Why Should Investors Consider Investing into Energy Stocks?

Written by AQUMON Team on 2021-07-27

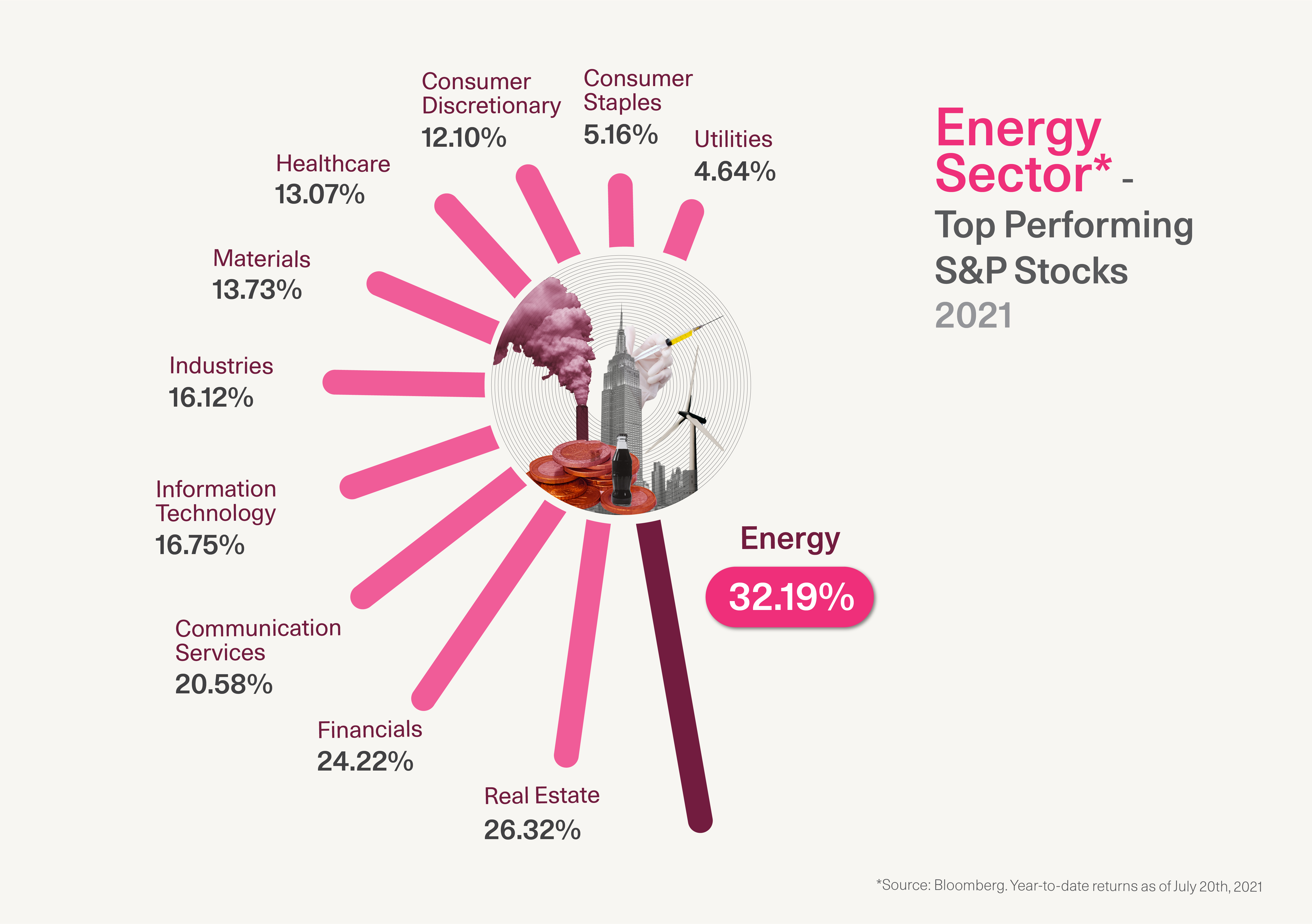

With rising inflation constantly making the news headlines and creating concerns for investors, one of the sectors creating new highs during this period is the energy sector. If we look at the US stock market, one of the top performing sectors has been the energy sector +25.57% year to date (YTD as of July 20th) and outperforming US broad stock markets by +10.47% YTD. This is echoed when 3 out of the top 10 performing stocks in the US’ S&P 500 index are energy related companies.

Even though this sector has seen a recent pullback of -9.95% since the past 1 ½ weeks (as of July 12th) due to COVID demand concerns, the upside for this sector remains. We’ll explain more below.

What Caused the Energy Sector to Outperform?

Both inflation and the economy reopening are factors that positively contribute to why energy pricing has spiked and why energy company stocks have also jumped to multi-year highs in 2021.

1. Inflation

Commodity prices are often believed by investors to be highly correlated and a leading indicator of inflation. The reason behind this is because commodities such as oil are highly involved in all areas of the economy like fueling cars, heating homes or even behind the production of consumer goods. Higher energy prices and higher overall prices (meaning rising inflation) as a result go hand in hand.

2. Economy Reopening

With economies gradually reopening in 2021 from COVID-19 and getting back to normal, this is beneficial for energy pricing and producers given there will be an increase in demand. As a reference, Brent Crude oil prices jumped +33.88% YTD (as of July 20th).

Related reading: Kickstart Your Finances in 2021

Related reading: H.K. Stocks 2021: The 2 Best Ways to Find Top Performing Stocks

What is the investment implication?

Even though energy stocks have taken a negative hit this week after the Organization of the Petroleum Exporting Countries (OPEC+) agreed to increase supply of brent crude oil (by 400,000 barrels each month from August 2021 to April 2022 and and 432,000 barrels from May through September 2022) we think this may be an overreaction. Even though there are COVID delta variant concerns dampening energy pricing in the short term we expect upcoming holiday travel and businesses to increase energy demand overseas and for prices to rebound.

Brent crude oil is currently at US$68.84 (as of July 21st) and the average outlook for 2nd half of 2021 is around US$72 per barrel according to the forecast in the most recent Short-Term Energy Outlook from the US Energy Information Administration (EIA). Looking at analyst outlooks it is not uncommon to see Brent prices could reach US$75-80 later this year so beyond increased demand there is potential further uplift from energy pricing.

Although in the short term there will likely be volatility within this sector and broad markets in general if there is further pullback ahead we think it will make sense for investors to give the energy sector a serious look.

Within energy, one area that investors could look into as an alternative is the renewable energy sector which is set to have medium to longer term support from US’ President Joe Biden's proposed climate plan which is aimed toward zeroing out greenhouse gas emissions from the power sector by 2035 and be a catalyst for the renewable energy companies.

Related reading: Introducing our New Stock Trading Function

Related reading: 2 Reasons to Consider More International Exposure in 2021

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.