SmartGlobal UltiMax: Top Three Things You Need to Know

Written by AQUMON Team on 2021-09-03

SmartGlobal UltiMax, the latest addition to our flagship investment series, is now LIVE! Based on our global asset allocation investment strategy, SmartGlobal UltiMax also includes SmartHedging and Smart Rotation functions to adjust the portfolio in a smarter and more dynamic way.

Despite the market volatility, SmartGlobal UltiMax helps you diversify risks and capture investment opportunities. It is the ultimate wealth manager at your service to grow your wealth.

We’ve received an overwhelming number of positive responses and sign ups for the waiting list. Given the portfolio's popularity, we’ve consolidated the 3 most frequently asked questions from our customers. Continue reading to learn more about the new portfolio.

Extended reading: 【New Product Preview】SmartGlobal UltiMax

Q1: What’s so special about the SmartGlobal UltiMax Portfolio? What’s the performance and return like?

Based on the foundations of our flagship asset allocation algorithm, SmartGlobal UltiMax is a substantial upgrade with an all-weather tactical asset rotation strategy. This auto-enables investors to diversify portfolio risks with the all new SmartHedging function and dynamically adjust portfolio holdings to capture market opportunities.

SmartGlobal UltiMax invests in a varied range of high-quality assets such as stocks, ETFs, REITs and more. This flexibility helps deliver stable returns whilst maximising your upside potential.

Extended Reading: ETFs: A Beginner's Guide

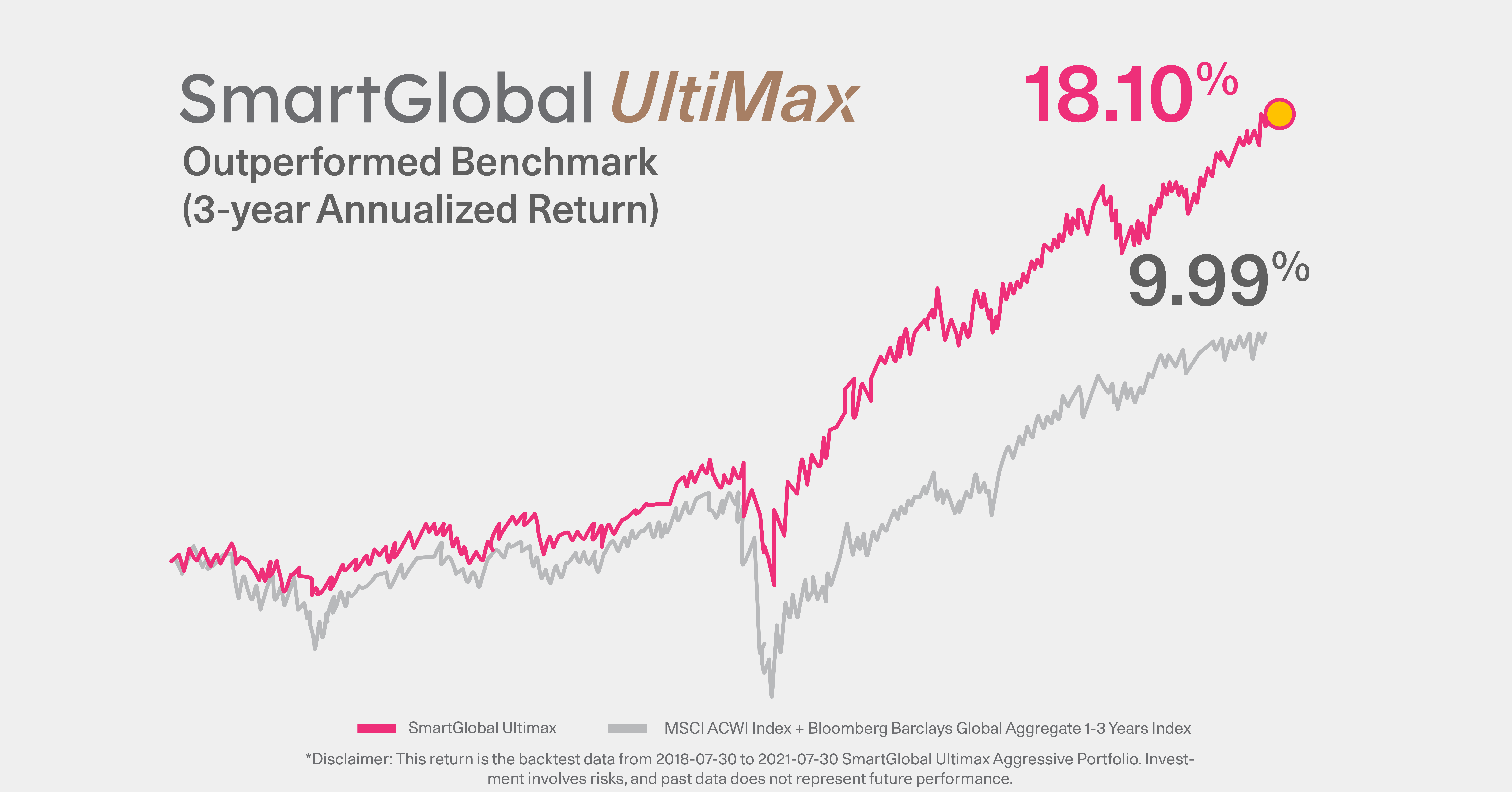

The three-year annualized return of the portfolio is as high as 18.10%*, outperforming the global multi-asset benchmark by 8.11%^. During volatile market conditions in the past 3 years, the portfolio demonstrates stronger resilience, dropping 40% less than the benchmark.

Moreover, a new auto-rebalancing function has been added to the portfolio. As long as this function is enabled, your portfolio will be always kept at an optimal level in accordance to the market conditions and investment strategies automatically. In a nutshell, it reduces investors’ workload to monitor their investments, so your time can be spent on something else you enjoy!

Extended Reading: Auto-rebalancing: What, Why, & How?

Q2: What is the investment threshold? Is it suitable for me?

The minimum investment amount for SmartGlobal UltiMax is US$13,000 (appro. HK$100,000). As the portfolio updates are more dynamic, it is currently only open to investors with Balanced, Growth and Aggressive risk types. Eager to capture the market opportunities that keep slipping by? Look no further! SmartGlobal UltiMax can take care of your investments, 24/7 through our full-service, automated robo advisor.

If you are looking for something more suitable for investment beginners, you can also consider other products from our popular flagship investment series - SmartGlobal (invest into HK ETFs) or SmartGlobal Max (invest into US ETFs).

Q3: How can I invest in SmartGlobal UltiMax? What are the Fees?

Account opening is simple and hassle-free on AQUMON. Upon opening an account, clients can invest in SmartGlobal UltiMax with just one click. Annualized advisory fees range from 0.7% to 1.0% depending on the investment amount.

Click HERE to learn more about our fee structure.

Grow Your Wealth in Your Sleep

SmartGlobal UltiMax, the ultimate money-making portfolio that can weather-proof your investments. AQUMON goes above and beyond to make investments accessible and empower you to reach your goals!

Download the AQUMON app now and try out the new portfolio.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.