Positive Outlook for 2021 but Watch out for Risks Ahead

Written by Ken on 2020-11-20

As global markets learned of more positive vaccine news, lagging regions lead the way with the EuroStoxx Index surging +7.12% last week and -8.36% year to date. In comparison the US’ S&P 500 index also gained +2.16% last week and +10.97% year to date. Local markets like the Hang Seng Index saw a minor uplift +1.73% last week.

AQUMON’s diversified ETF portfolios were -0.01% (defensive) to +2.31% (aggressive) last week and +2.38% (defensive) to +9.49% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio, with more regional exposure to Hong Kong/China, was +1.30% (defensive) to +12.38% (aggressive) year to date. Lagging sectors like energy stocks (+17.11%) and US small caps (+4.62%) were up strong last week.

Clients have been asking for our views rounding out 2020 and looking ahead into 2021 so we wanted to address these questions this week:

There are lot of positive catalysts as we enter 2021

Even though COVID-19 restrictions are raised once again this week in both overseas and Hong Kong, we continue to believe that upsides remain for financial markets particularly as we cross in 2021. Why?

1) Vaccine help is on the way

This past week we’ve seen promising phase 3 trial news from both Pfizer/BioNTech and Moderna, who said their vaccine was 95% and 94.5% effective respectively in fending off COVID-19. This was followed by Oxford-AstraZeneca Thursday who said in a phase 2 trial that their vaccine also showed promising preliminary results in both 18-55 year olds along with those above 56 years old.

Older individuals statistically have shown to be more susceptible to COVID-19 than younger individuals. This is all good news. We continue to believe there will likely be a wider scale rollout of vaccines to the general public before the middle of 2021.

2) Corporate earnings to recover as economies reopen

Even though most corporate earnings have been decimated this year, a combination of an effective vaccine(s) to reopen the economies coupled with low interest rates should make for a quick rebound in corporate earnings by Q2 of 2021.

Lower rates makes borrowing money cheaper which encourages both consumer and business spending, and in turn stimulates the economy. Stocks and risk assets will be the main beneficiary from this upcoming rebound in corporate earnings in 2021.

Regionally speaking, Asian economies and markets will likely recover quicker given relative to their western counterparts as they are already closer to normalcy even as we head into subsequent COVID-19 waves. A good litmus test, as we saw in Q3, is Asian corporate earnings are already quickly rebounding.

A recent survey of non-financial Asia corporates by Nikkei Asia found Chinese corporate net profits great by 43% year on year and outpaced their Asian counterparts by 9%. Investors heading into 2021 should consider higher allocation to Asia assets since they are better positioned from a region perspective.

We continue to be constructive on the market outlook into 2021 and for longer term investors suggest that they accumulate if they see bouts of market weakness heading into next year.

Until 2021 investors should be more careful with their portfolio’s downside risk

Even so, we are not oblivious of the recent market volatility and suggest investors to more carefully manage their risk as we head into year end. There are a few reasons for this:

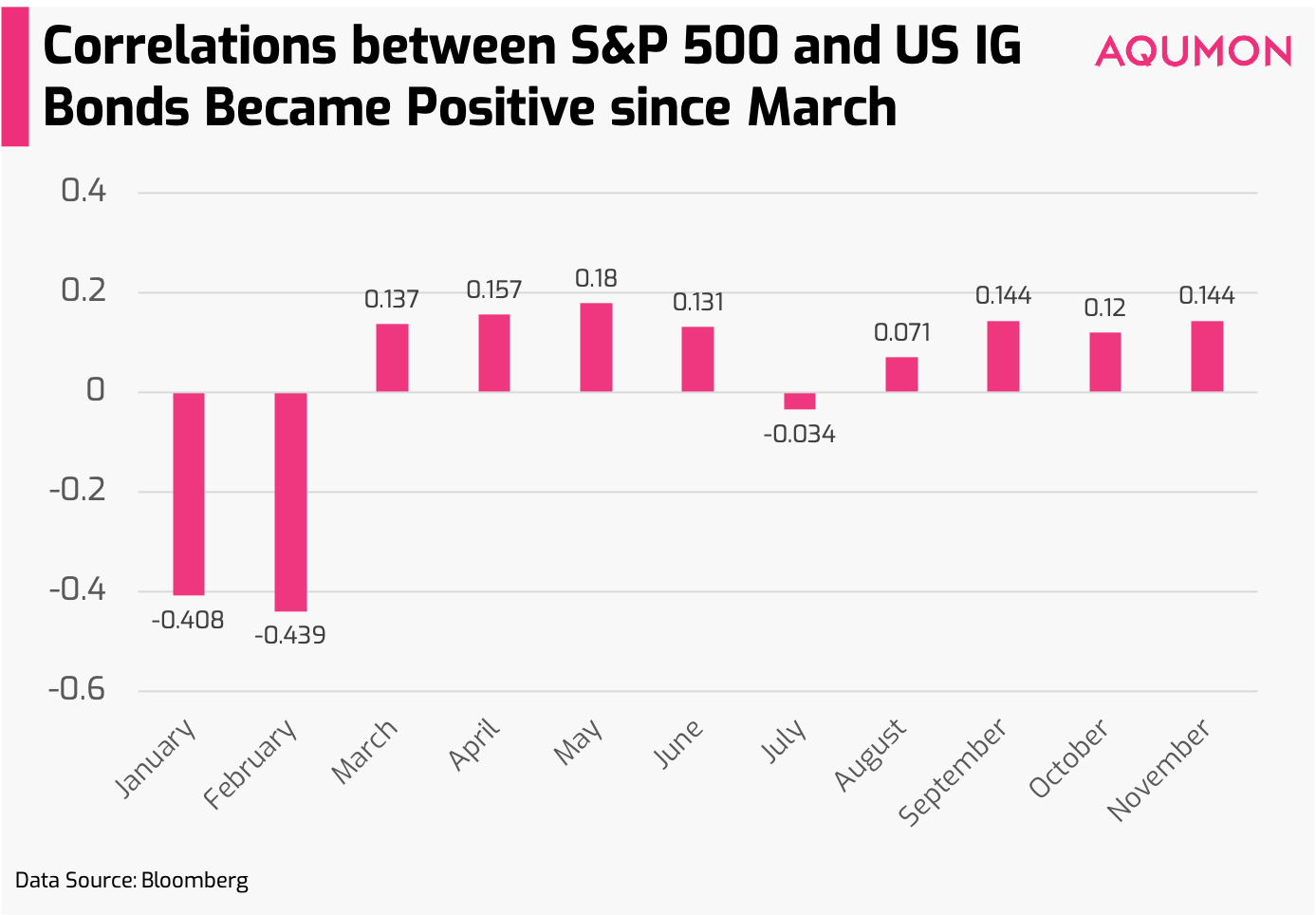

1) Asset correlations remain high

Traditional inverse relationship asset classes like certain stocks and bonds turned positive during March this year. Therefore, during recent market sell-offs, there were situations where bonds also sold off as well (as we saw in March, August and October).

When looking at the S&P 500 against the US invest grade bonds, you can see a major spike in correlation in March:

Traditionally speaking, stock prices go down and bond pricing should go up. This is not really the case anymore.

What should investors do? There’s two things to consider such as in the short term either allocate more into stocks or into bonds (so be less balanced) or utilizing more cash instead to offset future potential selloffs.

It’s widely understood that cash depreciates over time and is not beneficial for your investment returns. But if your goal is to minimize investment risk, then it could be something to consider in current conditions. Just make sure you are also aware major currencies like the US dollar is down 4.68% in 2020 and the outlook is it will continue to weaken so even cash has its risk as well.

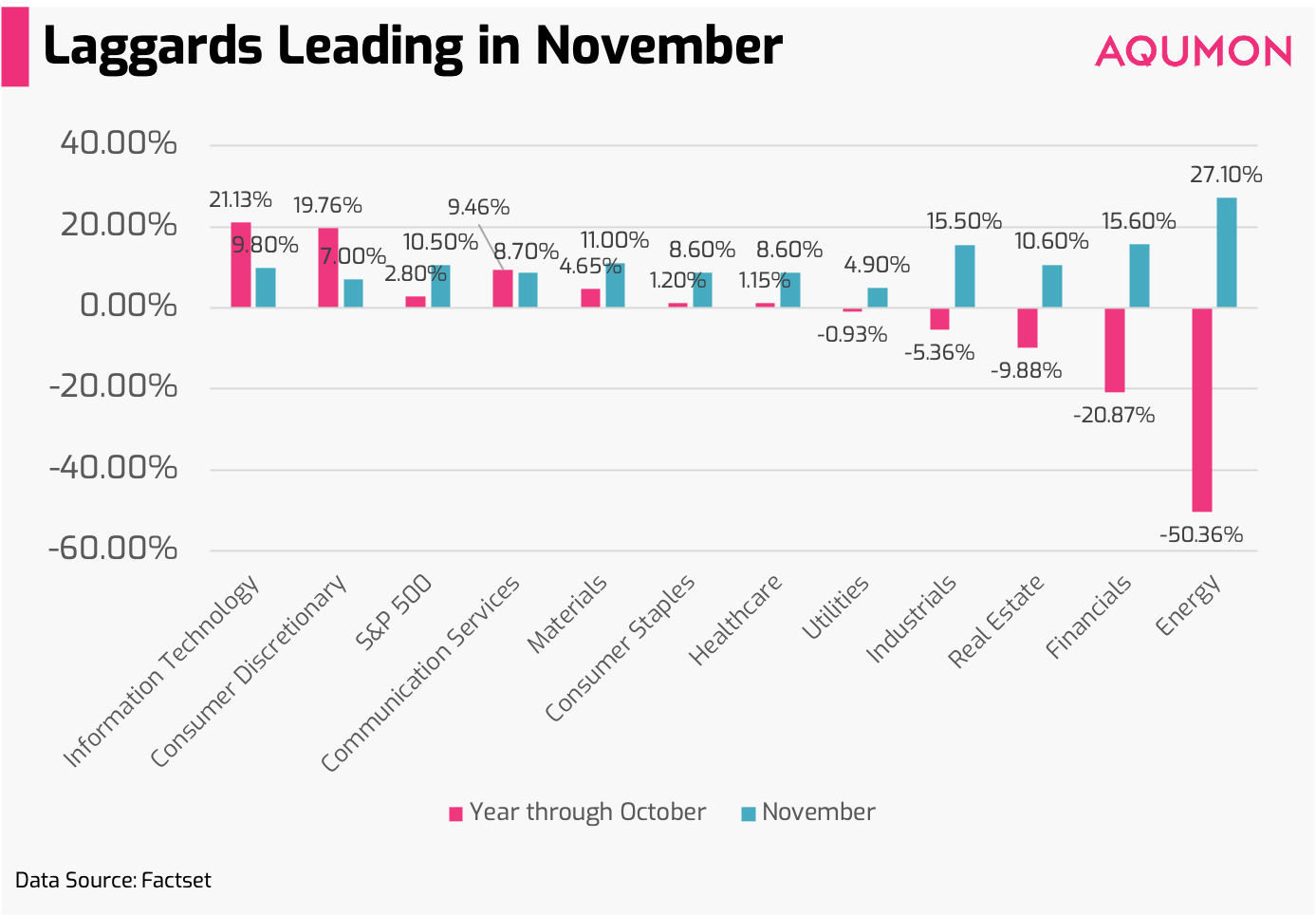

2) Rotation into lagging cyclicals from technology...and back

In November so far, we see laggards have led the way over technology stocks with +7.7% outperformance:

As we mentioned last week, lagging cylicals are still finding their legs. We even saw multiple rotations to and back from both sectors this week -- investors remain undecided between pandemic winners (technology companies) versus post-pandemic winners (cyclical laggards) as we receive more positive vaccine news, suggesting the light at the end of the economic reopening tunnel may be closer. This constant rotation will continue to happen into 2021 and keep volatility elevated for investors.

Furthermore, when looking at vaccine news beyond the initial market surge from the Pfizer news, subsequent vaccine news did little to uplift markets. This would suggest it is possible a sizable portion of the vaccine-related ‘good news’ may be priced into the market and we’ll need a bigger breakthrough to move markets.

These are a few reasons, even though we are positive on the market when looking ahead into 2021, that we ask investors to more carefully manage their portfolio’s risk as we round out 2020. For long term investors like us, we’ll be systematically accumulating if we see markets weaken ahead.

If you have any questions, please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON. Stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.