Are Our Economies Returning to Normal?

Written by Ken on 2020-05-05

Global financial markets were down slightly last week due to a late week U.S. China trade tension driven pullback. The U.S.’ S&P 500 Index was -0.21% last week and -12.38% year to date. Hong Kong and China stocks missed the selloff last week due to the public holidays so ended the week with the Hang Seng Index and CSI 300 Index +3.41% and +3.04% last week and -12.58% and -4.49% year to date.

AQUMON’s diversified ETF portfolios were -0.11% (defensive) to -2.94% (aggressive) last week and -0.72% (defensive) to -12.50% year to date (aggressive) year to date. The biggest return drivers last week were emerging market bonds (+1.78%) and energy stocks (+3.55%) as WTI oil rebounded +16.77%.

Earlier last week we saw markets rally on the back of more economies opening along with positive news regarding early coronavirus treatment success. We’ll go more into this topic this week.

Financial markets uplifted on coronavirus treatment (remdesivir) progress

Before we go into the investment implications let’s first clarify the difference between a treatment and a vaccine first. The biggest difference is that a treatment is used to help ‘manage’ a disease after one is infected while a vaccine is used to ‘prevent’ against a disease before infection. Remdesivir is classified as a treatment.

Treatments are important because vaccines traditionally can take multiple years if not longer to go from initial discovery to the marketplace while treatments are working with drugs that already exist and may have found to be safe in prior clinical trials thereby speeding up the process to market. Even with the whole world racing towards developing a coronavirus vaccine we’re likely still 12-18 months out from a coronavirus vaccine.

Remdesivir was developed by U.S. biopharmaceutical company Gilead Sciences close to a decade ago and was found to be ineffective as a treatment originally against the Ebola virus but subsequently effective against the Middle East respiratory syndrome-related coronavirus (MERS) by blocking the virus from replicating. Last week the U.S. launched the first clinical trial to evaluate an experimental treatment for the coronavirus using remdesivir. Sponsored by the National Institute of Allergy and Infectious Diseases (NIAID) the trial of 1,063 hospitalised coronavirus patients and preliminary results came back positive. Patients who received the treatment recovered 31% faster. Median time to recovery was 11 days for those who took remdesivir versus 15 days for those who received the placebo. The U.S.’ Food and Drug Administration (FDA) as a result has granted an emergency use authorisation (EUA) for the treatment of existing coronavirus patients.

Investors are excited because a potential medical breakthrough like this can be seen as a key step towards governments being able to ease restrictions and help countries reopen economies successfully as a result. This could be a sizable step towards a return to normalcy for all of us.

Although this is definitely positive news for investors like us that look closer we wanted to point out 2 things:

1) There are conflicting results. A separate trial of 237 patients published in the independent medical journal The Lancet also found that hospitalised patients taking remdesivir had a shorter time to recovery but that this was not statistically significant meaning the result at this point could be merely due to chance.

2) Even though the Food and Drug Administration (FDA) has granted an emergency use authorisation for remdesivir on coronavirus patients this is not the same as when the FDA approves a medicine. Normally after multiple rounds of successful clinical trials to conclude a drug is ‘safe’ the FDA (or similar governing body) will go through a formal approval before medical manufacturers can send production into overdrive to distribute to the masses. We are not there yet.

For those reading our blog chances are you’ve heard us mention before that the answer to a financial market and economic rebound remains rooted in a proper medical solution. This is a step in the right direction but investors should also be aware that at this point it is still experimental in nature. We will continue to monitor progress in this space.

Global economies reopening but it is a delicate situation

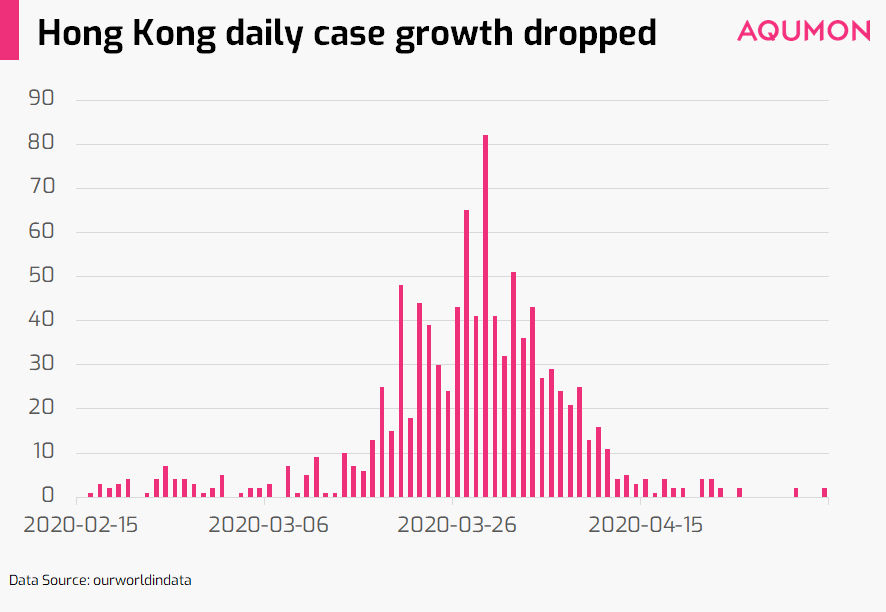

To further add to the positive news, as most of us are experiencing here at the front end of the curve in Hong Kong, we are slowly but surely further reopening our economy. As of Monday there were 15 consecutive days of no new local infections (1,041 total infection cases as of Monday) although it is important to point out we have only tested 2% of the population so there still remains a large area of unknowns. Even so infection numbers recently look significantly more in control versus in late March.

We should hear this week a slight relaxing of social distancing rules from the Hong Kong government along with plans for resumption of school for primary and secondary school students scheduled for late May into June. This is good news for all of us. Even so we should continue to be vigilant but this is a much needed positive jolt for Hong Kong’s economy which recorded its worst Gross Domestic Product (GDP) decline of 8.9% in the first quarter as of Monday.

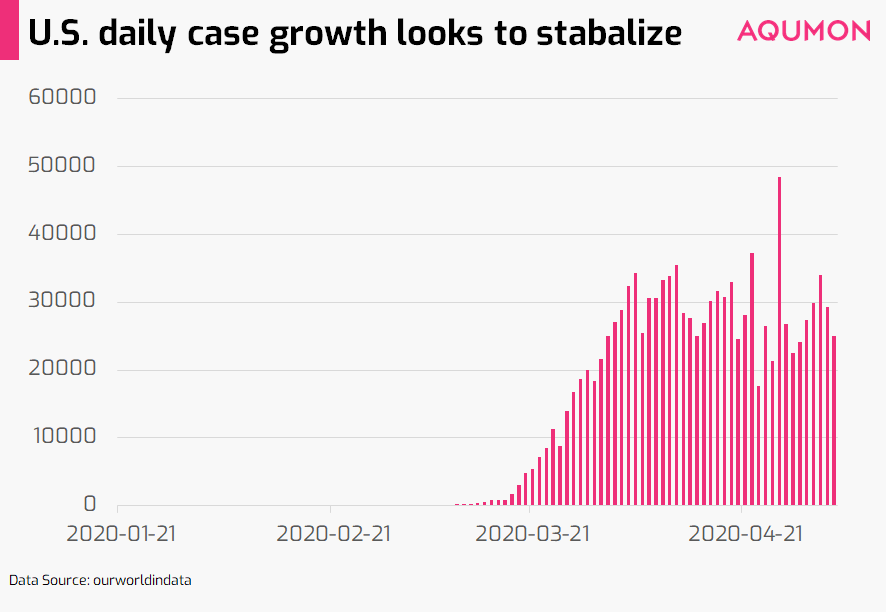

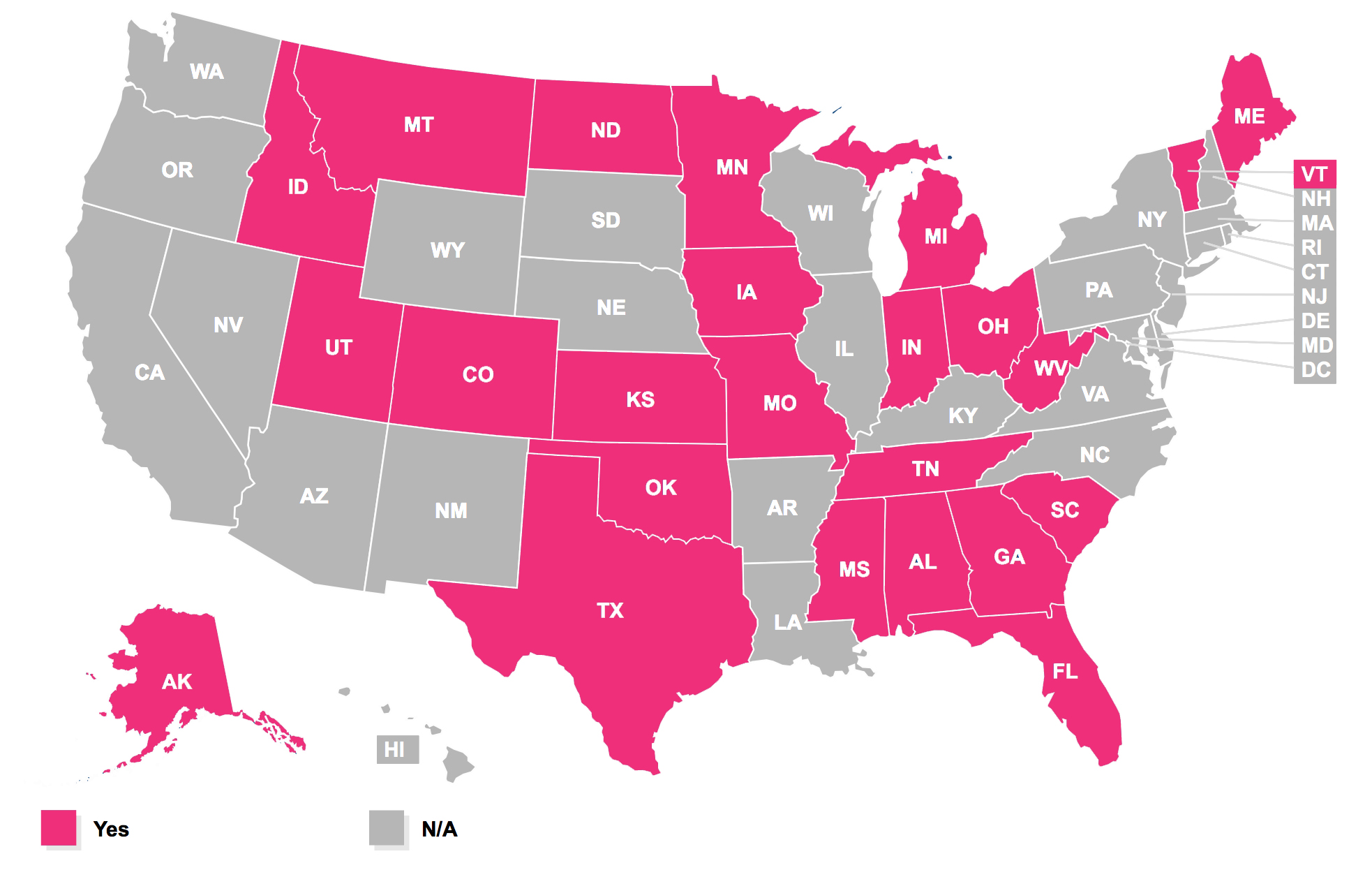

The U.S. with over 50% of the states (27) as of Monday had loosened social distancing restrictions in some way while others have announced changes that will take effect in the coming weeks. The U.S. just surpassed 1,212,900 total cases along daily cases but as a whole seems to be stabilizing.

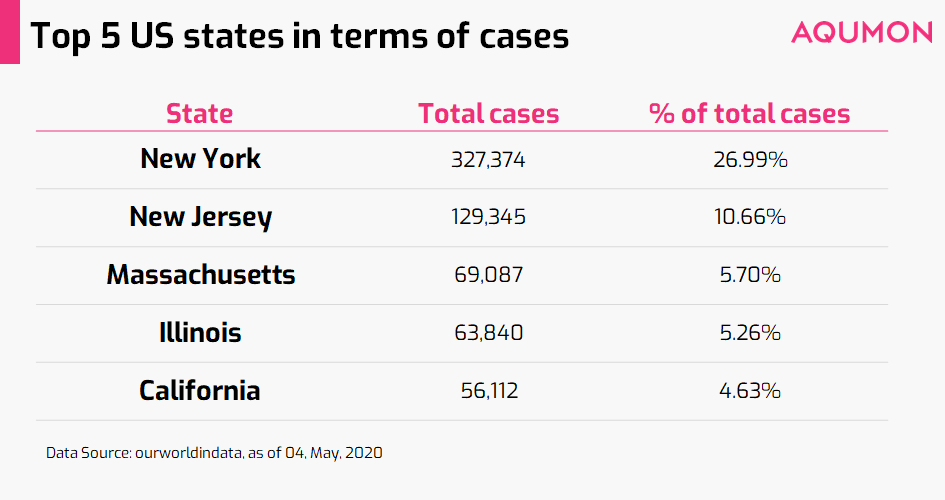

This is where it gets a bit trickier when you look at a state by state situation in terms of reopening. Here are top 5 states in terms of cases as of Monday:

What jumps out is particularly is the divergence between states that are hardest hit and ahead in the curve (this is important) listed above are not the ones first to start rolling back social distancing measures (highlighted in pink below). Right now the majority of changes include lifting of stay at home orders, relaxation in terms of larger gatherings and reopening of non-essential businesses and restaurants (in limited capacity).

Clearly there is heightened pressure to reopen the U.S. economy given that within 6 short weeks initial jobless claims (newly unemployed individuals applying for benefits) have surpassed 30 million. This continues to be a delicate situation in the U.S. and reopening certain states too soon adds to the risk of pushing back the overall recovery timeline.

What can we learn from past bear markets?

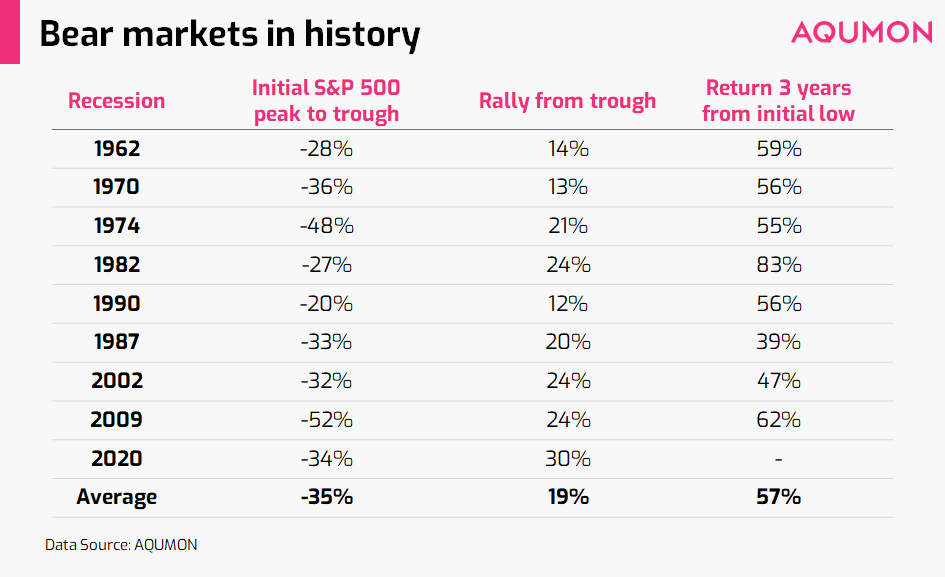

As dislocations between financial market performance and economic data continue to widen due to massive central bank stimulus what we’ve communicated to investors is the need to get back to basics and simplify your investment approach. Why? We did an analysis of the past bear markets and there’s a few insights we takeaway:

1) Market bottoms are rarely formed not in one stage but multiple stages. Meaning even if we are near a market bottom (a bit early to tell) volatility and larger market fluctuations are likely here to stay for a while. Investors should continue to stay diversified and improve their liquidity during this period to manage their risk while positioning for the eventual market recovery.

2) Extending your investment horizon to improve your returns particularly in times when markets are less and less driven by market fundamentals (like we are right now). In the past viral pandemics markets have been quick to bounce back but even in the cases of extreme bear market recessions we shouldn’t forget markets work in cycles (this is not the first time we’ve seen such a market downturn) and investors have come out ahead if they simply extend their investment horizon.

These simple but effective ideas are echoed by the legendary investor Warren Buffet during his company’s (Berkshire Hathaway) annual shareholder meeting this past weekend. He continues to be bullish on the U.S. (but in an even longer 20-year view) but he also logically asks investors to also be careful in managing their risk during this period because he believes the range of outcomes for the coronavirus pandemic remains extremely broad. Adding on top of this the re-emergence of U.S. China trade tensions (still developing), we feel these are wise words for investors to take note.

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.