2 Smart Ways to Pick Quality Tech Stocks in 2021

Written by AQUMON Team on 2021-06-18

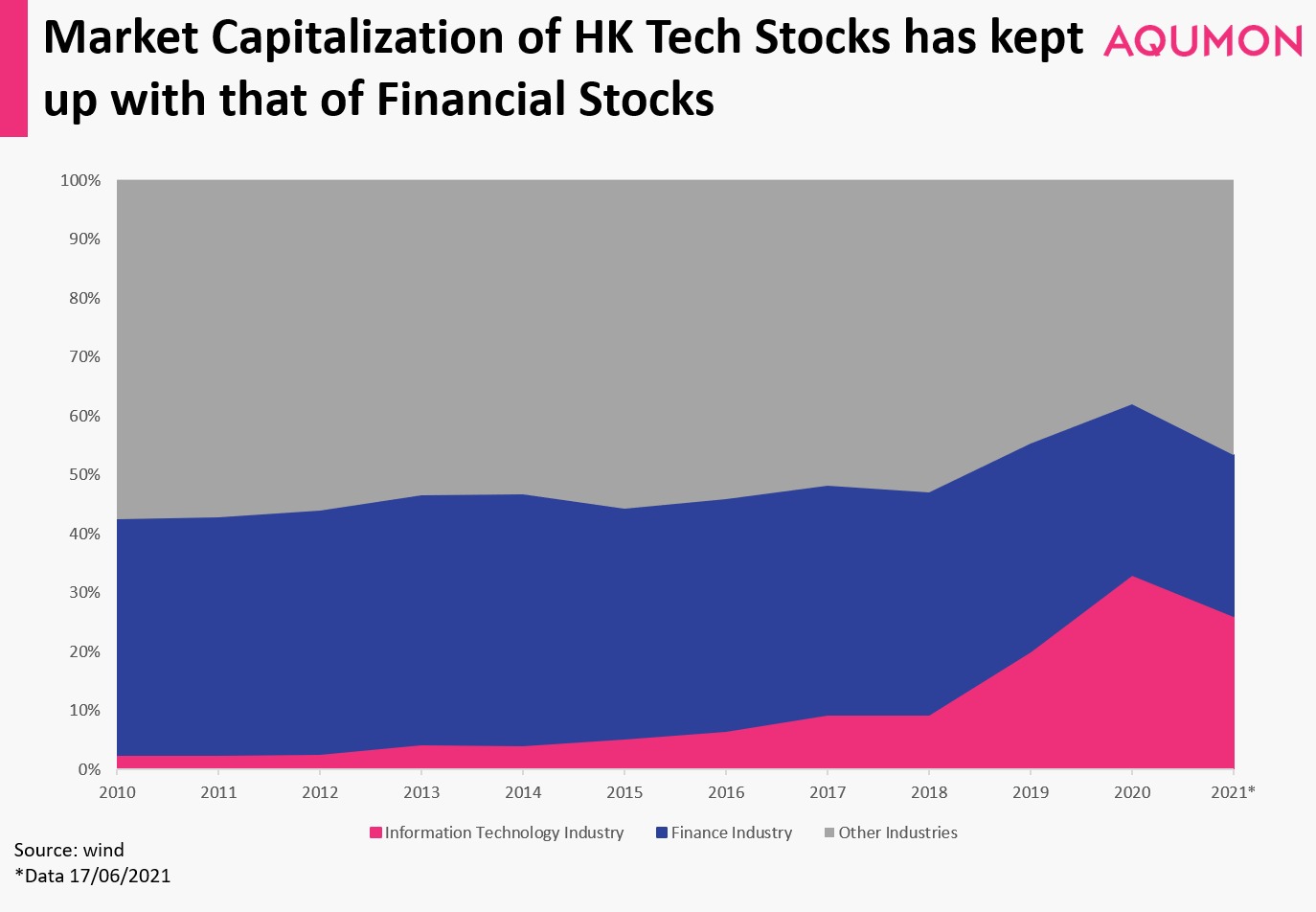

Technology stocks have definitely been some of the most attractive investments in recent years. Here in the Hong Kong stock market, the market capitalization of the IT sector has surpassed that of the financial sector in 2020.

As illustrated in the chart below, the market capitalization of the Hong Kong tech industry was only 10% in 2010. Following a turning point in 2018, IT stock market capitalization rose sharply to 26.6% in 2021. It’s current market capitalization share is very close to that of the financial sector (27.7% of total).

What is the best way to pick technology stocks?

The Hang Seng Technology Index was launched in July 2020. Similar to the NASDAQ, it measures the overall performance of technology stocks listed in Hong Kong.

This index consists of Hong Kong’s 30 largest tech companies by market capitalization. As such, the Hang Seng Technology Index can be classified as a large-cap tech stock index. Investors who are interested in these types of stocks can consider investing in the constituent stocks of the Hang Seng Technology Index.

In our previous article on top performing stocks, we highlighted that large-cap stocks typically have a strong business, technological ability, and market competitiveness. As such, they are better positioned to succeed in the future versus other corporations.

Extended reading: H.K. Stocks 2021: The 2 Best Ways to Find Top Performing Stocks

Besides market capitalization, a company’s revenue growth is also an important factor to consider when choosing tech stocks.

Many investors invest in tech stocks because they are optimistic about the future growth of the company.. In this case, we can take reference of the company’s past business growth.

Investors can use the growth rate of a firm’s total revenue to find stocks that are worth investing into.

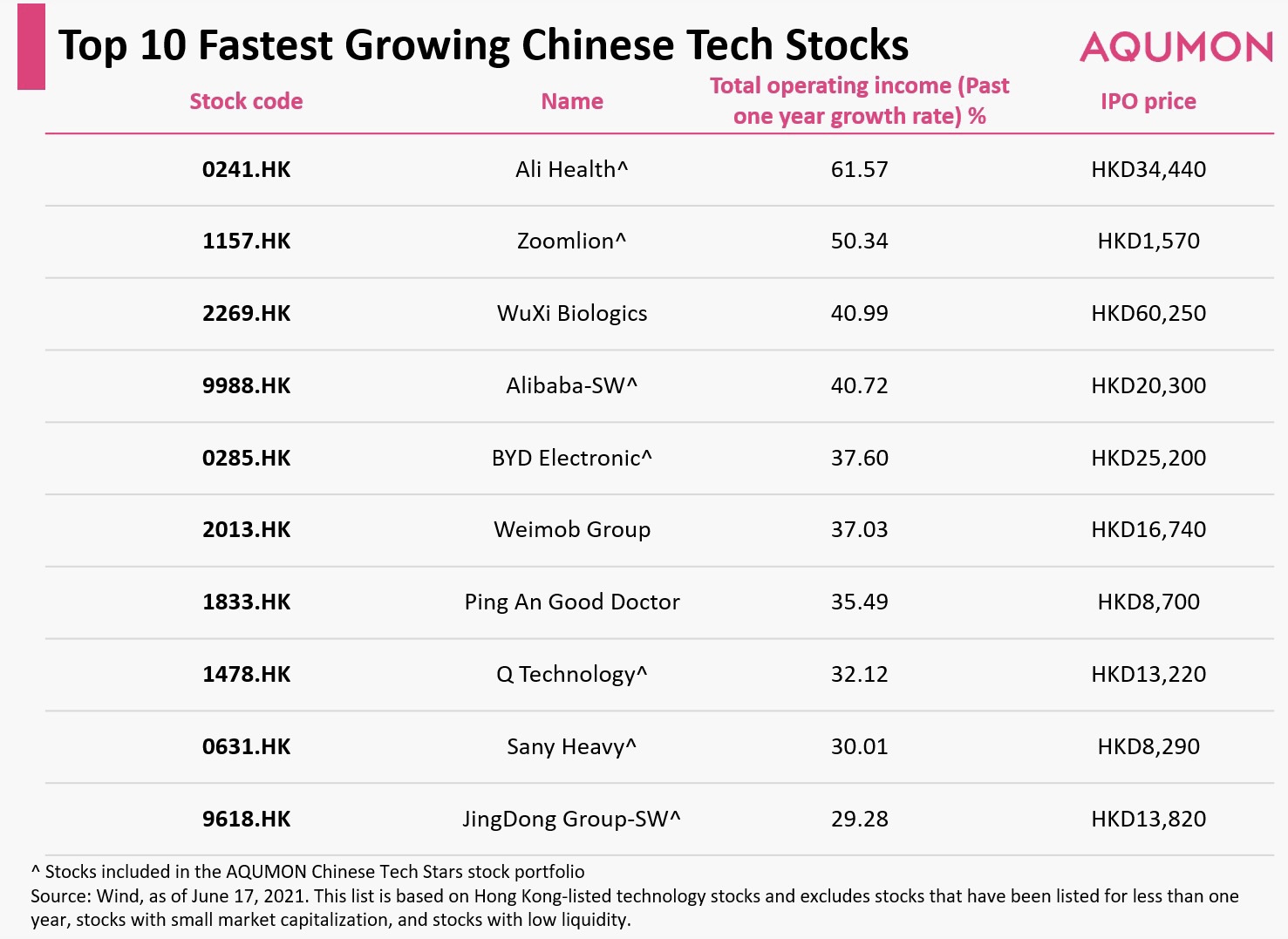

Top 10 Fastest Growing Chinese Tech Stocks

The below table shows the fastest growing Chinese tech stocks by their revenue growth rate over the past year. Each of these stocks is included in the Hang Seng Technology Index.

Ali Health (0241.HK): Ali Health develops internet health service platforms and invests in telecom and internet-related businesses. It achieved better market results than expected in the second half of FY 2020.

Zoomlion (1157.HK): A Chinese construction machinery equipment manufacturer that primarily develops and manufactures agricultural machinery and other high-tech equipment. It has previously achieved a year-on-year increase in revenue of over 100%.

WuXi Biologics (2269.HK): A leading provider of biopharmaceutical services in China, with revenue up 41% year-on-year.

Alibaba-SW (9988.HK): China's largest e-commerce and cloud company who provides an online e-commerce trading platform. Its revenue was up 64% year-on-year last quarter.

BYD Electronic (0285.HK): A leading global platform-based high-end manufacturing company who had a 108% year-on-year increase in operating revenue.

Weimob Group (2013.HK): China's leading cloud business enterprise and marketing solutions provider. It achieved high growth across the board despite the COVID-19 pandemic.

Ping An Good Doctor (1833.HK): A one-stop portal for online medical services in China with continued rapid growth in its core business medical services.

Q Technology (1478.HK): Located in Hong Kong, Q Technology is a leading global manufacturer of mid-to-high-end camera modules and fingerprint identification modules for smart mobile terminals. It previously achieved a large year-on-year increase in average unit sales price of camera modules.

Sany International (0631.HK): A Chinese company specializing in research and development, manufacturing, and sales of large-scale equipment manufacturing for coal mining. Possessing strong product competitiveness, the company's market share continued to grow and net profit increased by nearly 16% year-on-year.

Jingdong Group-SW (9618.HK): JingDong Group operates the first integrated e-commerce platform in China (JD.com) that has been successfully listed in the U.S. The company has achieved economies of scale in its operations and has outstanding supply chain capabilities despite competition.

Two Smart Ways to Invest in Technology Stocks

If you’re interested in tech stocks but are concerned about the risks associated with investing in a single stock, you may want to invest into multiple tech stocks via a portfolio approach. However, investing in multiple tech stocks has a higher investment threshold and usually costs tens of thousands of Hong Kong dollars.

To address this dilemma, here are two simple and smart ways for new investors to invest in tech stocks.

1) Invest in ETFs that track the Hang Seng Technology Index

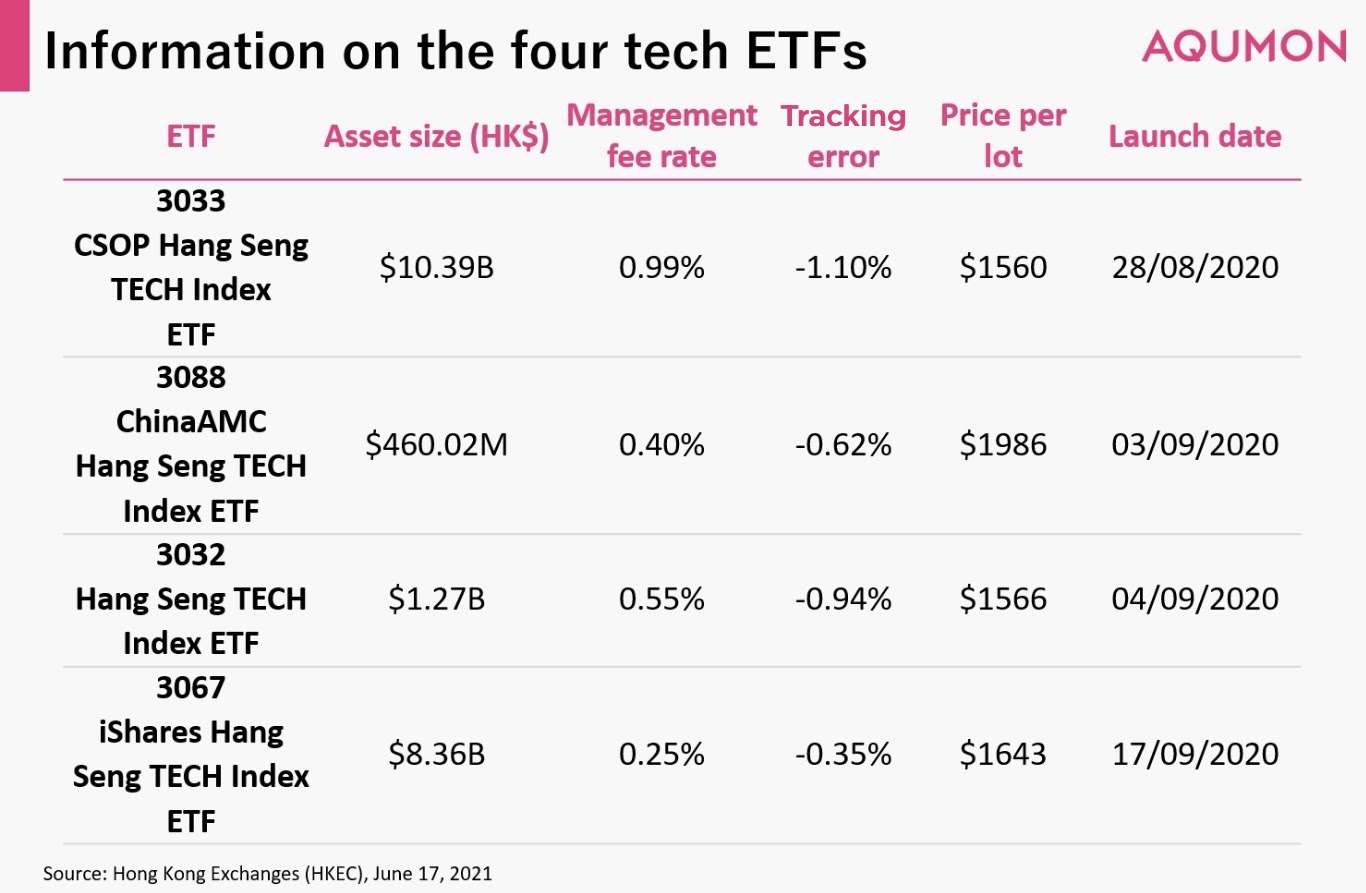

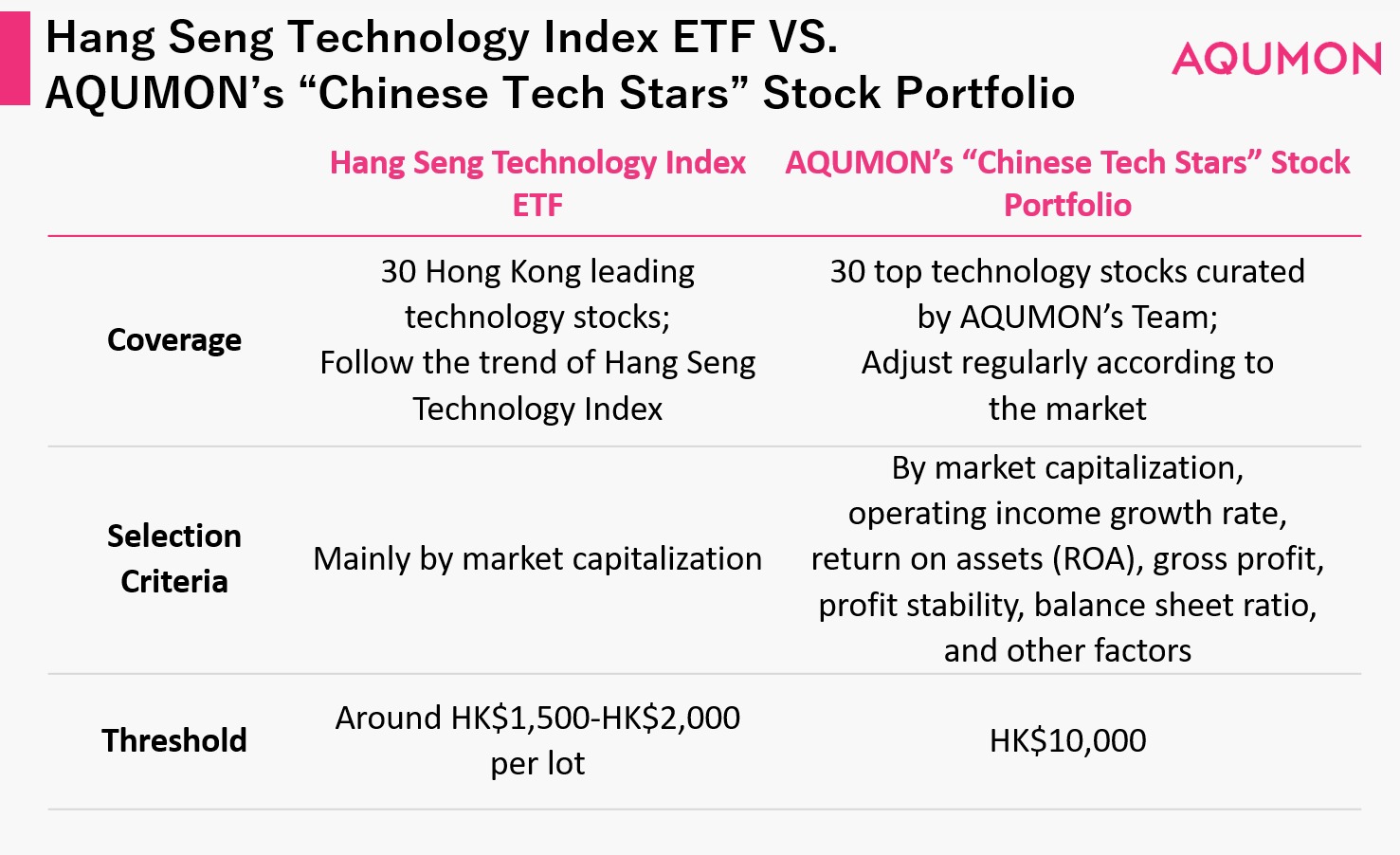

Since the Hang Seng Technology Index’s launch, many exchange traded funds (ETFs) that track the index’s movement have emerged. These ETFs track the cumulative movement of the Hang Seng Technology Index’s constituent 30 large-cap tech stocks. Compared to investing in individual stocks, ETFs are a good way to gain passive income in tech stocks.

Asset size, fees, and tracking deviation are the most important considerations when investing in ETFs. Specifically, higher asset sizes, lower fees, and smaller tracking errors are ideal.

We have compiled information on the four tech ETFs currently available to Hong Kong investors:

2) AQUMON’s “Chinese Tech Stars” Stock Portfolio

AQUMON’s SmartStock technology has developed a portfolio dedicated to Greater China technology stocks. To balance risk and returns, we have curated 30 top technology stocks.

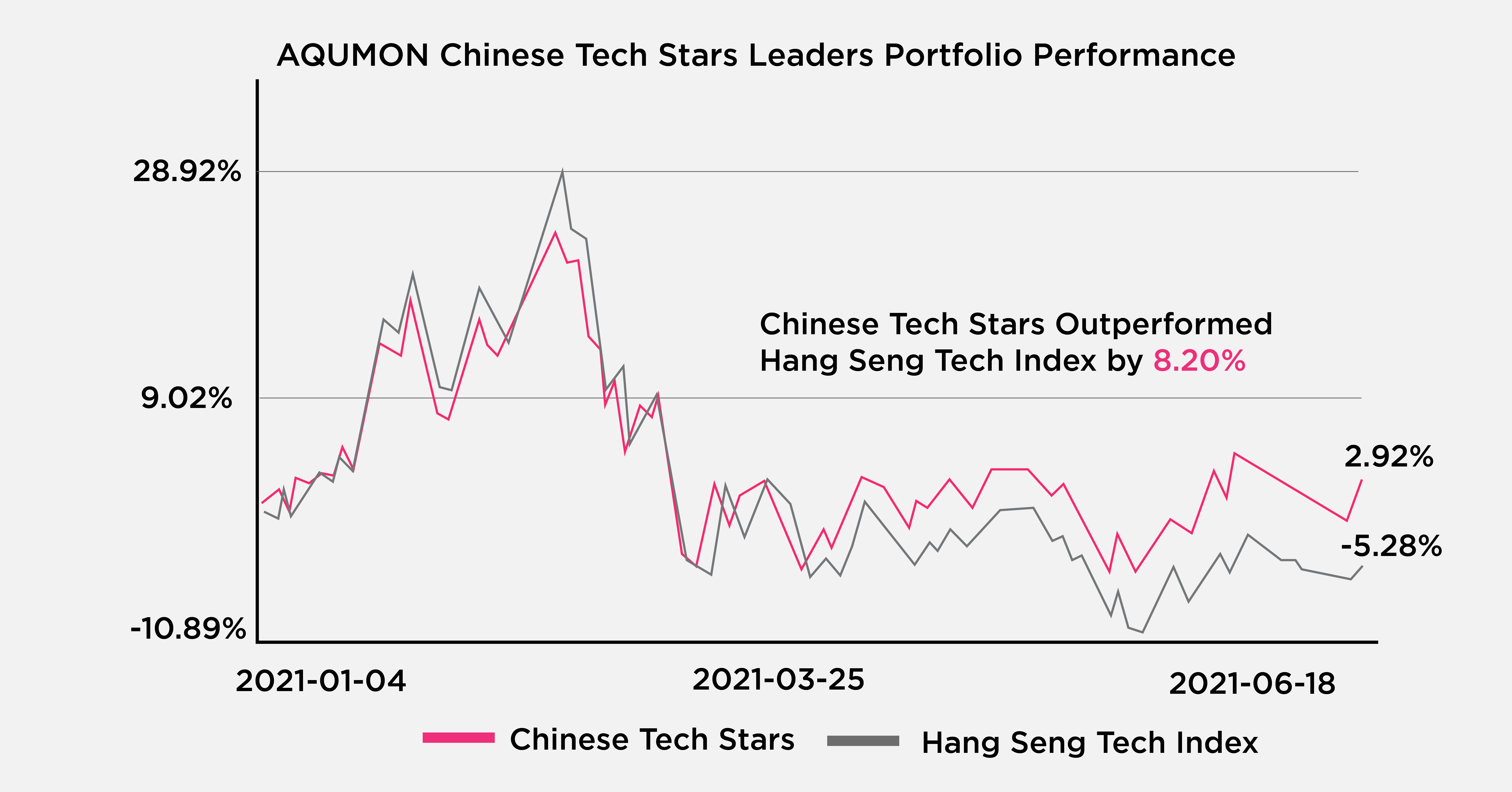

Despite market ups and downs in 2021, AQUMON’s Chinese Tech Stars portfolio yielded a 8.20%* higher return than the Hang Seng Technology Index over the past year!

AQUMON’s portfolio yields excellent returns because we consider not only the market capitalization of tech stocks, but also their operating income growth rate, return on assets (ROA), gross profit, profit stability, balance sheet ratio, and other factors. AQUMON uses the most advanced factor technology to select the best technology stocks. Click here to learn more about the AQUMON portfolio!

Related: Ranking the Most Profitable US Tech Stocks in 2021

Related: H.K. Stocks 2021: The 2 Best Ways to Find Top Performing Stocks

Special Offer: Endless Summer Rewards

Summer is finally here! For all new clients, enjoy HK$200 cash rebate upon successful account opening. What's more, refer a friend and enjoy additional HK$300. Unlimited referrals, unlimited cash! Register now!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.