What Can We Learn From Expert Gamblers

Written by Vanessa & Ria on 2019-06-20

Some people say that investing is like gambling. Both have the purpose of “using money to make more money”.

This is certainly not completely true. But investors and gamblers do have some things in common:

1. There is no absolute guarantee of return for either gambling or investing.

2. Investors and gamblers will both pay attention to different probabilities to get the result they want.

3. In certain situations, like poker, gamblers also need to study the behavior of their opponents in order to make decisions.

No matter how random the scene changes, there are always people who can become the myth of the game.

In his TED talk, British psychologist and author Dylan Evans analyzed how expert gamblers are able to outperform novices.

In this article, we will summarize some highlights of Evans’ speech, and we encourage everyone to watch the original video: What Can We Learn From Expert Gamblers?

Types of Gamblers

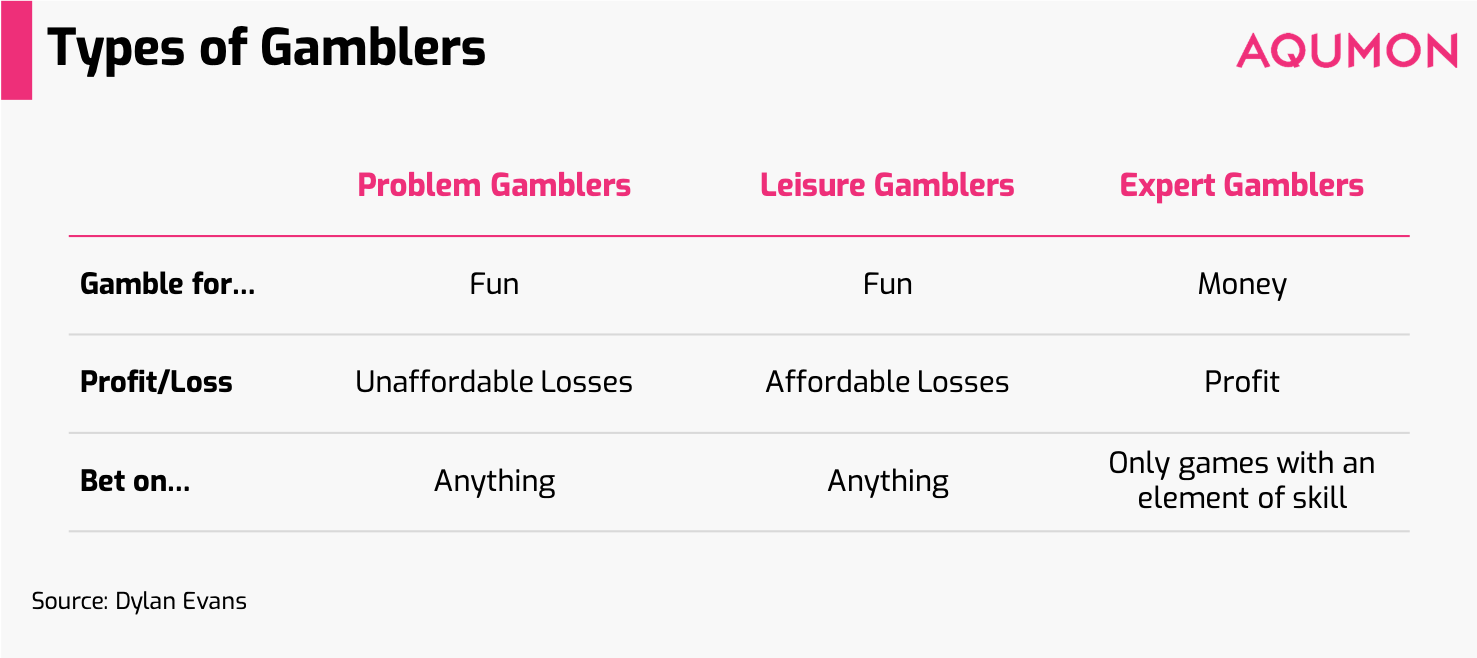

We can categorize gamblers into three groups: problem gamblers, leisure gamblers and expert gamblers.

This table explains the differences among these three groups:

◇ Problem gamblers make big bets on anything, which eventually leads to unaffordable losses

◇ Leisure gamblers wouldn’t bet an unaffordable amount, because they just gamble for fun

◇ However, expert gamblers would only bet on games that require an element of skill, so they can profit from gambling

Expert gamblers can be further categorized into: the poker players, the blackjack players and the sports betters.

On these games that actually require certain skill sets, the expert gamblers can often outperform novices.

Natural Born Mathematicians?

American psychologists Stephen Ceci and Jeffrey Liker visited a horse racing venue in Delaware in the 1980s and interviewed 30 avid racetrack patrons. During the week, these people would go to the racetrack every single day.

They found out that 14 of them were exceptionally good at forecasting the odds of winning that would be offered on each horse just prior to the race, while the other 16 were no different from the average punter.

The most scientific way of forecasting the horses’ odds of winning is building a linear regression model with seven variables associated with their past performance (like its average speed, average end position, etc.).

However, these ‘expert’ gamblers knew nothing about linear regression and have never studied statistical modeling. They unconsciously completed the calculations in their head based on the information that they consciously collected.

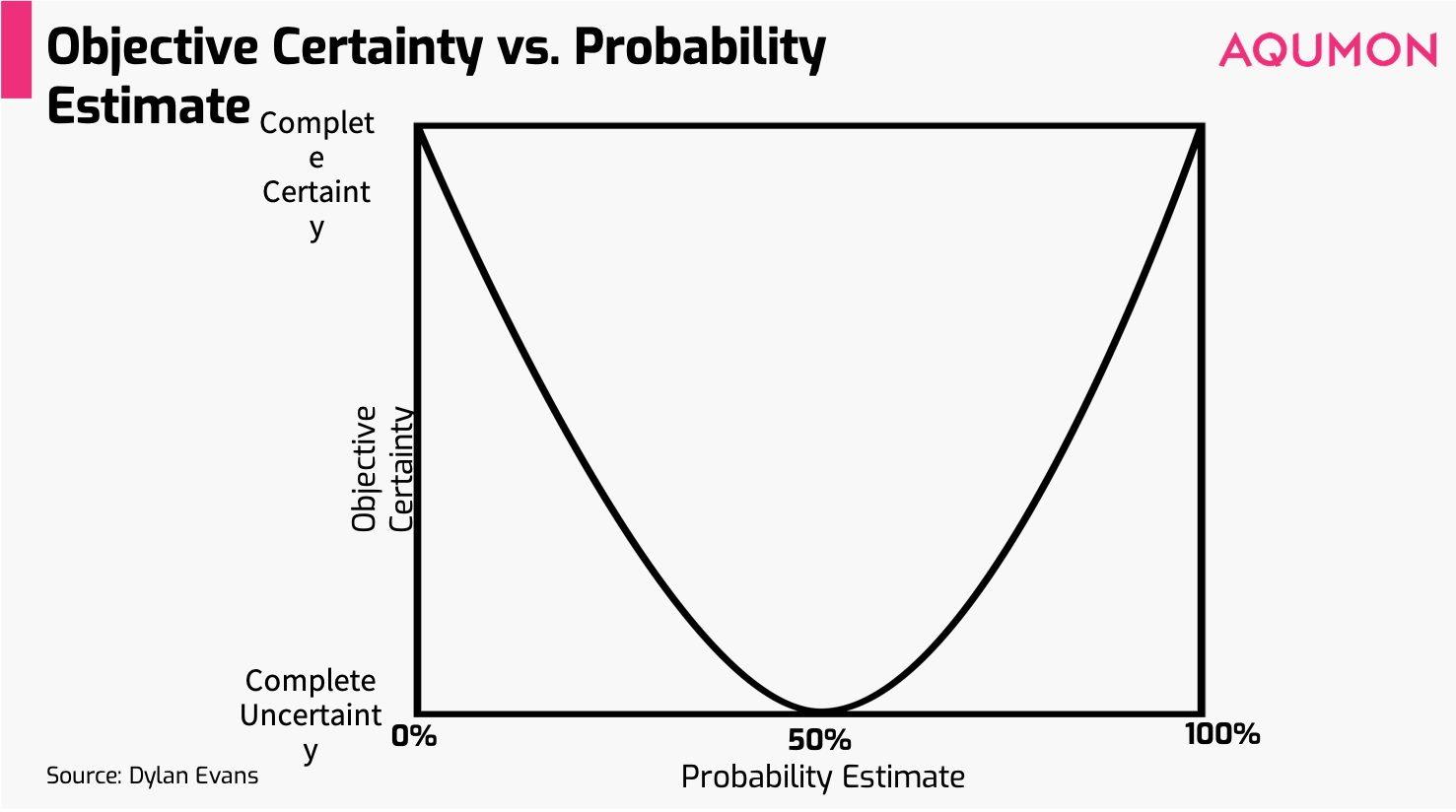

This ability to gather information from a wide variety of sources and eventually come up with a probability estimate is the concept of risk intelligence.

Three Ways of Using Probability to Make Decisions:

So how can this concept of “risk intelligence” help us make better decisions.

We know that it is not difficult to make decisions if the information given is certain, but we rarely study how to make decisions based on uncertain information.

For example, if someone tells you that it will rain tomorrow, you’ll easily decide to bring an umbrella with you. But if someone told you that there is a 60% chance of rain, would you start to

Professor Dylan Evans proposed three simple ways to use probabilities to help us make decisions:

1) Set a threshold

For example, you can say if there is a 70% chance of rain, I will bring an umbrella. The advantage of this approach is that everyone can set different thresholds.

For example, some people can say that they would only bring an umbrella if there is a 90% chance of rain.

The size of the threshold here refers to your ability to bear the risk of rain.

2) Bet size

In short, the more confident you are, the more you’ll bet, so your bet size is proportional to your confidence.

For example, you can decide to buy more or less of a company’s stock depending on how much you think that company is going to do well.

But the crucial part is having an appropriate degree of confidence. We might need to know more data, or even build a mathematical model to help us make a decision.

3) Expected value

People tend to bet all the have when they know it’s the last horse race or the last dice roll. Professional gamblers, however, will look at gambling in a longer horizon, which is measured by the concept of long-term average.

The expected value does not refer to any actual profit or loss. It is the average amount that you would win or lose if you place the same bet infinite amount of times.

This is a concept that is important for professional gamblers. Instead of looking at the maximum amount they could win or lose, they focus on what the average amount that they could win or lose per bet, that is the probability of each possible outcome multiplied by the sum of the values of each outcome.

According to the speaker Dylan Evans, his friend once said to him: "I don't have to bet my entire bankroll on this throw of the die or this horse race. I can always come back tomorrow."

The same is true for investment. Investors who put all their savings on one stock or one investment product are often eventually locked up and suffer a great loss.

Looking at investment in the long-term perspective will not only allow investors to be more rational, but also bring greater returns.

Conclusion

Of course, we have countless reasons to convince ourselves that in the investment market, the rules are more complicated than in the casinos, and this method may not be applicable.

But let’s take a look at the simple three-step formula to investing, shared by the legendary investor and the founder of Bridgewater --- Ray Dalios.

1) Decide How Much You Can Sock Away

Use the “risk quotient” to judge how much money you can save for investing in risky products.

2) Create a Diversified Portfolio

Don't block everything on a note, their combined long-term value is our ultimate benefit.

3) Learning the Market’s Long-Term Cycles

Increase the amount of your investment when you have great confidence in the market in the long-run. There is less variability in gambling, if you’re able to overcome the weakness of humanity, adhere to your principles and guard your bottom line, you can become an expert too.

However, in the stock market, there is a great difference in the investors’ ability to collect information and process them. This determines that the capital market is inherently unfair.

For ordinary people who want to start investing, these advice are already instructive.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.