Beginner Guide to Stock Trading: Things You Must Know

Written by AQUMON TEAM on 2021-08-19

Want to try your hand at stock trading but not sure how to start? We here at AQUMON understand how overwhelming market information can be, especially for new investors. That’s why we have summarized the 5 KEY TOPICS to kickstart your journey to become a trading expert!

This blog post will cover…

-

What is the stock market?

-

General stock trading fees

-

Types of orders

-

How to read stock charts

-

Common financial indicators

1) Introduction to the Stock Market

Before we discuss how to analyze and trade stocks, we must first learn about how the stock market operates!

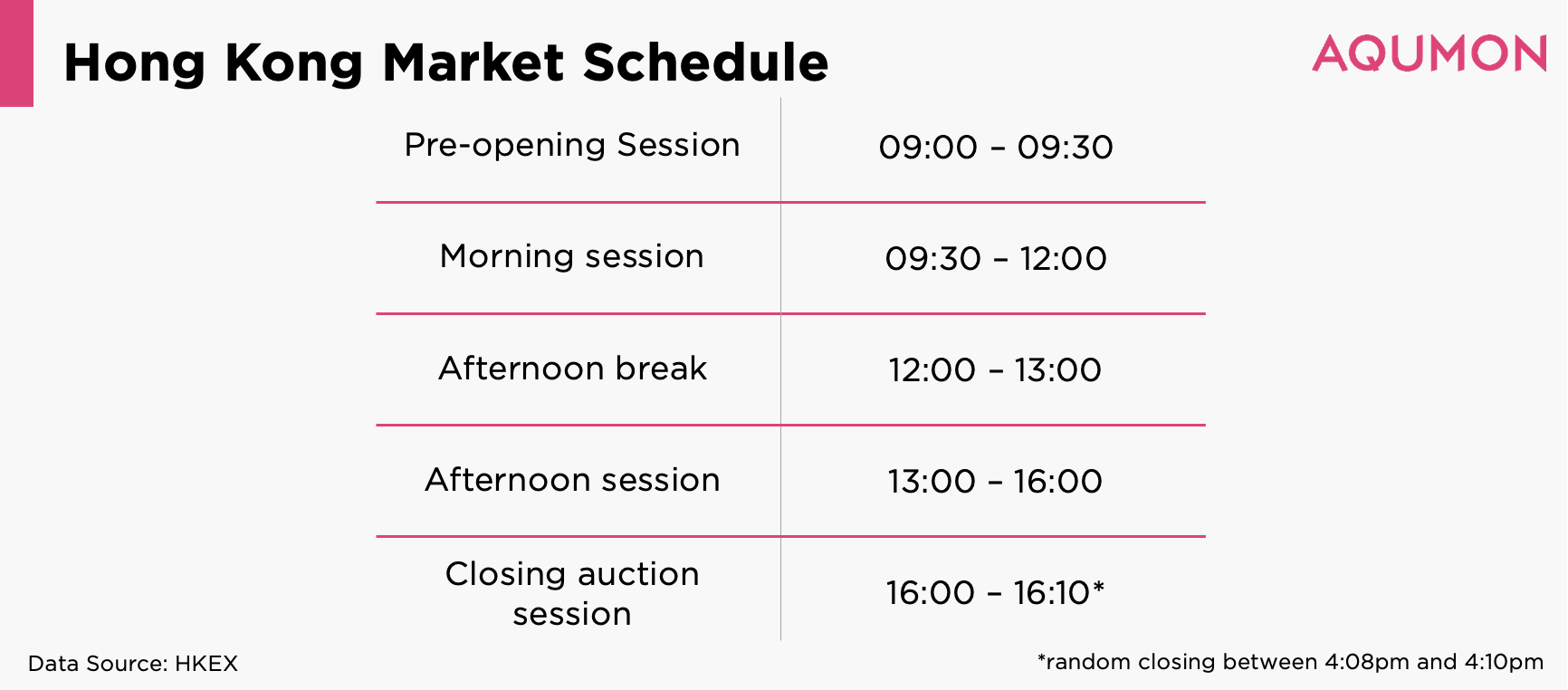

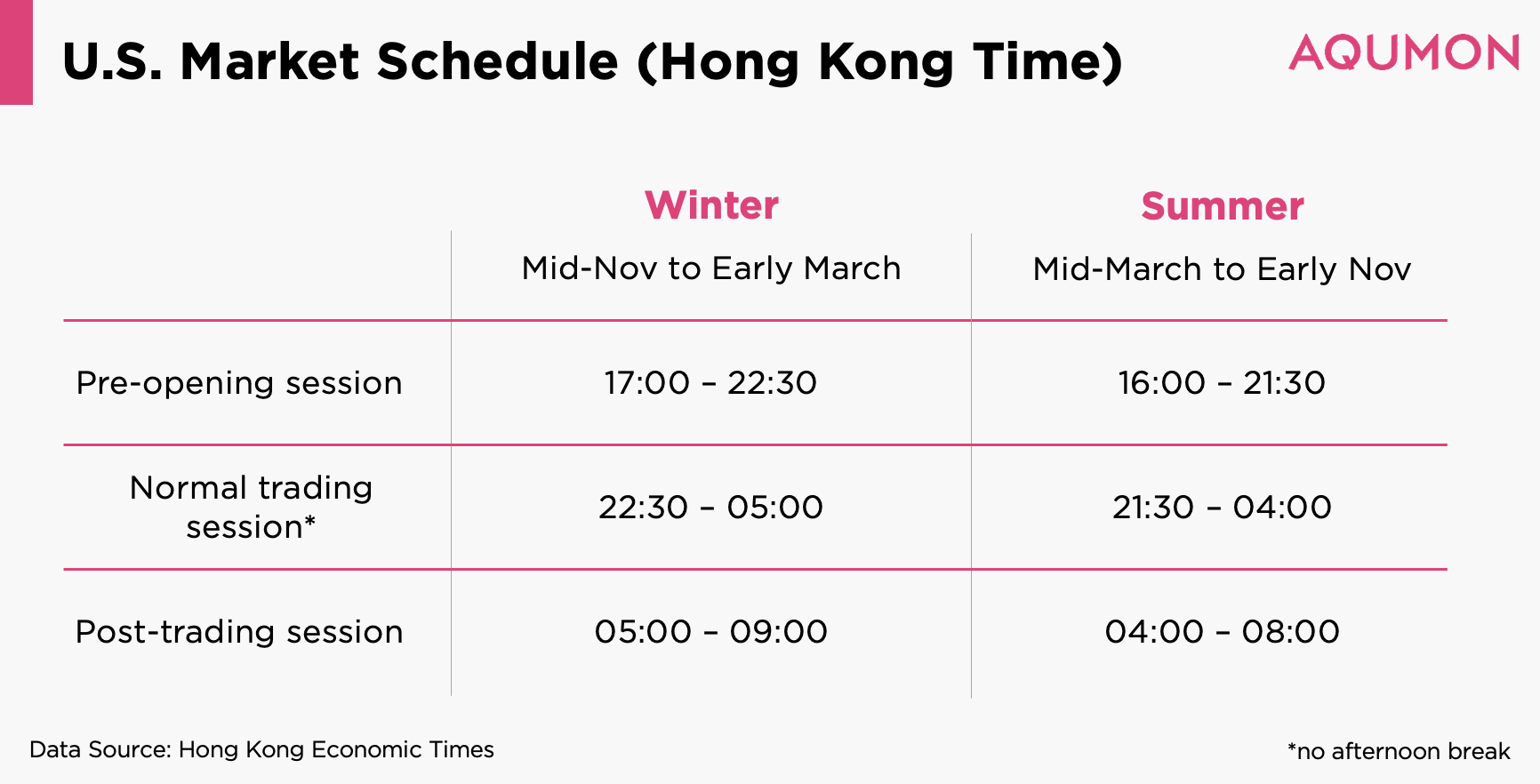

Q: Does the stock market operate 24 hours a day? When can I buy and sell stocks?

A: No, the stock market does not operate 24 hours a day. Both Hong Kong and U.S. stocks can only be traded at specific times as follows:

Q: I’ve heard about the Hang Seng Index before. What is it used for?

A: Each stock market has its own representative index that reflects the city/region’s stock markets. The Hang Seng Index (HSI) is an indicator index that reflects the Hong Kong stock market. It is calculated from the market value of the 55 Hang Seng Index constituent stocks. Indices allow investors to compare and analyze the performance of individual stocks or overall market trends.

The 55 constituent stocks of the Hang Seng Index are large and representative stocks selected from the four major industry classifications (Financial, Utilities, Property, and Industrial & Commercial). These blue chip stocks include Tencent (0700.HK), Alibaba (9988.HK), HSBC (0005.HK) and more.

Fact: Blue Chip Stock refers to a huge company with an excellent reputation. Typically has a market capitalization in the billions.

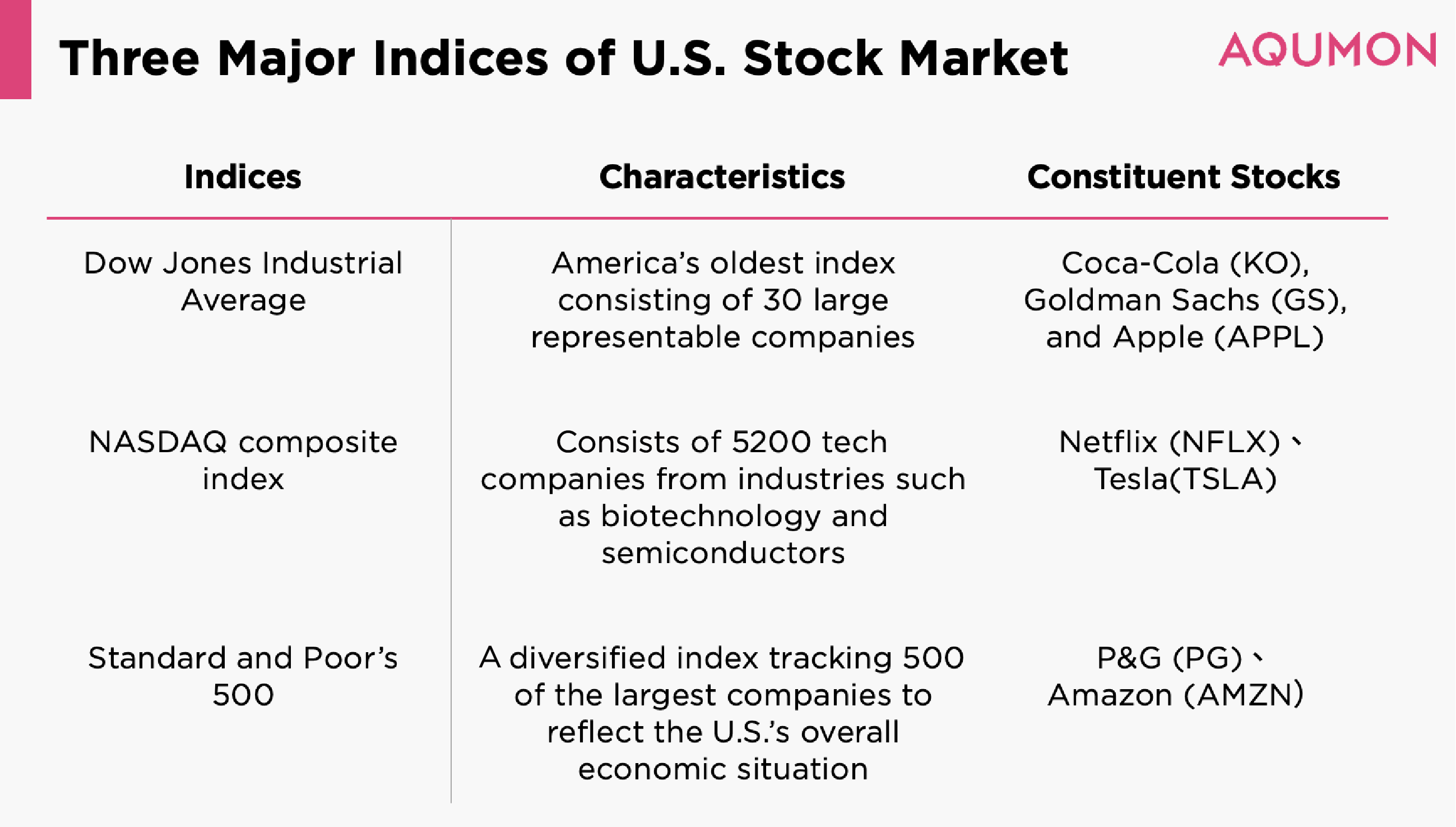

Given that the U.S. stock market is much larger than Hong Kong’s, it has three major indices: the Dow Jones Industrial Average (the “Dow”), the NASDAQ composite index (NASDAQ), and the Standard and Poor’s 500 (S&P 500).

Related: U.S. Indexes All Beginner Investors Should Know

Q: One lot? One share? What is the trading unit of a stock?

A: Hong Kong stocks are generally traded in board lots (a trading unit which is determined by the issuer). The number of shares ranges from 100 shares to 2,000 shares per lot and is determined by the issuing company.

For example Tencent (700.HK) minimum lot size is 100 so this means at HK$433.4 per share, you’ll need a minimum of HK$43,340 to buy 1 lot of Tencent.

If that is too much money, you can also consider trading odd-lots which means trading shares below the minimum lot size. The Stock Exchange of Hong Kong (HKEX) trading system does not automatically match odd-lot trades, but investors can still trade odd-lot stocks through a special lot market.

However, in the U.S. market, investors are able to trade individual shares. As such, the minimum investment threshold is much lower than that of Hong Kong stocks. For example, the current share price of Microsoft (MSFT) is approximately US$296.9* (~HK$2,316), which is lower than many Hong Kong lot prices. Investors can also buy fractions of a share through other trading platforms.

*Data as of Sept 14, 2021

2) Stock Trading Fees

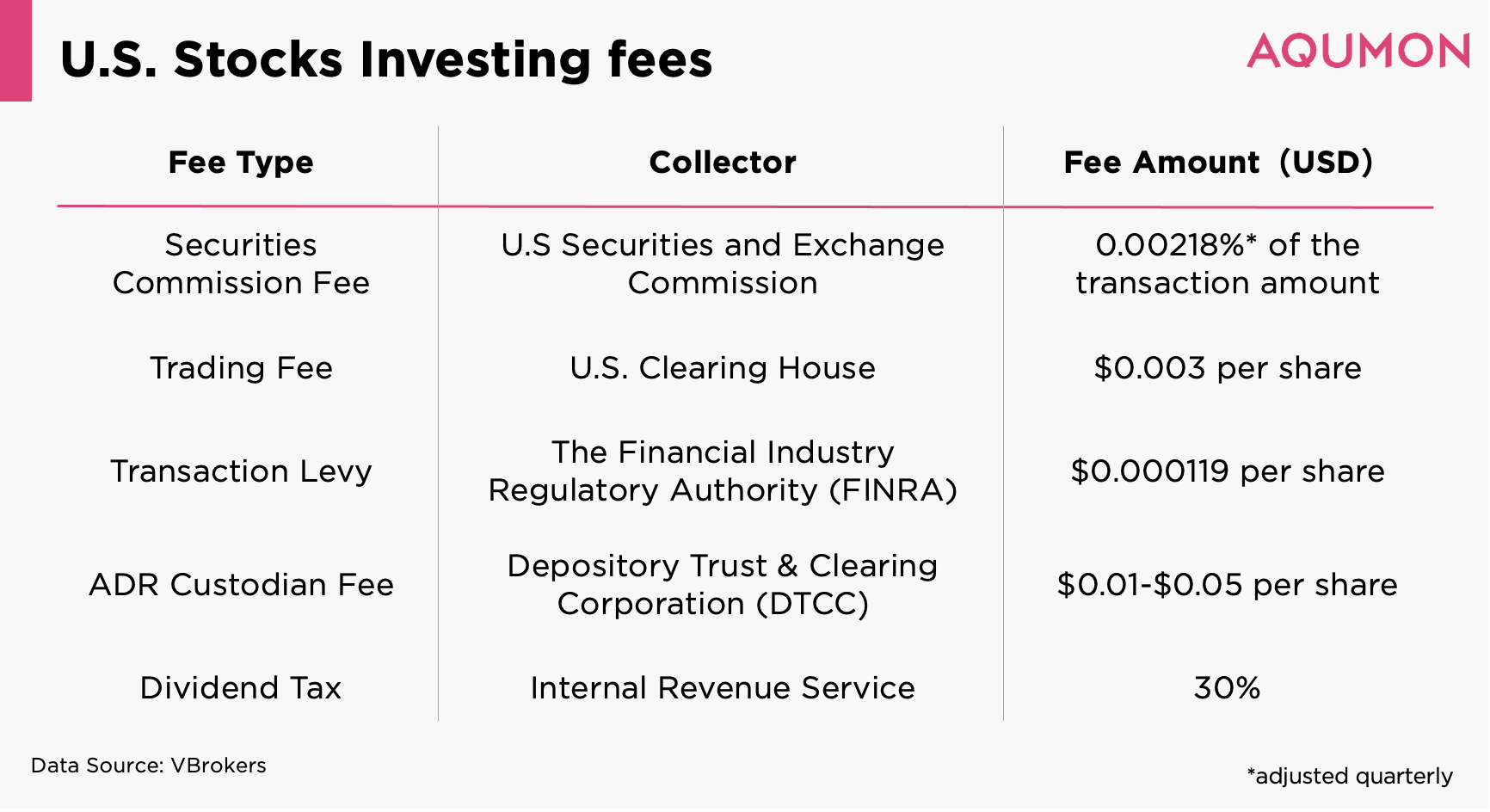

Besides the initial capital required for investing, investors also need to pay certain fees throughout the trading process. The fees charged for trading stocks vary across different financial jurisdictions.

Q: What fees do I need to pay when investing in stocks?

A: Investors need to pay fees such as brokerage, transaction levy, and trading fee. Charges vary from different securities firms. (Check out AQUMON’s fee structure for your reference!)

Note that a 30% dividend tax will be charged by the U.S. Internal Revenue Service upon any dividend revenue received by HK investors purchasing U.S. stocks.

3) Trading Prices

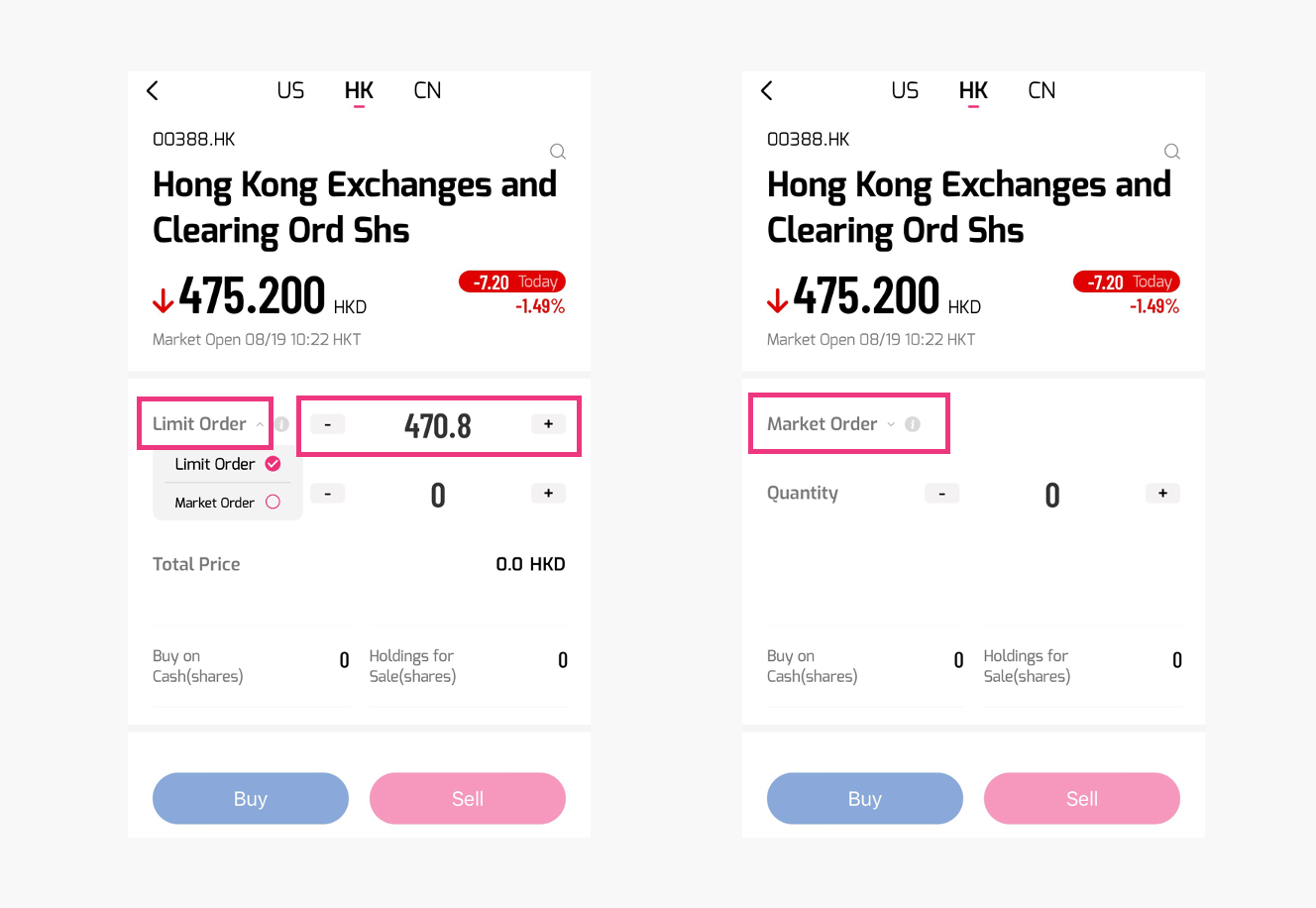

After understanding the basic operations of the stock market and its fees, you can start trading! The following are the basic trading orders, such as "limit orders" and "bidding orders".

Q: How many different types of “orders” are there?

A: HKEx's trading system only accepts five types of orders: 1) market orders, 2) market limit orders, 3) limit orders, 4) enhanced limit orders and 5) special limit orders.

Limit Order VS Market Order: Both Available in AQUMON

4) How to Read Stock Charts

Once you have familiarized yourself with the entire trading process, it is now time to choose what to invest in! It is essential to find a stock that meets your ideal return and risk tolerance. Therefore, investors must learn to do simple analysis in order to choose the right stocks for themselves.

Q: Stock charts look cramped and complicated. How do I read them?

A: Stock charts can tell you a lot of information about a stock such as price changes, current trading prices, historical highs and lows, and so on. You can “see” the story behind the stock by looking into its chart. Without looking at the chart you are basically flying blind with your investments.

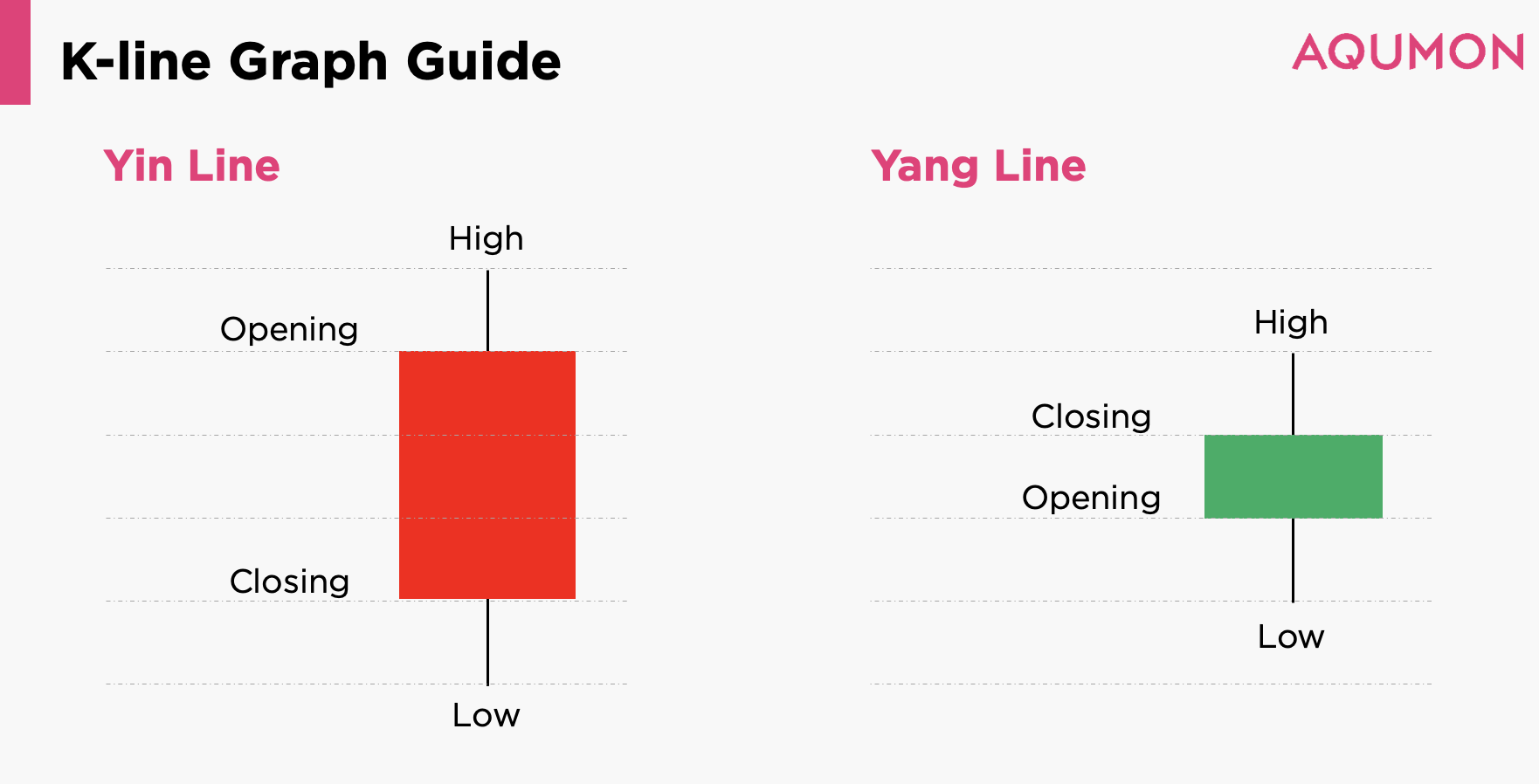

Besides the usual line charts, investors may need more information so we often see red and green K-line charts, also known as candlesticks because of their candle-like shape.

K-line charts show the opening, high, low and closing prices of a stock, and also reflect the rise and fall of the stock at a given time.

Longer candles indicate that the market price of the stock is more volatile. On the other hand, if the candle is very short, it means that the opening and closing prices are very close to each other and the price is more stable.

Related: A Beginner’s Guide to Stock Chart Reading

5) Common Financial Indicators

When analyzing a company's business, novice investors must learn some basic financial metrics to determine a company's operating efficiency and profitability. The most common financial metrics are return on assets (ROA) and return on equity (ROE).

Q: What are ROA and ROE?

A: Return on assets (ROA) is the ratio of after-tax net income to a company's total assets. It reflects how well a company is able to generate profit from all their available assets.

Return on equity (ROE) is the ratio of after-tax net income to shareholders' equity. It reflects how efficiently a company is able to use their invested capital to generate profit.

Q: How can I use these financial ratios to make investment decisions?

A: Since different industries have different profit models, ROA is generally used to compare the performance of different companies in the same industry. ROA is more valuable for heavy industries that rely more on assets, such as manufacturing and transportation.

The difference between ROE and ROA is that ROE does not take into account the source of funding from loans or liabilities, so investors can compare ROA and ROE to see how much a company relies on liabilities for its working capital. Therefore, ROA is also suitable for industries with high debt ratios.

Generally speaking, high ROA and ROE indicate that a company is operating efficiently and effectively converting its assets into profits. However, investors should also pay attention to the difference between ROE and ROA: if ROE is high but ROA is low, it means that the company's profits are created from a high debt ratio (which makes the investment riskier).

Before making each investment decision, investors should clearly measure risks and returns, and do their homework to achieve your financial goals through investment.

【Friend Referral】Invite friends and enjoy up to HK$3,000

As one of the leading digital wealth management platforms in Hong Kong, AQUMON is committed to providing smart, simple and affordable investment services to everyone.

In addition to our flagship ETF portfolios and thematic stock portfolios, AQUMON has also launched our stock trading service!

Stock trading service highlights:

-

Intelligent stock recommendation function, automatically recommending similar quality stocks

-

24/7 real-time foreign exchange, supporting different currencies

-

Cover major stock markets (Hong Kong, mainland China and US).

【Special Offer】

From now until Oct 31st, invite friends to open an account + complete initital investment to earn up to HK$3,000. Referees can also earn HK$500 upon first investment.

Share your referral link via AQUMON app. Check out HERE for more campaign details.

Download the AQUMON app now!

Related: AQUMON Stock Trading Features

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.