Hong Kong's Market Impact from Recent Changes

Written by Ken on 2020-06-02

After a month of ‘hibernation’ by a good number of investors we want to welcome everyone to June! Due to continued central bank support coupled with minimal setbacks from economies reopening global financial markets saw another solid month of returns (the US’ S&P 500 was up +4.53% for May). Last week wise, the S&P 500 Index was +3.01% and -5.77% year to date. Locally Hong Kong markets due to political tensions continue to see pressure and ended +0.14% for last week and -18.55% for the year.

AQUMON’s diversified ETF portfolios were +0.40% (defensive) to +2.75% (aggressive) last week and +1.31% (defensive) to -6.83% (aggressive) year to date. Last week markets were mainly driven by risk assets with emerging market (EM), developed markets ex-US and US stocks +3.43%, +4.59% and +2.98% respectively. In the month of May the strongest return drivers were US small caps (+7.65%), US technology (+6.60%) and EM bonds (+6.27%).

This week our focus will be on US and Hong Kong stock market return divergence along with the impact of Hong Kong’s removal from special trade status with the US.

US and Hong Kong stock market return diverging but there is support

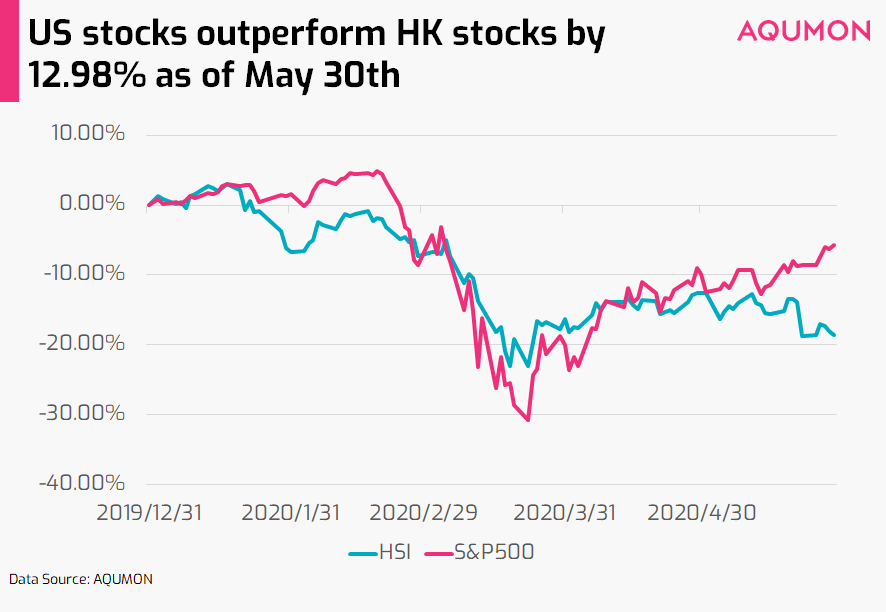

US President Donald Trump announced last Friday night that he will revoke Hong Kong’s special trade status due to the city being “no longer autonomous” from mainland China but gave little detail beyond that. Investors rejoiced since the Trump administration did not escalate US-China tensions (in terms of added tariffs) and the Hang Seng Index responded by rallying +3.36% on Monday. One thing to note is the US’ S&P 500 Index and Hong Kong’s Hang Seng Index continued to see sizable divergence in terms of returns year to date of +12.78% (US stocks outperforming HK stocks):

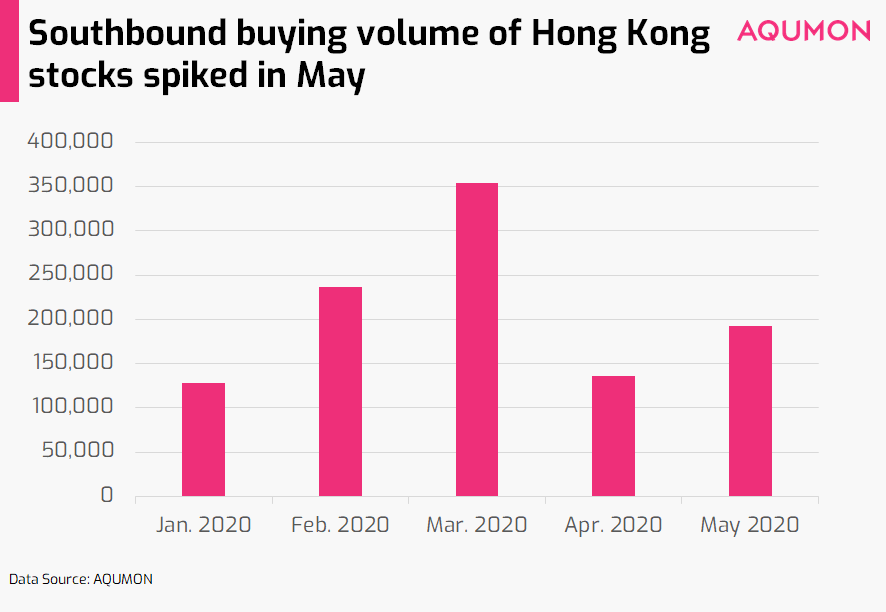

Even with the political and economic uncertainty brewing all is not doom and gloom since the Hang Seng index is trading at relatively low valuations at 9.86x price to earnings as of Monday. Furthermore, cheaper valuations of Hong Kong stocks (particularly relative to Chinese a-shares) are driving increased southbound investing by mainland Chinese investors through the Stock Connect should provide some support and avoid a selloff.

Momentum wise this is also echoed by what we hear on the ground amongst Hong Kong investors recently looking more to rotate out of HKD into USD related investment solutions. Part of this is due to concerns about the currency peg risk (which we will address below) and part of it is due to clients looking to diversify their assets globally particularly in the US following the earlier special trade status announcement.

Hong Kong’s special trade status diminishing but impact not direct

If Hong Kong’s trade status is removed what areas will be most impacted?

1) Increased tariffs on exports: Hong Kong currently enjoys special trade relations with the US as a free port via the Hong Kong Relations Act since 1992. This means no tariffs will be applied on the import and export of goods between Hong Kong and the US. But the impact will be minimal because the vast majority of Hong Kong’s exports to the US are not direct but ‘re-exports’ from China. Direct exports from Hong Kong to the US according to reports is less than HK$4 billion in 2017 and accounts for only 0.13% of Hong Kong's GDP. Conversely increased tariffs may negatively impact the US exports to Hong Kong since it has long enjoyed a trade surplus totaling US$ 297 billion from 2009 to 2018.

2) Unpegging of the HK Dollar: Hong Kong established a fixed exchange rate with the US since 1983 and a unpegging risk short term should not be a major concern for investors. As we mentioned to multiple clients if the security law already drove doubt into investors' minds, unpegging would be the 'last straw' symbolically for Hong Kong as a financial center to many investors. Without the peg it would symbolize that Hong Kong has lost control of its monetary policy (since the purpose of the fixed peg is to allow free movement of capital). This was echoed by Hong Kong Monetary Authority’s (HKMA) Chief Executive Eddie Yue who announced last week the peg would remain the bedrock of the city’s financial system and the HKMA has more than US$440 billion of foreign reserves to defend it.

What does this mean for investors?

This is still early days and as we saw with US President Donald Trump’s address on Friday whereby he left the door wide open in terms of what could or could not happen. We will continue to monitor this situation but currently for investors they should takeaway:

1) Increased volatility from trade tensions: From now until the US elections in November the US’ relationship with China will likely be under a major spotlight and potentially an integral part of Trump’s political rhetoric. This will bring added volatility to financial markets for short to medium term unless it gets resolved.

2) Short term political impact for Hong Kong markets is not significant: Short term the instability and changes on the political front likely will not directly and negatively impact our local markets so investors don’t need to overreact. Indirectly this may erode investor confidence particularly with investments from foreign entities and investors so this may result in medium/long term downward pressure.

Being home biased with your investments, especially in Hong Kong, continues to underperform other major markets this year (as shown above) so allocating and diversifying globally makes most sense for investors in the current investment environment. Furthermore with added volatility from trade tensions along with potential COVID-19 related setbacks and surprises means investors need to be careful about managing their portfolios downside risk through systematic diversification, monitoring and rebalancing.

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.