AQUMON Launches the SmartFund Platform for ICBC (Asia)

Written by AQUMON Team on 2021-02-11

AQUMON, one of the largest digital investment companies in Asia, launched an algorithm-driven fund selector platform, SmartFund, which was first adopted by Industrial and Commercial Bank of China (Asia) Limited (“ICBC (Asia)”) in Hong Kong and made available in late 2020.

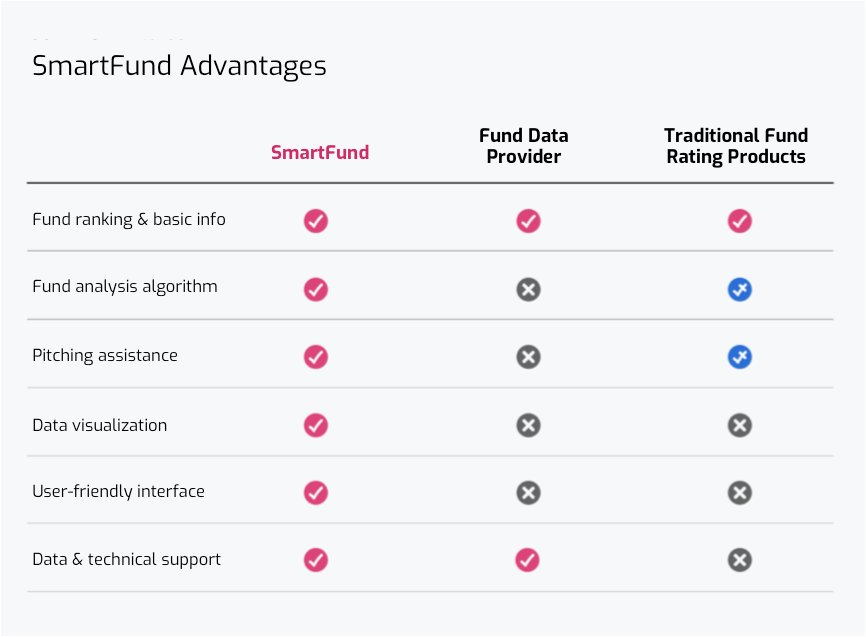

SmartFund, a new generation big data analytics platform developed by AQUMON, utilizes multi-factor algorithms-driven analysis to provide quality fund recommendations. While the mutual fund market is surrounded by options and asymmetric information, SmartFund is able to resolve a series of fund distribution/ sales problems. Different from other tools available in the market, SmartFund can not only display historical data, but also provide forward-looking fund rankings in its clean and simple interface after multi-dimensional analyses of over 500 factors. Investment consultants can access abundant and timely information to recommend high-potential mutual fund products. Moreover, SmartFund is a SaaS-based (Software as a Service) platform which allows institutions to launch and update rapidly without developing their own applications or infrastructure.

ICBC (Asia) is the first financial institution adopting AQUMON's SmartFund platform in Hong Kong. SmartFund's professional model can assist ICBC (Asia) in conducting fully statistical and scientific analyses of nearly 1,000 funds on ICBC (Asia)’s product shelves, thereby providing a list of recommendations and product highlights across asset classes. Investment consultants can then provide their clients with professional fund information by referring to SmartFund's recommendations, helping clients formulate customized investment strategies and identify the well performing fund portfolio that could meet personal investment needs, so as to maximize potential returns under different market conditions.

"Wealth management is one of the development focuses in ICBC (Asia)'s retail business. Through partnering with AQUMON, we have established a dedicated fund analysis tool, allowing our investment consultants to help our clients in making better investment decisions by accessing to more accurate fund analyses and recommendations. At ICBC (Asia), we always put our customers at the center of everything we do. We have been leveraging the advantages of fintech, combining offline and online business models and utilizing big data to create a better and innovative service experience for our clients with different needs," said Flora Leung, Head of Retail Banking & Wealth Management Department at ICBC (Asia).

"We are honored to be offering our brand-new fund analytics and sales assistive tool to the world's top financial institutions. ICBC (Asia)'s forward-looking adoption of financial technology will revolutionize traditional wealth management, increasing sales efficiency and making investment more scientific, accurate and traceable, thereby boosting business performances. Our SmartFund module is segregated from our flagship global asset allocation algorithm. Our aim is to increase the wealth management prowess of financial institutions incrementally through our algorithm as well as our brand-new and smooth UI/UX, " said Kelvin Lei, co-founder of AQUMON.

The technology service provider, AQUMON, is a fintech company incubated at the Hong Kong University of Science and Technology in 2015. After over five years of development, AQUMON has partnered with over 80 financial institutions in Hong Kong, Mainland China and overseas, ranging from banks, securities houses to asset management firms. AQUMON's key investors include Zheng He Capital, Lenovo Capital, Alibaba Entrepreneurs Fund, Affiliate of Bank of China International and Hong Kong University of Science and Technology.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.