2023 Q3 Market Insights and Porfolio Performance Updates

Written by AQUMON Team on 2023-10-20

2023 Q3 Global Financial Markets Key Highlights

The third quarter of 2023 witnessed significant developments in global financial markets. Here are the key highlights:

In July 2023, the Federal Reserve raised interest rates by a quarter percentage point, bringing the short-term benchmark fed funds rate to 5.25% to 5.50%. This decision reflects the Fed's confidence in the economy's resilience and the potential for robust growth. The current rate level is the highest in 22 years.

U.S. stocks consolidated in Q3, with the S&P 500 declining by 3.65% after a strong start to the year. The market has become increasingly concentrated in large companies, primarily driven by the impressive performance of tech giants. At the end of the quarter, the top 10 stocks in the S&P 500 accounted for approximately 32% of the index.

Amidst uncertainty in China's property market and growth prospects, both Hong Kong's Hang Seng Index and China's stock market faced significant challenges in Q3 2023. Hong Kong's Hang Seng Index closed in bear territory, down 11.59% year-to-date and a drop of over 20% from the highs recorded in January. China's stock market struggled, particularly in the property sector, as investors awaited clarity on potential stimulus measures.

How Did AQUMON's Portfolios Perform?

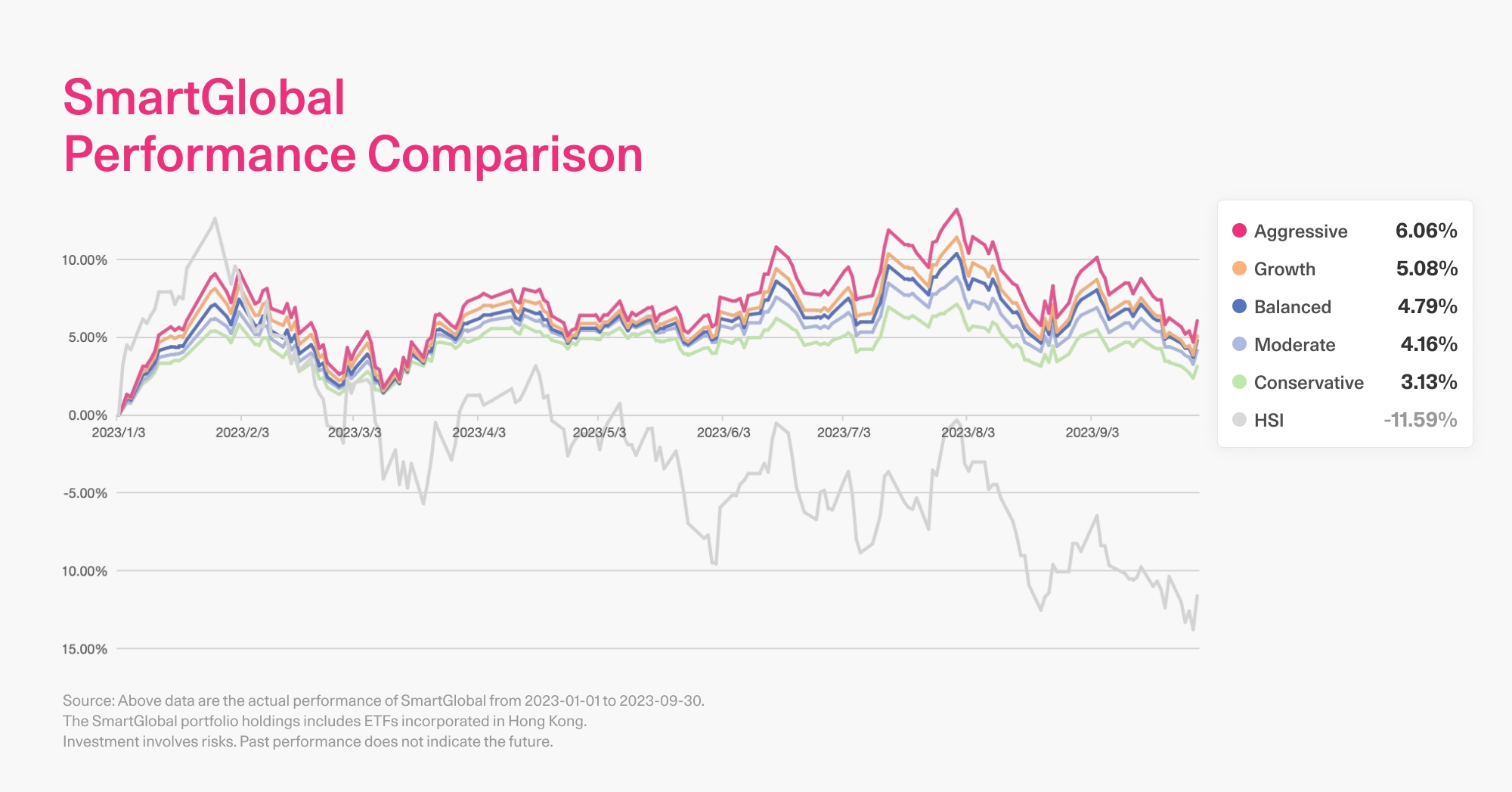

Despite challenging conditions in the Hong Kong stock market, AQUMON's SmartGlobal flagship portfolio continues to achieve impressive gains. Regardless of the chosen risk levels, all portfolios consistently outperform the Hang Seng Index, demonstrating exceptional performance. A closer look at the year-to-date return comparison highlights the resilience and success of AQUMON's investment strategies in navigating market uncertainties.

AQUMON also offers theme portfolios like "Global Tech Giants," concentrating on innovative tech companies, allowing you to seize the opportunities presented by the AI trend and optimize your potential returns.

Q4 market outlook: Will there be a stock market rebound?

While higher interest rates may initially impact US stocks negatively, there are optimistic factors to consider as we approach year-end. These include favorable seasonality, improving core inflation, and the potential for a rebound driven by bearish sentiment. Historical patterns suggest decreased volatility and stronger performance in the final months of the year. The fourth quarter has historically been positive for stocks, with October potentially experiencing some volatility but overall generating positive returns.

The US market data also suggests limited downward potential. The U.S. Dollar Index (DXY) has rebounded from 100 since July 19, 2023, reaching 106.42. A stronger U.S. dollar can benefit domestic industries, attract foreign investors, provide a safe-haven status, and encourage capital flows.

Hong Kong and Chinese stocks face a challenging fourth quarter due to a gloomy economic outlook and ongoing troubles in the property market. Analysts see little hope for a stimulus to spark a market rally. Despite better-than-expected economic data in August, buying interest remained muted. The trading suspension of China Evergrande Group and uncertainties surrounding its founder further weigh on stocks.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximize their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.