Fancy a Tony Leung NFT? The digital assets selling for millions

Written by AQUMON Team on 2021-10-06

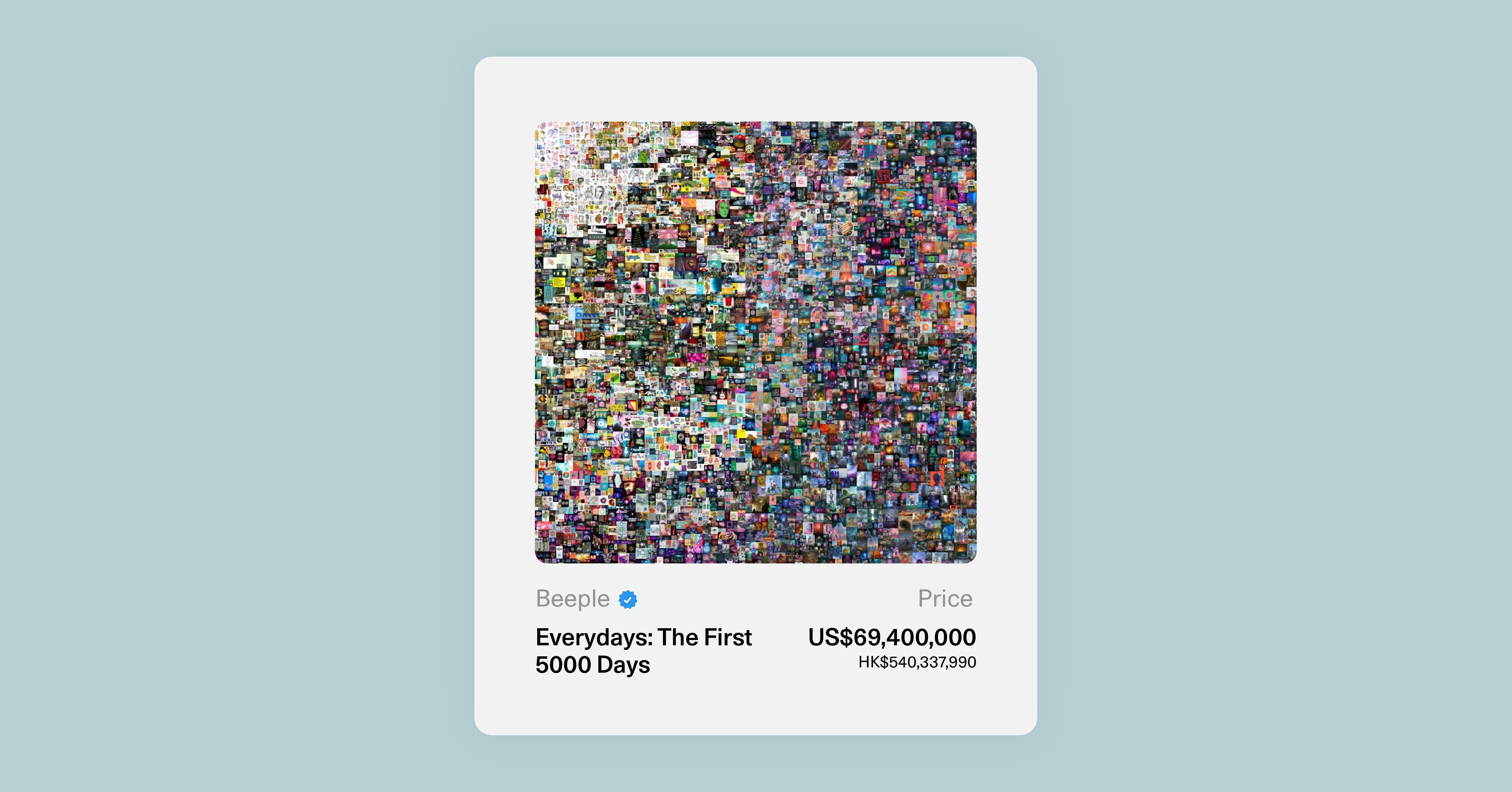

You might’ve heard of or even seen NFTs floating across the interweb recently. Maybe it’s because the most expensive NFT ever sold went under the hammer at Christie’s for a whopping US$69 million, or because Sotheby’s will be auctioning never-seen-before, behind-the-scenes footage from Wong Kar-Wai’s critically acclaimed film In the Mood For Love. The highest bidder will be the exclusive owner of a 91-second long clip featuring Tony Leung and Maggie Cheung.

In any case, non-fungible tokens, or NFTs, are reshaping the landscape for collectibles and digital art.

So we’re going to give you a breakdown on what they are, where they came from, and why they’re a lot more important than turning a few people into overnight millionaires.

What’s an NFT? What does it stand for?

Non-fungible tokens, or NFTs, are any one-of-a-kind digital asset that can be traded and recorded on the blockchain with a unique certification that protects from duplication.

The ‘non-fungible’ aspect means that something can’t be directly interchanged with another item. The opposite of such is a ‘fungible’ HK$10 coin; you can trade a HK$10 coin for another HK$10 coin and get the exact same thing. The Mona Lisa, however, is non-fungible; you can’t exchange it for another Mona Lisa because it is a unique asset.

While there is a misconception that NFTs are only linked to the art world, the reality is starkly different; NFTs represent everything unique in disciplines such as gaming, music and more that require a high level of security, transparency and privacy. This is what makes NFTs a perfect match for unique assets in the art world.

How do NFTs work?

At the most basic level, NFTs are crypto-assets that are powered by blockchain technology, similar to how cryptocurrencies like Bitcoin and Dogecoin are powered by their respective blockchain networks.

The difference between NFTs and cryptocurrencies is that NFTs aren’t currencies you can use to buy things with. Instead, blockchains are used to authenticate NFTs as one-of-a-kind digital items. Think of the blockchain as a permanent system of recording information; the blockchain records all information related to a particular NFT such as the number of times it’s been traded, at what price, and by who.

Traditional art such as paintings are considered valuable mainly because they are one of a kind. But with the growth of technology, their digital counterparts can be duplicated endlessly, which could potentially lower their unique value. This is a problem. NFTs solve this exact pain point because now such artwork can be "tokenised" through NFTs to create a unique digital certificate of ownership (that can not be duplicated), yet can be bought and sold easily.

But what are NFTs used for?

In the physical world, certifiable things like NFTs are called “collectibles;” think of baseball cards, rare Pokémon cards, or even famous works of art. Like these physical collectibles, the non-fungibility of NFTs makes it easy to see why both individuals and big corporations (particularly those in sports and entertainment) might want to issue their own NFT items.

One of the most prominent examples of this is the NBA, whose TopShot programme allows fans to buy unique sports highlights and own them forever. Once owned by a fan, these highlights can continue being traded among collectors and communities, operating like any secondary market. As these NFTs are tied to the blockchain, collectors can ensure authenticity prior to bidding or buying.

You can buy NFTs almost anywhere

One could argue that it’s actually more difficult to buy physical art than you think; when’s the last time you went to Art Basel, Art Central or to Sotheby’s and walked out with a brand new painting? Unless you’re a multimillionaire, the answer’s probably never. On the other hand, NFT marketplaces are accessible to anyone with a computer and an internet connection. Platforms like Opensea, Foundation, Cryptopunks, and Zora have instigated the democratisation of valuable digital assets for the greater public.

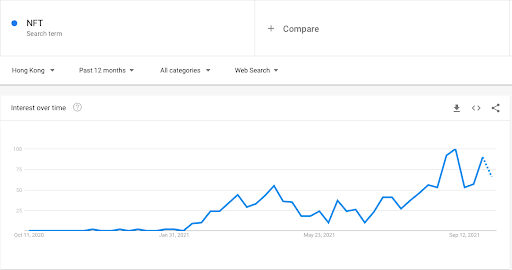

But wait, are NFTs a big thing in Hong Kong?

Despite Hong Kong’s small size, new NFT projects continue to be launched at a fast pace; the arts is by far the biggest pioneer of the local NFT scene. For example, this month will mark the first-ever virtual art fair in the city, showcasing more than 200 digital and NFT artworks by renowned artists such as Refik Anadol.

The real importance of NFTs isn’t what they are, but the beneficiaries from their trades

NFTs are a reminder that the quality of a digital item isn’t necessarily what drives its value, but rather its uniqueness. Non-fungibility promises to change the way ownership works, the way trading works, and who the ultimate beneficiaries of these trades are.

As these digital assets are sold from the source (the artist) and tracked through the blockchain, the artist is not the only person who can verify the assets’ authenticity; an NFT that’s tied to a blockchain can’t fool anyone, which is often a huge upside for the artist. Since the artist is connected to their NFT through a blockchain, the artist often gets a percentage of any resale of the work on secondary markets. If you bought a Van Gogh for a dollar and sold it for millions to a private collector, Van Gogh or his estate would not get a single dollar from that secondary sale. With NFTs, artists can continue to benefit from their art, regardless of how many times the NFT has changed hands.

So what does NFTs have to do with investing?

With the rise of cryptocurrencies, NFTs now offer investors another alternative asset class to consider for their investment portfolios. Even though Beeple’s “Everydays: the First 5000 Days” art piece selling for US$69,400,000 may dominate headlines, NFTs in general have been on the rise in value. When we look at the NFT index, which is designed to track tokens' performance within the NFT industry, the index shows that NFTs are up +283% in the 7 months since the index was launched in March 2021:

How did the US’ S&P 500 Index do in comparison? It was up +13% in that same time period, which means NFTs in general outperformed this benchmark by +270%.

Art and now NFTs have always been a bit of a higher risk higher reward game, but for investors interested in alternative assets, NFTs are a viable and potentially valuable asset class now available to the masses.

What are the risks? Will this gold rush come crashing down?

The concept of NFTs is still nascent within the bigger history of collectible valuables, so its long-term survival and inherent value is still up in the air. But while the uniqueness of NFTs can merit the (sometimes) extreme valuation of these assets, this in and of itself could very well be its achilles’ heel. You might be the owner of a unique digital asset, but what’s stopping artists from flooding the market with more ‘unique’ supply of your once special art-piece? Today’s NFT market might seem like a gold rush, but if there’s an endless supply of gold, how could it retain its value? The NFT you bought might not be the unique snowflake it once was, and you might just end up wondering why you’ve spent all that money on a snippet of In The Mood for Love no one else has even seen.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.