Is The Metaverse Hype or The Next Big Investment?

Written by AQUMON Team on 2021-11-11

Major technology companies like Microsoft, Nvidia, and most prominently Facebook are abuzz about a greenfield investment opportunity called the Metaverse, coined by some as the next big evolution of the Internet - Web 3. But the buzz isn’t just with big companies; retail investors seem to be just as intrigued with meta-investing as well. A recently launched Metaverse-themed ETF, has just surpassed US$300 million* in assets under management (AUM).

This paradigm shift in how everyone’s thinking about the internet raises a big question: will the Metaverse switch over from science fiction into the consciousness of everyday investors? And if you are as investment-savvy as you are tech-savvy, you might also be wondering how you can invest into the Metaverse.

*Source: Roundhill Investments, data as of Nov 10, 2021

What is the ‘Metaverse’?

The term “Metaverse” was first coined by the popular sci-fi writer Neal Stephenson from his best-selling 1992 novel Snow Crash. Best described as an all-encompassing, ever-present Internet society, the Metaverse is much more pervasive in today’s society than you might expect. Although Facebook’s recent name change to Meta is the most public evocation towards the Metaverse this year, many companies are already making big bucks in this space. Fortnite and Roblox are some of the most popular companies building virtual realities as scalable business models. Earlier this June, the latter firm went public with a current market cap of US$44 billion and revenues of over US$454.1 million as of Q2 2021.

Despite the rising prevalence of the Metaverse in popular rhetoric, the hazy nature of the term has caused many to misinterpret it as a concept that only exists in video games. But in reality, the Metaverse is more than that; the goal of the Metaverse is to use the Internet to replicate many, if not all, tangible aspects of real-world life, including commerce, socialization, and entertainment.

From an investment perspective, the explosion in virtual reality as a scalable business opportunity could be compared to the dot-com boom of the late 1990s. Brands outside of tech are already betting big money on virtual reality; Nike sells virtual Air Jordans on Fortnite, and Gucci recently started selling virtual bags on Roblox at more than US$4,000 apiece.

How big will the Metaverse get?

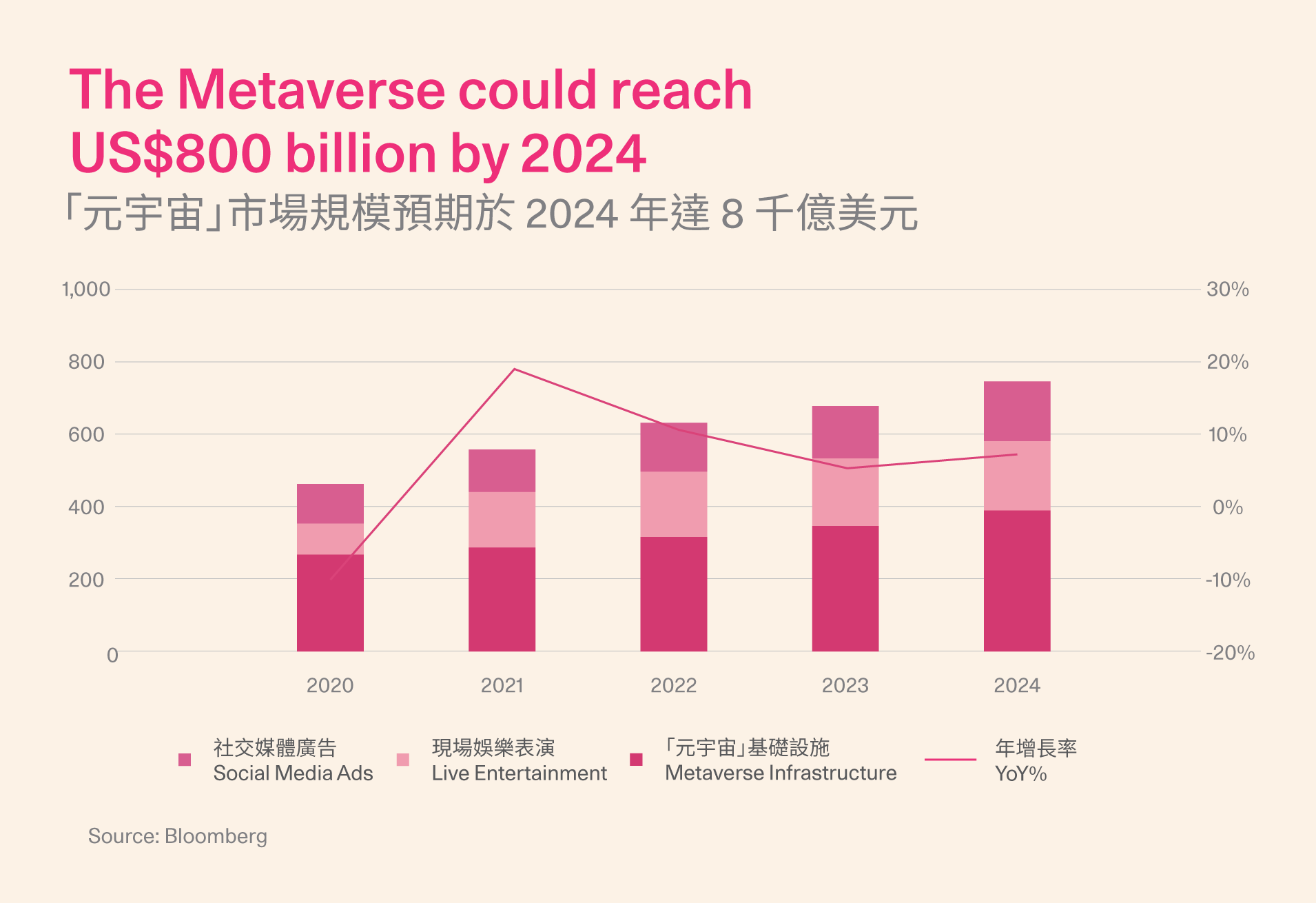

So exactly how big will the Metaverse become? Bloomberg has estimated that the market opportunity for the Metaverse could reach US$800 billion by 2024; most of this growth will be concentrated in high-growth start-ups and established tech companies focused on building the infrastructure required for the Metaverse to exist.

How can I invest in the Metaverse?

With a projected compound annual growth rate of 939% from now until 2030, the Metaverse looks to be a highly lucrative investment opportunity for retail investors. But how can we approach Metaverse investing in a smart and methodical manner? Investments in the space can be divided into four broad categories:

Metaverse Infrastructure (Computing, Networking, Hardware):

The Metaverse will need a vast infrastructure of real-time rendering, image-drawing, and graphics to become truly immersive for users. Chipmakers such as Nvidia (NVDA) and Qualcomm (QCOM) are just some of the firms whose competencies might satisfy the massive amounts of computing power required to build and sustain the Metaverse.

Metaverse Payment Systems:

Morgan Stanley predicts that Metaverse functions will extend beyond gaming and social networking to trade virtual goods and services. In a recent report, investment bank Jefferies argues that cryptocurrencies will play a sizable role in virtual realities, most notably as the primary currency in which transactions will be conducted. Today, there are already various platforms that readily accept crypto as payment for virtual products. Users of Decentraland, for example, can build worlds and trade VR-based real estate using the platform’s own virtual currency.

Metaverse Platforms:

For a Metaverse to exist, companies must develop and operate immersive digital simulations, environments, and worlds for users and businesses. It is only through these worlds that parties explore, create, and trade goods and services in various experiences that simulate the tangible real world. Roblox (RBLX), Fortnite (Epic Games: EPOR), Decentraland, and Sandbox are just some of the more successful use-cases in creating scalable virtual spaces.

Metaverse Content, Assets, and Identity Services:

With big money pouring into virtual spaces, companies that specialize in the secure protection and financial management of digital assets are required to ensure the security of the Metaverse, its users, and their assets. Companies like Square Inc (SQ) and Paypal Holdings Inc (PYPL) are some of the firms whose services will be needed to develop a secure financial infrastructure for the Metaverse going forward.

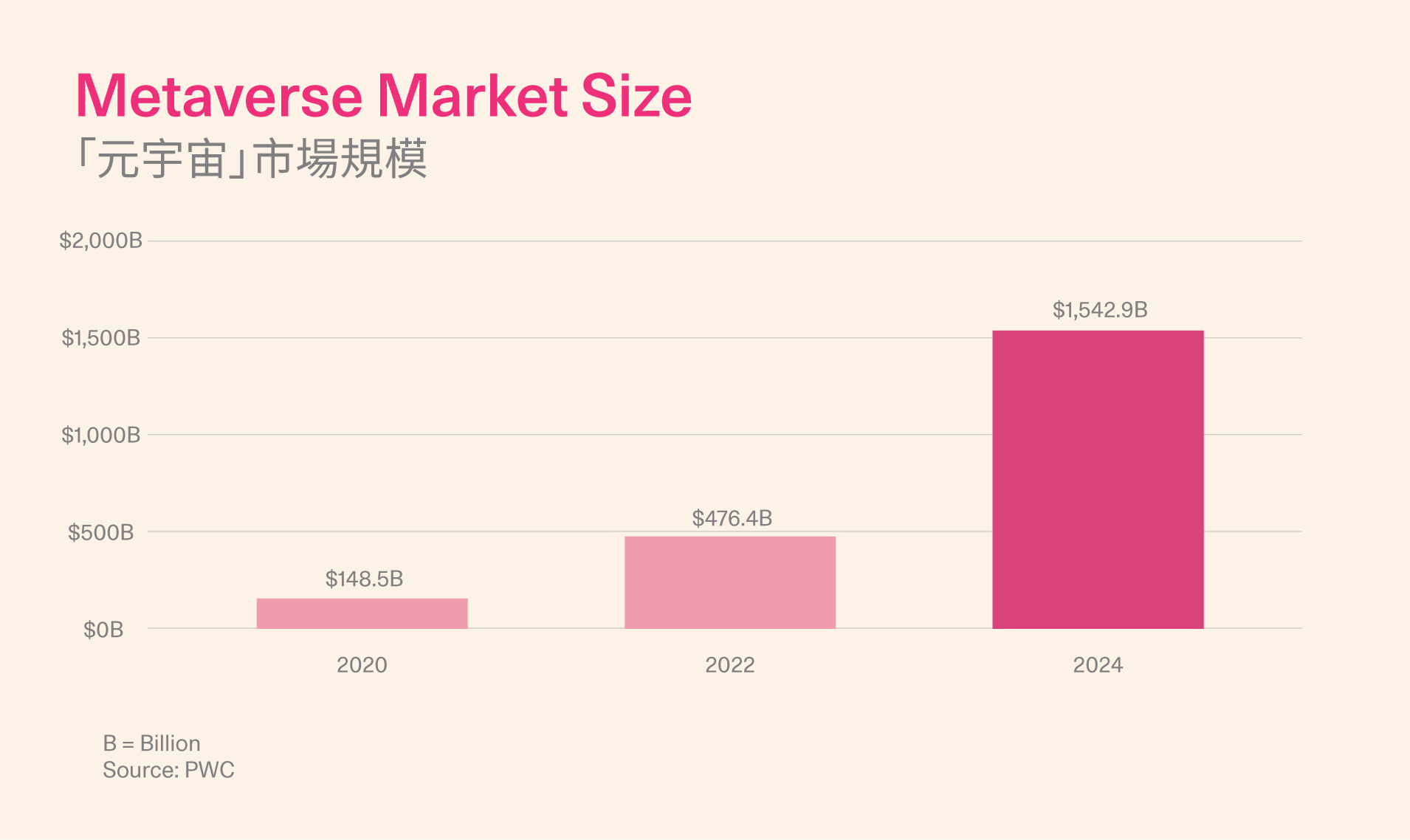

When we consider the total addressable size of the Metaverse, the market could be worth well over US$1 trillion beyond the year 2030. The Metaverse could very well become as pervasive and essential to everyday life as the Internet is today, paving the way for unparalleled upwards potential, provided that you invest wisely, of course.

Researching and selecting your own Metaverse stocks can be pretty difficult, time-consuming, and costly. But AQUMON provides you with a hassle-free way to kickstart your investing journey into the digital space.

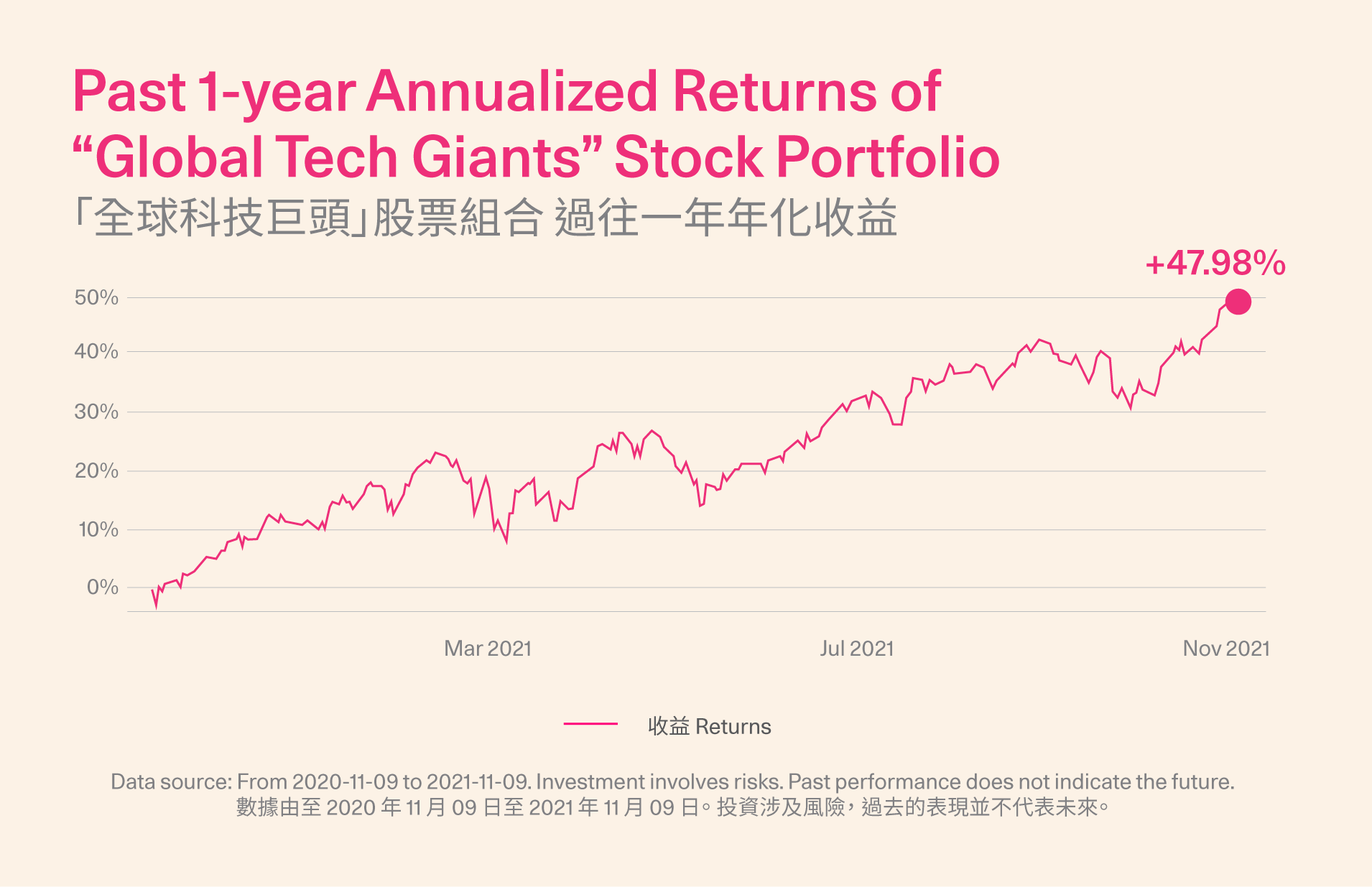

One of our most popular thematic stock portfolios, Global Tech Giants stock portfolio allows you to own shares of prominent Metaverse companies like Facebook (FB), Square (SQ), Nvidia (NVDA), and Microsoft (MSFT) for just US$1,000. In the past year alone, this portfolio has achieved +47.98% in annualized returns.

To start investing into the Metaverse today, click HERE to register an AQUMON account today!

*This article does not contain investment advice or recommendations. Investing involves risks, and readers should conduct their own research when making a decision.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.