Why Investors Shouldn't Fear but Cheer for Halloween

Written by Ken on 2020-10-23

Last week, global financial markets hovered back and forth on monetary stimulus hopes, with returns ending up quite mixed regionally speaking. The US’ S&P 500 was +0.19% last week and +7.83% year to date; the Euro STOXX 50 in comparison was -0.84% last week. Hong Kong and China markets saw positive uplifts of +1.11% and +2.36% last week.

AQUMON’s diversified ETF portfolios were +0.03% (defensive) to -0.17% (aggressive) last week and +2.35% (defensive) to +5.84% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio, with more regional exposure to Hong Kong/China, was +1.16% (defensive) to +10.10% (aggressive) year to date. Last week’s main portfolio drivers were Chinese stocks (+1.90%), US technology stocks (+0.98%), and US investment grade bonds (+0.14%); all other assets remained pretty muted last week.

With Halloween right around the corner on October 31st, we think there are a lot of interesting parallels between Halloween and the current condition of the financial markets we could address this week. For example, did you know there is something called the “Halloween Effect” in investing? Read on to learn more.

Based on history, investors should not fear but instead cheer for Halloween

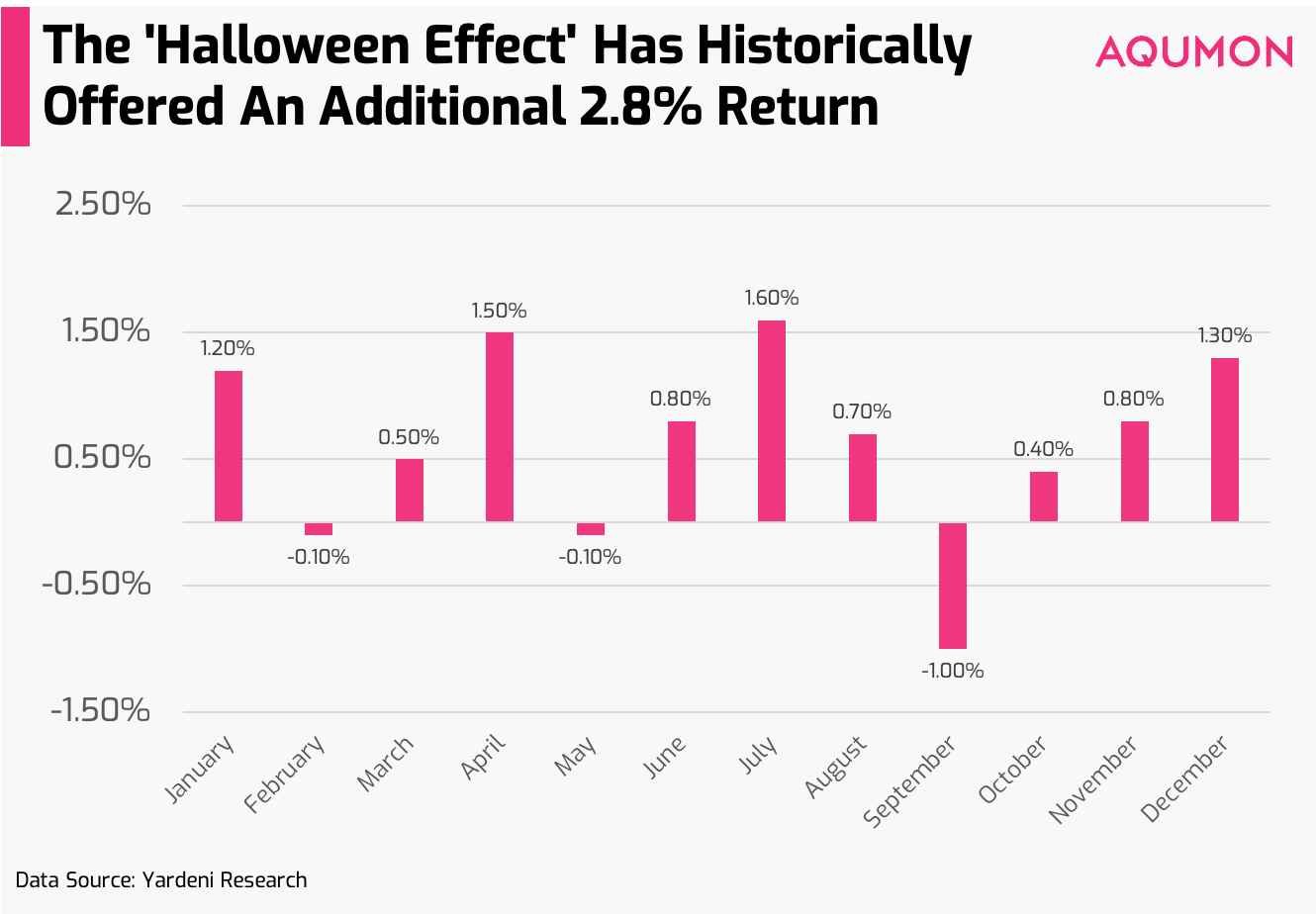

The “Halloween Effect” is the tendency for financial markets to perform better from November to April (6 months post Halloween) than in other months. If we look closer at the performance of the US’ S&P 500 index over the past 92 years (from 1929-2020) from November to April, you would see +5.2% return versus +2.4% from May to October:

Why is there such an effect? Although it is hard to pinpoint one exact reason, in 2002, Sven Bouman of AEGON Asset Management in The Hague and Ben Jacobsen of Erasmus University Rotterdam argued in their research paper: The Halloween Indicator, Sell in May and Go Away that there was a cyclical reason for this happening due to traders traditionally closing or reducing their investment positions during the summer months. Bouman and Jacobsen found that this was not isolated to just the US stock market; the Halloween Effect is global in nature, applying to 36 out of the 37 financial markets they looked at.

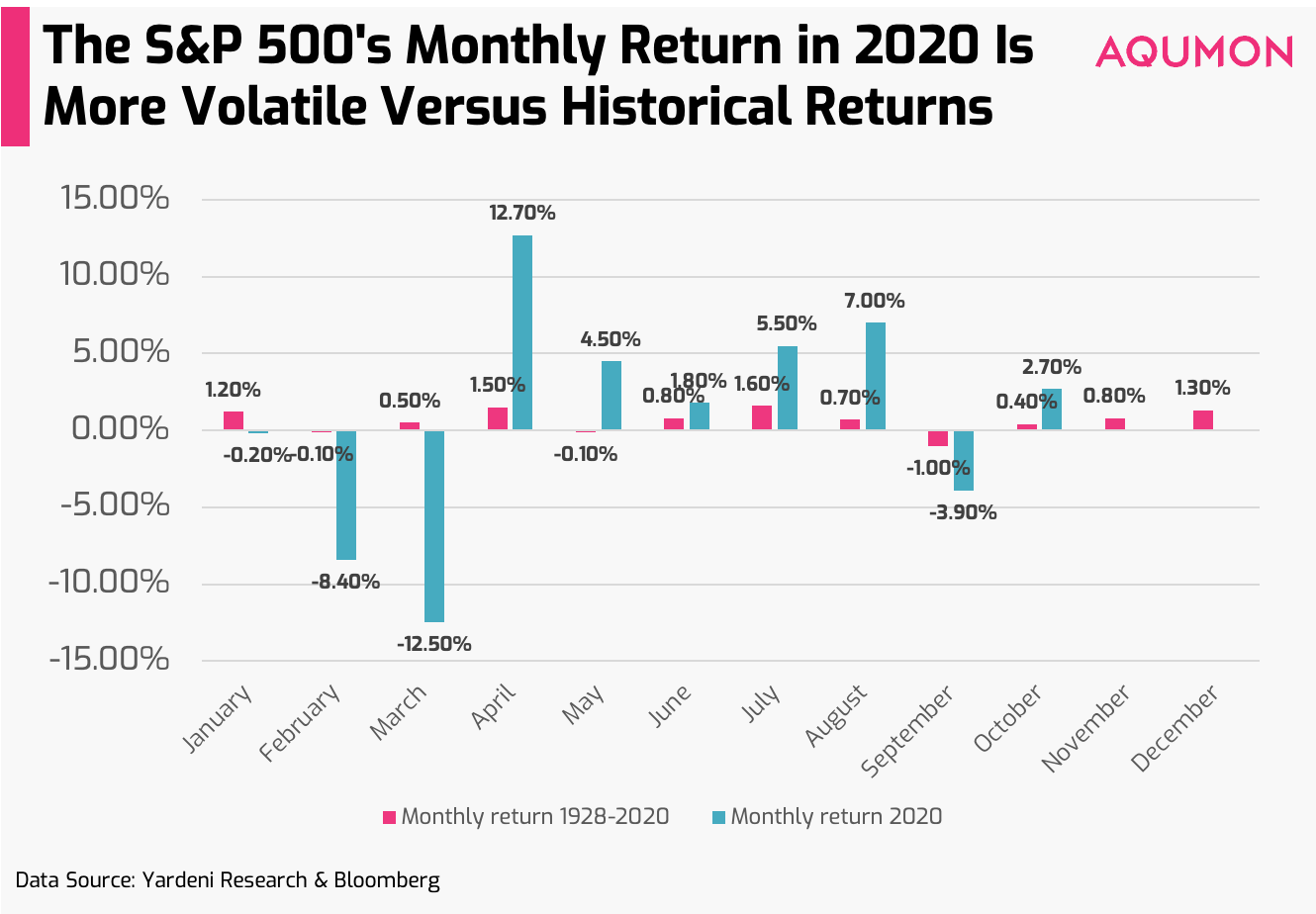

So the big question our readers will naturally ask is does it apply to 2020? Here you can see the S&P 500 index 2020 monthly returns charted against the average returns from 1928-2020:

Looks quite different right? What are the few takeaways investors should be aware of:

1) Market volatility is higher in 2020

What we told investors at the start of 2020 about greater volatility (more extreme gains/losses) has rung true so far. Our suggestion to investors was that 2020 is a year where you would need to be carefully managing your investment portfolio’s downside risk, besides chasing returns. This was especially apparent early in the year in February and March when global financial markets like the MSCI World index dropped -35.24% from peak (February 12th) to trough (March 23rd) in just 29 trading days. What was equally surprising is that it only took 107 trading days (August 26th) for all its prior losses to be recovered. So those investors who stayed invested during the volatility and potentially even invested more were rewarded.

We envision that there is still upside in financial markets ahead, although we also caution investors to be aware that volatility will remain heightened until the end of the year. So if the markets do see a sudden pullback, it will likely be quick and sharp, followed by a potentially quick rebound.

2) Market upside is likely less from Halloween Effect

A big part of the Halloween Effect argument earlier was from the cyclical behavior nature of traders in the market, but logically speaking, investor behaviors and habits have changed significantly under COVID-19. In the past where investors went on holiday during the summer months are now replaced by everyone staying home and having nowhere to go on a vacation. So looking ahead we continue to believe the upside will come from (from short to medium term): 1) monetary stimulus and 2) economies reopening with a COVID-19 solution.

Will the US presidential election result be a ‘trick’ or a ‘treat’ for investors?

With the US presidential election happening in merely 11 days (November 3rd), many investors are turning to the poll results to analyse the potential winner and how they would impact markets. As the readers of our blog know, election results barely matter to long-term investors. Since 1929 and during 16 different US presidencies, the S&P 500 index has delivered an average annual returns of +10% regardless of who is elected as president. Furthermore, we caution investors to be careful about using popular polls to ‘predict’ the winner.

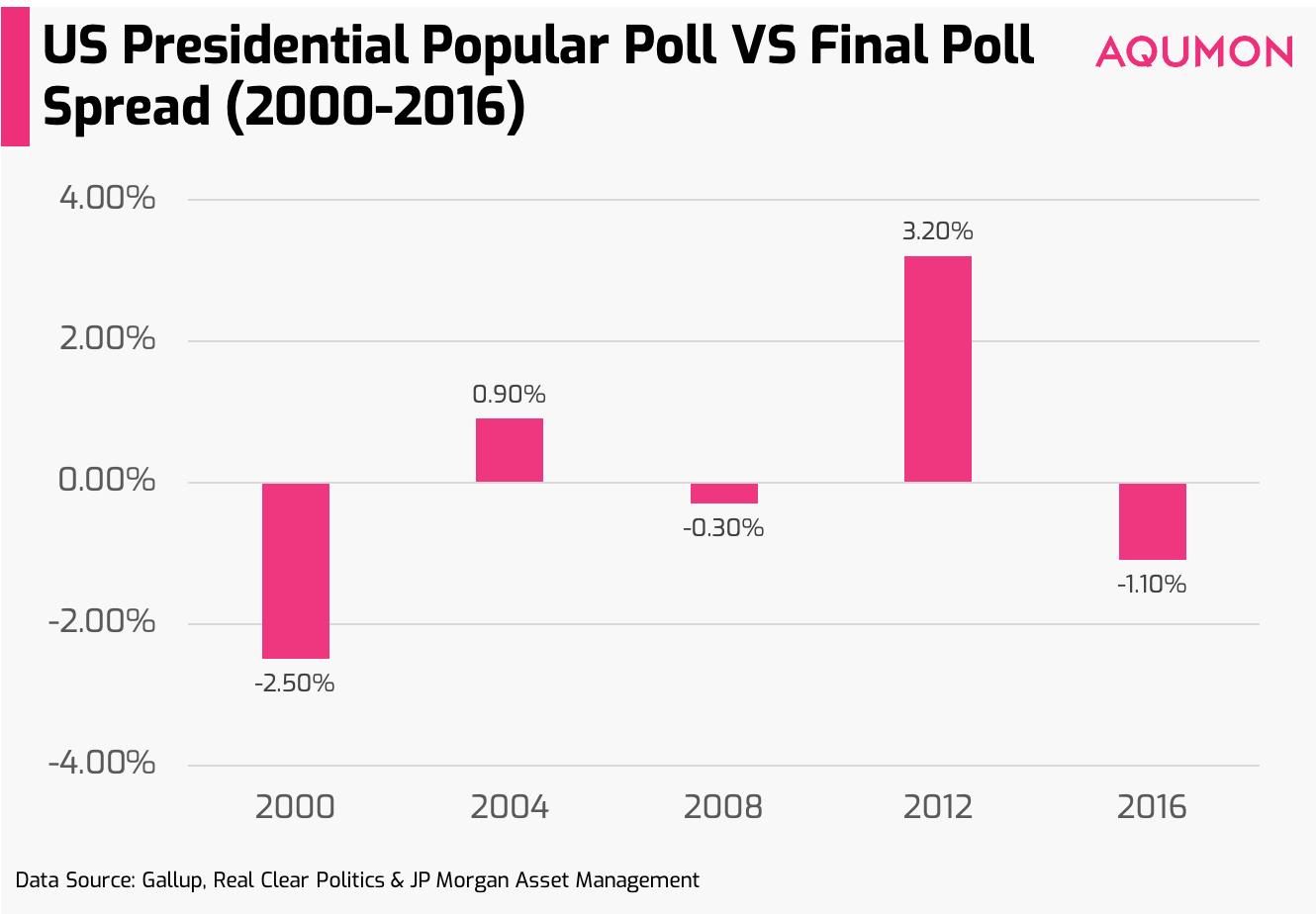

JP Morgan, Gallup and Real Clear Politics did a pretty decent analysis looking at the popular poll results in the past 10 years against how the winning presidential candidate fared in the final popular vote. So if we look at the difference (between polls vs the final popular vote results), the range was generally -2.5% to 3.2% for a ‘spread’ of 5.7%:

Furthermore, the most important thing investors need to be aware of is that the US presidential election is determined by the electoral college vote of 538 appointed electors and not directly via the majority of the American public. So even if a candidate wins the popular vote, they can still lose the presidency. We only need to look back at 2016 when the current US president Donald Trump won by 77 vote electoral vote margin (270 or more is needed to win), even though he lost the popular vote. Additionally, there is selection bias to consider when considering poll results. This does not mean polls are not useful but investors need to be aware there is a sizable margin for error and it is at best ‘a tool’ (and not a crystal ball).

In the spirit of Halloween, we do feel that a ‘treat’ is likely coming for investors in the form of more monetary stimulus by the US government, regardless of whichever candidate wins. What investors should be aware of is although markets are hanging on daily to the progress of the US stimulus talks, we believe that this will not officially pass and be executed until after the November 3rd election. This is not a bad thing because financial markets are forward looking, meaning that if there is positive news, we will see a positive uplift in markets on the news (way before the average American sees the benefits from the stimulus).

So what should investors do?

Although we sound like a broken record, the key is to stay diversified in this current market to manage your portfolio’s downside risk (while positioning for upside/rotations) along with being ‘greedy’ when other investors are fearful. If you see sizable pullbacks and the cost looks attractive, it makes sense to carefully put in more money into the market as long as you are investing for the longer term.

If you have any questions, please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON. Stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.