AQUMON’s New Thematic SmartStock Portfolios

Written by AQUMON Team on 2020-12-14

As Asia's leading digital wealth management platform, AQUMON is upgrading our investment solutions once again by offering our SmartStock Portfolios. The investment strategy uses big data and algorithms to help customers dynamically select high quality thematic stock portfolios. Furthemore, it combines the best of passive and active investing by integrating the most advanced factor stock selection alongside intelligent portfolio adjustment. This is a brand new technological experience, helping investors more effectively achieve their investment goals.

When it comes to investing, most people are generally aware of 2 types of investment strategies: Active and Passive investing. So what’s the difference?

Active investing: This is an investment strategy where the objective is to outperform financial markets by buying and selling investments with a focus on short-term profits (3-12 months).

Passive Investing: This investment strategy’s objective is to capture and match financial market returns by using a buy-and-hold approach with a focus on generating returns over a longer time horizon (over 12 months). AQUMON’s globally diversified exchange traded funds (ETFs) portfolio is successfully using this type of investment strategy.

What is Factor Investing then?

Factor investing, commonly used by sophisticated investors like hedge fund managers, is an investment strategy that uses a systematic approach to capture higher risk-adjusted returns or lower risk for your investment. The strategy’s goal is to identify and take advantage of an investment’s longer term underlying characteristics. Factor investing has seen rapid adoption and has already developed into an over US$1.9 trillion* (HK$ 15 trillion) market utilized by most major financial institutions and institutional investors.

Factor based strategies are also strongly backed by academic research. This original investment phenomenon was discovered by two American Nobel Laureates, Eugene Fama and Kenneth French, back in the 1990s. What they figured out was that they could divide up and reverse engineer the return of stocks into smaller pieces called ‘factors’, like DNA to a human, and generate outperforming returns or reduce risk as a result.

There are currently over 600 known factors which affect investment value. This can make it very difficult for investors to identify and assess which factors they should invest into if they are looking for longer term benefits.

This is where AQUMON’s PowerFactors can help.

AQUMON’s PowerFactors: Unlock Your Investment Portfolio’s True Return Potential

AQUMON’s Quantitative Research team has developed these PowerFactor investment strategies that easily identify the underlying factors investors should target and systematically screens for them. Stocks are then allocated into diversified portfolios through quantitative methods. The end result is investors receive solid and steady investment outperformance over time.

How does it work?

For example: Logically, we all agree that companies that are consistently profitable will likely generate higher stock returns. But how exactly can we identify which companies are consistently profitable when there are thousands of stock choices? AQUMON does it in 3 steps:

Step 1: Screen over 6,000 stocks in the US market to select a pool of high-quality stocks.

Step 2: Use the following 6 PowerFactors that most influence "sustainable profitability" to develop a standard scoring criteria, and then rank all the stocks that have been screened.

- Return on net assets

- Gross profit on equity

- Operating cash flow on equity

- Gross profit margins

- Ratio of total assets

- EBITA on net assets

Step 3: Our algorithm selects 10-20 stocks from these rankings and calculates how much to invest in each (i.e. determining their respective portfolio weights). This results in a systematically diverse portfolio of the most consistently profitable US stocks.

Factor investing and its benefits is now as easy as screen, select, confirm.

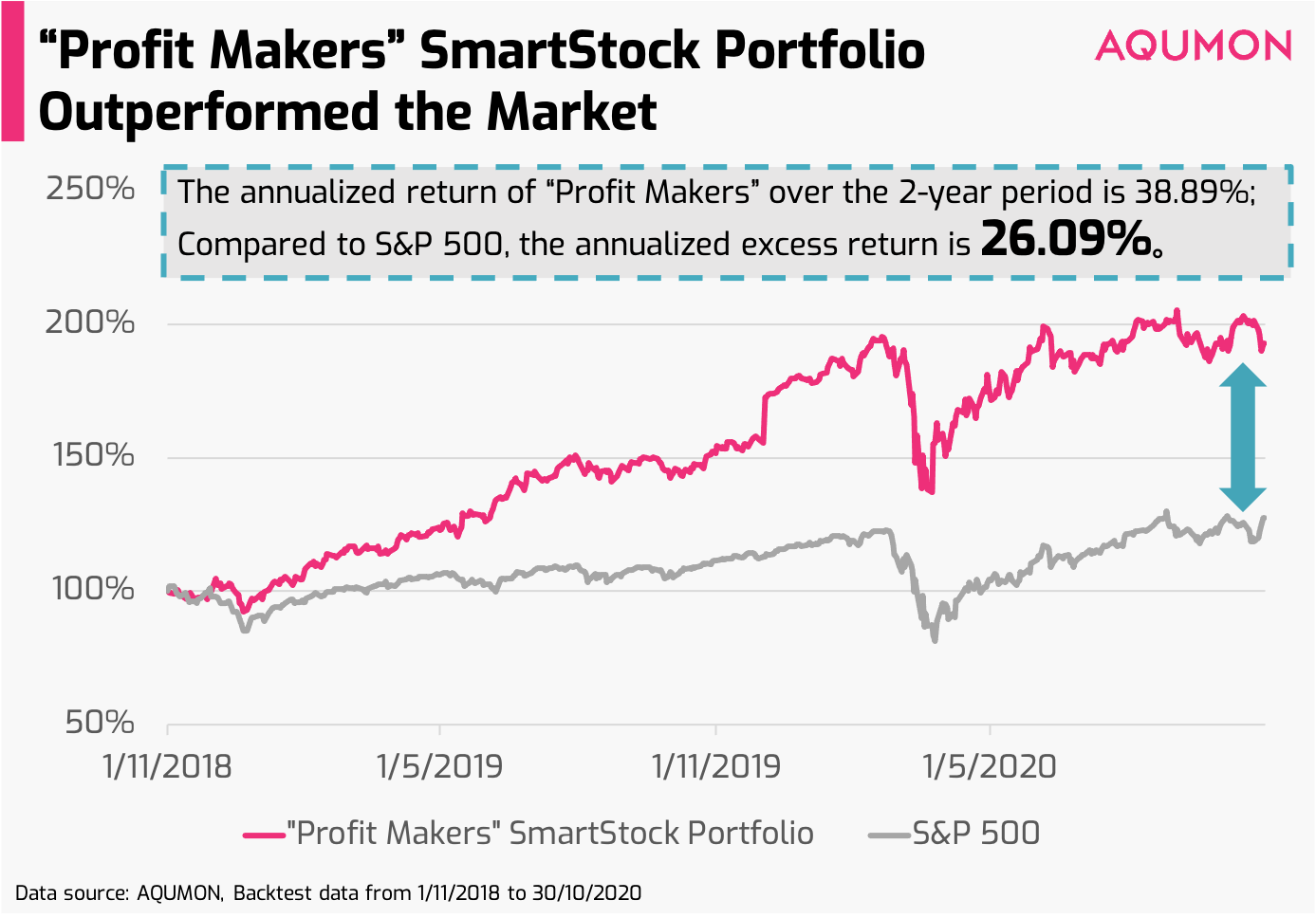

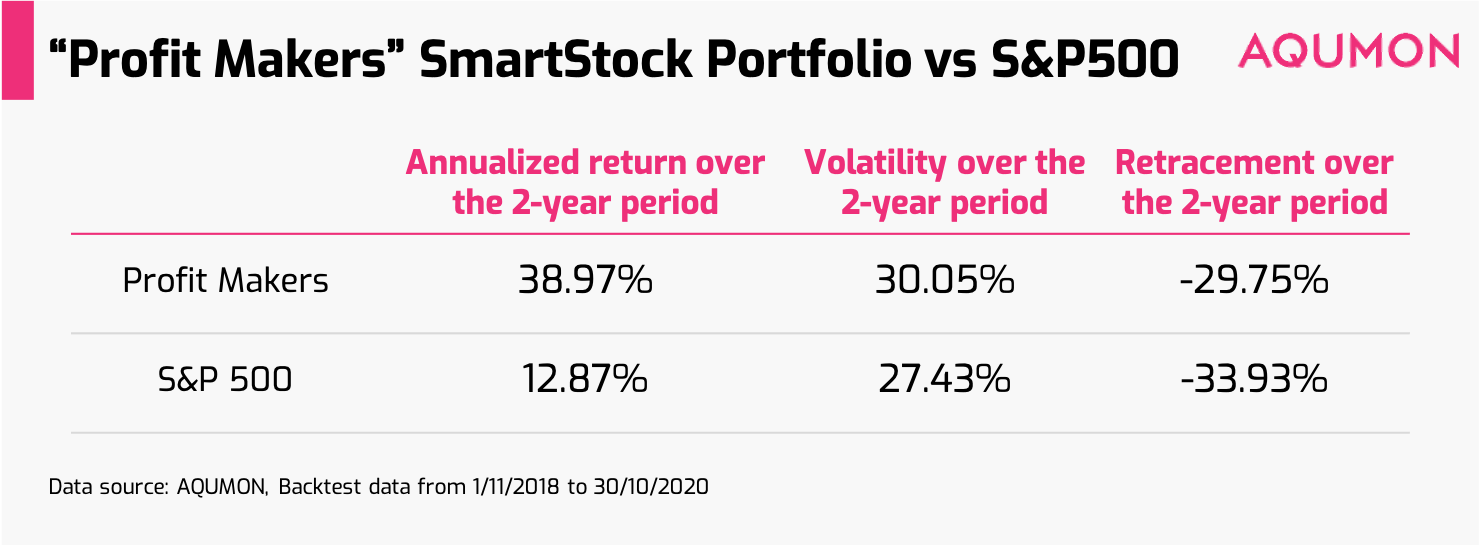

Here are the returns:

AQUMON’s investment logic is open and transparent. We now provide a simple solution for investors to gain immediate benefits to factor based investing via AQUMON’s thematic SmartStock Portfolios through PowerFactors. All new thematic SmartStock Portfolios can soon be accessed in AQUMON’s mobile app.

Through AQUMON’s, get access to the future of investing...today

*Source: Blackrock, eVestment and Preqin

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.