Don't Fear the Recent Tech Selloff

Written by Ken on 2020-09-09

Due to the weakness in US technology stocks, global financial markets partially sold off last week. The US’ S&P 500 was dragged down as a result (-2.31% last week and +6.07% year to date).The Nasdaq was -3.27% last week and +26.09% so far in 2020. Regionally European and Hong Kong stocks also slumped down -1.66% and -2.86% respectively last week. We know most clients may want to ask about this week’s US technology stock selloff so we’ll address that more below.

AQUMON’s diversified ETF portfolios were +0.11% (defensive) to -1.85% (aggressive) last week and +2.29% (defensive) to +5.81% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio with more regional exposure to Hong Kong/China is +1.07% (defensive) to +10.14% (aggressive) year to date. Safe assets like bonds also stayed relatively flat and gold was -2.16% last week. Beyond US technology stocks and US broad markets, larger portfolio drags last week included energy (-4.31%) and emerging markets (-2.33%) stocks.

With everyone’s focus likely on the US technology stock space we thought it was very timely to address the key questions and concerns you have on the sector and in terms of broad markets.

September has been a rotation out of tech instead of a broad market selloff

As a more experienced investor given how much valuations have run up in the US tech sector in 2020, a bit of a pullback is not abnormal. Valuations are a bit expensive but likely not in bubble territory for US tech when looking at forward earnings per share (EPS) estimates of 27x (during the height of the tech bubble in the 1990s forward EPS was above 70x). Especially when we look at other sectors (particularly more value orientated sectors like financials, utilities and energy) the selloff impact has been significantly less (we’ll go into this below).

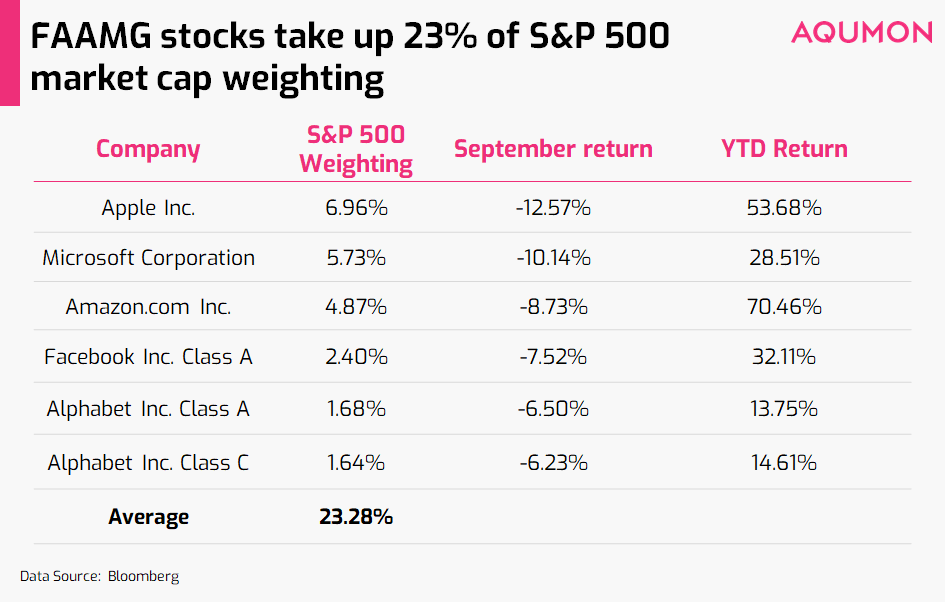

It may very well feel like a broad market selloff since indexes like the US’ S&P 500 are tied heavily to large technology stocks. FAAMG stocks’ (Facebook, Amazon, Apple, Microsoft and Alphabet) market capitalization comprises over 23.28% of the S&P 500’s total weighting. So any move (up or down) by these US tech names will have a bigger impact on US broad markets. You can see the weightings and recent returns here:

Even though these giant tech stocks have pulled back 6-13% the past month they are still returning +15-54% year to date.

It’s important to keep things in perspective

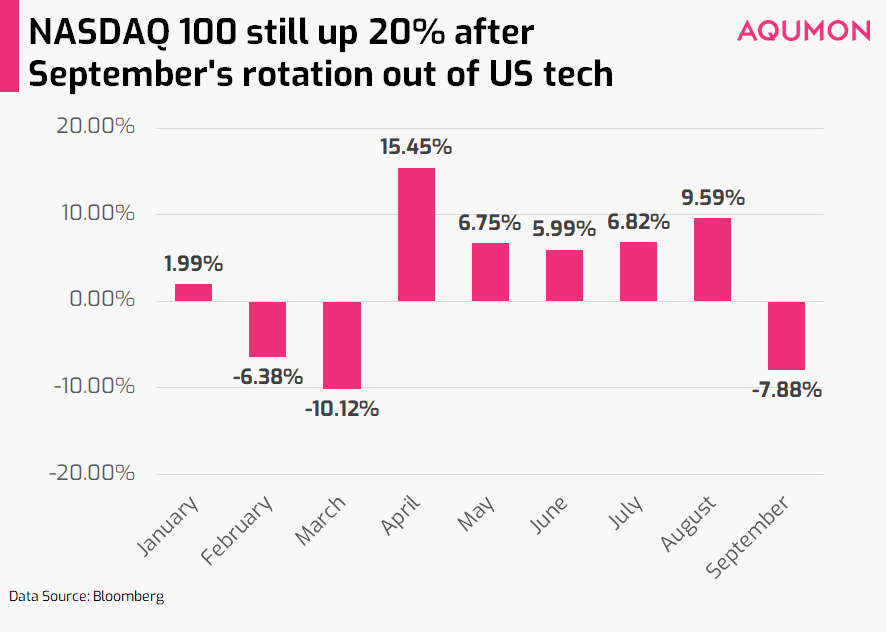

Even with this month’s -7.88% pullback (-10.34% since the high on September 2nd), the Nasdaq 100 index is still up +20.90% year to date and a whopping +58.11% since the market’s recent bottom on March 23rd:

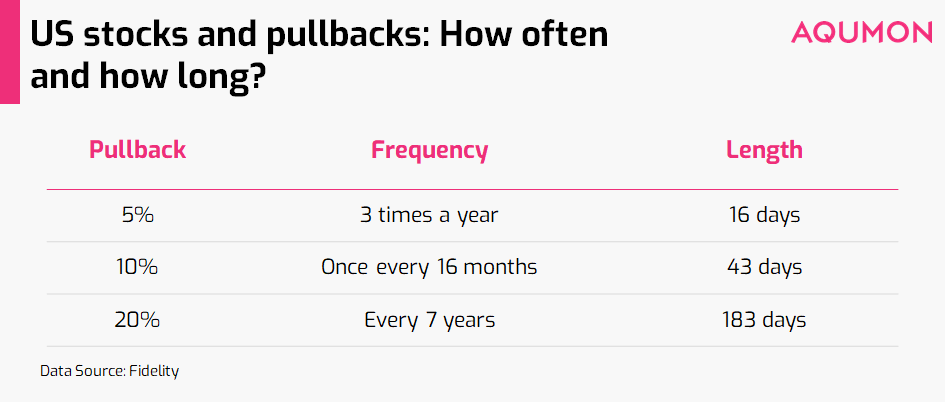

In the grand scheme of things this pullback in September only brought the Nasdaq back to levels from 26 short days ago. When looking at broad markets the question we get from investors is how often do markets pull back? If we look at S&P 500 index data since 1950 until 2020 compiled by US financial firm Fidelity, it's more often than you would think:

So long term wise this recent pullback is actually quite normal and one of the reasons why we suggest to investors to not fear this recent selloff. Instead, treat this as an opportunity where you can reassess your portfolio’s risk and systematically add to your longer term investment goals at cheaper levels.

Rotation into value sectors (not cash directly) a ‘healthy’ sign for markets

Even though volatility has heightened slightly with the US’ VIX index at 31.46 (highest levels since mid-July) they are still a far cry from the 66.04 levels we saw during the height of this year’s selloff in March. There are also 2 things happening that we feel is comforting to see and likely does not mean the end of the current market rally:

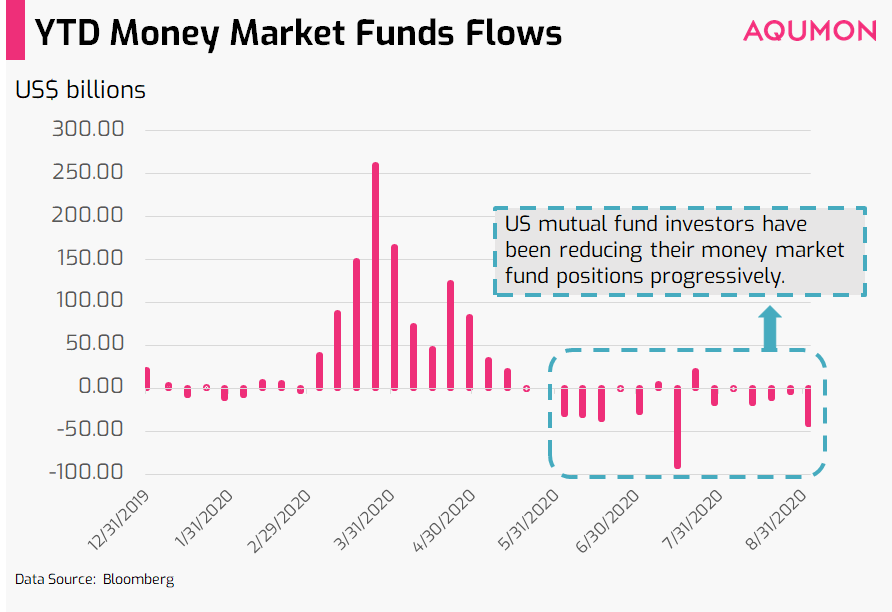

1) Investors have not panicked by immediately cashing out:

Actually quite the opposite. Although the data is latest as of September 2nd (doesn’t yet capture the tech market selloff starting September 3rd) What we see amongst US mutual fund investors is they have progressively since May been reducing their money market fund positions (often seen as a ‘cash alternative’ investing into highly liquid short-term debt investments). This is a very different situation from back in March in April when we saw mutual funds investors immediately switching to cash (and exiting the market):

2) Healthy rotations into laggers both in terms of sectors and regions:

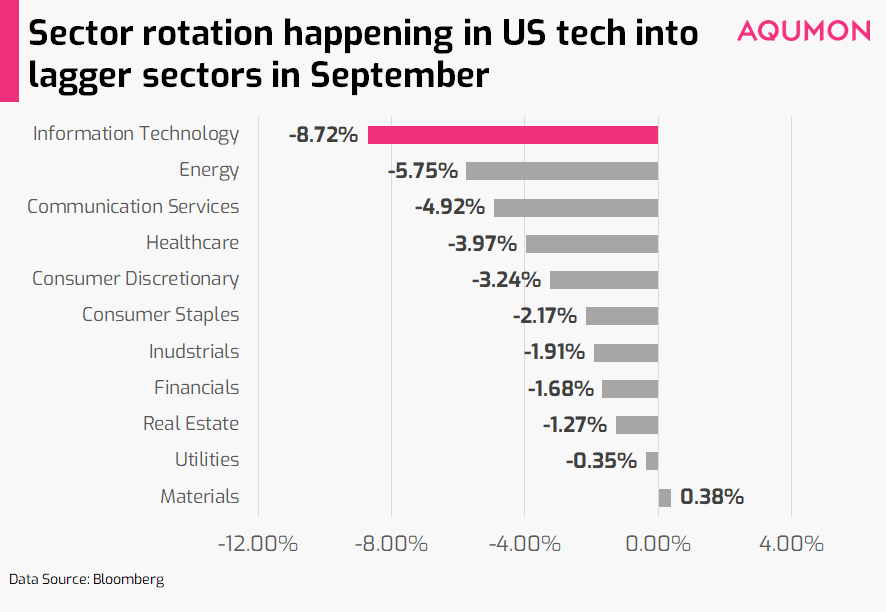

If money isn’t going to cash then where is it going? Since the main argument for the recent selloff in US technology has been based on valuations being too high, the natural reaction we see amongst investors globally is a rotation into ‘less loved’ underperforming sectors and regions. If we look at the 3 main sectors dragged down by FAAMG stocks (Facebook, Amazon, Apple, Microsoft, and Alphabet’s Google) which include information technology, communication services and consumer discretionary, sectors who have underperformed all year like utilities, financials and materials are outperforming (relative to tech) in September:

Although fundamental economics and markets are currently quite dislocated we are in agreement with a recent report by Bank of America that further rotations from growth sectors (like technology) into value sectors may accelerate when a COVID-19 vaccine is found. Even though this is a big if (and when) the logic makes quite a lot of sense. There is a good reason why technology companies continue to outperform mainly because they are one of the only sectors where their business is improving during COVID-19 and they have healthier cash-rich balance sheets. When economies finally reopen successfully we may favor sectors that have underperformed due to COVID-19. The honest truth is in a zero/negative interest rate environment coupled with COVID-19, there’s not many places your money can go but stocks (particularly in tech) if you are looking for returns.

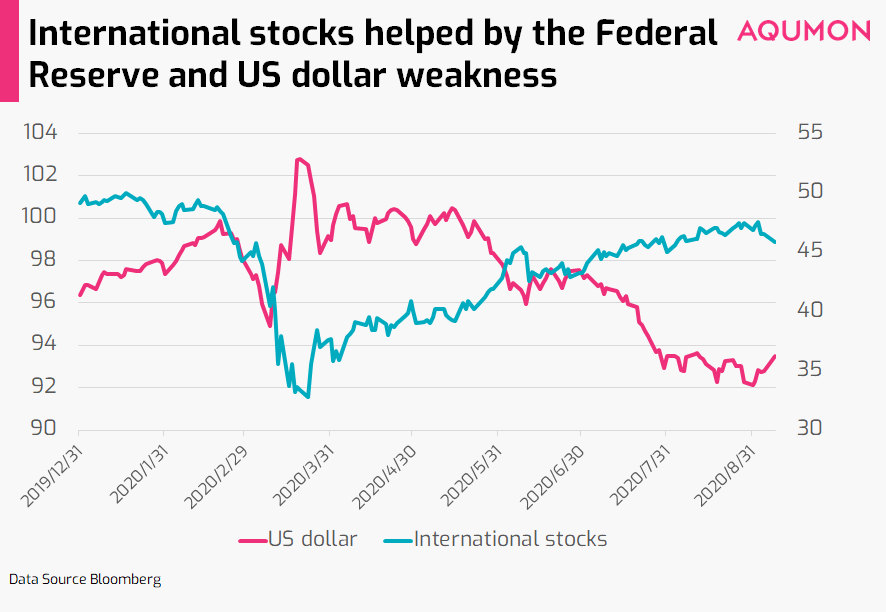

Furthermore the continued devaluation of the US dollar (-3.02% year to date and -9.08% since the peak on March 20th) has prompted investors traditionally investing into US assets to look overseas. Although the dominant run of US technology stocks has masked this somewhat, we do see a strong correlation between outperformance of non-US regional stock markets against the weakening US dollar:

This is partly the reason why we see the world’s most famous investor Warren Buffet also looking overseas with his recent US$6 billion (~HK$46.5 billion) investment into 5 of Japan’s largest trading companies: Itochu Corp, Marubeni Corp, Mitsubishi Corp, Mitsui & Co and Sumitomo Corp. Beyond a simple currency play (the yen is basically a ‘hedge’ the US dollar) the balance sheets of these specific companies are also extremely strong from a cash angle. As a comparison JP Morgan pointed out this week that Japanese companies in general are 50% net cash versus in Europe or the US where it is about 15-20%. So this is quite in line with Warren Buffet’s viewpoint that companies he feels will outperform COVID-19 need to be liquid.

Given it will be hard to predict exactly when and which sectors or regions will benefit from the rotations, staying diversified for investors is still the most effective approach both from managing your downside risk and also capturing upside as rotations happen.

Hong Kong’s Hang Seng Index and new tech stocks standing to benefit

Speaking of looking overseas for value, when it comes to lagger regional markets that may see a technology catalyst we’ve been mentioning to investors since June that they should keep a close eye on the Hong Kong stock market. There are 2 main reasons why Hong Kong’s market stands to benefit beyond just Chinese companies that driven back to Hong Kong from the US to IPO due to the ongoing tradel tensions:

1) Hong Kong’s Hang Seng Index (HSI) will get more tech exposure:

It’s already happened and will continue to happen. Due to rule changes that now allow dual-class shares (so companies listed on multiple regional markets) to be listed in Hong Kong, these reforms have recently attracted close to 100 tech and biotech companies (predominantly Chinese) to list in Hong Kong. These new companies already take up over 23% of the market capitalization of Hong Kong’s total market cap as per financial company Jefferies. This week the HSI gave itself a further makeover by including Alibaba Group Holding, Xiaomi and pharmaceutical research group WuXi Biologics in its 50-stock index. Going forward it is quite possible they may include recently listed online retailer JD.com, game developer NetEase and Alibaba affiliate Ant Group which is aiming for US$30 billion (~HK$232.5 billion) listing in October/November. Given how the US’ S&P 500 has over 23% exposure to FAAMG stocks, the HSI could very well have similar technology-orientated characteristics in the near future.

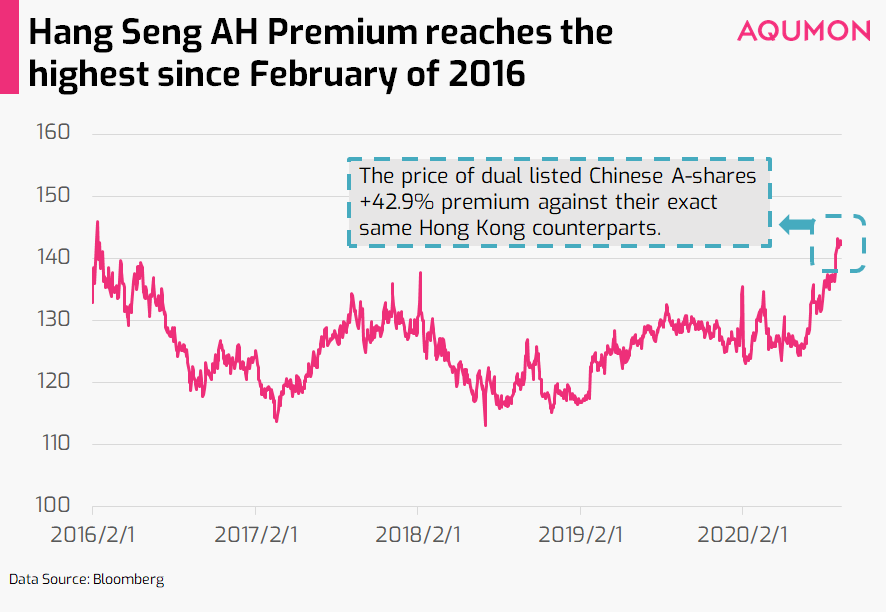

2) Hong Kong’s stocks look attractively valued relative to a-shares:

With China’s CSI 300 index outperforming Hong Kong’s Hang Seng index by an enormous +27.24% as of Tuesday investors both in mainland China and overseas will give Hong Kong’s stocks a good hard look from a value angle. If we look at the Hang Seng AH Premium index (tracks the price premium of dual listed Chinese A-shares against their exact same Hong Kong counterparts) the +42.9% premium is the highest we have seen since February of 2016:

So for investors that are looking for a technology-orientated regional stock market along with being reasonably (or maybe even cheaply) valued, Hong Kong’s Hang Seng Index seems like an attractive choice.

So what should investors do?

1) Investors need to manage their portfolio’s risk:

Via diversification, what they invest into and how much they invest. These are all factors you can control (unlikely trying to time the market). As we mentioned volatility may be heightened ahead so managing risk is something you should be aware of. Why?

Beyond market unknowns we see very heavy options usage in the market not only by the recently revealed ‘Nasdaq whale’ Softbank but also realistically by retail investors. An option is a contract giving the buyer the right, but not the obligation, to buy or sell an underlying asset (a stock or index) at a specific price on or before a certain date. Basically it allows you to make a ‘bet’ on the future direction with minimal investment (versus buying the stock/index outright). Even though Softbank may be vilified by buying US$4 billion (~HK$31 billion) worth of such options on tech stocks, recent research suggests similar bullish options usage by US retail investors amount to over US$40 billion (~HK$310 billion)! Although this points to the positive outlook investors have on markets, if these complex products unwind in a hurry it could cause unusually large pullbacks or heightened volatility. So don’t forget to manage your risk.

2) Look deeper and understand what is driving markets:

The best way to reduce our fears (and minimize poor decision making) is knowledge and understanding. As an experienced investor we view the recent pullback and rotations as a healthy development in the market (versus the alternative of everyone just buying into 1 singular sector). As a longer term investor, pullbacks like what we’ve seen in September so far has happened many times in the past and will continue to happen many more times down the road. This is not abnormal.

As we’ve been mentioning to investors when looking ahead volatility will likely be higher so managing your portfolio’s risk is your #1 priority. Even though we agree investors can use this opportunity to accumulate, they should also leave some bullets on the side (say for every $10 you want to invest, put in $2-3 first) with the intention to invest more if we see further weakness in markets. May seem a little scary but it really makes sense to truly ‘buy low and lower’ for the health of your long term investment portfolio.

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.