What's a Best Seller During a Recession?

Written by Catherine and Elva on 2020-08-14

What’s the best selling item during an economic downturn? Lipstick!

There exists an interesting economic phenomenon known as the “Lipstick Effect". This observation describes the rise in lipstick sales during periods of financial distress. The origins of the “Lipstick Effect” can be traced back to the Great Depression in the 1930s; every industry was struggling to survive but unexpectedly, sales of lipstick were on the rise. After almost a hundred years, this phenomenon made a comeback. For example, during the financial crisis of 2008, cosmetics giant L’Oreal’s lipsticks grew by 5.3%.

The less money you have, the more lipstick you’ll buy?

During recessions, humans often worry about their financial security and thus reduce their spending. What many do not realise, however, is that recessions often leave individuals with more “free capital” than usual. Our desire to spend still holds strong regardless of economic conditions; when we can’t buy extravagant luxuries, consumers turn to small, affordable luxuries such as lipsticks for psychological comfort. Lipstick is one of those comforts that are “cheap yet unnecessary.” Hence, many people turn to spending money to make themselves happy and comfort their souls during hard times. Who can resist the feeling of soft lipstick touching your lips; amazing isn’t it?

The Un-Lipstick Effect in COVID Economy

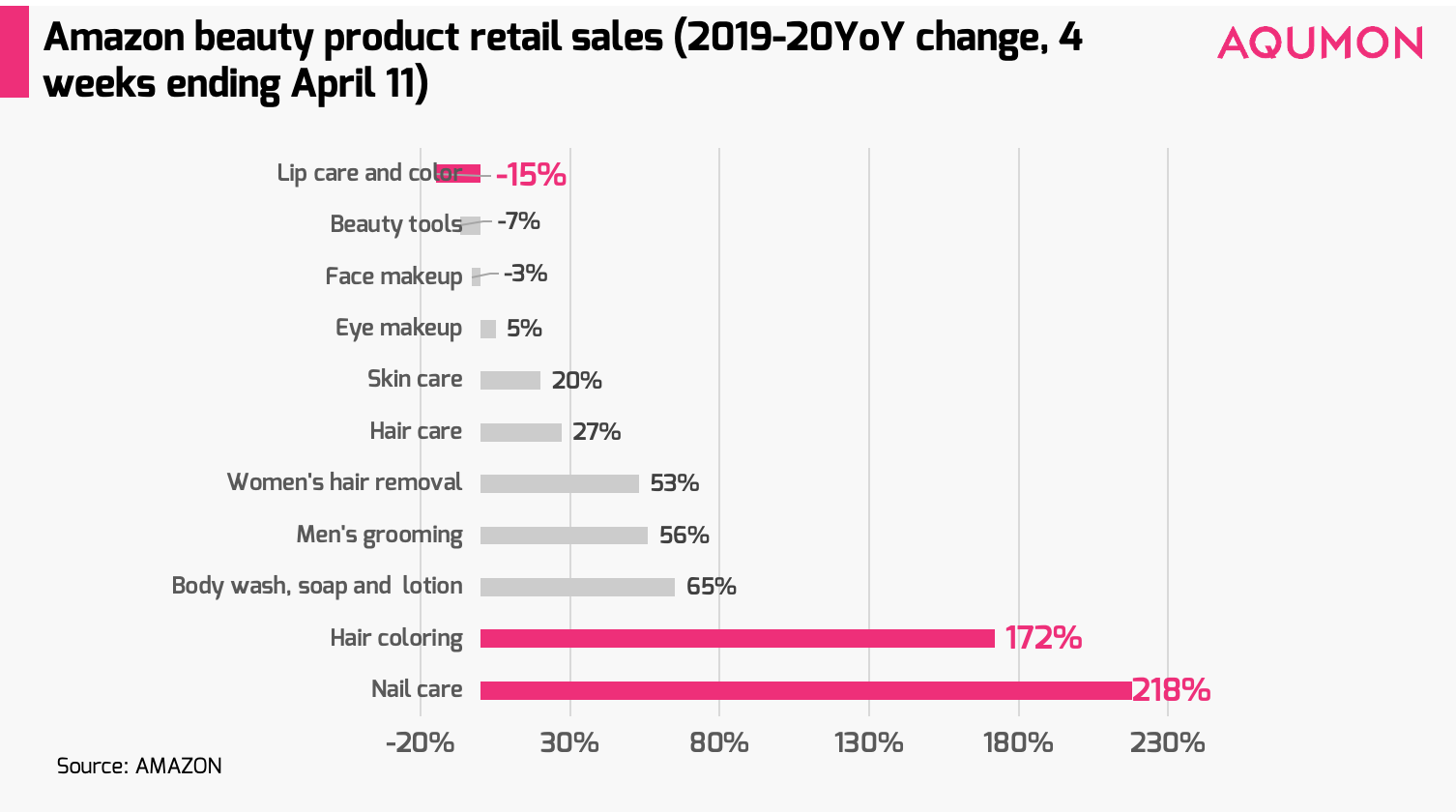

Due to the COVID19 pandemic, masks have become indispensable in our daily lives. However, as masks cover two-thirds of our faces, there is little value in wearing lipstick. For the first time ever, lipstick has lost its "counter-effect" aura. McKinsey’s research data showed that on Amazon, the sales of "lip care and lip gloss" products were poorer than other cosmetics products, declining by 15% compared to the same period last year.

On the other hand, we are seeing the rise of other beauty phenomena during COVID-19: the "nail polish effect" and the "hair dye effect". Nielsen's survey data showed that U.S. sales of Madison Reed hair dye kits grew 10-fold in April, while sales of Revlon nail polish was also boosted by 10 times. On Amazon, nail care sales surged 218% and hair dye sales jumped 172%.

Emotion-Driven Shopping Behavior

Our emotions often influence our consumption behavior. When we are happy, we tend to buy things to reward ourselves. When we are unhappy, of course, we tend to buy things to comfort ourselves. We know we have fallen into the spiral of retail therapy that we can't get out of.

As a smart investor, our emotions are affected by different market information and we are bound to have ups and downs. When it comes to investment, it is not wise to be affected by our own emotions.

AQUMON, a robo advisor, removes the volatility of human emotions and rationally makes investment decisions based on market conditions, helping you swim upstream against the current!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.