How did Tesla join the Trillion-dollar Club?

Written by AQUMON Team on 2021-11-03

Tesla Becomes Latest Member of the Trillion Dollar Club. What has propelled the stock to stratospheric heights?

Tesla, Inc. became the latest American company to join the elusive Trillion Dollar Club, following the footsteps of Microsoft, Apple, Alphabet, and Amazon. After a series of moves this past month, Tesla’s stock price has risen by more than 50%.

So why are investors so optimistic about Tesla? Is it too late to get into the Tesla rally? Keep on reading to learn our best tips on how to make the most out of this price rally!

Why are investors bullish on Tesla’s stock?

1. Investors’ interest in Tesla speaks to the market’s overall positive sentiment on intelligent driving and electric vehicles.

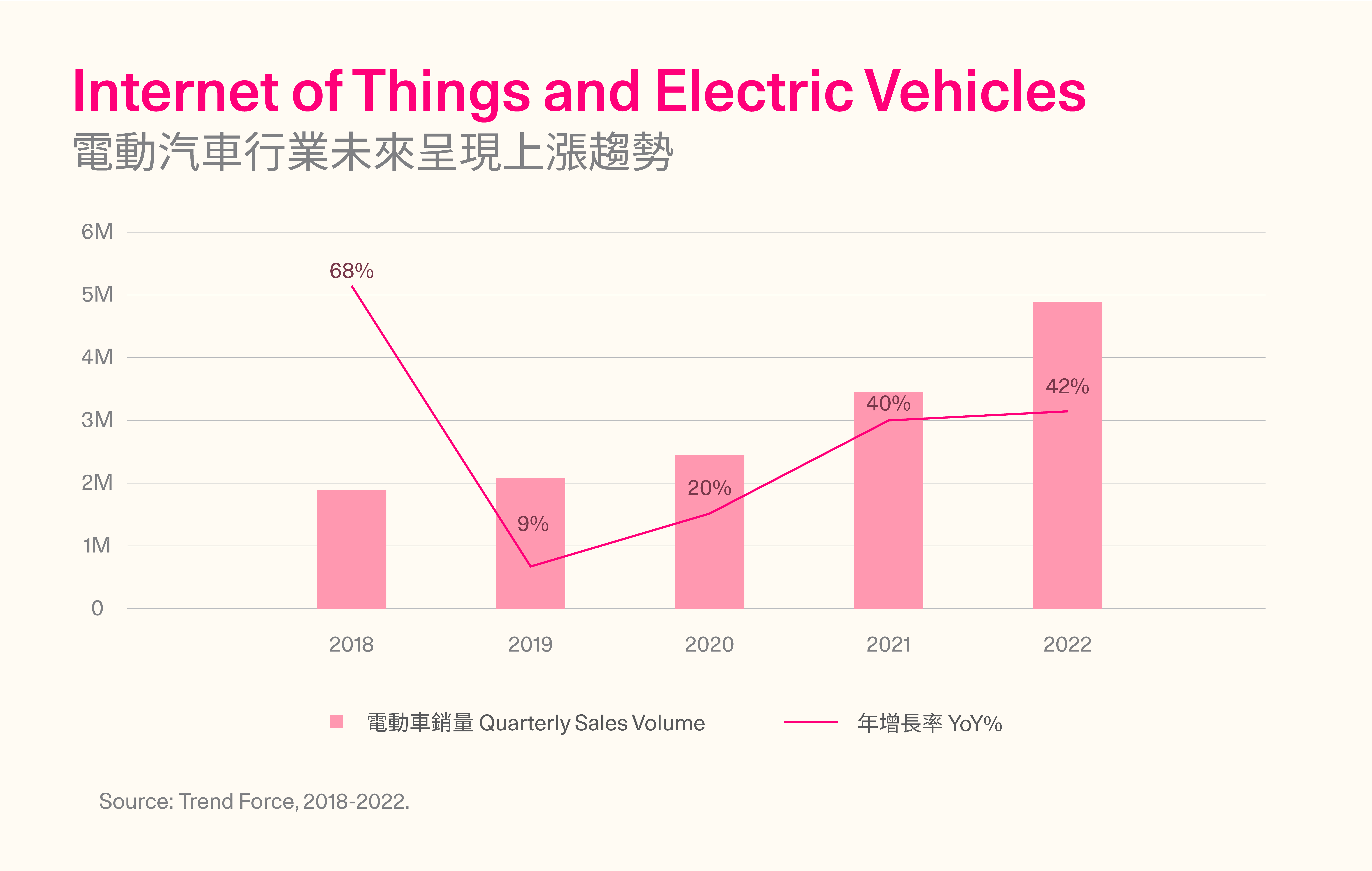

With interest in the ‘Internet of Things’ showing no signs of slowing down, intelligent driving is proving to be a dominant force within this sector. Since 2020, sales of traditional automobiles have slowly declined, but electric vehicle sales have steadily increased*.

Within the past year alone, more electric vehicle stocks have made themselves known to investors, such as Weilai, BYD, Xiaopeng Motors and so on. In addition to new electric vehicle brands, traditional auto companies such as Audi, Porsche and Jaguar are also introducing their own lines of electric vehicles. This trend showcases the importance electric vehicles play in the future of the auto industry.

2. Government-Endorsed Green Development

One of the major selling points of electric cars is that they emit zero carbon emissions, which has caught the attention of government regulators. Last Thursday, the state of California introduced America’s first e-legislation for ride-hailing services, requiring 90% of their fleets to be electric by 2030. With ‘zero carbon emission’ goals and targets being introduced by many countries, more and more governments are introducing legislation to curb carbon emissions from private cars, paving the way for a large-scale transition towards electric vehicles.

3. Optimism on Tesla R&D Capabilities

Investors look at Tesla not only as a car manufacturer, but also as a technology company. Since 2010, Tesla has expanded from its core business of electric vehicle manufacturing by acquiring solar energy supplier SolarCity in 2016. As of 2020, Tesla has begun developing its own batteries in the hopes to become a fully functional power company. In 2021, Tesla introduced the Tesla Bot, showcasing just how powerful its AI and robotic capabilities are to the world. However, these developments did not come without controversy; a string of accidents related to Tesla’s auto-pilot feature called into question the maturity of Tesla’s AI and machine-learning technologies. Even market leaders like Tesla still have a lot of room for future development.

3 Reasons for Tesla’s Stock Price Rise

1. Strong Demand

Large orders for Tesla vehicles indicates strong market demand for their products. Last week, American car rental company Hertz was reported to have signed a deal to purchase 100,000 Model 3 cars in a deal worth US$4.2 billion. Ride-hailing company Uber also announced that it would purchase 50,000 Tesla vehicles for their drivers.

Despite Elon Musk saying that no contract between Tesla and Hertz has been signed, this event is still regarded as a turning point in the electric vehicle industry towards the mainstream.

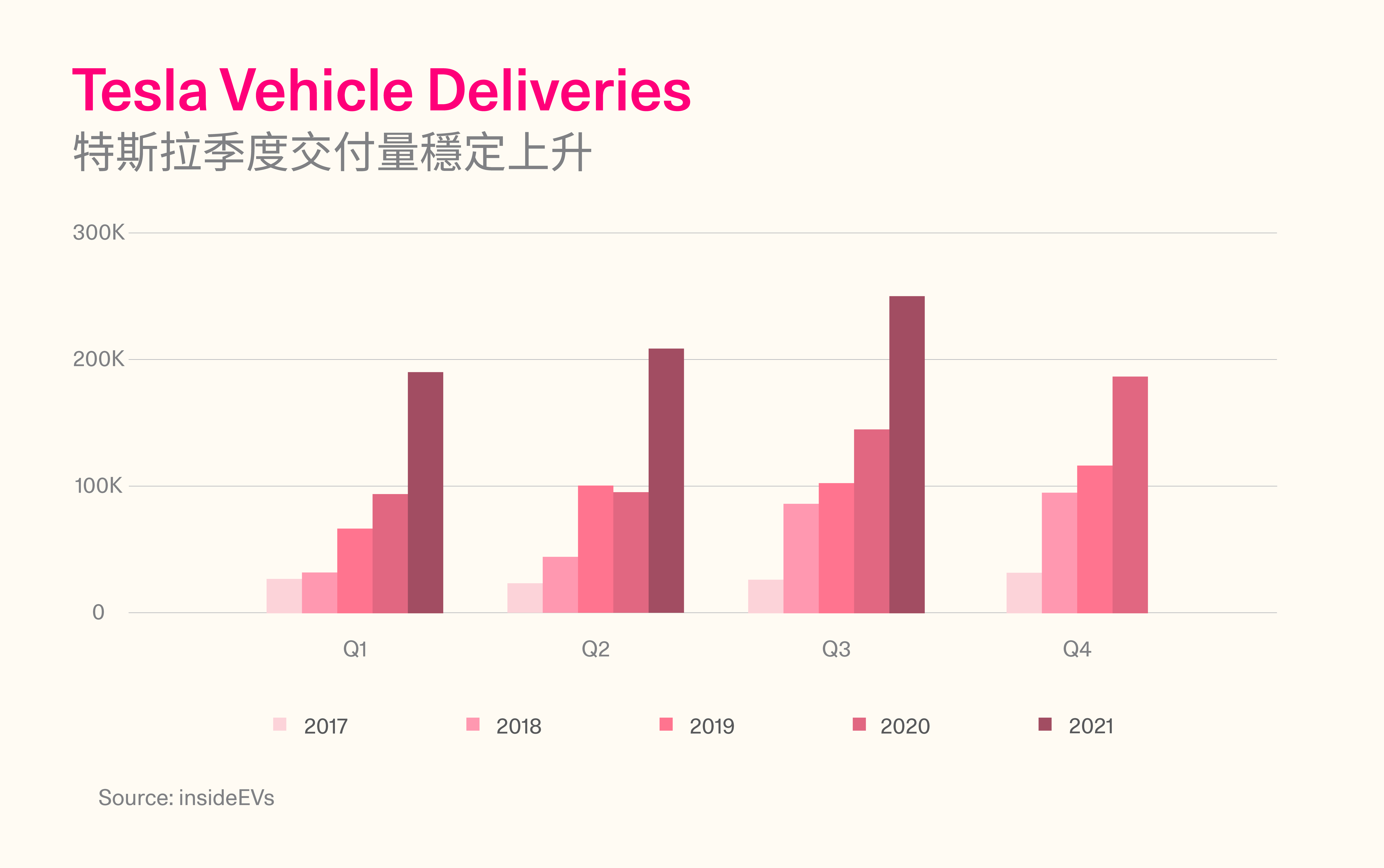

2. High Production Output

EV production has hit record highs despite the global chip shortage and supply chain disruptions. Tesla has continued to invest in its own supply chain capabilities to ensure minimal production setbacks. Although many manufacturers have experienced supply chain disruptions due to the global pandemic, Tesla has continued to show resilience through its manufacturing capabilities. High levels of automation and intelligent operations within its Giga Factories have stabilised Tesla’s ability to manufacture and deliver vehicles. Analysts project that 900,000 Tesla vehicles will be delivered by the end of 2021 on top of an average annual growth rate of around 50%.

3. Strong Third-Quarter Earnings

Tesla’s third quarter earnings reports showed that operating income increased by 57% year-on-year with profit margins of 14.6%, well above analysts’ expectations. Unlike other electric vehicle firms, Tesla has been profitable for nine consecutive quarters. Stable cash flows and profitability indicate that Tesla has finally turned into an attractive target for investors. As Tesla’s marginal cost of manufacturing falls as production increases, the firm is poised for even more profits in the future.

Are there risks to investing in Tesla now?

Some analysts have suggested that Tesla’s price-to-earnings ratio of 391.13 (as of Nov 2) is too high compared to other vehicle manufacturers. It’s worth noting that the P/E ratio is suitable for evaluating value-based blue chip stocks with stable operations and earnings, such as Toyota or Ford Motors. But because Tesla is often classified as a growth stock as opposed to a value stock due to its strong year-on-year profit growth and consistently positive investor expectations, it is natural for the stock to have such a high P/E ratio.

As a high-growth company however, investors must be aware of Tesla’s ability to fall short of investor expectations. When this happens, there is likely to be large fluctuations in the company’s stock prices. Growth stocks like Tesla are also highly susceptible to external shocks such as tightening fiscal policy and macroeconomic concerns, making them rather risky investment options.

For an individual investor like yourself, diversifying your investments is the best way to control your risks and capture returns instead of betting on a single stock.

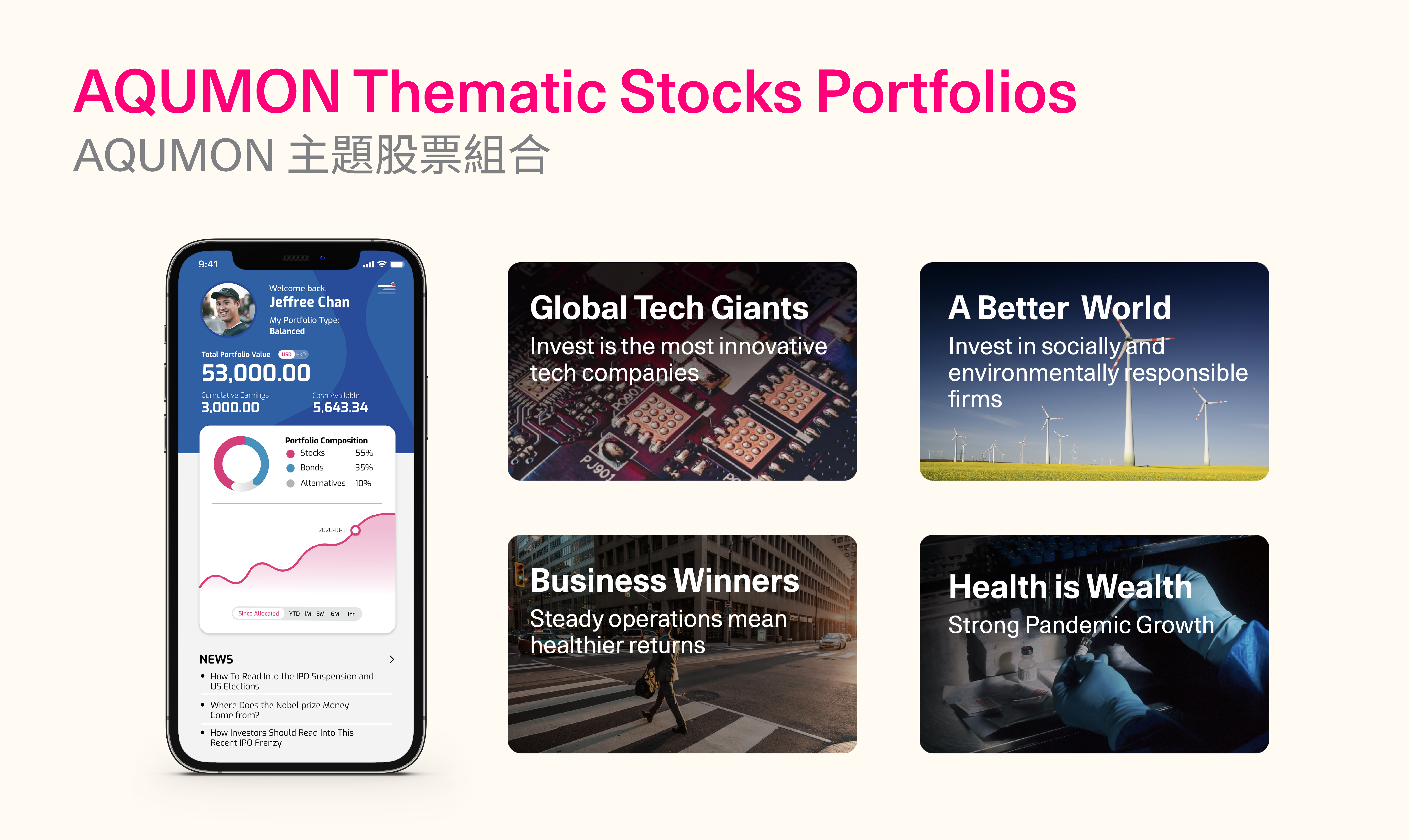

If you want to invest US$1,000 somewhere, this probably won’t be enough to buy one share of Tesla. But if you want to invest in the stock market, AQUMON’s thematic stock portfolios are great alternatives; several of them include Tesla’s Stock (Global Tech Giants and U.S. Market Leaders!)

Want to find out what stocks we’d recommend besides Tesla? Download the AQUMON app now to learn more!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.