SmartGlobal® (US ETF) 2019 Semi-Annual Investment Return Report

Written by AQUMON Team on 2019-07-04

Market Overview:

Halfway through 2019, the global financial markets have had lots of fluctuations during the past six months.

The market bounced in the beginning of 2019 amidst pessimism. The CSI 300 Index even recorded a gain of more than 30% within the first four months this year.

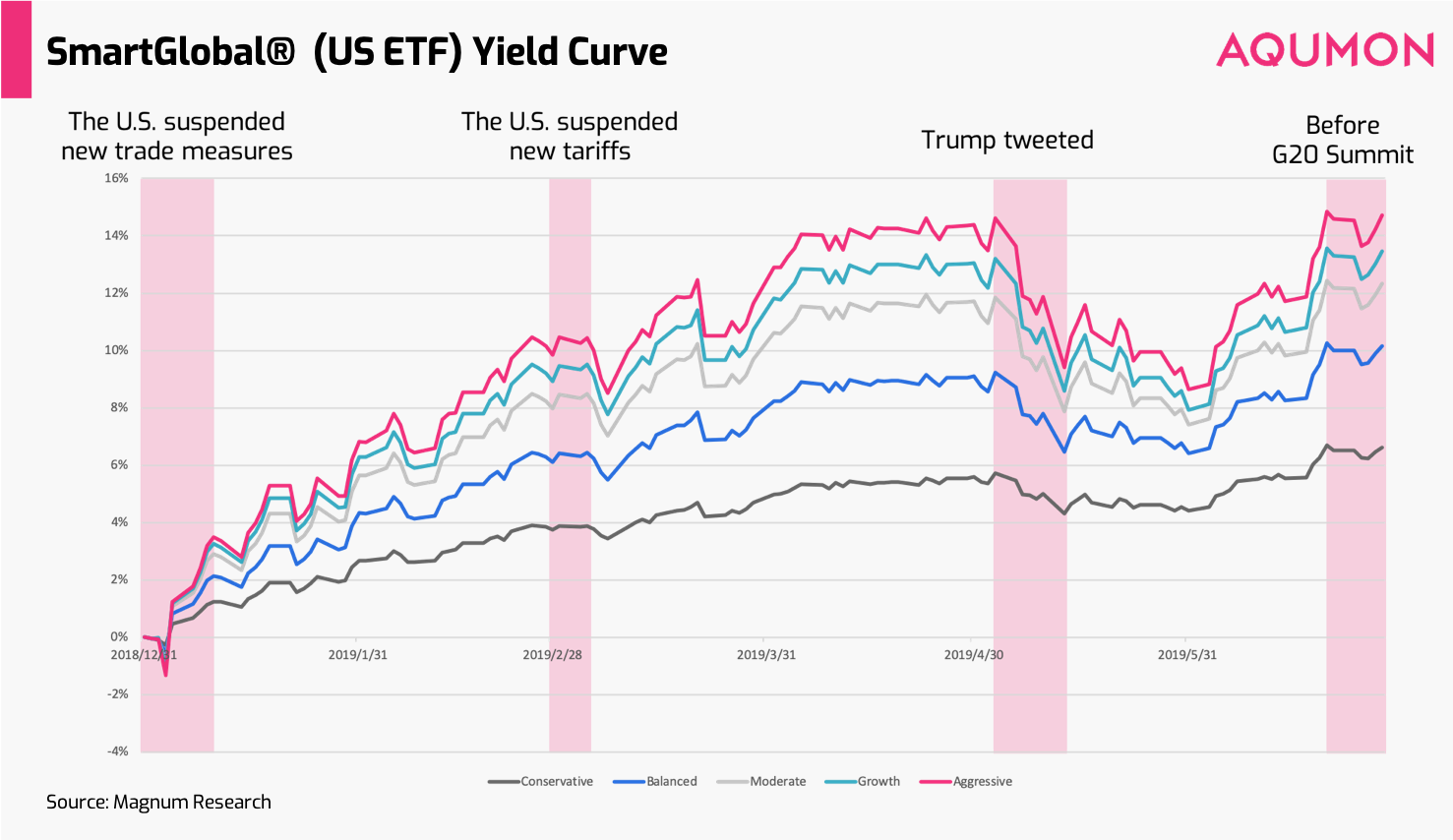

In March 2019, global economic growth started to slow down. At the beginning of the month, the United States announced significant progress on the trade war and extended the time limit for suspending new trade measures. In addition, US economic data and labor market fell short of expectations, and global economic growth is expected to continue to decrease.

Later in May, Trump once again threatened to raise tariffs against China. The tariffs on billions of Chinese goods increased from 10% to 25%. The market panicked, and the VIX index soared to 20.5.

Entering June, the market continued to experience shocks due to uncertainty. The Fed’s interest rate decision did not change, and the situation in the Middle East became increasingly tense, but the market gradually warmed up.

At the G20 summit at the end of June, China and the U.S. restarted trade negotiations, and the US decided not to impose new tariffs on Chinese imports. The trade war tension, which began in December 2018, has been alleviated as China and the United States agreed to hold a 90-day negotiation on trade at the G20 summit.

SmartGlobal® (US ETF)

The AQUMON SmartGlobal® Max (US ETF) algorithm provides investors with long-term sustainable growth in assets by investing in US-listed exchange-traded funds (ETFs). Based on the ETFs’ asset management scale, listing date, fee rate, tracking error, liquidity and other factors, the algorithm selects high-quality assets from over 2,000 ETFs in the US market, covering more than 50 countries around the world. This provides our investors with long-term global asset allocation solutions.

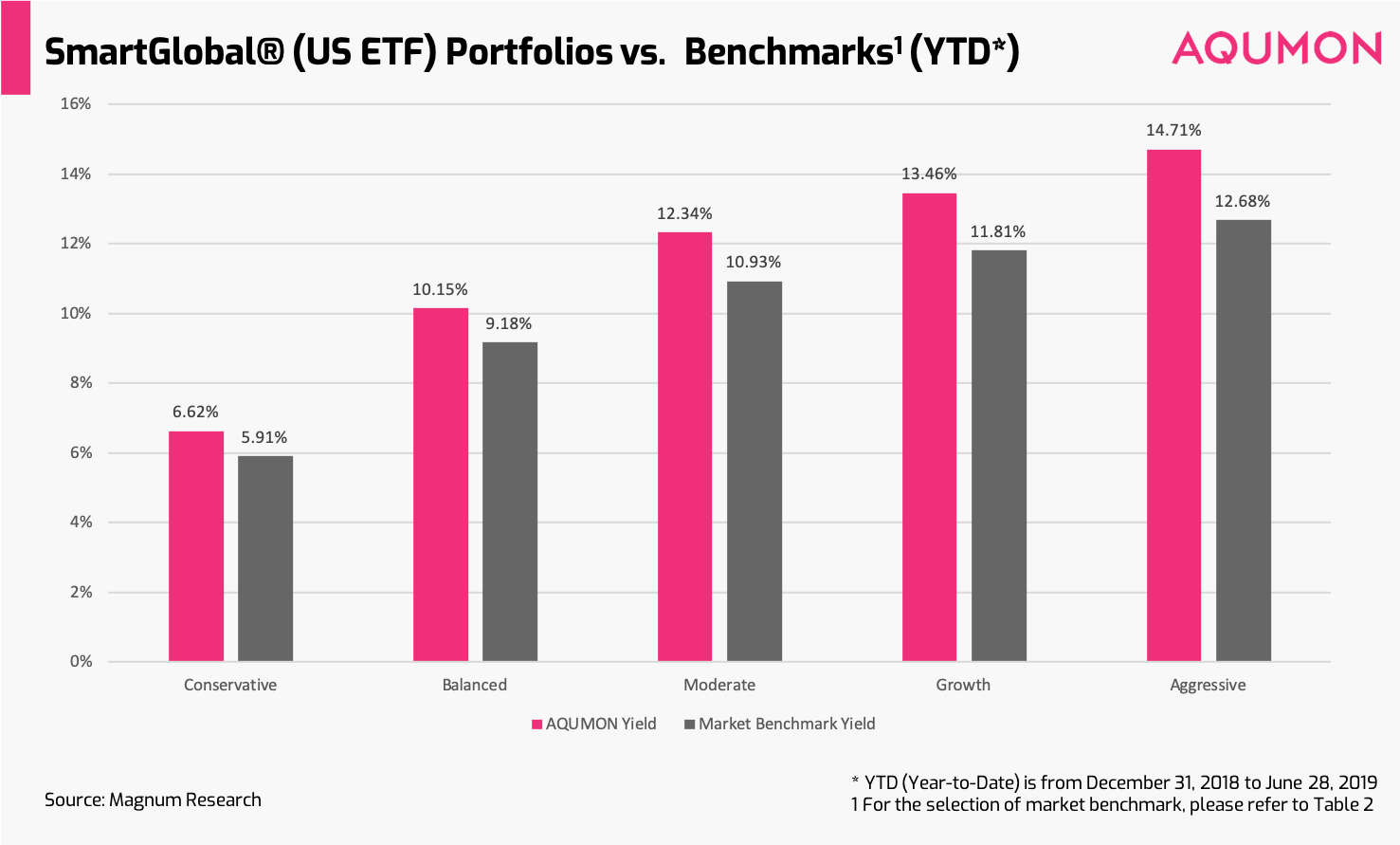

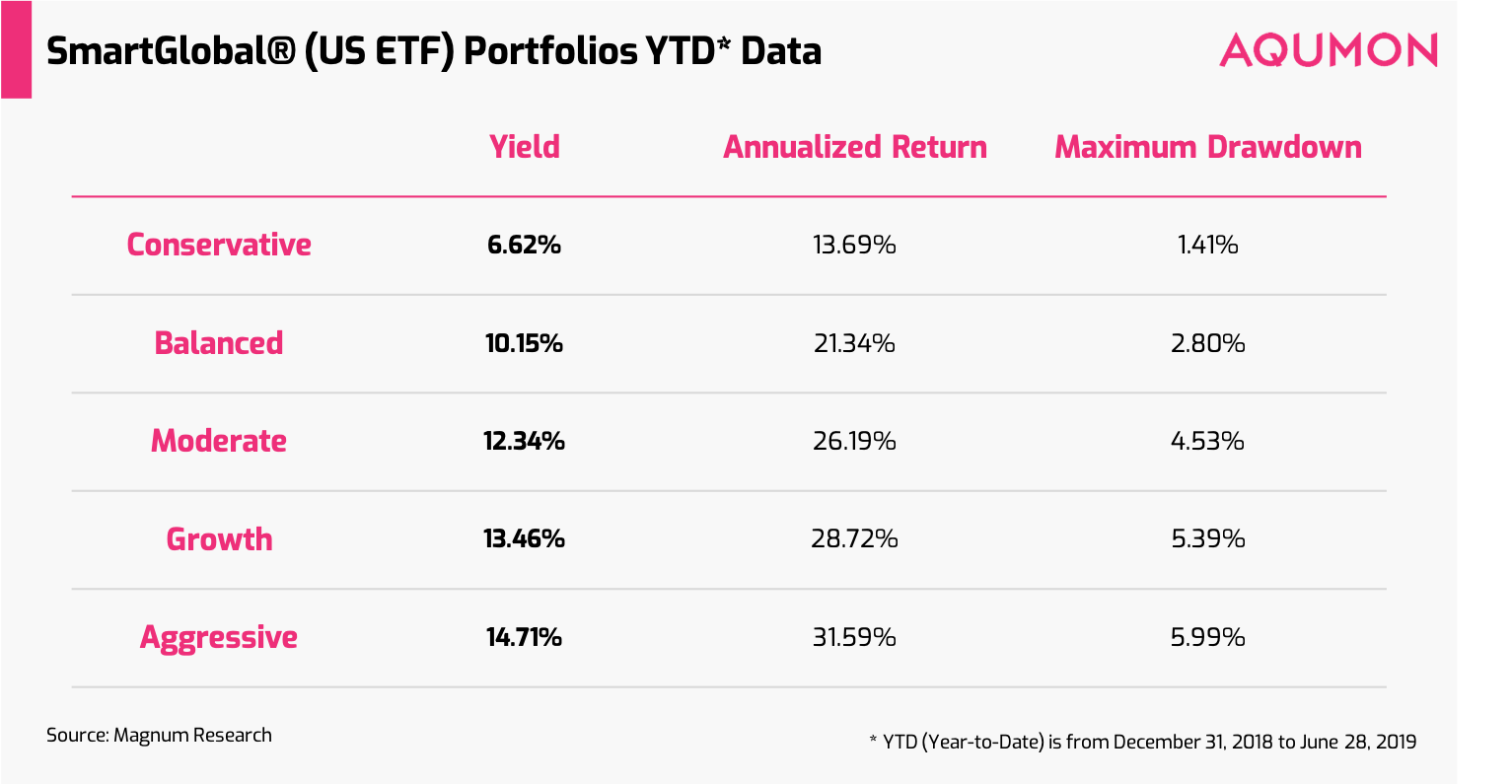

Since the beginning of this year, the market volatility has increased dramatically, and the performance of various assets has been unstable. However, AQUMON's global asset allocation effectively diversified risk. Therefore, all of our combinations, except for the conservative portfolio, have outperformed their corresponding market benchmark’s year-to-date (June 28, 2019). AQUMON’s moderate, growth and aggressive portfolios have, on average, an excess return of 1.63% over market benchmarks.

Among them, the portfolio with higher risk index is suitable for investors who are more aggressive and have a higher risk tolerance. This type of portfolio demonstrates high exposure in equity.

For example, the aggressive investment portfolio has a year-to-date yield of 14.71%, which is 2.03% over the market benchmark, effectively reflecting the increase in the stock and bond markets this year.

For investors who are relatively conservative and prefer steady growth, low-risk portfolios would be more appropriate. Among them, the moderate portfolio has a year-to-date yield of 12.34%, which is 1.40% over the market benchmark. Such portfolios have more exposure in fixed-income assets, shows less volatility, and diversifies the inherent risk from stock investments.

Conclusion:

From the year-to-date analysis, although the world's major markets have made steady gains in the first quarter, the uncertainty of the trade war will still have a great impact on investment earnings. Rise in volatility, which is similar to what happened in 2018, might become the norm. This is also consistent with our predictions in the 2018 Annual Report.

Looking forward to the rest of 2019, the market expects the Fed to have one or two interest rate cuts. The trade war between China and the U.S. and geopolitical risks in the Middle East still persist. We believe that despite market volatility, investors should focus on long-term investments and diversify risk.

As a trusted investment advisory system, AQUMON will continue to provide our clients with a one-stop global asset allocation solution that continuously monitors the markets. We aim at providing our clients with a simple, convenient, and professional investment experience.

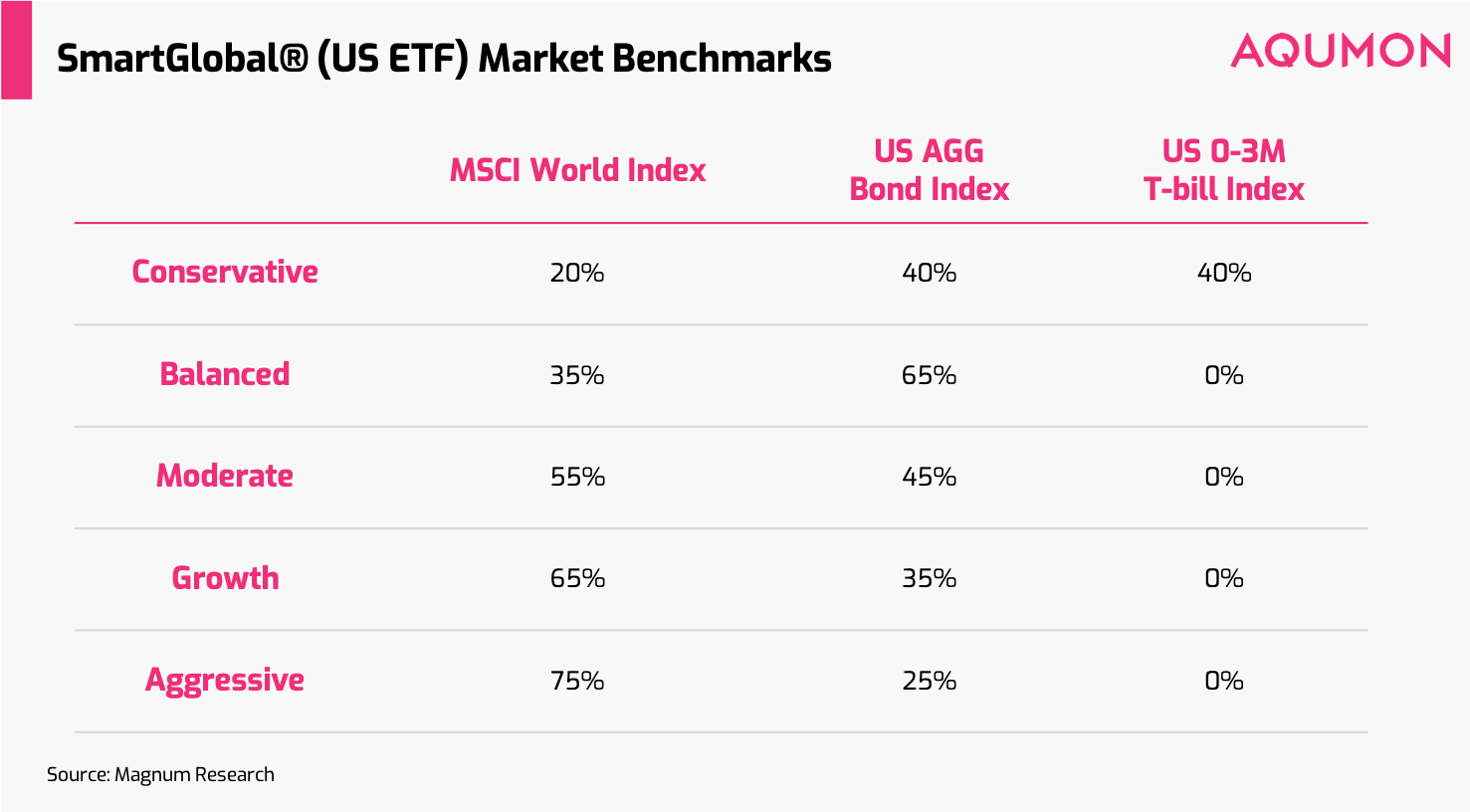

Market benchmark:

The market benchmark consists of the following indices in proportions. In order to compare objectively and fairly with market benchmarks, AQUMON selected market benchmarks with similar volatility to the corresponding portfolio.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.