Are Liquor Stocks Good Investments?

Written by Arthur Lei on 2019-09-04

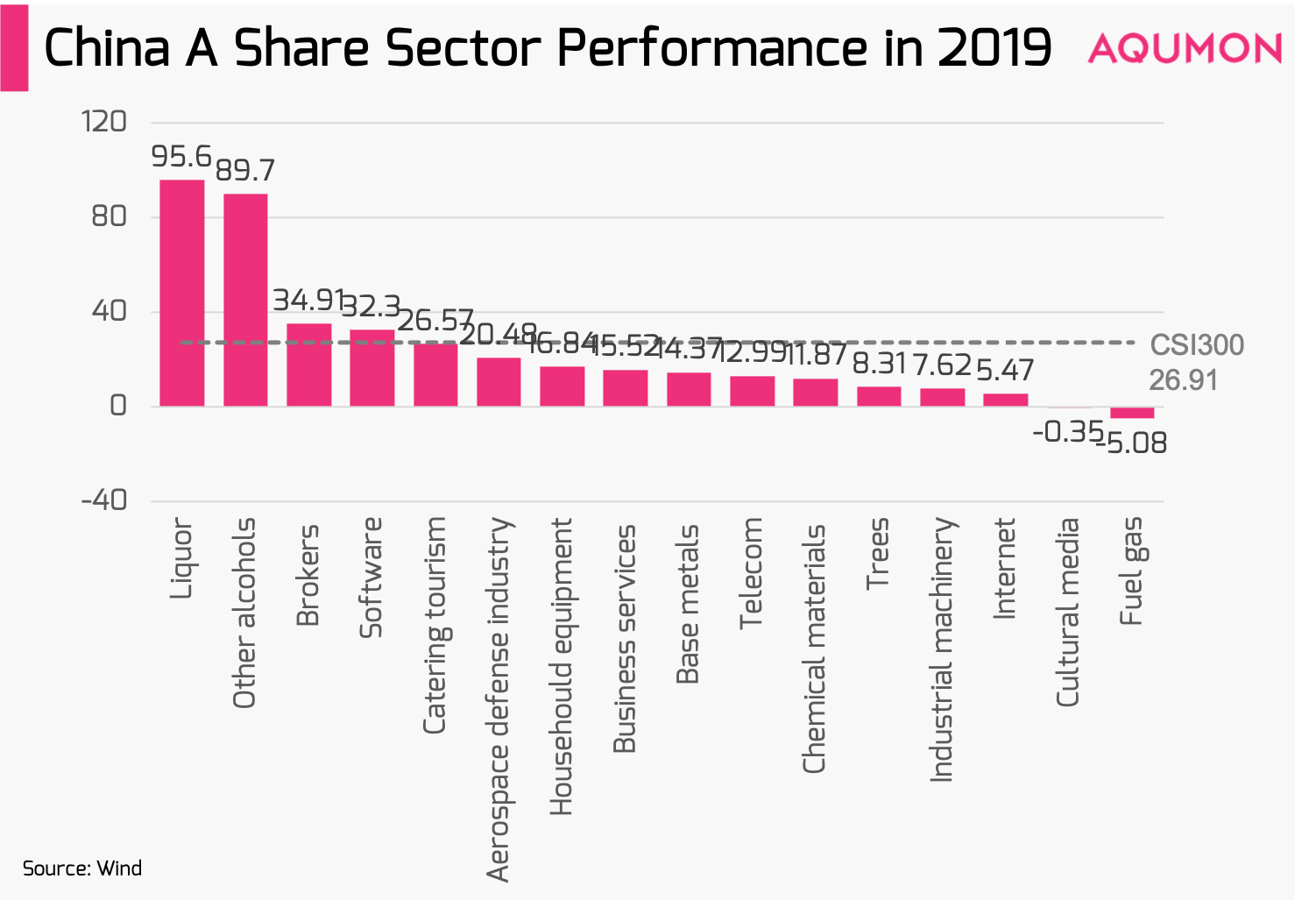

With the trade war in full swing, several sharp declines have been observed in the China A-share market. However, the liquor sector has been outshining other sectors for quite a few years, and still maintains an upward trend and attracts investors. The most prominent company Kweichow Moutai share price has exceeded 1,000 Yuan as the top-ranking high-priced stock of A shares.

We might wonder: what is driving force for the liquor sector? Is it worth our attention and investment? In this article, we will split this subject into the following small problems step by step to understand the current China A share liquor sector.

Some of the basic question and answers are listed below.

1. What factors affect the liquor price?

The price is mainly determined by supply and demand.

Demand influencing factors: Economic growth, User stickiness, Policy, Investment expectations;

Supply influencing factors: Industry consolidation, Market judgment, Policy impact.

2. How did the price of liquor change in the past few years?

The price of low-end liquor continued to rise slowly. The price of mid- to high-end liquor was lower by the policy in 2012-2015 and has been rising rapidly since 2016.

3. Interim Results of Liquor Stocks in 2019 and the Current Valuation

The current interim results of liquor stocks are in line with expectations. However, the valuation of liquor sector is relatively high, and has returned to the higher valuation level of the golden age around the year of 2011.

4. Current Investment Opportunity for Liquor Stocks

At present, we believe that the price of liquor will continue to rise during the year. But in the future, due to slowing economic growth, falling real estate prices and the release of liquor inventories, the price of liquor (especially high-end liquor prices) will decline.

Based on the demand for liquor, its stock price is expected to continue to rise during the year, and the growth level refers to the high point of the average dynamic PE ratio in 2012.

Investors who have already entered can continue to hold, however, the possibility of stock price decline will increase next year, and current external investors will not be recommended to enter.

Factors that Affect Liquor Price

We can analyze these changes from both supply and demand.

Four factors that affect the demand for liquor:

◇ Economic growth

◇ User stickiness

◇ Policy

◇ Investment expectation

Liquor is firstly a consumer good, and its demand is mainly affected by China's economic growth. For example, the growth rate of Maotai’s terminal value over the past decade has kept pace with the growth rate of PPI and fixed asset investment. Due to China's profound and historical table culture of wine, business reception meals often come with liquor. Therefore, in an overall upward economic situation with increasing business activities, the demand for liquor will naturally rise.

However, liquor is also a special consumer good, and its demand has an ability to resist “recession” in a short period. In the context of the economic slowdown in 2007-2008 and 2017-2018, the speed reduction of net profit growth of the liquor sector is relatively lower compared with other industries and could promise a positive growth. Because liquor has strong user stickiness, the repurchase rate is high, and the loyalty of the recognized liquor brand is considerable, so that the liquor has a certain degree of “addiction” that makes its demand to hold a certain amount of momentum even under the slow down economic growth.

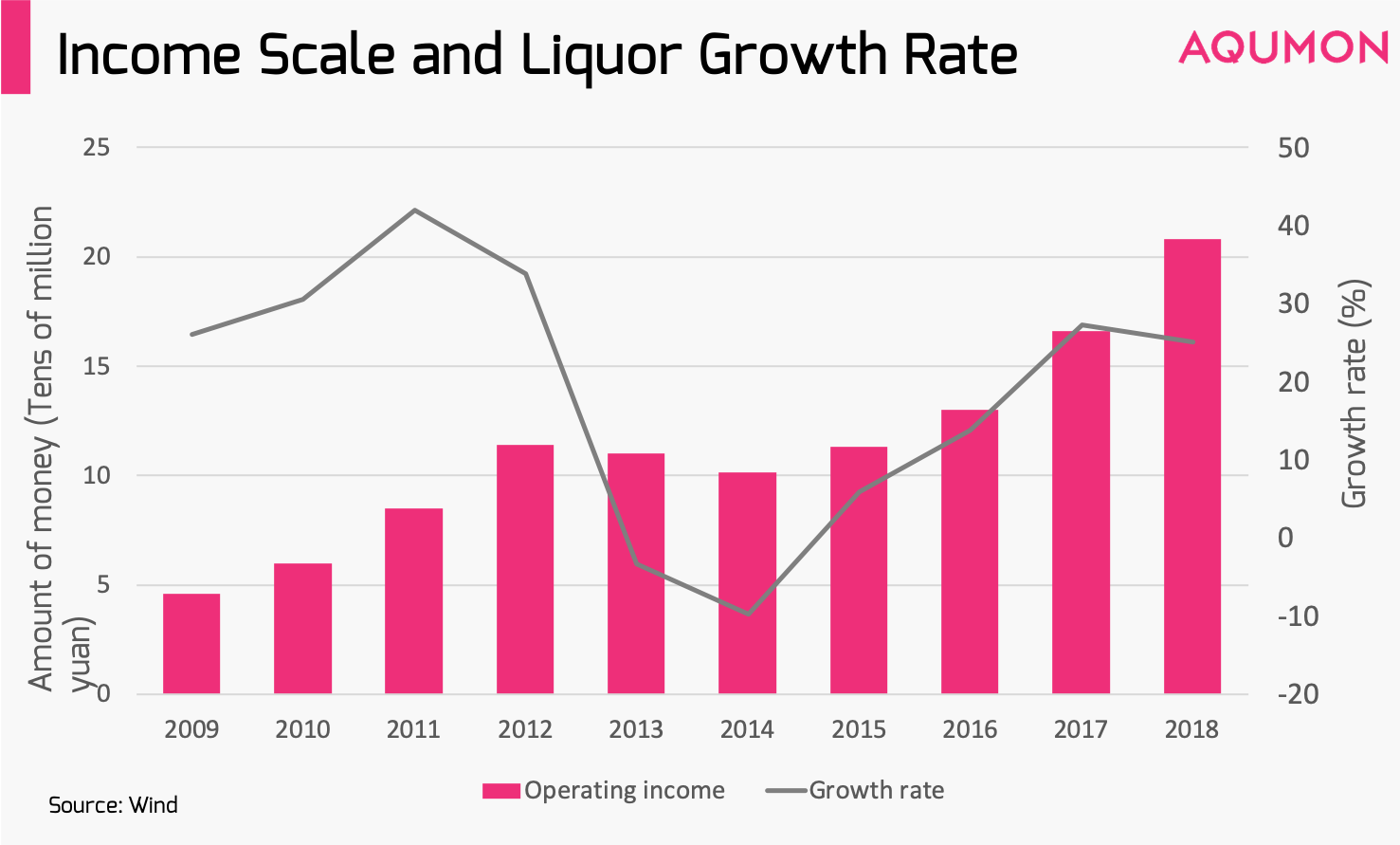

Of course, we must admit that the liquor industry is strongly influenced by the policy. After the central government controlled the public consumption in 2012, the liquor industry suffered a short winter from 2012 to 2015, especially for high-end liquor brands such as Maotai and Wuliangye that experienced a sharp decline in both price and turnover.

In recent years, some high-end liquor brands such as Moutai, have also generated investment demand. As merchants and individuals expect Moutai prices to keep rising, they stock up to earn the benefits brought by rising prices. In the past two years, Moutai sales, driven by investment demand, accounted for more than 20% of total sales.

Three factors that affect the supply of liquor:

◇Industry consolidation

◇Market judgment

◇Policy impact

The supply of liquor is more influenced by the integration of companies in this industry, their expectations on demand and policies (such as taxation). But in general, liquor supply has been mainly affected by the integration of wine companies in recent years. Since 2010, the growth rate of liquor supply has slowed down year by year, and the annual growth rate of production has dropped from 27% in 2010 to 3% in 2018. It is believed that this rate will last in the future.

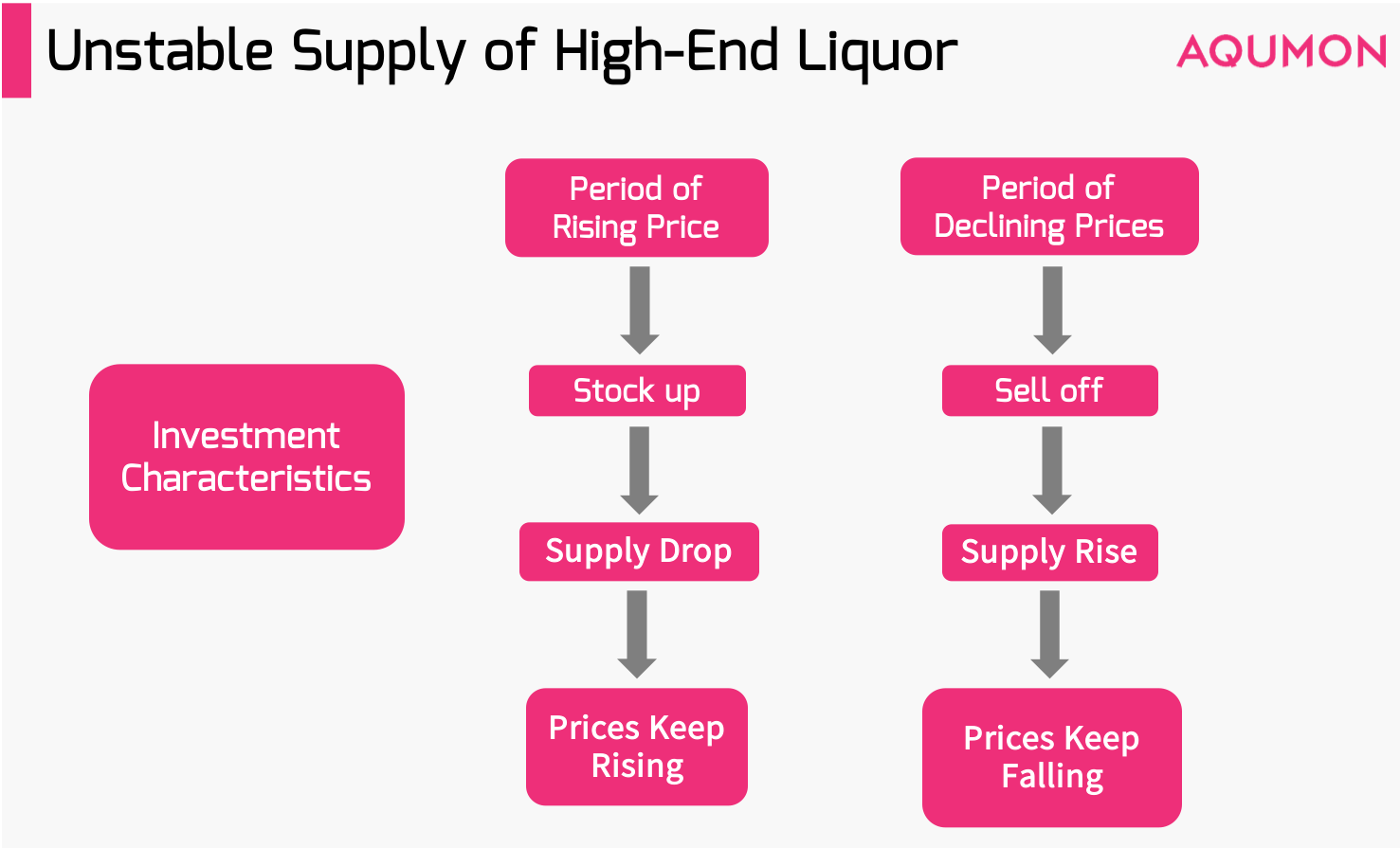

However, it should be mentioned that the supply of high-end liquor represented by Moutai is unstable.

Due to the unique investment properties of high-end liquor, merchants expect that the price increase of Moutai will be carried out so that they stock up during the economy ascent, which will reduce the supply of terminal markets and lead to price increases.

Once the economy has downward pressure, the demand for high-end liquor will fall, which in turn will curb the market's expectation of its prices. At the same time, merchants and individuals will take profits or control losses through selling off. The resulting short-term supply increase will have a huge impact on the price of high-end liquor.

Take Moutai as an example. At the China Food and Drinks Fair in 2018, Moutai officially disclosed that “The scale of Moutai’s domestic household inventory is more than 6,000 tons, accounting for about 20% of the annual output”. Huge social stocks also increase the uncertainty of Moutai supply.

Liquor prices have been rising?

The price of liquor can be divided into low-end and medium-to-high-end liquor.

Low-end liquor has continued to rise slowly over the past few years with economic growth and consumption upgrades. The price of mid- to high-end liquor has experienced a short-term negative growth in 2012-2015 in the past few years and has continued to rise since 2016.

Take the market price of 53-alcohol Moutai (500ml) as an example. In 2012-2013, the market price of Moutai began to decline after reaching 2,000 yuan. From 2014 to 2015, when the sales of Moutai faced depressions, the retail price fell below 1000 yuan in 2014; at the beginning of 2016, the price of Moutai began to recover strongly, and it has returned to more than 2,000 yuan.

It should be noted that the increase in the price of high-end liquor since 2016 is not only related to the consumption upgrade caused by the increase in people’s income, but also due to the wealth effect brought by the rise of real estate since 2016.

This logic is very similar to the “line up to eat” phenomenon that Shanghai and Shenzhen have seen in recent years. Before this round of real estate rise, the restaurants in Shanghai and Shenzhen are not as popular as nowadays. After the house prices have risen, many citizens with multiple housing properties are more willing to go out and consume, which caused the more and more “queueing” recently.

This factor will cause the demand for high-end liquor to be affected by asset prices. At present, the real estate market is facing a downturn, and the policy of “living and not speculating” is getting stronger and stronger, and the risk of asset price decline is increasing, which will also bring about the decline in demand and prices of high-end liquor. And the price decline will be magnified by the folk destocking mentioned earlier.

Wine company interim results and valuation

At present, the interim results of liquor stocks are in line with expectations.

Take Guizhou Moutai and Wuliangye, which have already disclosed the interim report, as an example:

◇Guizhou Moutai: In the second quarter of this year, the company achieved operating income of 17.844 billion yuan, a year-on-year growth of 12.01%. Although the growth rate has slowed down, it can be attributed that the recycling quota has not been released from the direct channel. With the arrival of the direct marketing plan in the second half of the year, the company's revenue is expected to increase.

◇Wuliangye: In the second quarter of this year, Wuliangye achieved an operating income of 9.56 billion yuan, a year-on-year increase of 26.4%, and a net profit of 2.825 billion yuan, a year-on-year increase of 32.7%.

At present, the overall valuation of A-shares is low, and the TTM of all A-shares in December is less than 17 times, far below the historical average.

However, the valuation of the liquor industry is not low.

The TTM of all A-share liquors in December was 32 times, and the corporate value/EBITDA was also 26 times. It has returned to the valuation level of the golden age of the liquor sector in 2011.

In fact, the liquor sector has risen by about 95% this year, largely filling in the valuation depression due to A-shares decline at the end of last year.

We can think that the valuation and performance match in the short term. Due to the high probability that the financial data of the wine companies will reach the expected level this year, the market of the liquor sector is expected to continue during the year.

However, based on the previous considerations of the economy and supply and demand, the liquor industry will continue needing observation next year. Especially high-end liquor stocks need to be more cautious.

Is the liquor stock still worth investing?

Many people are worried about whether the liquor is now in a bubble stage. First, before discussing whether the liquor stocks are already in the bubble, we need to understand what a bubble is.

The definition of a bubble is that the price of an asset far exceeds its value. So we can analyze the source of the value of its assets, compare and analyze historical prices and current price to identify.

Liquor stocks are equity assets and are value stocks. Their main source of value is both performance and valuation.

At present, the overall performance of the liquor stocks is in line with expectations, and this year's results are expected to meet expectations. The valuation has reached a higher level, although there is still a small distance from the historical peak, but unless the market has a large capital injection, the valuation of the liquor sector has little room for growth.

Therefore, we believe that the current price of the stocks in the liquor sector is at a reasonable high.

As valuations rise to the historical peak, liquor stock prices are expected to continue to rise slightly during the year. Investors who have already entered can continue to hold.

However, the pressure of slowing domestic economic growth will further increase as the world economy slows down and the impact of Sino-US trade wars, while the downward pressure on real estate prices rises, coupled with the supply shocks brought by social inventories and the increase in price volatility. The demand for high-end liquor will decline next year.

The performance of the liquor sector is therefore subject to greater uncertainty. We do not recommend investors who have not yet entered the market to continue to invest.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.