Is investing a "Squid Game"? 2 investing lessons learned.

Written by AQUMON Team on 2021-10-07

For those of you who have been glued to watching “Squid Games”, the South Korean hit thriller that is topping Netflix’s streaming charts in 83 countries, we wanted to take a moment to share with you 2 important investing takeaways you can learn from the series.

If you haven’t seen the series, here's a little background first: the drama tells a story of how 456 down-on-luck individuals choose to play a series of childhood games, such as “tug of war” or “red light green light”, designed by a mysterious organization with deadly consequences if they lose. The winner? They take home a cool 45.6 Billion Won (~HK$298.3 million) and are given a second chance at life.

The story’s main protagonist, Gi-hun Seong (player #456), struggles in life with a crippling debt of 400 million won (~HK$2.6 million), so he decides to play this twisted game for a chance to pay for his mother’s surgery and get custody of his daughter from his ex-wife.

Hopefully your life is far from a “Squid Game” situation, however there are 2 important investing lessons we can learn from the deadly games of this hit series:

***SPOILER ALERT (don’t say we didn’t warn you)***

Investing takeaway #1:

When all hell breaks loose...stay calm. You will likely be rewarded in the long run.

Which game can you learn this takeaway from: Red light green light

Rules: All players stand at the starting line. When players hear “green light”, they move towards the finish line. When they hear “red light” they must stop and freeze. If they are still moving after “red light” is called the player loses and dies. Players have 5 minutes to cross the finish line.

What happened in the game: The players went into the game not knowing the consequence of losing was death, so when the first player caught moving got shot, for a brief period most players panicked and started to run towards the exit. All these players sadly ended up dying. Those who stayed calm ended up successfully completing the game and stayed alive.

Investing takeaway explained: When markets take a turn for the worse, especially for a less experienced investor, it can feel like everyone is running for the exit and getting culled. It is important then to stay calm and keep things in perspective.

In the words of the world’s most famous Investor Warren Buffet “Be fearful when others are greedy and greedy when others are fearful'. In order to achieve this one must be calm even in the face of uncertainty and adverse situations.

Investors should obviously try to protect their money but also naturally understand that they are aiming for medium to longer term investment goals; the ups and downs (even violent ones) will happen midway but should not throw you off your goals.

For example, during last year's big financial market selloff in February to March 2020, the US’ S&P 500 Index dropped -33.6% in just 34 days. Many investors also ran for the exit by selling their stocks but those who stayed calm, stayed invested and maybe even accumulated carefully during the selloff benefited greatly:

Just staying invested until October 1st 2021, investors in 1 ½ years received an additional +29.3% return. For those who got lucky and got in at the bottom, their return since March 23rd 2020 was an additional +94.7% return!

Even in a more extreme example, like the Global Financial Crisis of 2008, where the US stock market plunged -56.8% from October 2007 until March 2009, fast forward to now the S&P 500 Index is +544.0% since the market bottom 12 ½ years ago.

Looking ahead we anticipate there will be more market volatility as we recover from COVID-19 and central banks start to pull back on the support. So it pays off for investors to stay calm during a market selloff.

Investing takeaway #2:

To achieve an optimal investing outcome it often requires investing into a combination of assets.

Which game can you learn this takeaway from: Tug of war

Rules: Find and form a group of ten players. Each team has to keep pulling the rope until it crosses the centerline. The losing team falls off the platform and ultimately to their death.

What happened in the game: One of the Squid Game’s villain Deok-su Jang (player #101) due a tip from Byeong-gi (player #111) knew about the game in advance and purposely formed a team of 10 strong men knowing strength was a major advantage in tug of war. Gi-hun (player #456) team in comparison had both women and an elderly man, which on the surface is seen as a major disadvantage. But they ultimately beat a stronger all-male team and avoided death due to:

1) Having a strategy

2) Everyone understanding their role

3) The ability to change their strategy midway

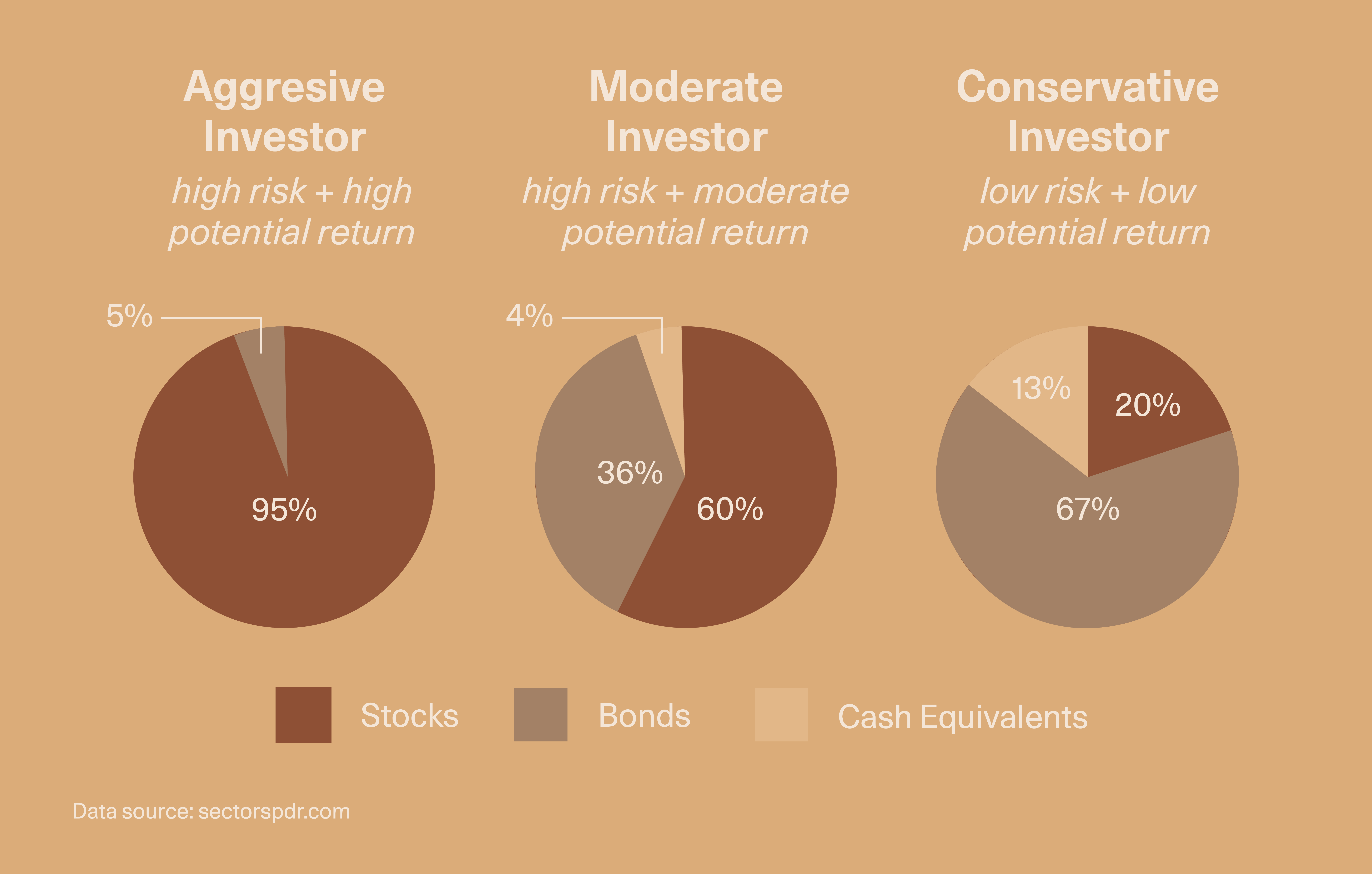

Investing takeaway explained: That’s exactly the core principle behind one of the key investment strategies called “asset allocation”. Asset allocation is based on the principle that different assets (e.g. stocks, bonds, commodities, alternative investments etc) perform differently in different market and economic conditions, but it is the combination of them that will deliver optimal returns for investors of different levels of risk tolerance in the long term.

In simple speak, it is like investing in a diversified manner but there is nuance where different types of investors should have different asset combinations:

So during periods of good (or bad) market conditions, each of your portfolio’s assets, much like the teammates in Gi-hun’s team, will serve a different purpose.

For example, traditionally speaking in bad market conditions, your bonds and commodities (like gold) will help keep your portfolio better protected and may even rise in value under such conditions, even though your stocks may drop in value.

Furthermore, in the current low interest rate environment, where bonds may not provide the protection or income it is known for, it is important to stay nimble and adjust your strategy just like Sang-woo Cho (player #218) did at the last minute by walking multiple steps ahead and delivering them the win. In investing terms, investors may also need to consider adjusting their portfolio to have alternative assets, like cryptocurrencies or even hedging, rather than just taking a traditional approach in the current investment environment.

So approach your investments much like how Il-nam Oh (player #1) suggested:

1) Have a strategy ahead of time

2) Understand the role of each of your invested assets

3) Be flexible to changes in strategy

Consider an investment strategy of a mix of assets in your investment portfolio (called “diversified asset allocation”) which will better help you ride out the ups and downs of the markets.

Although in the Squid Game series all the participants play multiple games, in reality… investing is not a game and should be approached with thoughtfulness, strategy and a calm mind in order to achieve success.

If you are looking for a “gganbu” a.k.a “neighbourhood best friend” in investing (#SquidGameLingo) download the AQUMON smart investment app to immediately benefit from these investing takeaways.

Not only does AQUMON’s algorithm-based approach help make automated and customized investment recommendations that fits your needs, but it also intelligently adjusts as market conditions change.

Happy investing from AQUMON and may we all have a chance (through smart investing) at getting that 45.6 billion won!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.