Grow Money Outside of Your Savings Account II

Written by Marcus on 2019-03-04

In the last article, we discussed the close relationship between short-term investments and people’s financial plans. Sufficient liquidity and higher-yield investment products are both important for individuals when making decisions on short-term investments.

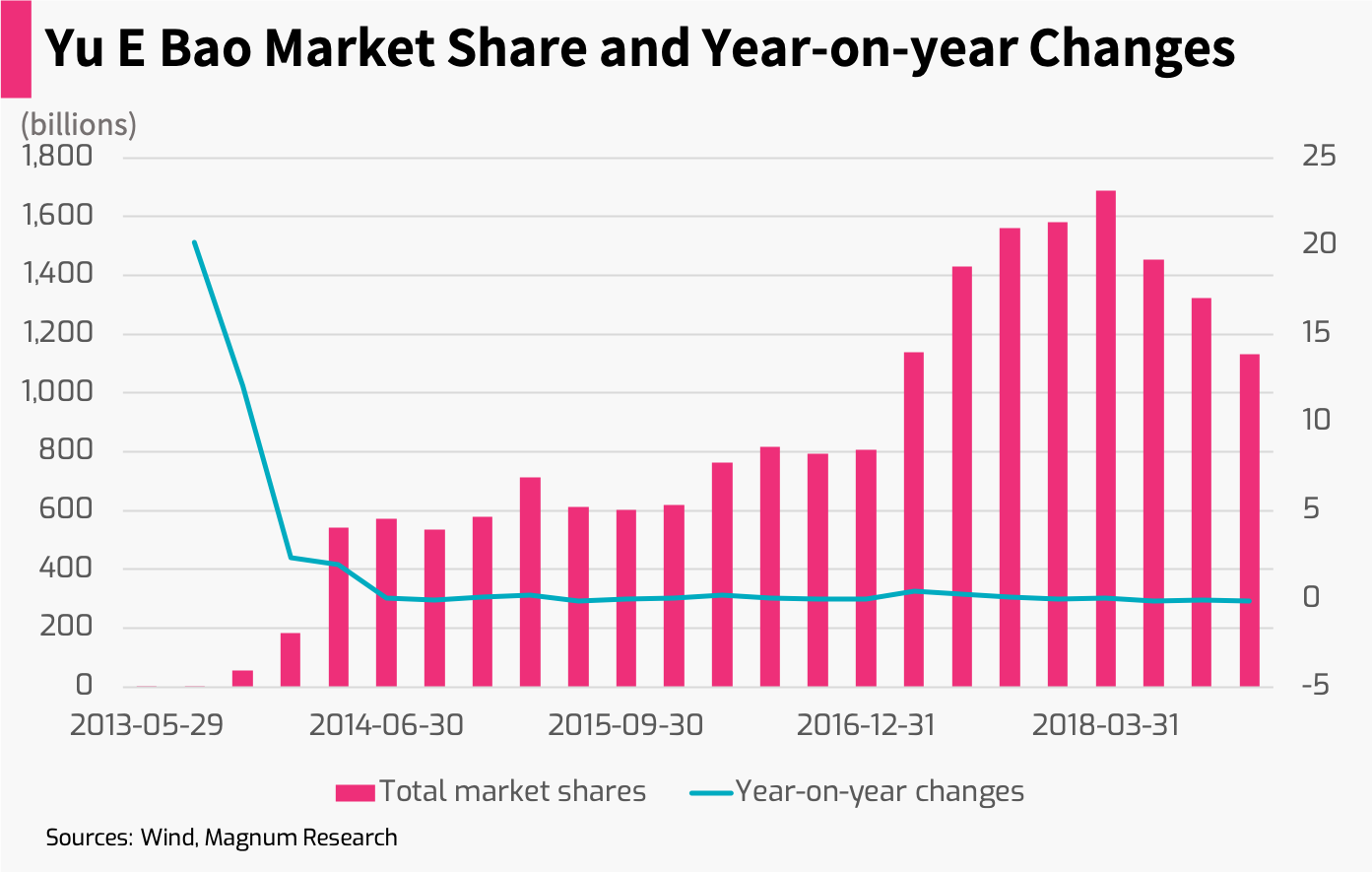

At the same time, we also mentioned about the money market fund represented by Yu E Bao. Nowadays, Yu E Bao is no longer a leader of Tianhong Fund, due to the reason that the money market fund is affected by interest rate changes.

With lower market interest rates, the funds liquidity will be more higher. At this moment, short-term assets such as interbank deposit certificates or deposit prices will fall, so as the yield of money market funds.

Short-term Bonds - Investment "Stabilizers"

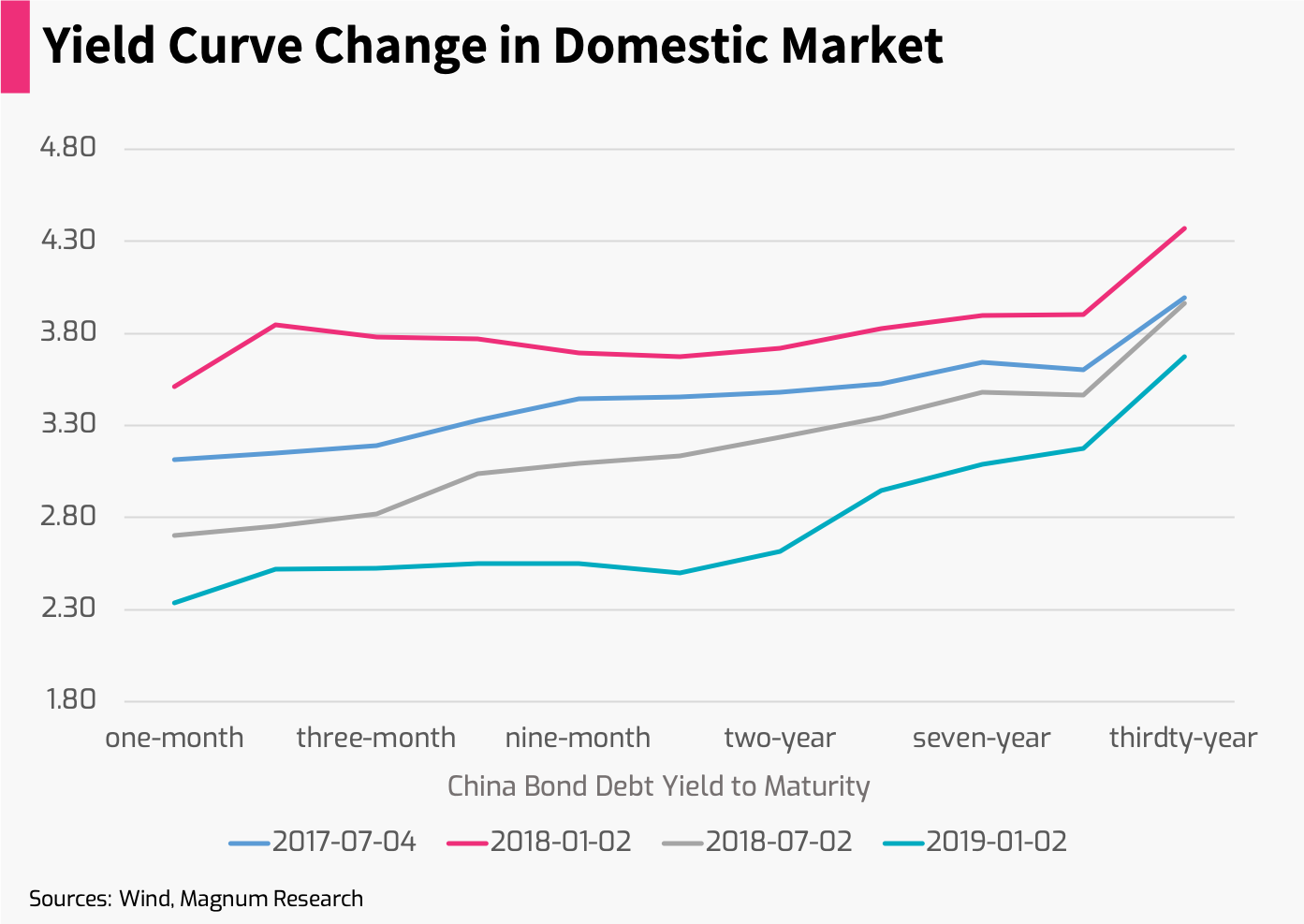

After the economic downturn in 2018, the central bank has fully guaranteed the liquidity of the market, while results in a declining money market fund yield.

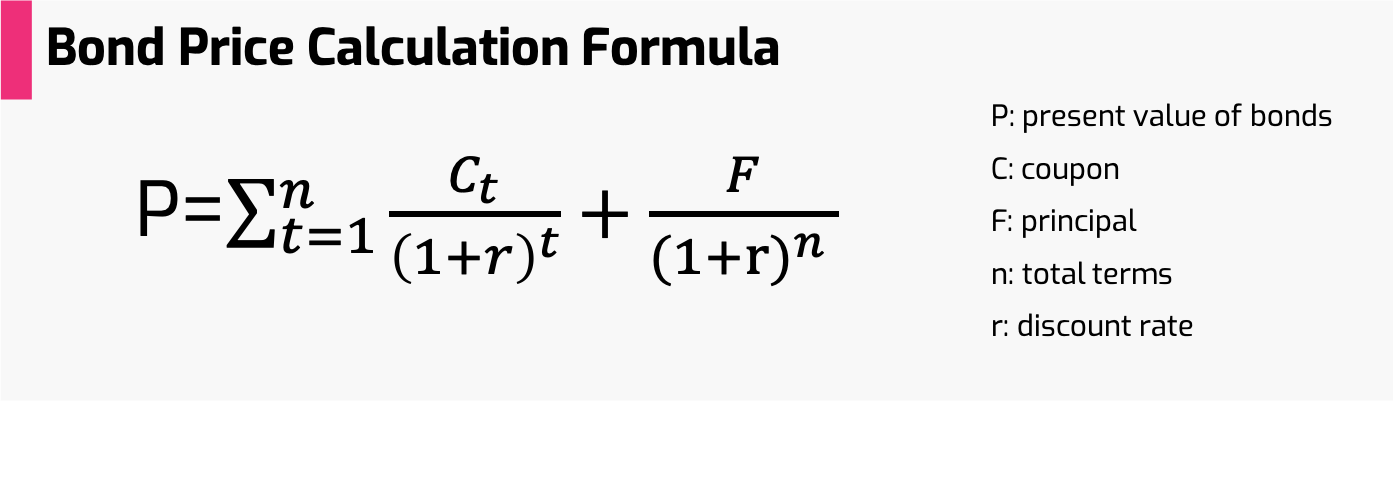

As can be seen from the formula below, the price of bonds is inversely related to interest rates. When interest rates fall, the price of bonds tends to rise.

For individual investor, bond fund is a good investment choice.

For individual investor, bond fund is a good investment choice.

Short-term investments are designed to ensure adequate liquidity and lower risks for people.

Here, we will discuss short-term bond funds.

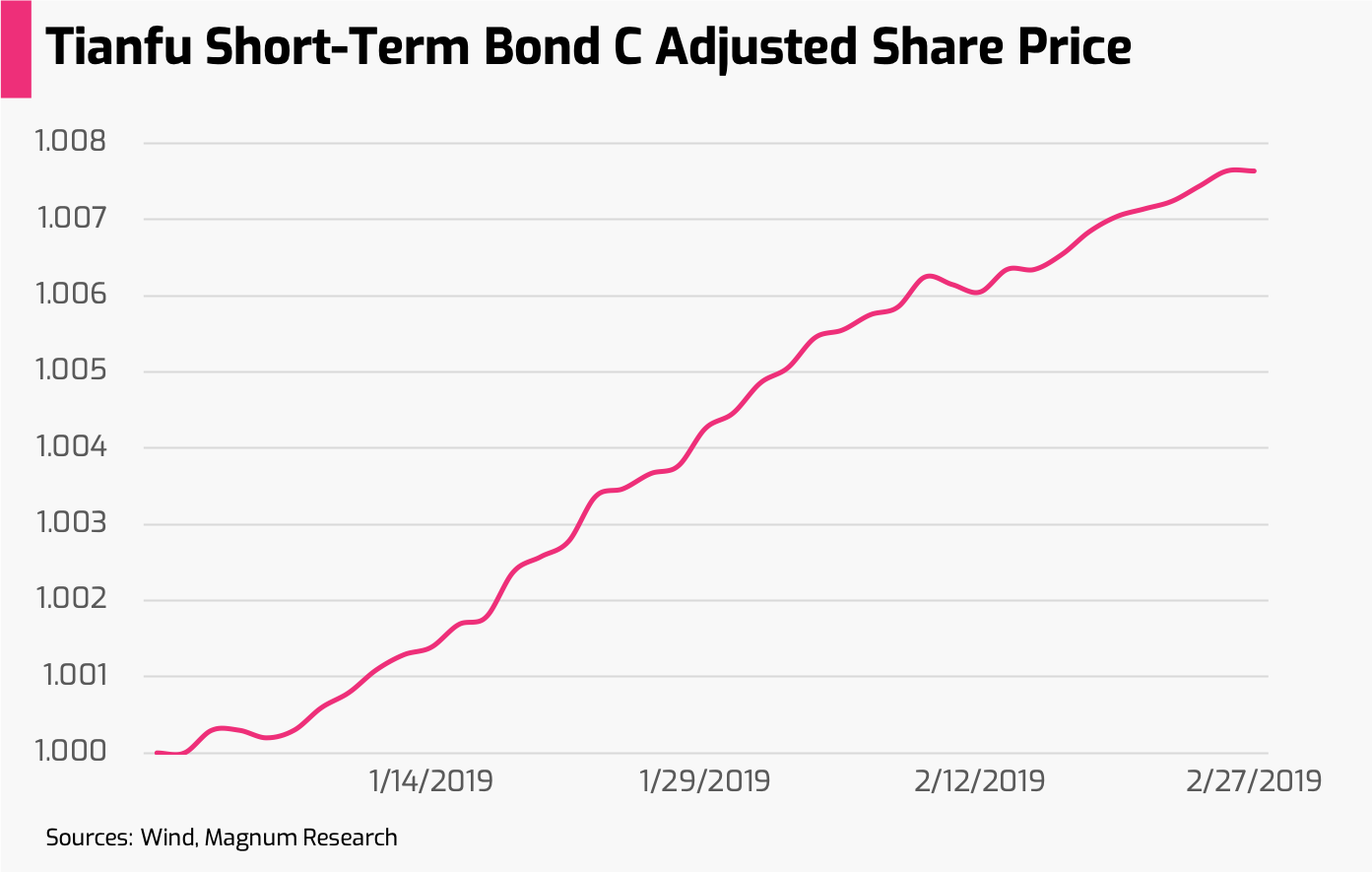

Huitianfu Fund, one of the China's well-known short-term pure debt fund- Tianfu Short-term Bond C (006647), mainly composits of government bonds, central bank bills, corporate bonds, medium-term notes, short-term financing bills, and ultra-short-term financing bills.

From the above figure, we can see that the portfolio has achieved a return of 0.94% since it was listed on December 13 last year. The annualized rate of return reached 4.93%, far exceeding the annual growth rate of 2.5% of the money market fund.

Short-term Bond Holding Costs

However, when investing in short-term bonds, you will find that the net profits are still much less than expected, since purchasing fund includes corresponding management fee.

So is there a short-term investment tool will achieve satisfactory return while provide a lower management fee?

In fact, the ETF whose underlying assets are short-term or ultra-short-term bonds can offer investors such a choice.

Lower Cost and Better Returns - Short-term Debt ETF

ETF, exchange-traded fund, is an open-end fund with a variable fund share listed and traded on the exchange market.

The index ETF represents the ownership of stocks or bonds. It refers to an index fund that trades on stock exchanges like stocks. The trading price and the net value of fund shares are basically consistent with the index being tracked. Therefore, an investor buying or selling an ETF is equivalent to buying and selling the index it tracks, and can obtain substantially the same benefits as the index.

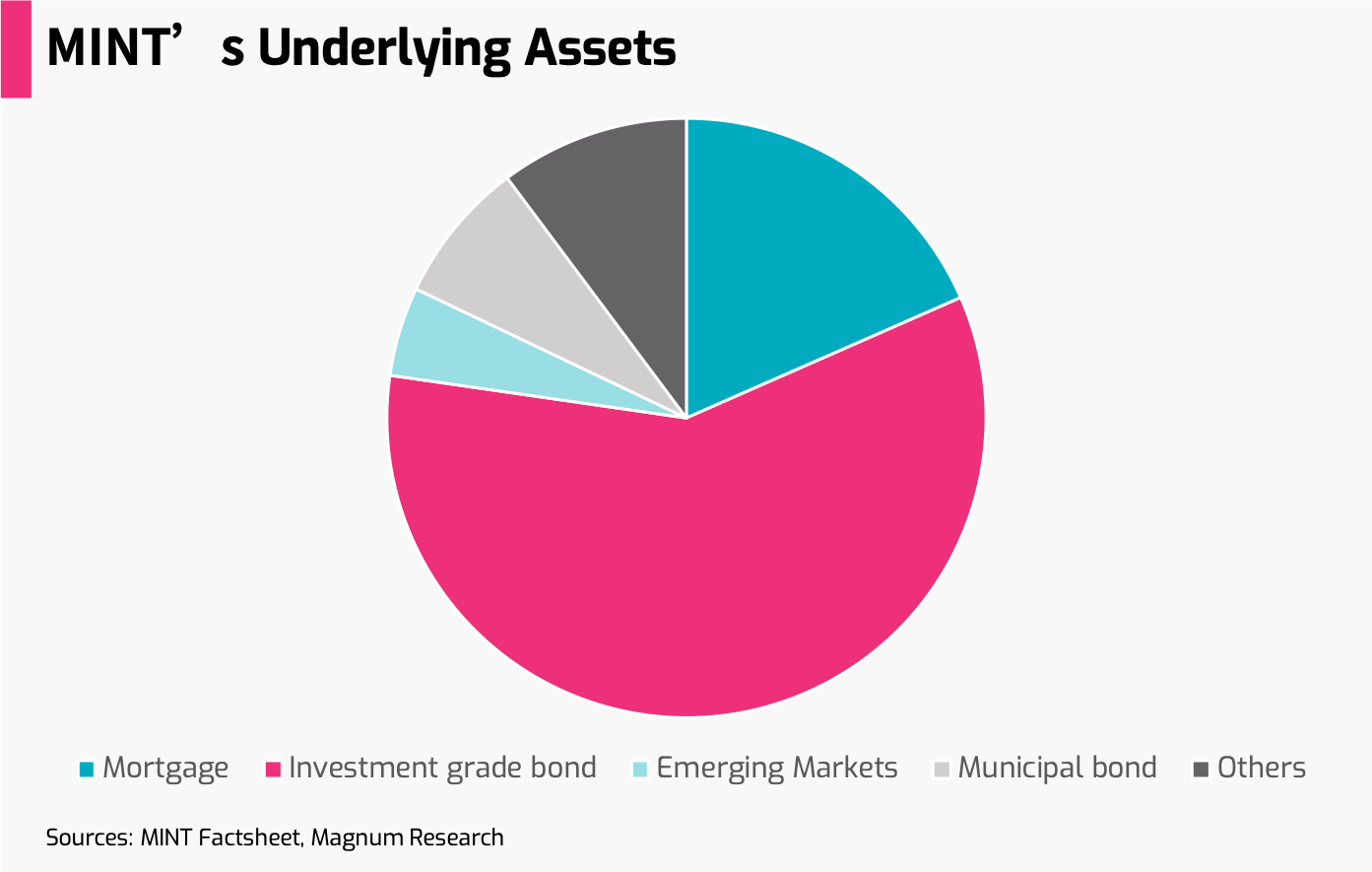

When the underlying assets of the ETFs are short-term or ultra-short-term bonds, the investment effect can be achieved with high liquidity and low rates. We take PIMCO's enhanced short-term ETF (MINT) as an example. The ETF investment is allocated in a high-liquidity, low-risk market with an effective duration of 0.29 years.

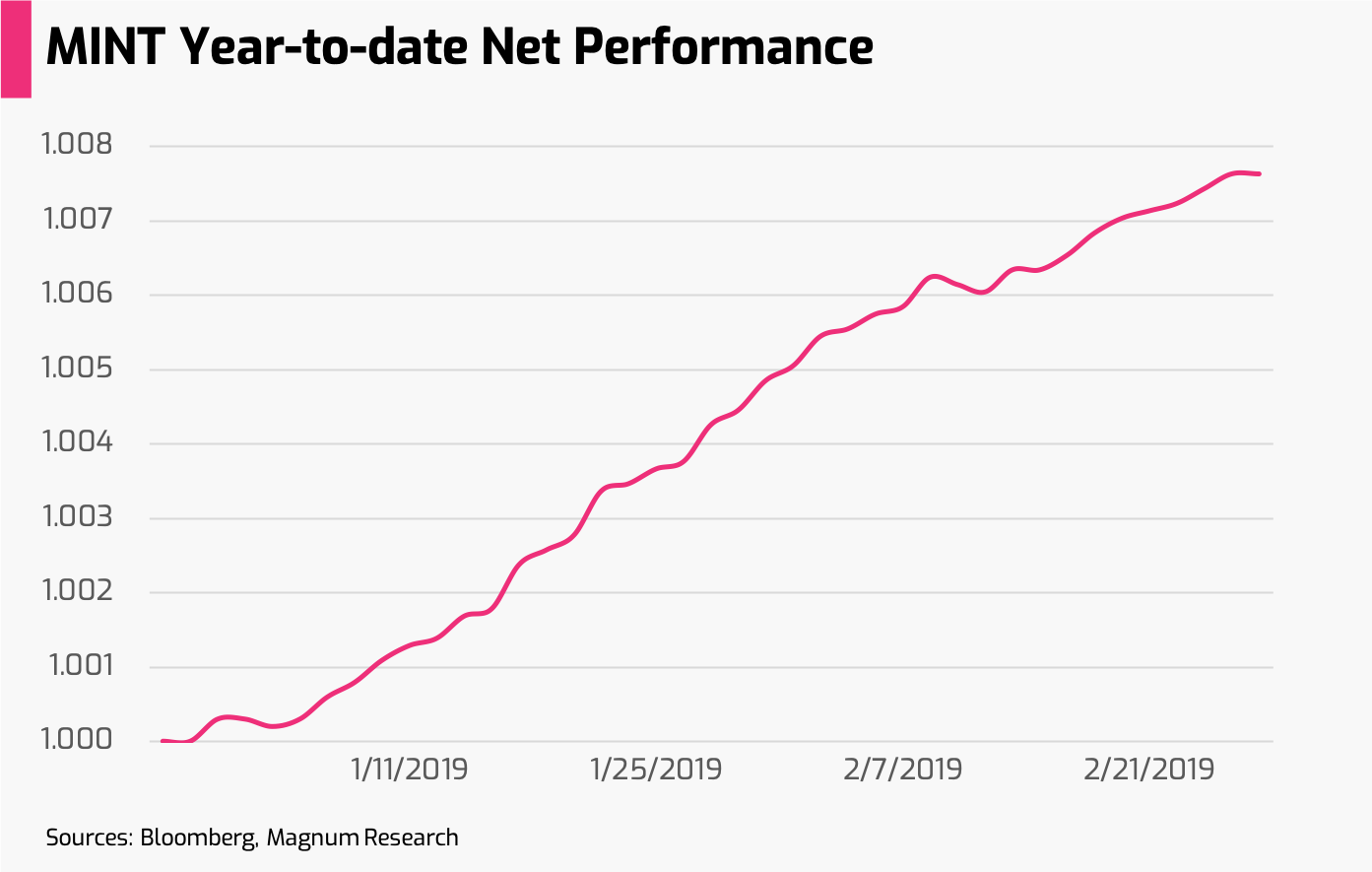

It can be seen that MINT is completely an asset that meets our ideal short-term investment demands, and the ETF has a rate of 0.42%, which is only half of the short-term pure debt fund. From the perspective of profitability, the short-term bond ETF represented by MINT has gained 0.76% year-to-date return, equivalent to an annualized rate of return of about 4.9%.

Compared with the short-term bond funds mentioned above, although short-term bond ETFs have a higher threshold, they have a lower management fees, thus creating more excess returns for investors.

Conclusions

Short-term or ultra-short-term bond ETFs are currently the best short-term investment tools, but what ETFs investors should buy and how to allocate to achieve a steady and satisfactory return, is still a complicated financial problem.

In response to this situation, AQUMON developed a short-term investment tool——SmartDeposit, for individual investors using a bond ETF as the underlying asset. SmartDeposit will provide investors a lower investment threshold, lower risks, higher liquidity and a comparable return as the money funds do.

For individual investors with short-term investment needs, the SmartDeposit will be on board in the near future, so please stay tuned with us!

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.