Money Moves to Make Before 2020 Ends

Written by Catherine & Jobie on 2020-12-04

2020 has been a roller coaster for every one of us – if you can’t wait for it to be over, you are certainly not alone! 2021 is right around the corner, which means it’s time to reflect and ask yourself: Have you made the proper moves to be financially successful this year?

Maybe you rocked it or maybe you didn’t, but that doesn’t mean you can’t finish the year strong! Here are some money moves that you must take (if you haven’t already) before the year ends to set a solid foundation for the year coming!

1.) Review and be SMART with your financial goals

Before setting new financial resolutions for next year, block a few hours to review the status of the goals you set this year – see what’s working for you and what’s not on track. This will help you prioritize your goals for the new year.

Ask yourself: Did you meet the goals? Why/ why not? Which area did you succeed or struggle? What should you do better next year to ensure a better outcome?

Now that you have a better understanding of your saving and spending habits, it's time to create an action plan to continue accumulating your wealth in the next year! Don’t forget to be SMART with goal setting!

- Specific - Well defined and clear

- Measurable - with specific criteria that measure your progress towards that accomplishment of the goal

- Achievable - attainable and not impossible to achieve

- Relevant - within reach, realistic, and relevant to your life purpose

- Time-bound - with a clearly defined timeline (include a starting date and a target date) to create a sense of urgency

(Source: Corporate Finance Institution)

2.) Financial pyramid: How to budget

All factors should be taken into account when it comes to financial planning. Saving for retirement might be one of your goals, but if you don’t have a plan for emergencies then sipping martinis on the beach when you retire will forever be just a dream of yours.

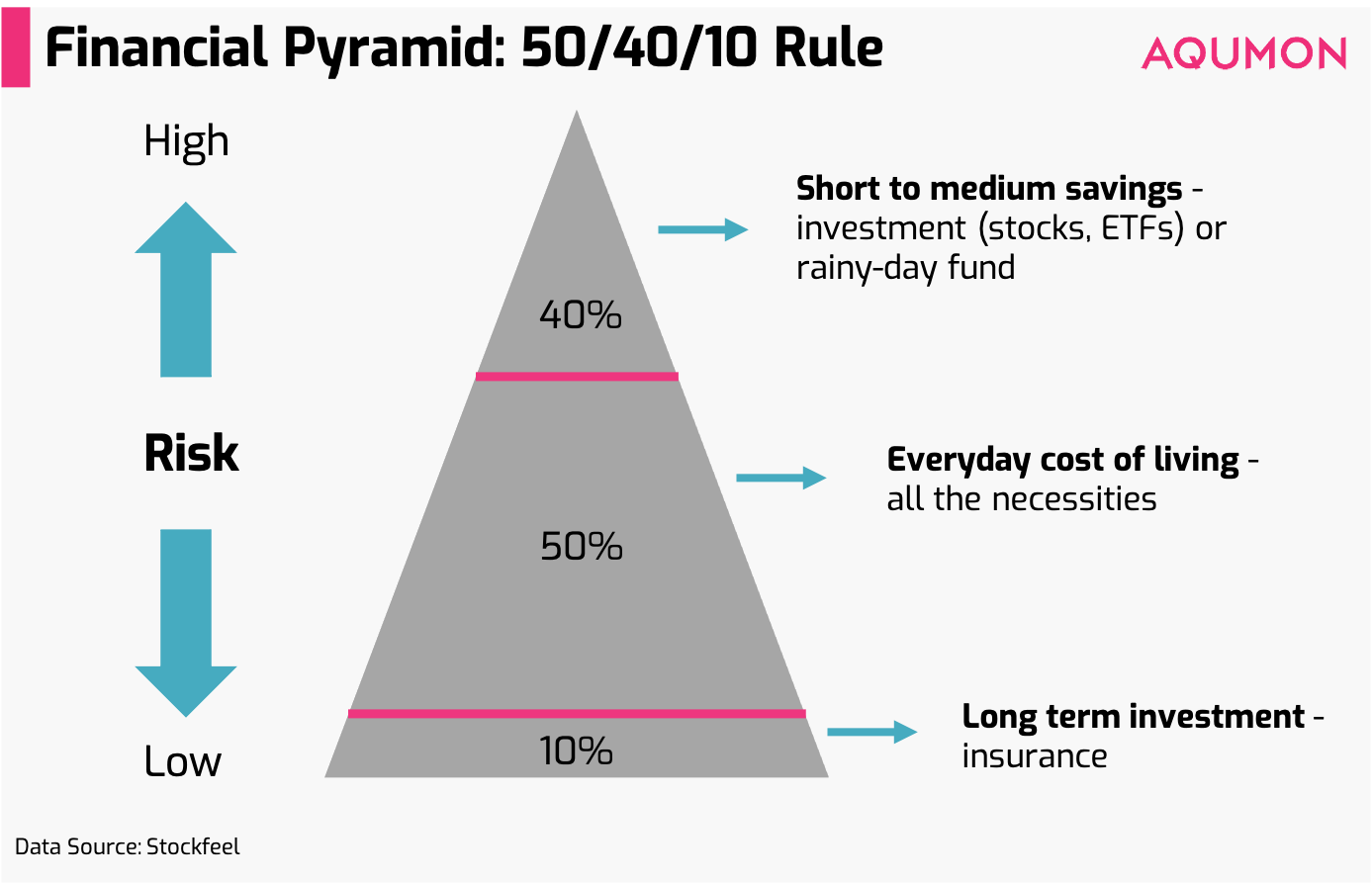

Think of building your wealth as a pyramid as you are doing your financial planning. The financial pyramid follows the 50/40/10 rule; this approach has you divide your income into three parts: 50% for everyday cost of living, 40% for short to medium savings, and 10% for long term investment.

The 10% is considered as a protection piece. Insurance is essential for risk management as it acts as a safety net to catch you in any unforeseeable circumstances.

3.) Grow your wealth

Since we mentioned risk management above, let’s talk about investing! The upside of 2020 is that we spend less money on commuting, on lunches/ dinners out, or on vacations. If you find yourself with some extra cash on hand after reviewing your goals and expenses, now is the time to use it to your benefit!

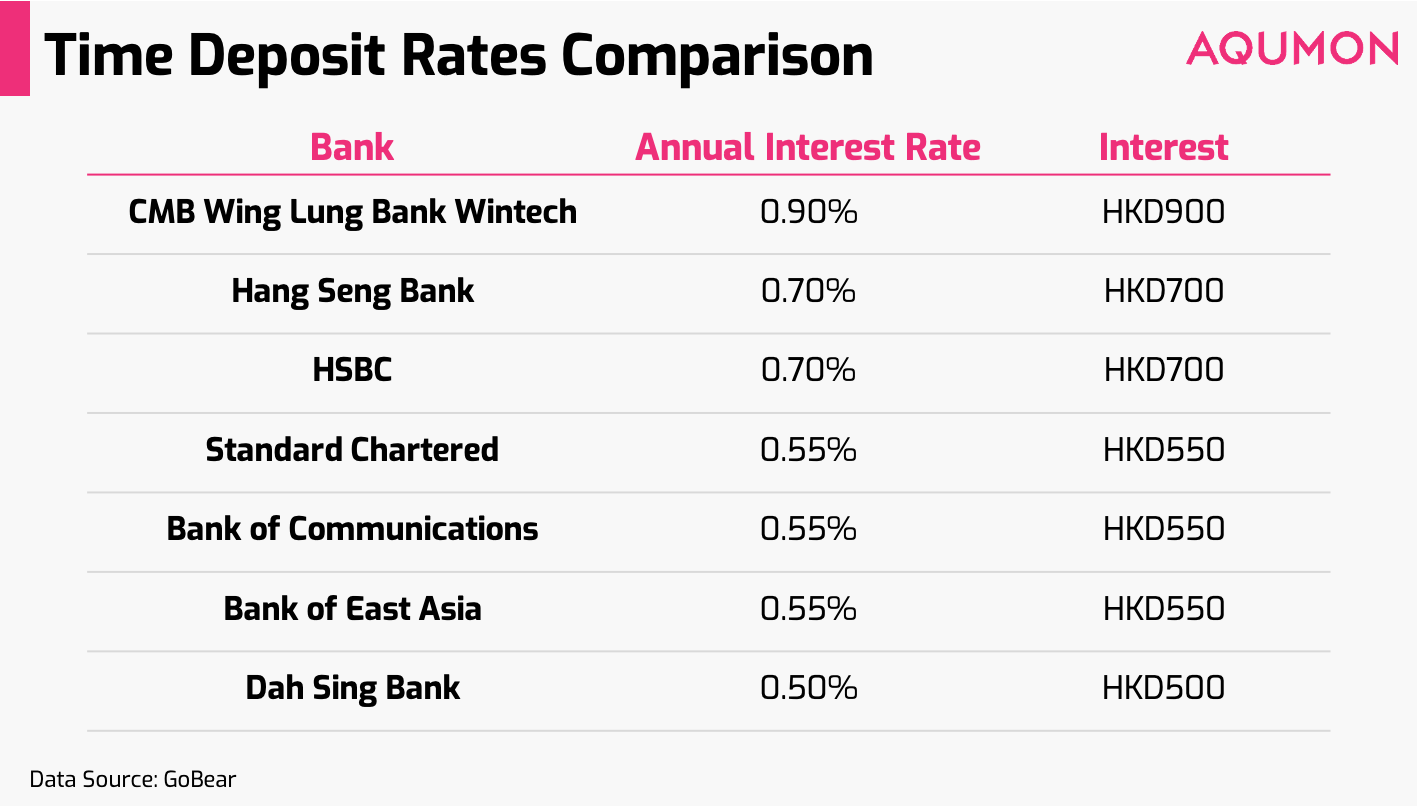

Saving alone is not enough to grow your wealth. Money sitting at the bank is not going to grow itself, so why don’t you try investing? A rather conservative option will be time deposits – though guaranteed stability, it gives you a relatively low return.

For instance, if you deposit HKD100,000 for 12 months, there is generally 0.1% to 0.9% annual interest rate.

Global asset allocation will be a great option if you are looking for investments with higher returns! It consists of 60% of stocks and 40% of bonds to diversify the market risks. Despite all the ups and downs in the market over the years, the annual return rate is between 6.39% to 7.7% on average*.

*source from http://www.lazyportfolioetf.com/allocation/stocks-bonds-60-40/

Want to try global asset allocation, but not sure where to start? AQUMON is here to help with a minimum investment amount of USD1,000! Our SmartGlobal Max Basic includes 5-6 US listed ETFs and had 5.44% to 6.63% return rate in the past year.

Though 2020 is coming to an end, it is never too late to start accumulating your wealth! Start investing with AQUMON today, and let us handle all the hard work for you.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.