Youtuber Graham Chin's Journey to Building Success and Wealth

Written by AQUMON Team on 2021-02-01

Coronavirus has increased reliance on the internet due to widespread lockdowns and social distancing rules. Amid the pandemic, Graham Chin started his YouTube channel in 2020 to share his experiences on personal finance and investment in hopes of improving Hongkongers’ financial literacy. Here, he explains what shaped his mindset and paved his investment journey.

Tell us a bit about yourself.

Hi I’m Graham. I graduated from Boston University three years ago and returned to Hong Kong to help with my parents’ business. I’ve also started my own YouTube Channel ‘Earn with you (和你賺)’ a year ago to share my investment experience with others.

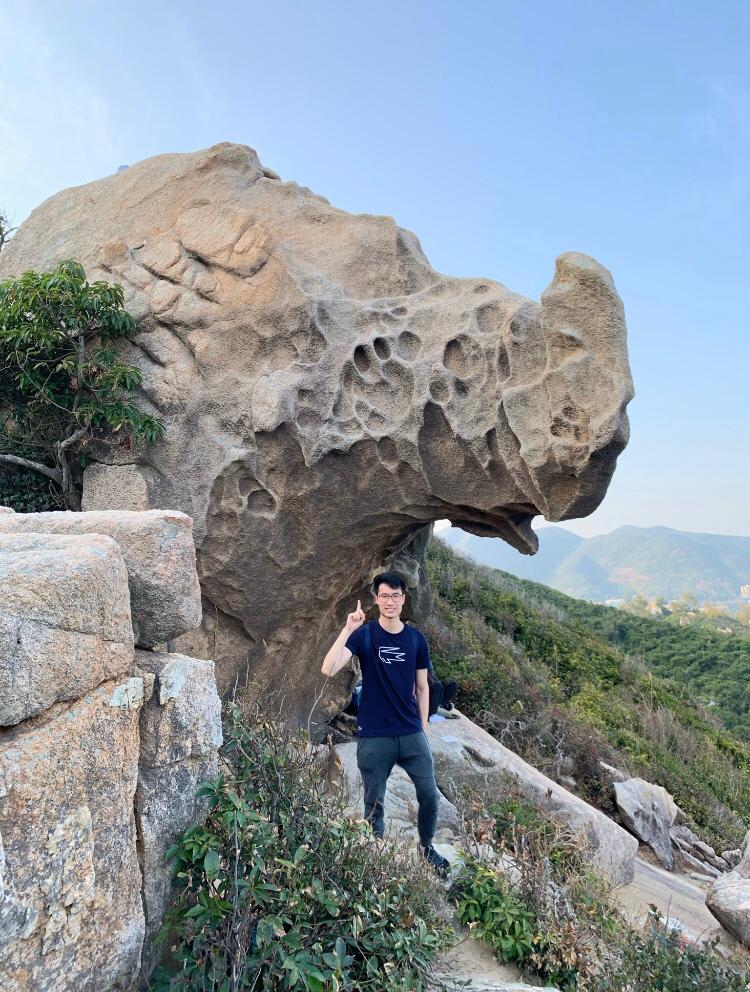

(Photo Courtesy of Graham Chin)

Did your upbringing influence your view of money?

I think my saving habit is mainly influenced by my parents. They don’t splurge or spend money carelessly. Since I studied Economics and Finance back in university, I have some foundational knowledge on how to read company financial statements or analyse global markets. I’d also watch investment-related videos on YouTube to improve my financial knowledge. On top of that, I often exchange views on the stock market with my younger brother who worked at a securities firm.

Let’s talk about your relationship with money - when was your money moment?

When I was young, my parents would ask me to do household chores in return for a few dollars. They’d then ask me to save the money up for things I like - that’s how I developed my saving habit.

(Shared by 和你賺 Earn with You (@earnwithyou) on Instagram)

Share with us your investment journey. How did your view of investment change with time?

I only started investing after I graduated because I wanted to have another stream of income and the starting salary of my first job wasn’t great. I also bought some cryptocurrencies and other passive investment funds like ETFs on the side.

To be honest, I’ve tried day trading for some time but stopped after losing money. The volatility of the markets was personally highly stressful as it requires close monitoring. So nowadays I prefer a long-term investment approach where I hold the stocks for a longer period of time and forego chasing the short term gains.

What recommendations do you have for people managing their personal finances?

I think our views on wealth management change as we enter different life stages. To me, there are three pillars to wealth management. First is saving to gradually accumulate wealth. Second is controlling your expenses and living within your means. Third is investing to grow your money. Although they may sound simple, it takes skills, experience, discipline, and patience to master these three aspects and achieve your long-term financial goals.

(Photo Courtesy of Graham Chin)

What are your money goals?

I believe many of the young people’s goal is to buy their first property in Hong Kong and I’m no exception. I think it’s very difficult to save enough money for your initial down payment just from your salary. Through investing and creating multiple streams of income, I hope to buy a flat before 30. For me, I try to put half of my salary into a separate savings account to avoid excessive spending. You must also rely on investment to grow your money. So I will continue to study and improve my investment skills to hopefully reach my goal.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.