In REITs We Trust

Written by AQUMON Team on 2020-04-22

When we talk about real estate, often we talk about its investment value. When investing in real estate, many people think of buying a house and collecting rent, as well as an increase in property value.

Another way to look at real estate, similar to the way people look at funds and stocks, to enjoy the benefits of real estate investment with just a little money, is to invest through REITs -- Real Estate Investment Trusts.

What is REITs?

It’s the name of investment trust funds managed by professional teams to invest in various types of real estate and the return will be the investment income.

In one sentence, it is to buy a house and collect rent. However, what is better than investing in real estate is that you can collect rent from any real estate in the world while not owning a single real property. Here are four characteristics of REITs:

- Low barriers to entry: REITs are similar to stocks and ETFs because they can be traded in secondary market, and unlike physical properties, they don’t require a lot of capital for initial investment.

- Wide investment scope: REITs products consist of decentralized properties, and thus have diversified risks. REITs is an access to all types of real estate around the world, including shopping malls, office buildings, and residences.

- High dividend distribution: The income of REITs mainly comes from rent, and there are laws and regulations in the United States and Hong Kong that dictates 90% of the income to be distributed to shareholders.

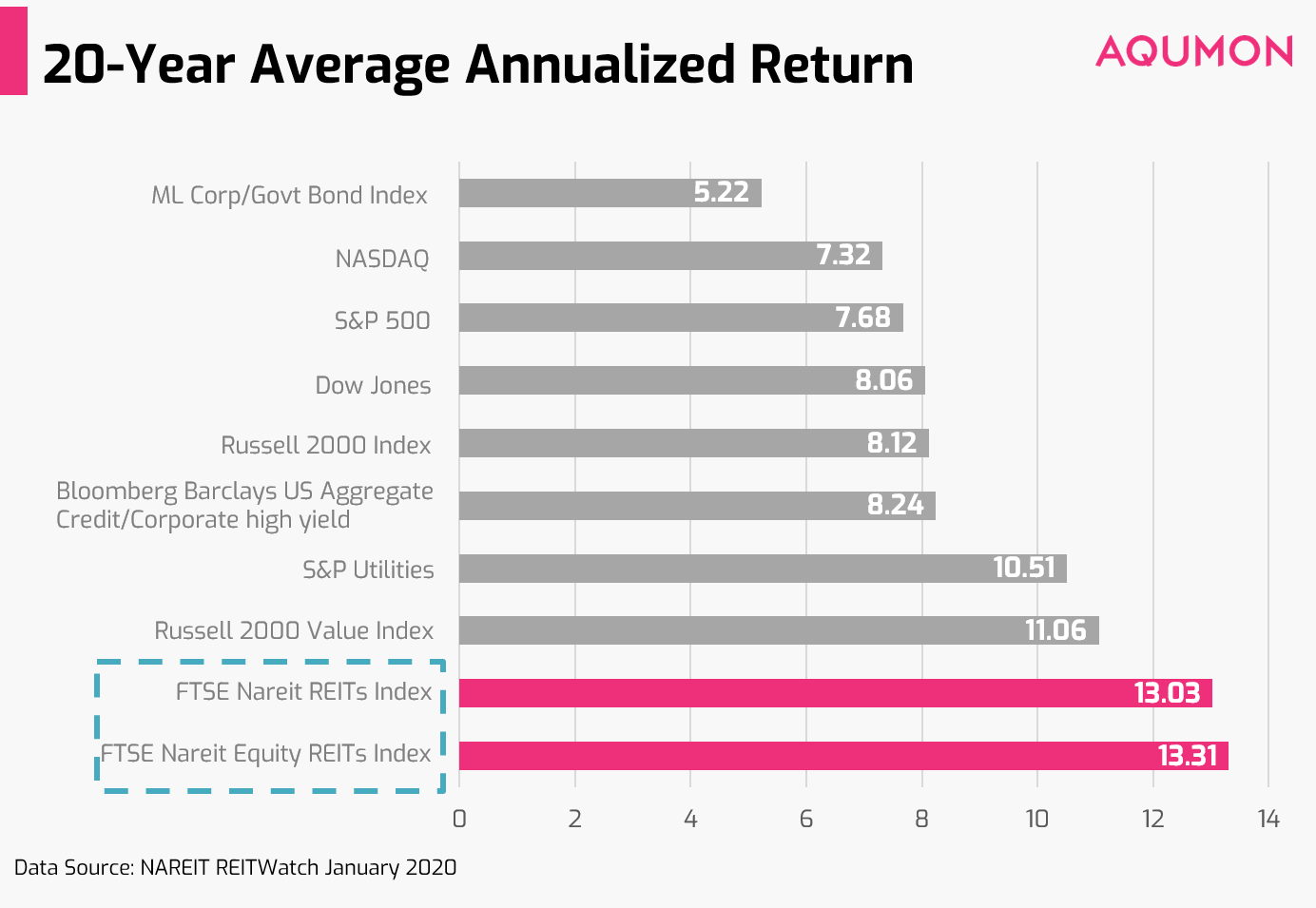

- Excellent return: REITs has equity-like properties, including the value of long-term investment.

In addition, we should also notice that compared with other investment products on the market, REITs has these characteristics:

- REITs has low correlation with other assets

- After a collective market collapse, REITs products rebounded more strongly (Details below)

Since the initial release of REITs in the United States, many countries and regions have followed the similar framework adopted by the United States in their own countries. Currently, there are 1492 different REITs products issued by 46 countries and regions in the world, of which the United States is the largest market, and the REITs market in Hong Kong is also very mature. There are 12 listed REITs traded at HKSE, many of which hold Chinese mainland assets, including Yuexiu Real Estate Fund (Guangzhou IFC), China Merchants Property Trust (5 Shenzhen Shekou properties) and Chunquan Industrial Trust (Beijing Huamao Center). However, strictly speaking, China does not have REITs market. Some "REITs-like" products are more like real estate bonds, with an emphasis on the credit risk of the bond issuer, and have no tax incentives for investors. Also, the legal framework is mature, and thus there is no internationally recognized REITs in China mainland.

However, towards the end of last year, Chinese Securities Law began to include clauses related to asset-backed securities. Shenzhen also proposed to experiment public offering of REITs at Shenzhen Stock Exchange. With these two market events, REITs, having been ignored for many years, became a hot topic in China again. If the relevant legal framework, especially the dividend tax-related policies is executed, REITs public offerings would be just around the corner.

Will there be "REITs with Chinese characteristics"?

As 5G continues to grow and develop in China, many industries are also speculating that after the launch of REITs public offerings in mainland China, they can raise funds from the investors to support China's 5G network construction. If this idea comes true, it will not only comply with national policies, but also solve the financing problems of many new infrastructure projects. Of course, in addition to new infrastructure projects, REITs can also help ease other highly leveraged and / or heavy asset traditional industries (such as energy, telecommunications, utilities, and industry) through asset securitization, reducing China's overall debt burden. Finally, the launch of REITs can also provide a new tool for mainland Chinese investors to participate in the capital market in a low interest rate environment.

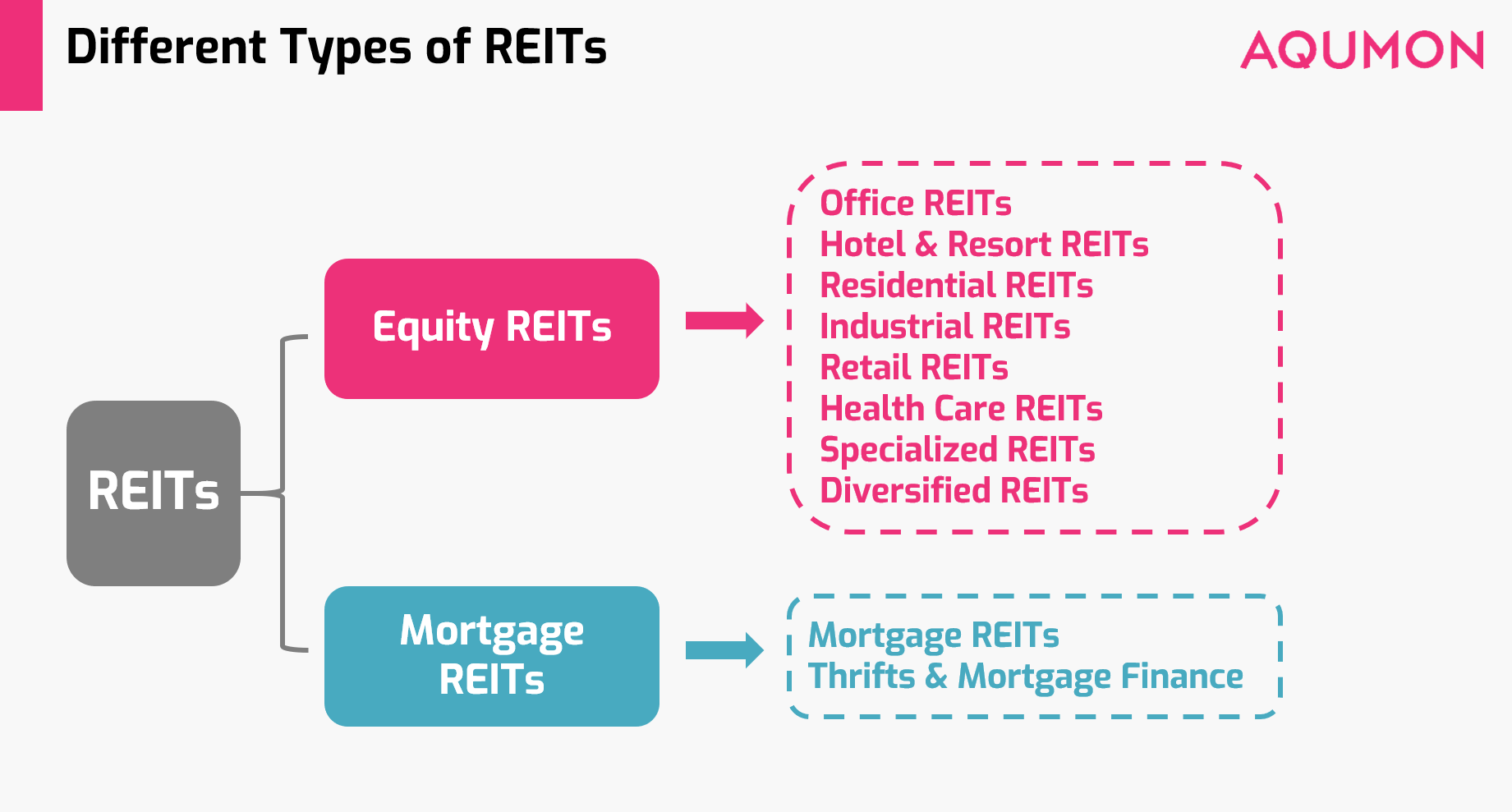

In addition to regions, REITs are also divided into different sectors, as shown in the figure below.

What are factors of REITs price?

At its simplest, the factors affecting house prices are very similar to those affecting REITs, but there’s also some difference:

1. Macroeconomics

The faster the economic grows, the better REITs performs, but REITs of different sectors are sensitive to different economic indicators. For example, Office REITs (office buildings) are mainly affected by employment rate, and Retail REITs (shopping centers) are mainly affected by retail sales growth rate. In contrast, industrial buildings are less affected by the growth rate of employment or retail sales.

Generally, real estate assets are regarded as inflation resisting, and its demand increases as inflation increases. However, high inflation will also lead to high interest rate and unhealthy economic conditions; at the same time, high interest rates increase the burden of mortgages, thereby reducing the demand for real estate. Therefore, net net, inflation is a negative indicator of REITs performance.

The average rental-to-sale ratio in the market is a measure of the profitability of owning a property in the area (in short, the rate of return obtained by renting a property). A higher average rental-to-sale ratio usually indicates the rent obtained by renting a house is higher, and thus return from REITs in the region is higher.

People always say that the housing price in Hong Kong very abnormal, but it is not abnormal if measured by the average rent-to-sale ratio. For example, if you spend 15 million HKD to buy a 50-square-meter small apartment in Wan Chai and rent it to office workers, the annual rent is about 400,000 HKD, and the yield is about 2.67%; If you spend 10 million RMB to buy a 100-square-meter apartment in Jingan, Shanghai, The annual rent is 150,000 RMB, and the yield is only 1.5%, which is the same as the Chinese 1-year deposit interest rate. Therefore, looking at the rent-to-sale ratio alone, the Hong Kong real estate market is in fact, reasonable.

2. Fundamentals

Like listed companies, the stock price of REITs is also driven by factors such as profit growth, profitability, cash flow, valuation, etc., but the metrics are different.

For example, the main indicator of earnings growth is the growth rate of net operating income (NOI). Net operating income is operating income minus working capital and tax costs, which is equivalent to earnings before interest and taxes (EBIT) in other industries in accounting. However, if REITs pays more than 90% of its net revenue to shareholders, there is no need to pay corporate tax, so net revenue (NOI) is equivalent to the general company's net income (NI).

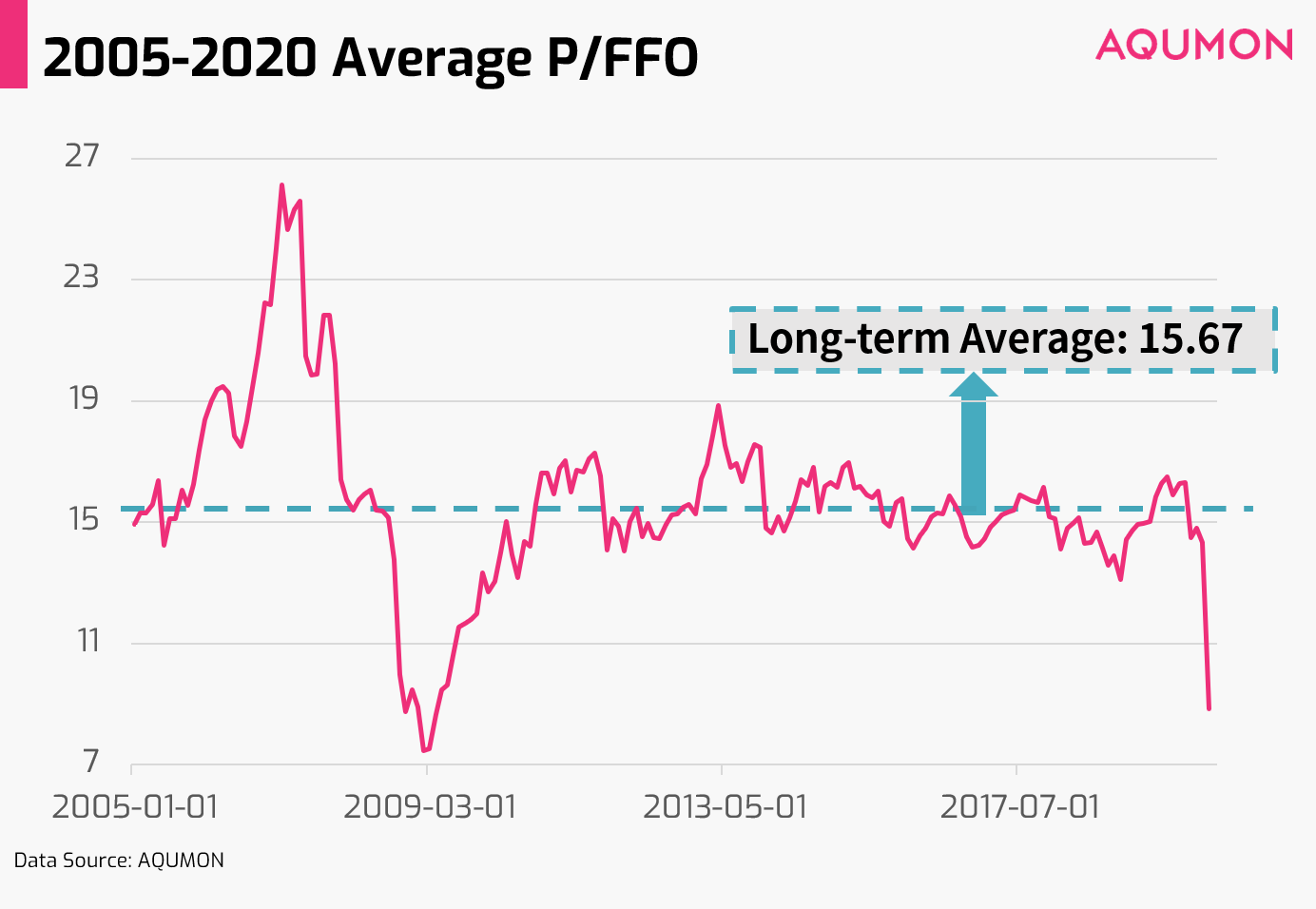

The indicators that measure the cash flow of REITs are mainly operating cash flow (FFO), which is equivalent to the operating cash flow of general companies; AFFO (adjusted operating cash flow) is also a commonly used indicator. AFFO further subtracts capital expenditure from FFO, which is equivalent to free cash flow. Although capital expenditure has a negative impact on cash flow, it is usually used for mergers and acquisitions, the purchase of new properties, and the renovation of existing properties and thus will bring REITs external growth potential.

On a valuation level, P / NOI (equivalent to P / E), P / NAV (equivalent to P / B), and P / FFO are some commonly used indicators.

3. Technicals

In addition to macroeconomic and fundamental factors, factors such as past performance, liquidity and volatility also affect the price of REITs.

Is it a good time to invest in REITs?

Market followers might have noticed that REITs price dropped a lot recently. Is now a good time to invest? To answer this question, we should take a look at the history.

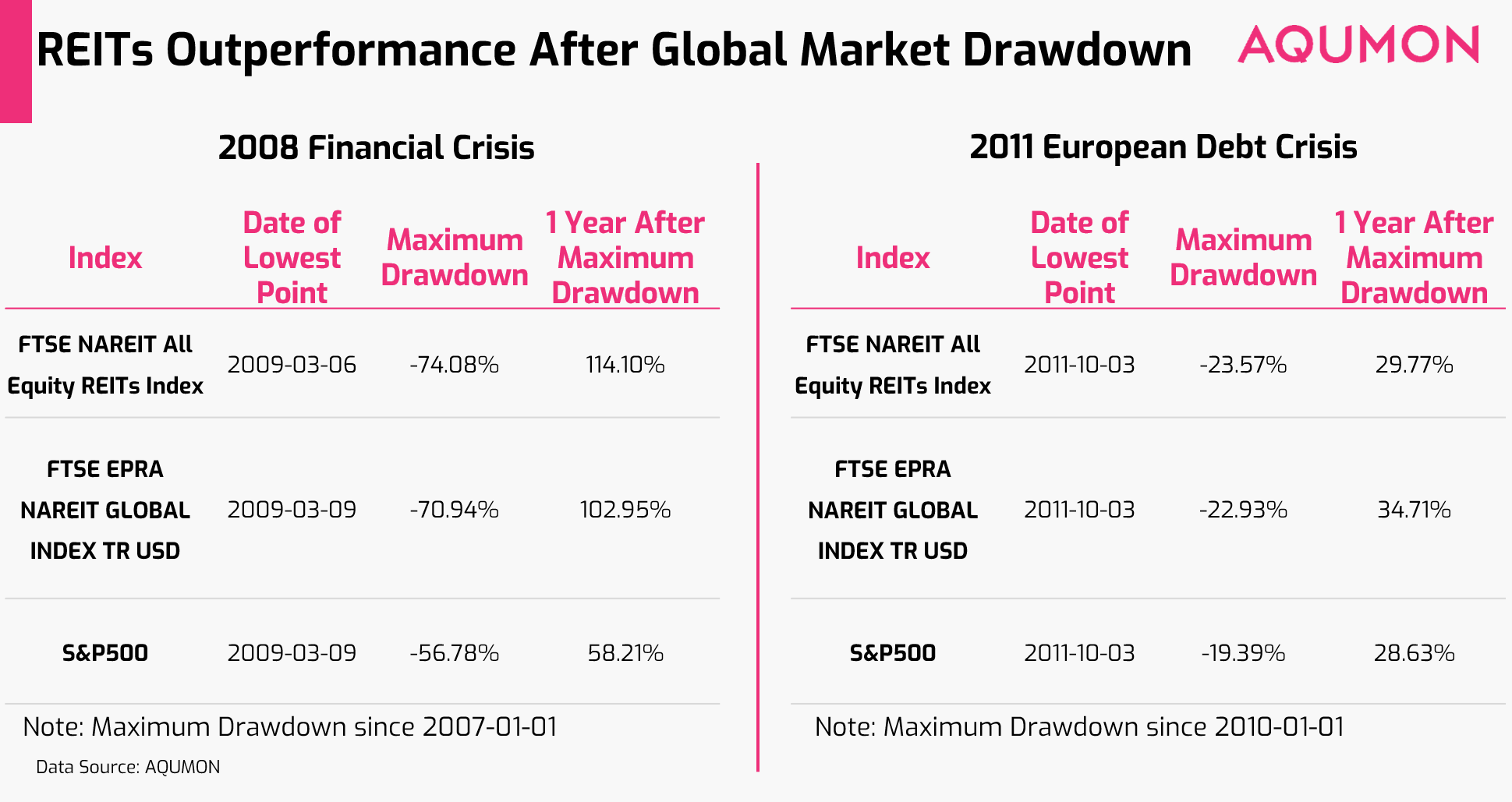

During the 2008 financial crisis, although REITs went down more than S & P 500, the price doubled a year later while S & P 500 only rebounded by 50%; REITs rebounded more strongly took less time to recover.

During another plunge in 2011, same thing happened again. After the drawdown, while the stock market rebounded by less than 30%, REITs rebounded by 34.71%.

Regarding the plunge of REITs in 2020, I hope you can see some positive signals: First of all, the COVID-19 situation has improved with the growth rate of epidemic in Western countries slowing down and the epidemic situation in Asia stabilized, market sentiment is gradually becoming more optimistic, which is also reflected in the stock market; Secondly, no matter from the perspective of drawdown, dividend yield or valuation, REITs is currently at a low valuation. If the history of 2008 and 2011 is a reference for the future, then the worst time may have already passed, and now is a good time to enter the REITs market.

Mark Twain once said, "History doesn’t repeat itself, but it often rhymes"

When applying to the financial market, my understanding of this quote is that not every financial crisis is exactly the same, but the core and principle are the same because human nature has not changed, and the way market operates has not changed.

After the market reaches extremes, mean reversion will take place and prices will return to normal eventually. This is the internal operating mechanism of the financial market.

After learning about REITs, the next question for us is: how to choose high-quality REITs product to?

There are 1492 REITs in the world, not every one is suitable for us. Recently, we also did a lot of research on global REITs and reached some conclusions (including how to select REITs products and some test performance of our strategy). We welcome everyone to comment on this passage and discuss with us. You can also leave a message or contact the AQUMON investment team to know more about how to invest.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.