Performance and Case study of Bespoke - Personalized Investment

Written by AQUMON Team on 2022-03-28

Key Summary

- Since our launch in December 2021, AQUMON Bespoke has received tremendous support from clients. By leveraging SmartAdvice, an intelligent investment advisory system, we are able to offer accessible hyper-personalized and scientific wealth management services to the customer.

- AQUMON Bespoke provides a streamlined investment process where clients can place an order simply through the AQUMON app. Enjoy professional services at a lower cost with greater flexibility.

- AQUMON’s portfolios have demonstrated great resilience with lower max. drawdowns in times of volatility. Most of them have outperformed the benchmark.

Case Study

To give you a holistic view of what you can expect for AQUMON’s Bespoke service, here’s a case study to demonstrate the process.

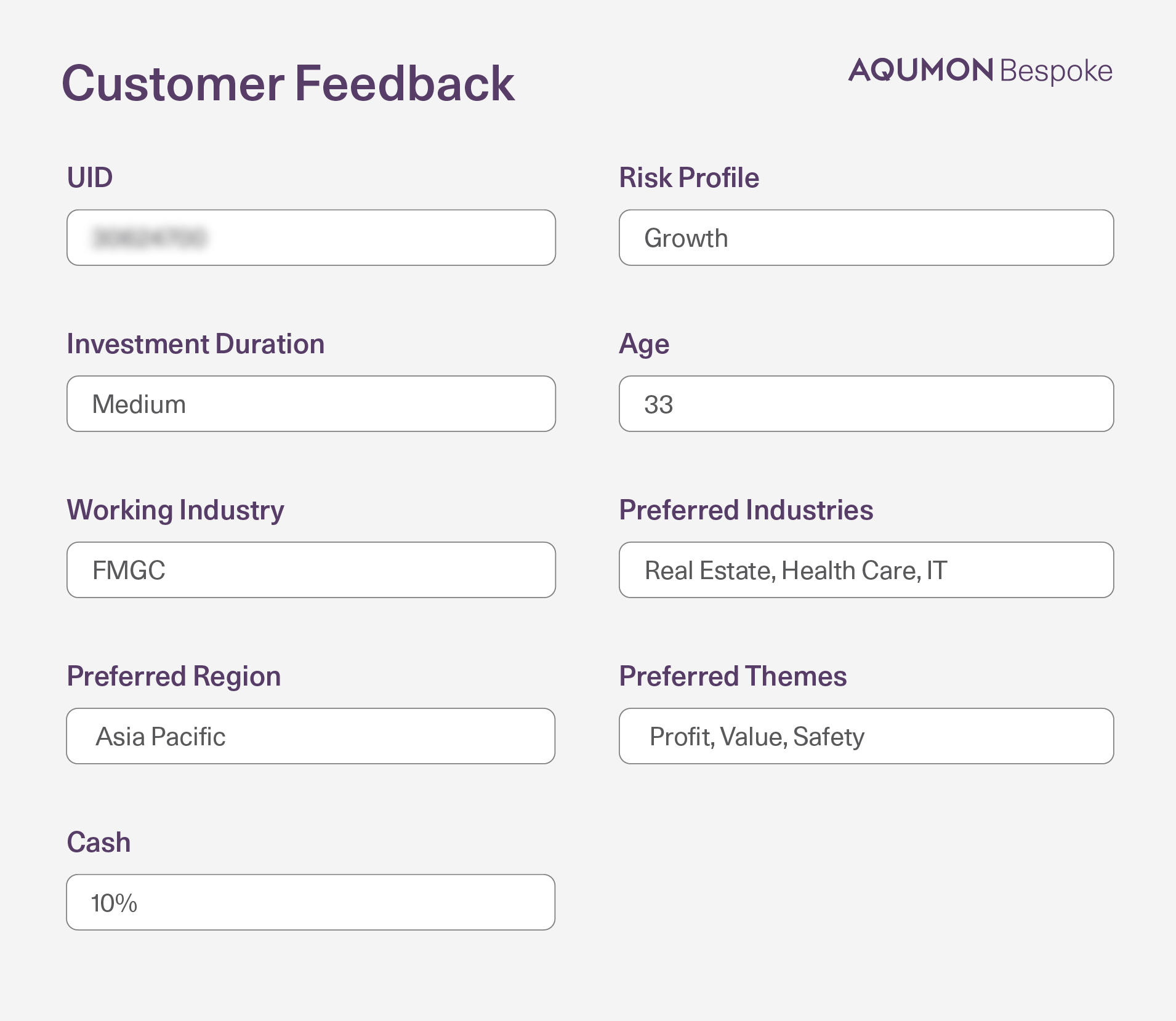

Step 1: Understand your Investment Preference in a Holistic Manner

Upon signing up for AQUMON Bespoke, your dedicated Wealth Manager will arrange a meeting to understand your current holdings, investment preferences and risk profiles, which will help us recommend a systematic and tailored investment plan for you.

Pic: A Free Snapshot of Your Financial Picture

Step 2: Portfolio Analysis and SmartAdvice Recommendations.

After understanding your needs, we will examine further into your current holdings - find out where your plan falls short, and help you optimize it with the main mandate to achieve long-term capital gain. Essentially we will be giving your portfolio a complimentary health check.

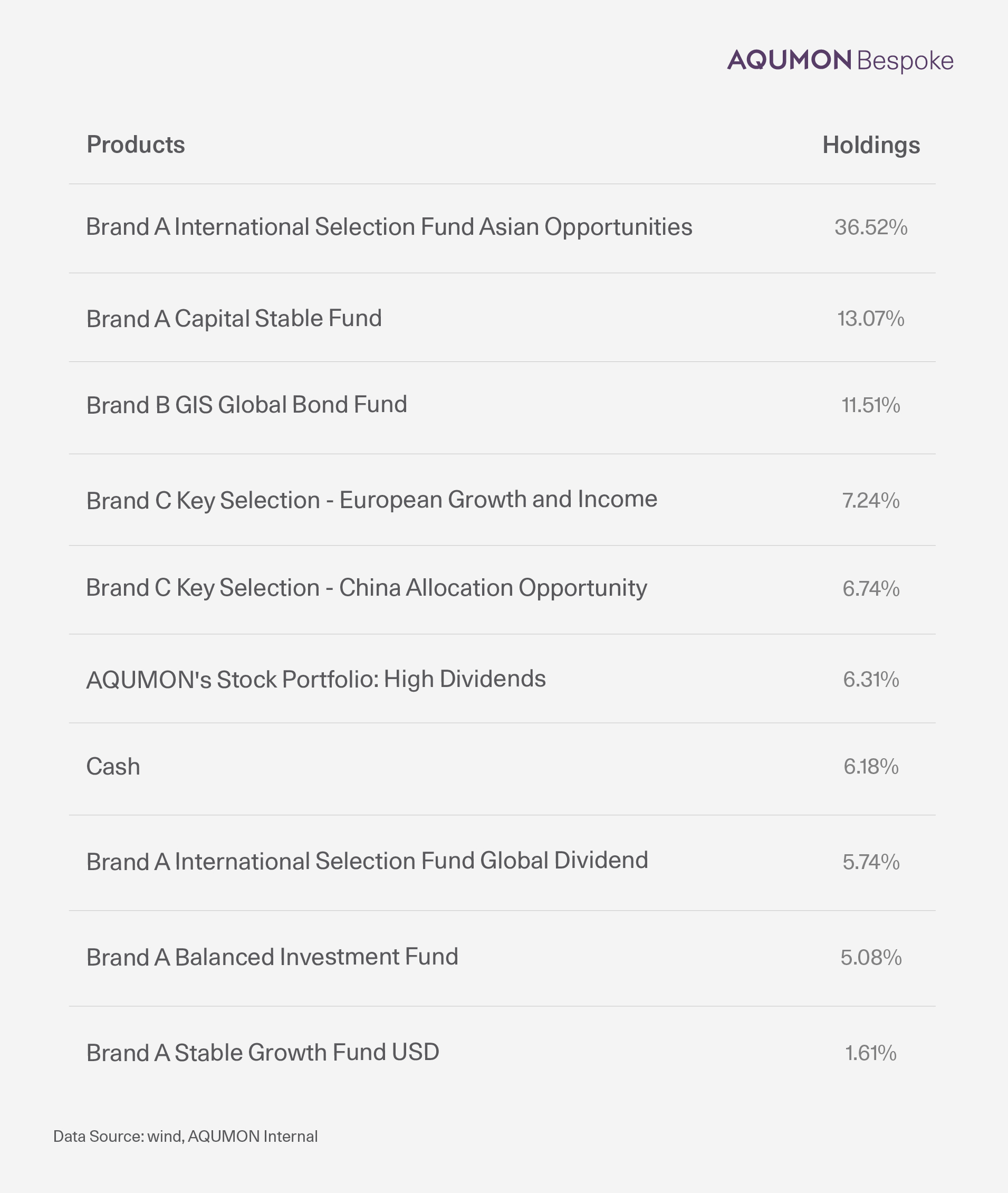

Take one of our Bespoke clients (Mr. A) as an example. Mr. A is close to retirement age. He is a growth investor who seeks for market outperformance with relatively low-medium risk appetite.

Pain Point:

- He invested into multiple products, yet the asset classes were not diversified in a systematic manner.

- His portfolio performance was not doing great, having suffered sustained loss for a period of time.

- His portfolio was skewed towards the Asia Pacific region. He would like to reduce the exposure to hedge against the current regional risk.

Pic: Existing Holdings of a Bespoke Client

AQUMON’s Suggestions on Existing Holdings:

- The allocation on core assets should be increased to protect the portfolio from volatility.

- Regional exposure is not diversified enough with too much equity exposure in APAC. We recommend a systematic approach to diversify into different regions and industries.

- Bond duration is too long, which leads to a poor performance of certain products. Given the rate hikes, the yields from treasury bonds are expected to be lowered.

- Holding too much cash. Weighting should be optimized to seize market opportunities.

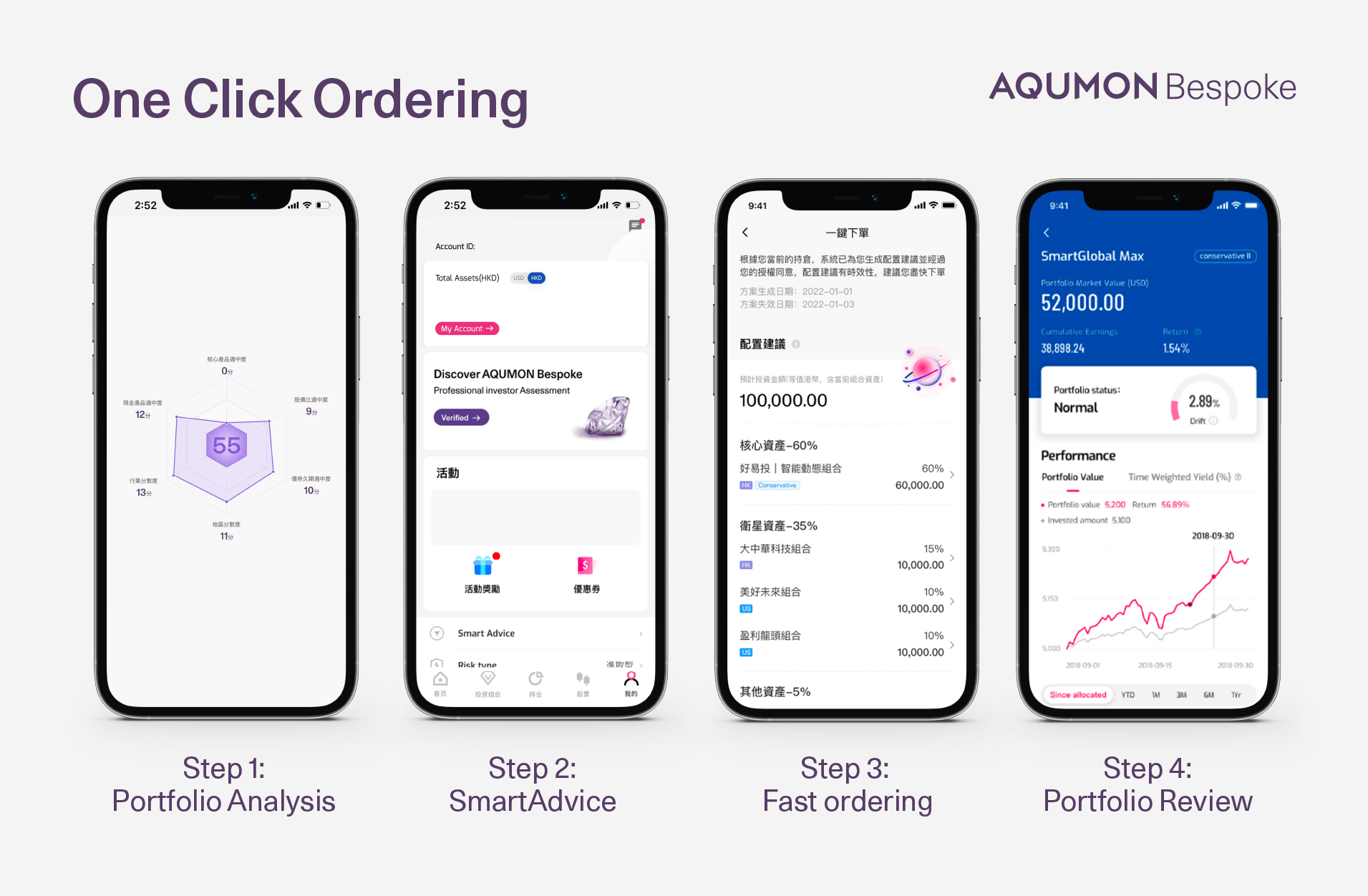

An investment plan with optimal weighting will be generated through our proprietary algorithmic tool, SmartAdvice. If clients are satisfied with the recommendation, they can place the order with a simple click via AQUMON app.

Dive Deeper into the Product Performance

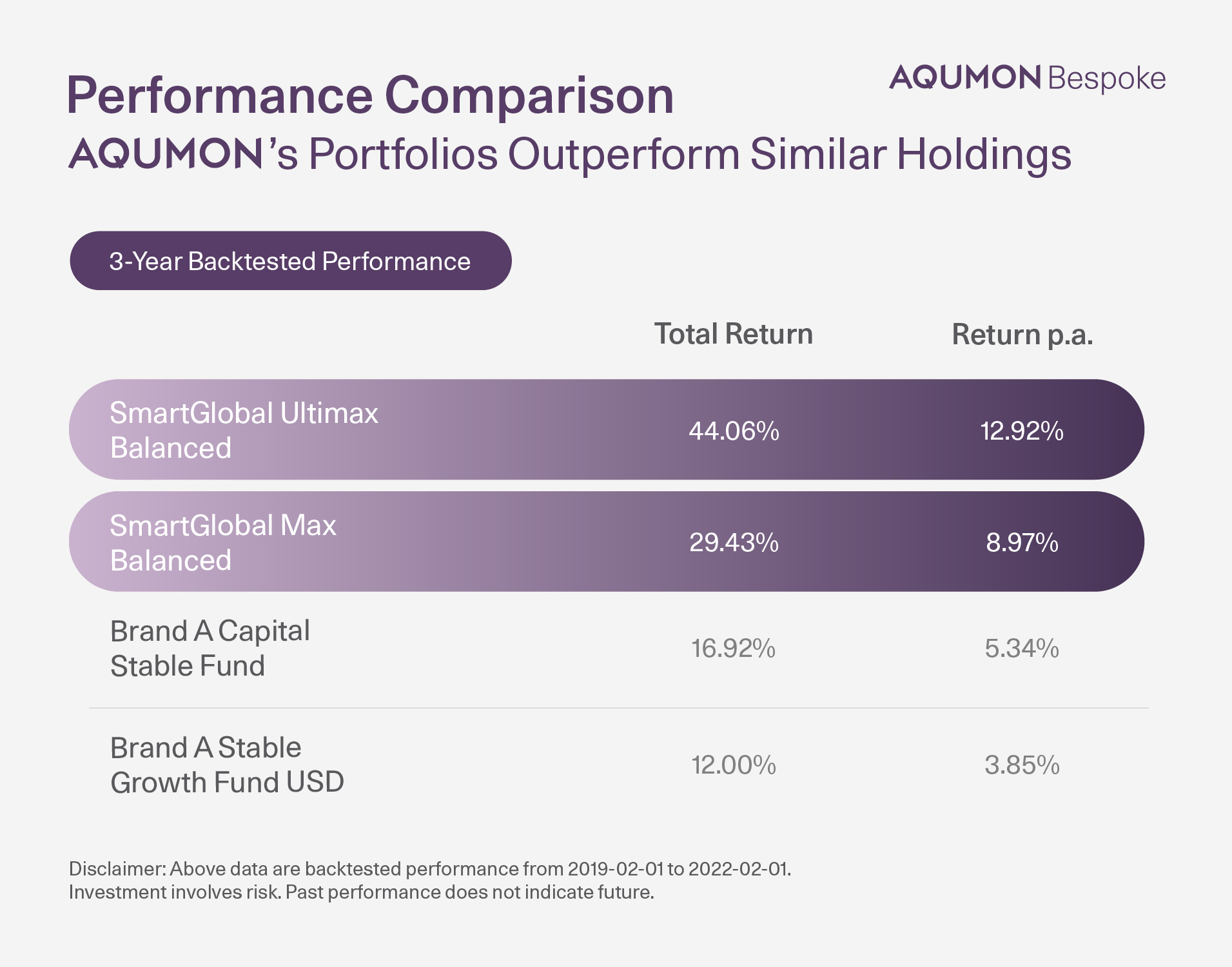

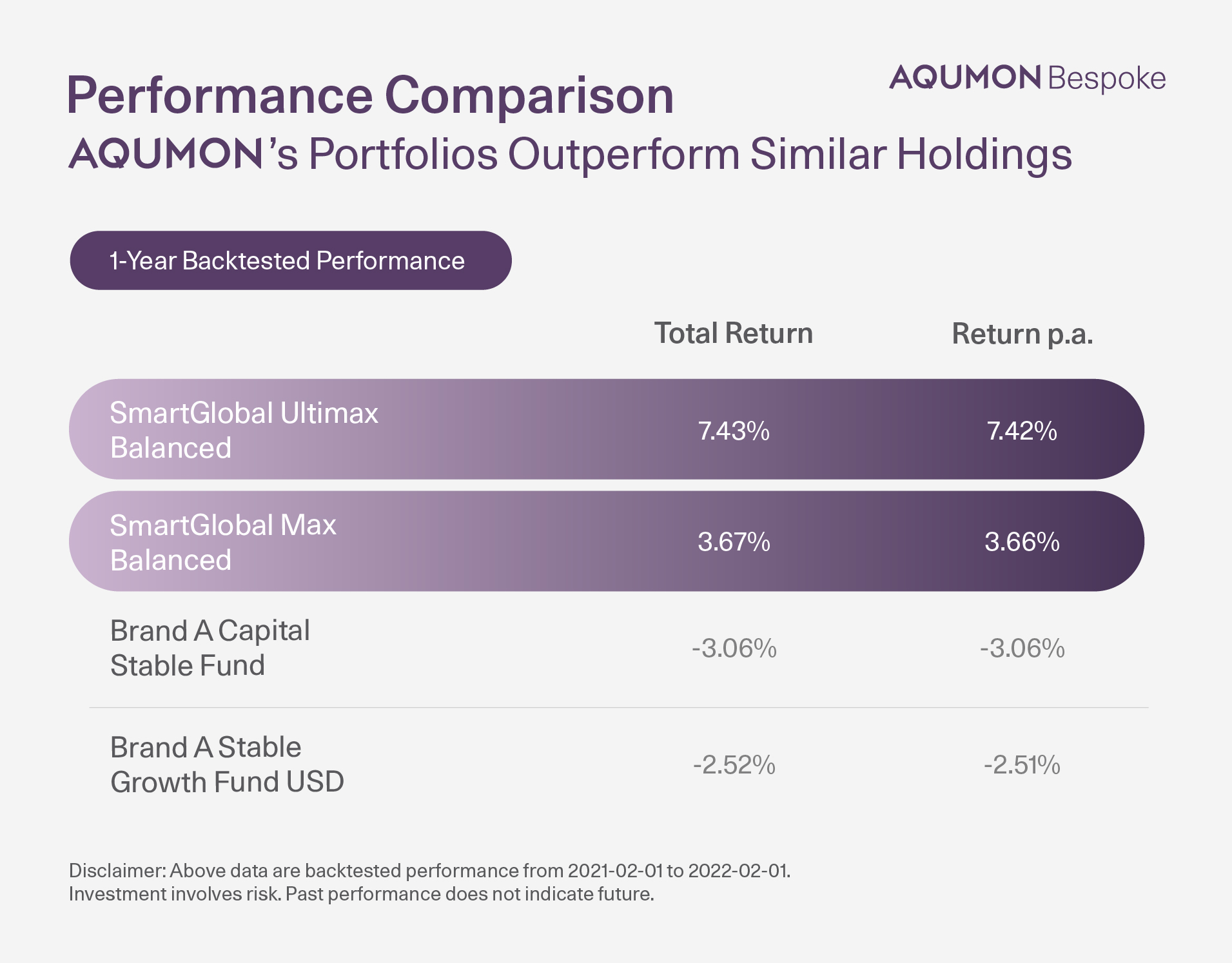

Performance Comparison: AQUMON’s Portfolios Outperform Similar Holdings

One of the pain points for Mr. A is a lackluster portfolio performance. The Bespoke team took a closer look at his current holdings to determine where we could improve performance.

Upon investigation, there were two funds - Brand A Capital Stable Fund (accounts for 13.07% of his current holdings) and Brand A Stable Growth Fund USD (accounts for 1.61%) that are similar to our portfolios - SmartGlobal UltiMax (globally-diversified with hedging) and SmartGlobal Max (invest in US-listed ETFs).

AQUMON’s portfolios have outperformed both funds in terms of 3-year and 1-year backtested performance. One of the main reasons for Mr A’s suboptimal performance hinged on the fact that the U.S. bond funds had a very long maturity period. Given the rate hikes in coming months, the treasury yields are expected to be lower.

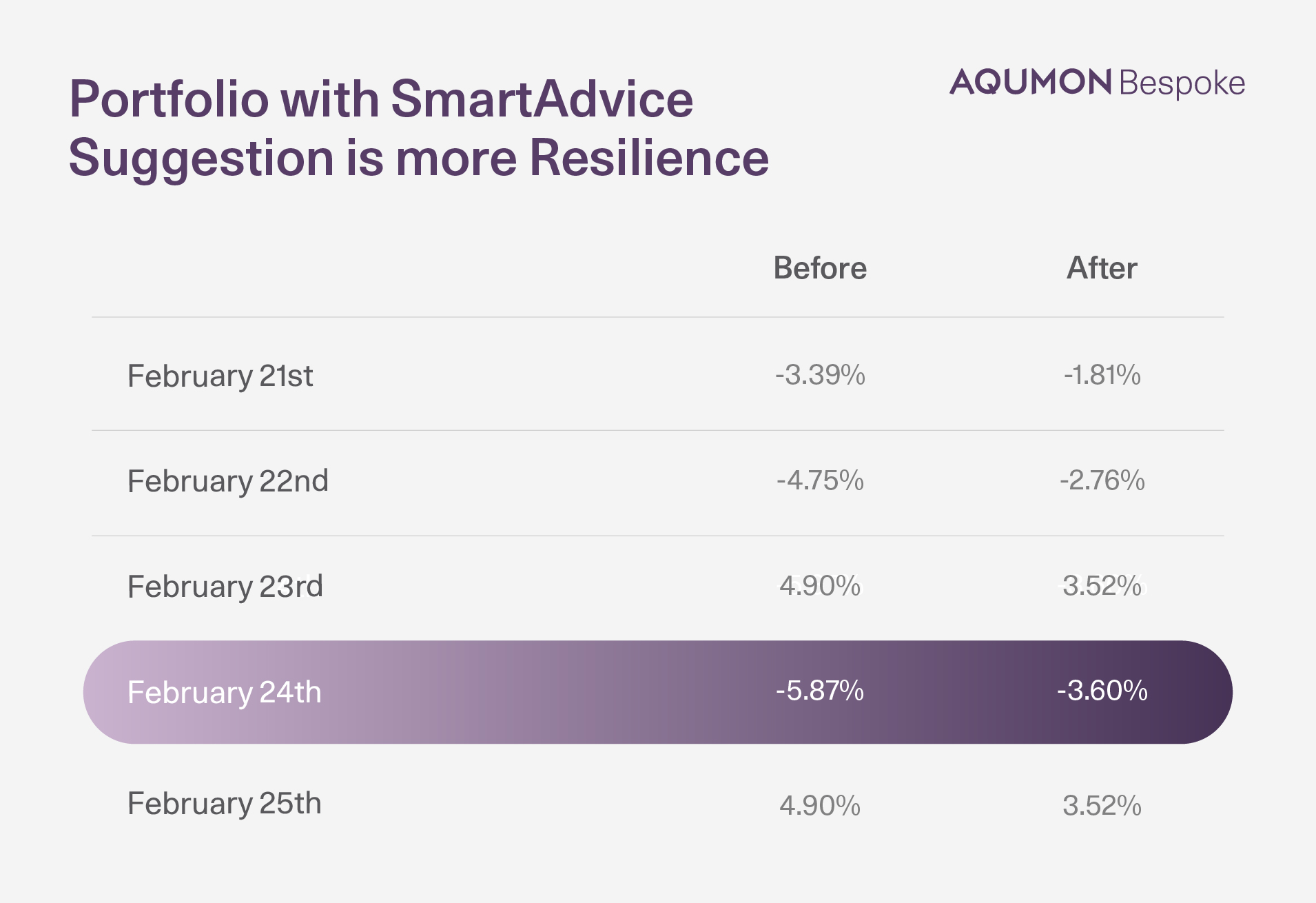

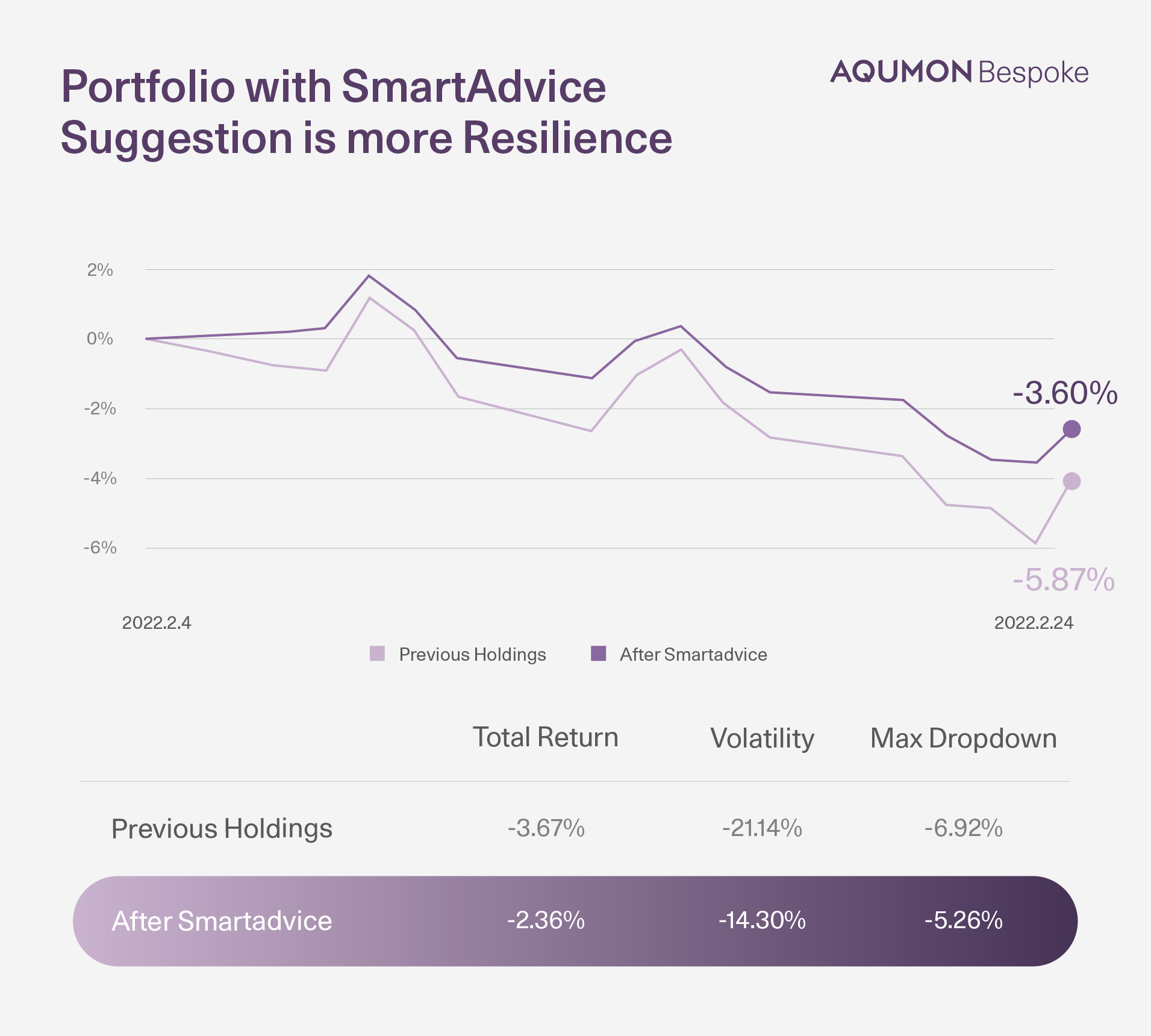

Mitigate Portfolio Risks and Optimize Returns

With the US Fed’s rate hikes, inflation, China government’s crackdown on technology sector, and the Ukraine-Russia war - markets are full of unexpected events and volatility. We all wish to have a crystal ball that guides us to ‘’buy low, sell high’’. Yet, it’s always the opposite in reality. As a result, resilience is another important factor when it comes to constructing a long-term wealth management plan.

Take Mr. A’s portfolio as an example. Our SmartAdvice plan protects him from a daily loss of up to 2.27%. max drawdown to 1.66%. This is made possible thanks to our systematic core-satellite investment approach, which can protect the portfolio from volatility with long-term diversified holdings.

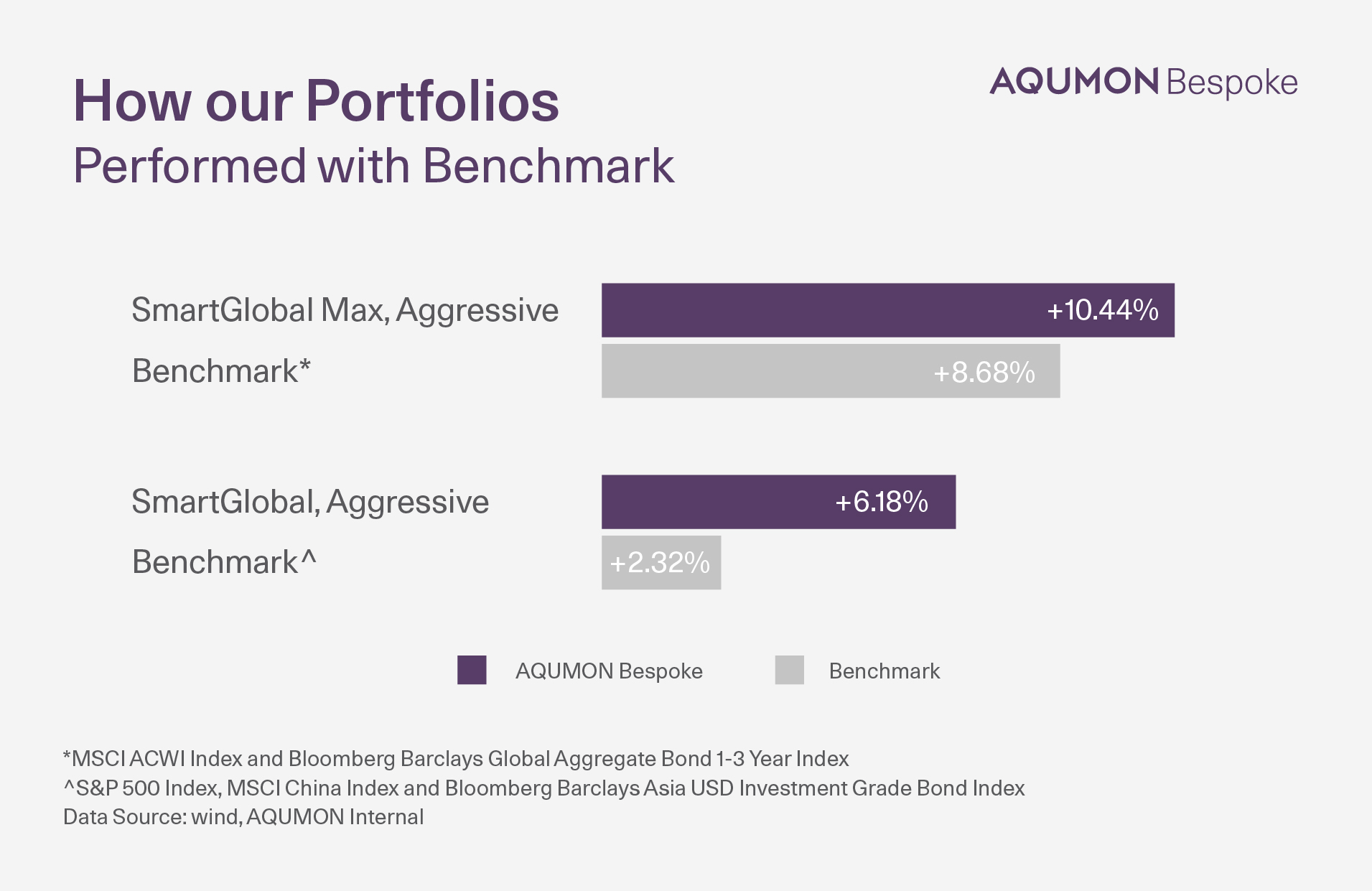

How our Portfolios Performed Against Benchmark

Leveraging on the globally-diversified asset allocation strategy, both our flagship ETF portfolios - SmartGlobal Max (invest into US ETFs) and SmartGlobal (invest in HK ETFs) have an outstanding 3-year annualized returns that has consistently outperformed the benchmark.

Given the strong track record, AQUMON is devoted to helping clients achieve their long-term investment goals.

What Makes AQUMON Bespoke Unique?

AQUMON Bespoke is a hyper-personalized investment service, especially catered to those who want more sophisticated portfolio management capabilities and exclusive 1-to-1 services. After collecting feedback from our Bespoke clients, there are 4 reasons that makes us stand out from our competitors:

1. Scientific and Data-driven

Leveraging on the SmartAdvice system, Bespoke portfolio investment recommendations are generated based on the core-satellite framework and can help achieve long-term capital gains without compromising on the risk control factors. Investment recommendations are scientifically balanced for risk adjusted returns and can help clients make informed decisions with ease.

2. Customer-centric

Investors often face two separate issues when it comes to investments: firstly, they are not sure what to invest into and secondly, how much to allocate to different investments. Bespoke analyzes a clients’ current holdings, investment preferences and risk profile, and then recommends a tailor-made investment plan. Usually the recommendation will factor in allocation for both core and satellite assets to diversify your portfolio in a systematic way.

3. Convenient with Reasonable Advisory Fee

With one simple click, clients can invest in multiple portfolios via the AQUMON app, which saves the hassle of manual ordering and documentation. Investments can be tracked and reviewed at a glance. The only fees incurred are the existing advisory fee within the platform.

4. Low Investment Threshold to do Systematic Asset Allocation

Clients can enjoy scientific asset allocation and professional service on par with established private banks yet at a low investment threshold of only HK$2,000,000, which is 4 times lower than said private banks.

Schedule a Consultation Today

If you are looking for a hyper-personalized, data-driven and professional wealth management service, schedule a free consultation with our Bespoke wealth manager today! Make your wealth grow scientifically.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.