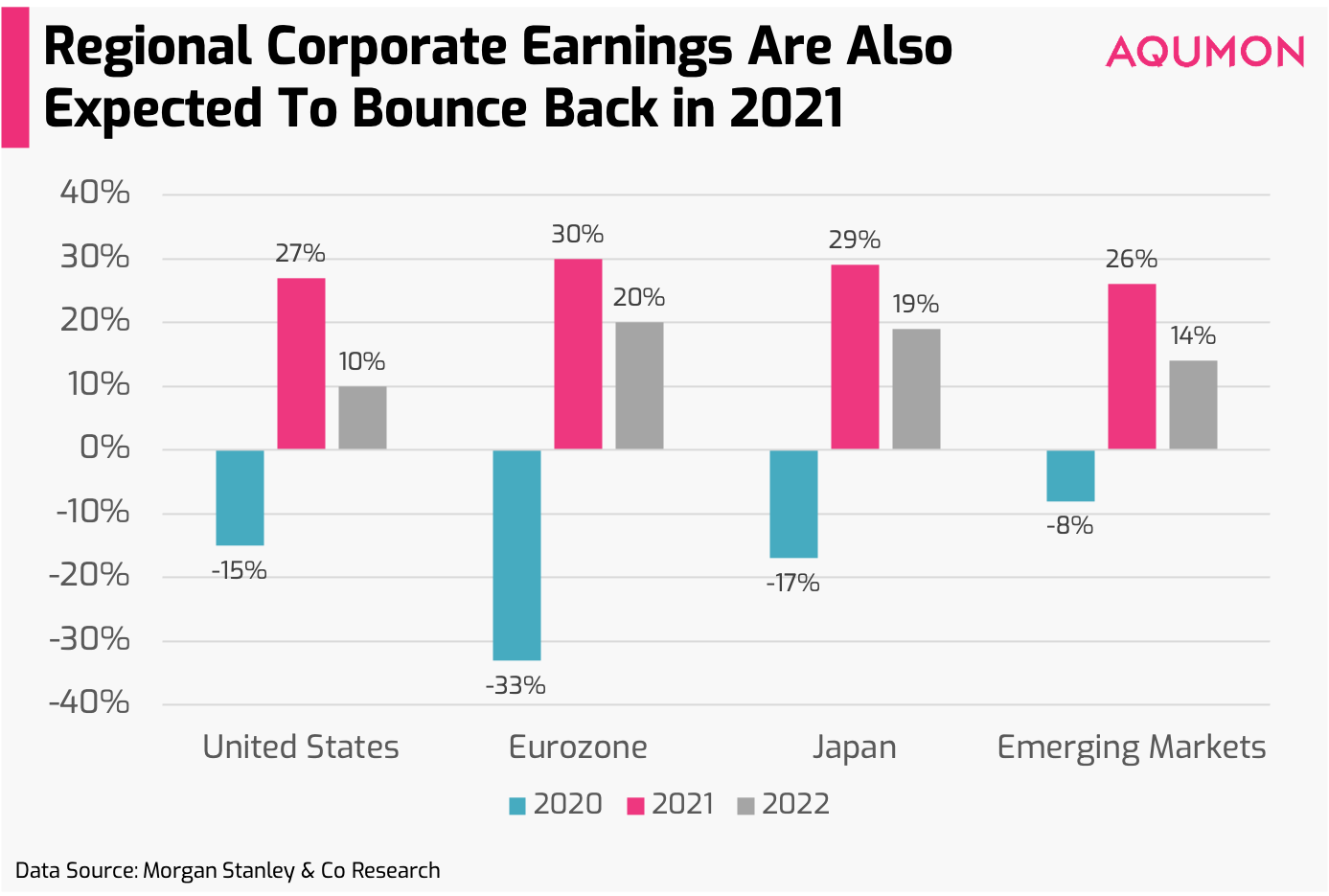

This type of positive outlook is also projected to be mirrored on the corporate level when looking at Earnings Per Share (EPS) growth forecasts for all regions from this year’s on average -18% contraction to 2021’s 26% to 30% expansion with further double digit EPS growth expected in 2022:

With economies and corporations both expected to excel in 2021, coupled with interest rates for bonds at close to 0%, this bodes well for risk assets like stocks in 2021.

Even though Eurozone stocks is one of this year’s biggest regional performance laggers with the EuroStoxx 50 -5.80% year to date, we feel Asian stocks are better positioned in 2021 due to a combination of being more reasonably valued, their economies recovering relatively quicker from COVID-19 and also being in comparison more under owned by international investors in 2020.

More liquidity is coming

Even though the US election may not be ‘officially’ sorted out, on Tuesday US Treasury Secretary Steve Mnuchin and House Speaker Nancy Pelosi held stimulus talks for the first time since election day. After much discussion the bipartisan group in principle agreed to a new COVID-19 relief package worth US$900B (~HK$6.98 trillion) which is on the higher end of analyst forecasts.

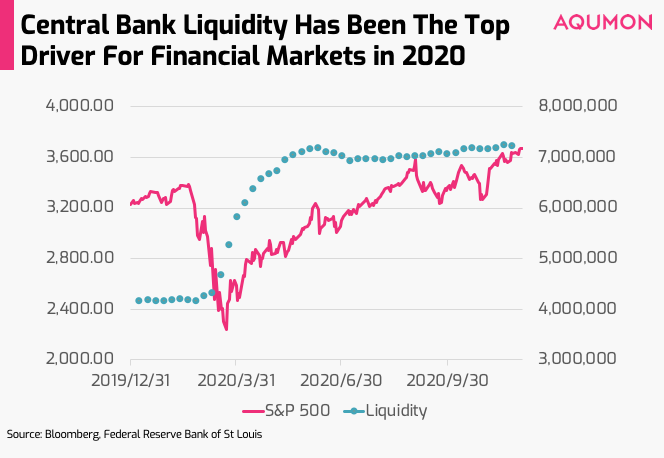

For those of us following our blog you’ll likely heard us talk about “follow the cash” because we strongly believe the #1 driver for global financial markets in 2020 has been due to fiscal stimulus measures. You can see the rebound of the S&P 500 this year closely correlates with the Fed’s decision to increase liquidity in the market:

So with more liquidity on the way we believe this will continue to help bridge the weak economic fundamentals and lift markets higher even though there are also uncertainties ahead.

Market volatility expected to be elevated heading into 2021

Even though there things are looking rosy ahead, we are cognizant that it will unlikely be without short term delays and setbacks. Investors should be aware of 3 factors that increase volatility in markets in December:

1) Profit taking pressure

With financial markets like the US’ S&P 500 index hitting all-time highs for the 2nd week in a row alongside cyclical habits of investors to close out positions near year end globally we are seeing short term profit taking reactions by investors. Short term, profit taking pressure will likely cause markets to be a little more bumpy.

2) Recovery setbacks

One day after we received the positive news of Pfizer’s vaccine rollout in the United Kingdom the market received word Thursday that due to supply chain obstacles Pfizer will need to halve their initial production estimate from 100 million doses to 50 million by the end of this year. The company pointed out that raw materials they acquired for early production did not meet their standards so this resulted in production delays. Pfizer believes they will be able to meet their 1 billion dose target by the end of 2021. With most market expectations probably more overly optimistic we err on the side of caution exactly due to these potential recovery setbacks.

3) Market uncertainties still remain

In a recent interview with the New York Times, US President-elect Joe Biden communicated that he will not quickly end the Phase 1 trade agreement which Donald Trump signed with China in January nor take steps to remove tariffs on Chinese exports. Although this suggests that the tensions between the superpowers will remain high, we don’t believe tensions will worsen and greatly hinder the rally in financial markets heading into 2021.

As we’ve been communicating with investors for the past few months, we suggest accumulating if we see market pullbacks but be careful in the meantime about managing your portfolio’s risk. With bond correlations relatively high against stocks coupled with higher anticipated market volatility, this is a big reason why we feel when entering 2021 that investors should also hold a little more cash and potentially gold (even though we see short term pressure) to help their portfolios protect more against downside risk.

If you have any questions, please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON. Stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.