Auto-rebalancing: What, Why, & How?

Written by AQUMON Team on 2021-08-06

Given the unpredictability of the market, investments must be tweaked every so often. As the market rises and falls, we should regularly review our investment portfolio and make adjustments!

What is rebalancing? What is auto-rebalancing?

AQUMON uses big data and algorithmic technology to make investment recommendations for clients based on their risk tolerance and market data. If you’re a young investor who has a higher risk appetite, then the proportion of stocks in your portfolio will also be higher.

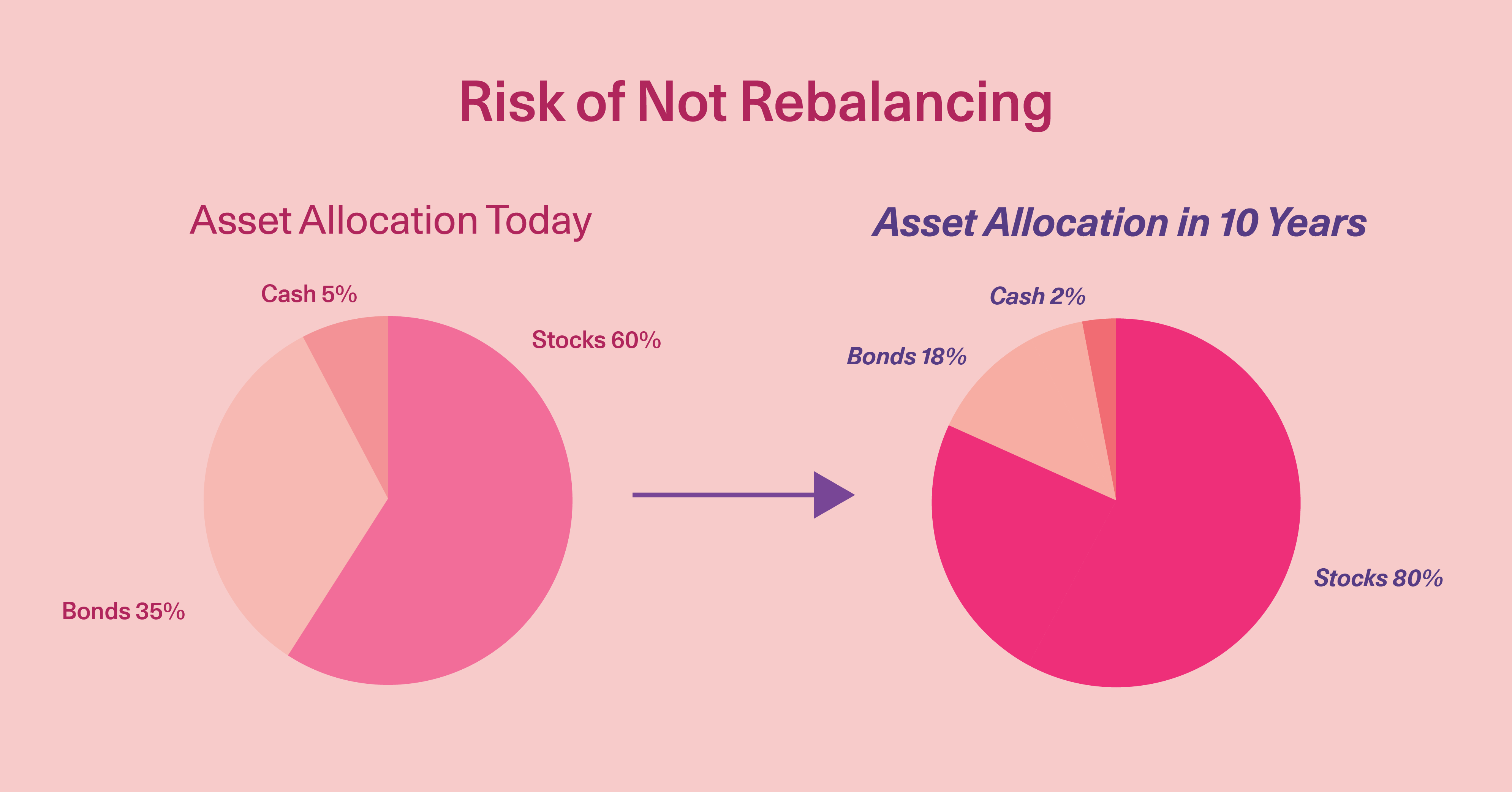

However, if the market shifts and the price of one stock rises, then the amount of that stock as a percent of your total portfolio increases. This causes the overall risk of your portfolio to be higher. When your portfolio deviates too much from our recommended optimal position, AQUMON will recommend clients to rebalance their positions.

Just like how you and I need regular doctor check-ups, your portfolio also needs regular adjustments to detect risk early and protect your profits!

If you don't want to manually readjust your portfolio every time, AQUMON’s new feature can definitely help you out: auto-rebalancing!

When this feature is turned on, your investment will be automatically rebalanced to be in the optimal condition; if this feature is turned off, you will need to confirm the readjustment manually.

3 Benefits of Auto-Rebalancing

1) “hands-off” adjustments

Typically, AQUMON's investment portfolios are adjusted 2-4 times/year. In the past, some clients said that they may have missed the best time to adjust their portfolios because they did not pay attention to our adjustment notices.

2) Saves time and effort

Given that most don’t have the time or energy to conduct market research, it is very difficult for the average retail investor to accurately determine the optimal trades timings. However, if you turn on the AQUMON auto-rebalancing function, all adjustments will be done automatically without any action by the client. This will save your time in watching markets and executing trades!

3) Ability to invest in AQUMON’s new products (coming soon!)

As Asia's leading smart investment platform, we are constantly refining our strategies to achieve higher investment returns for our clients. Soon, we will launch our new more active investment product with hedging capabilities. This product has a stronger performance profile and requires a higher rebalancing frequency. As such, it can only be purchased by clients who have the auto-rebalancing feature enabled.

Will the Auto-Rebalancing Feature Cause me to Incur More Fees?

AQUMON charges 0 commission fees on our investment portfolios and only charges a one-time advisory fee based on your investment amount. Therefore, AQUMON will not charge commissions nor platform fees for each portfolio rebalancing.

However, third party fees (such as those charged by the stock exchange) will be charged to the client upon rebalancing (please click here to view the fees).

How do I Enable the Auto-Rebalancing Feature?

Follow the steps below to enable the auto-rebalancing function.

When you want to disable the auto-rebalancing function, you can turn it off in the "Me” page.

When will Portfolio Rebalancing be Triggered?

1. Market changes or changes in risk appetite

The AQUMON system monitors the deviation of your portfolio holdings from the optimal portfolio position. As the market moves, an adjustment may be triggered when the deviation exceeds a threshold. If your risk appetite changes, such as from aggressive to conservative, we will also adjust your portfolio for you.

2. Strategy Upgrade

AQUMON's algorithmic research team closely monitors market conditions and continuously adjusts our strategies in a timely manner. We are always introducing new upgraded algorithms in response to changes in the market.

AQUMON hopes to help you on your way to a simpler and smarter investment journey!

Aug Special Campaign

From Aug 2nd to Aug 20th, register and open an account via a dedicated event link to get your free stocks. Hot stocks include Apple (AAPL.US) and Robinhood (HOOD.US)

Related reading: 2021 AQUMON Half-Year Performance Review

Related reading: 【Product Upgrade】 US Stock Trading is Live!

Related reading: Introducing our New Stock Trading Function

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.