2 Reasons to Consider More International Exposure in 2021

Written by Ken on 2020-12-14

With more mixed economic recovery news in the market last week, we saw diverging returns globally. The US’ S&P 500 index up +1.67% last week and +14.50% year to date. US technology like the Nasdaq index was uplifted +2.12% last week and +38.91% year to date. Conversely, Hong Kong stocks were down -0.22% and -4.80% respectively.

AQUMON’s diversified ETF portfolios were -0.01% (defensive) to +0.83% (aggressive) last week and +2.43% (defensive) to +11.58% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio, with more regional exposure to Hong Kong/China, was +1.30% (defensive) to +14.23% (aggressive) year to date. Beyond US and technology stocks, the biggest drivers last week were US small caps (+2.03%), emerging market stocks (+1.19%) and gold (+2.82%).

Some investors reached out to us after our recent Market Insights asking why their investment portfolios should be more internationally exposed next year so we’ll address this topic this week by listing 2 main reasons why:

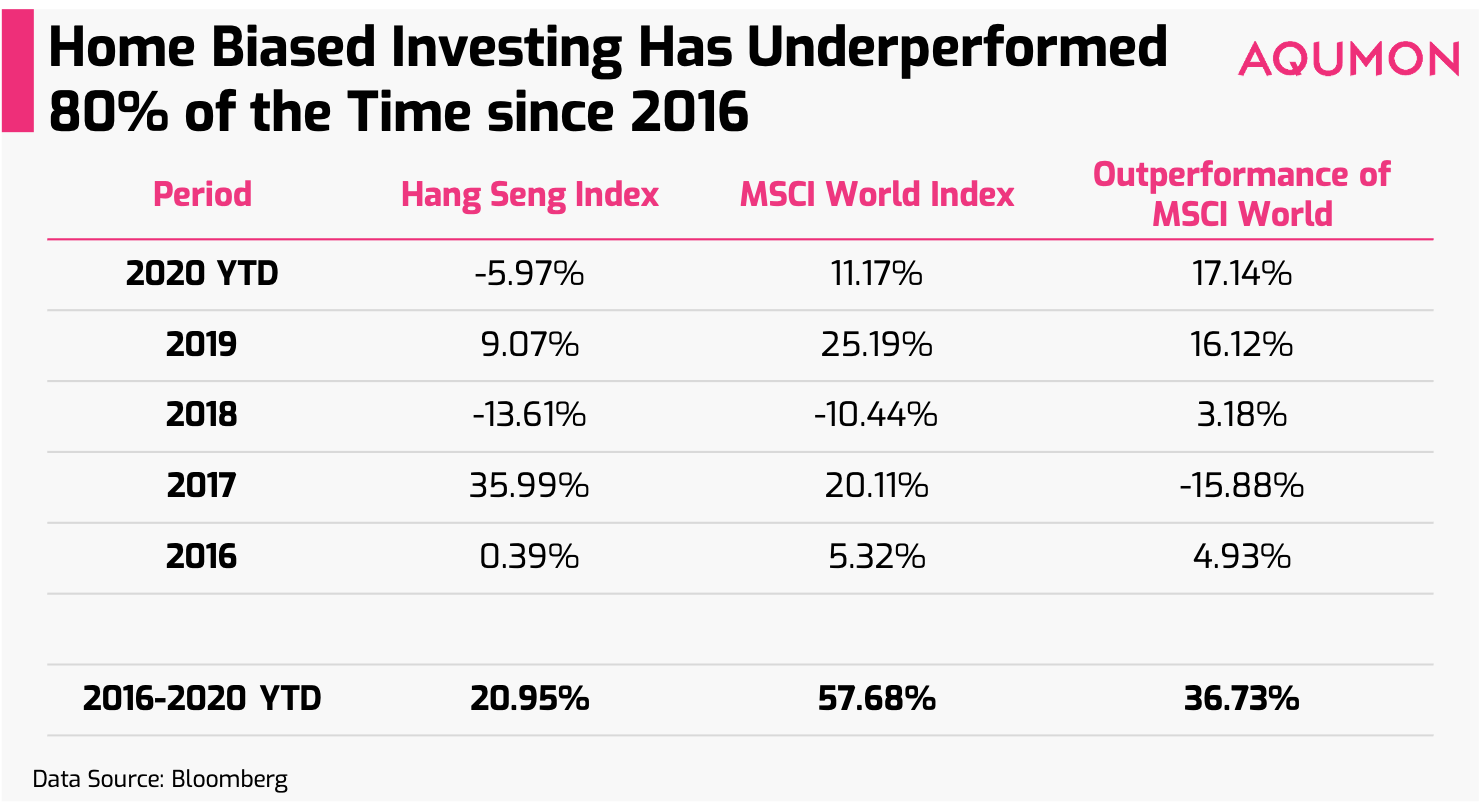

Staying home bias has not been favorable for Hong Kong investors

So how have investors performed investing localling in Hong Kong versus globally? If we are looking at broad markets, the outperformance of the MSCI World index versus Hong Kong’s Hang Seng index currently stands at +17.14% year to date! Actually if we look closely at the past 5 years being home biased has underperformed 80% of the time:

Does this mean investors shouldn’t invest in the Hong Kong market? Of course not, but it does mean unless Hong Kong investors are more selective, having international exposure in your portfolio is the easiest thing to do to both diversify your regional risk and as the return numbers suggest, capture more return upside. We’ll talk a little more below why specifically it makes sense to get more international exposure at this present point in time.

This doesn’t mean all is lost for the Hong Kong market. For example, we look favorably upon the recent influx in local IPOs which we feel will be a catalyst to drive both Hong Kong stock pricing and investor appetite up in 2021. Since most of these companies are technology orientated growth companies, carefully adding local tech exposure we feel is beneficial for home-based clients’ portfolios in the new year.

Increasing your international exposure allows you to better capture the rotation into cylicals

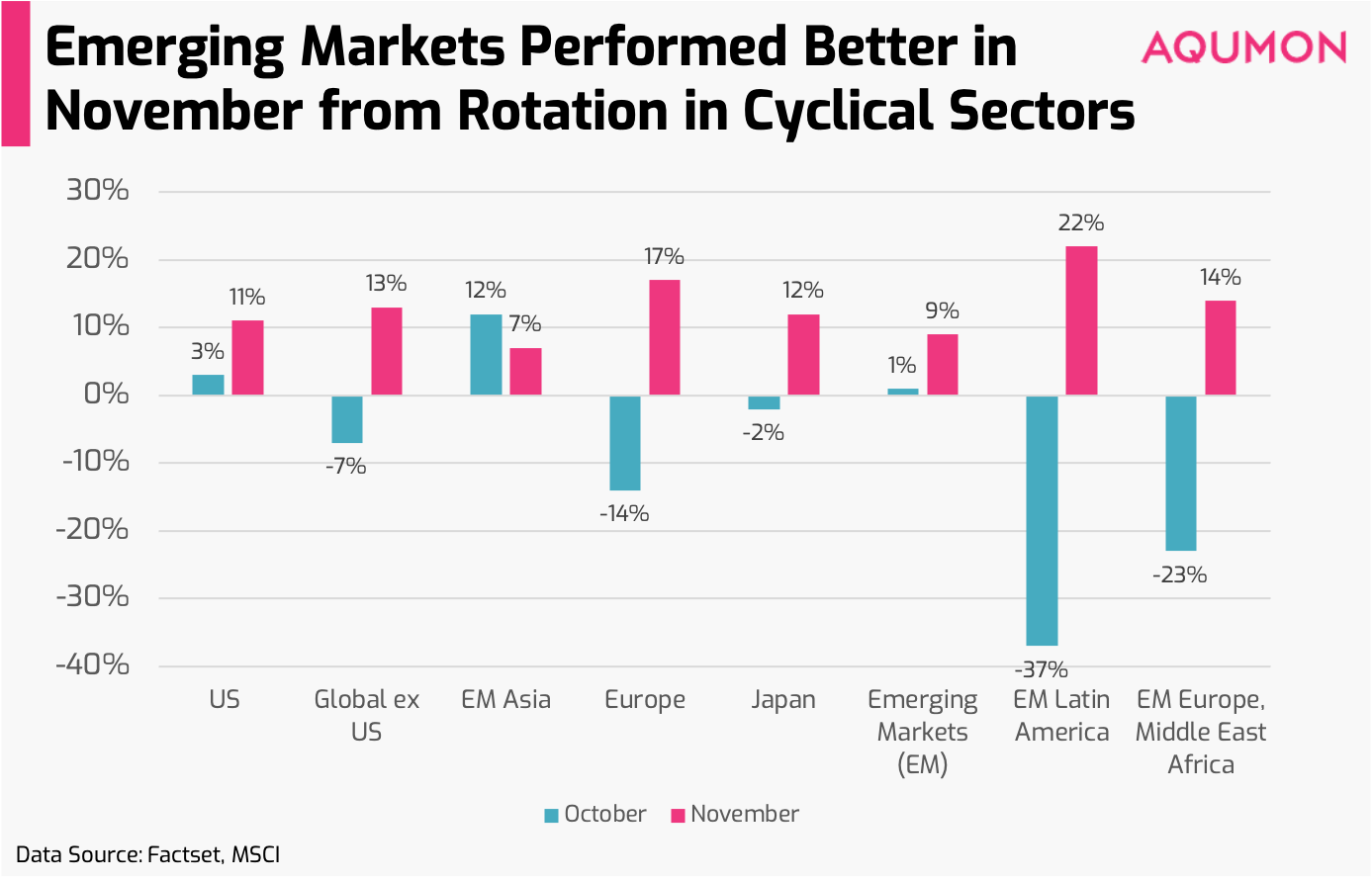

Even though global markets staged a record breaking comeback in November, with the MSCI World Index +12.66% last month, regional returns were very diverging the past 2 months with US and emerging markets (EM) Asia leading the way in October and while in November most emerging markets outperformed instead:

What was the reason for this? If looking closer behind the numbers, we find a big reason is due to the makeup of the companies in each region. Specifically we find that US and EM Asia have more exposure to growth orientated sectors while other regions are more tilted towards cyclical sectors (e..g materials, industrials, financials consumer discretionary etc):

Beyond the cyclical sector playing ‘catch up’ after lagging performance wise most this year, the other main reasons why we are seeing outperformance is traditionally speaking cyclical sectors do better during periods of earnings growth (which we are positive on heading into 2021) and are what most analysts would call economic recovery plays.

So as our global economies further recover from COVID-19, we feel international exposure will help investors better capture the upside from the investor rotation from growth into cyclical sectors. This coupled along with faster recovery from COVID-19 (particularly for Asia based markets), lower valuations and benefits from the continued decline of the US dollar in 2021 are reasons why investors should seriously consider gaining international exposure in their portfolios.

What are the top 2021 market risks on the minds of investment professionals?

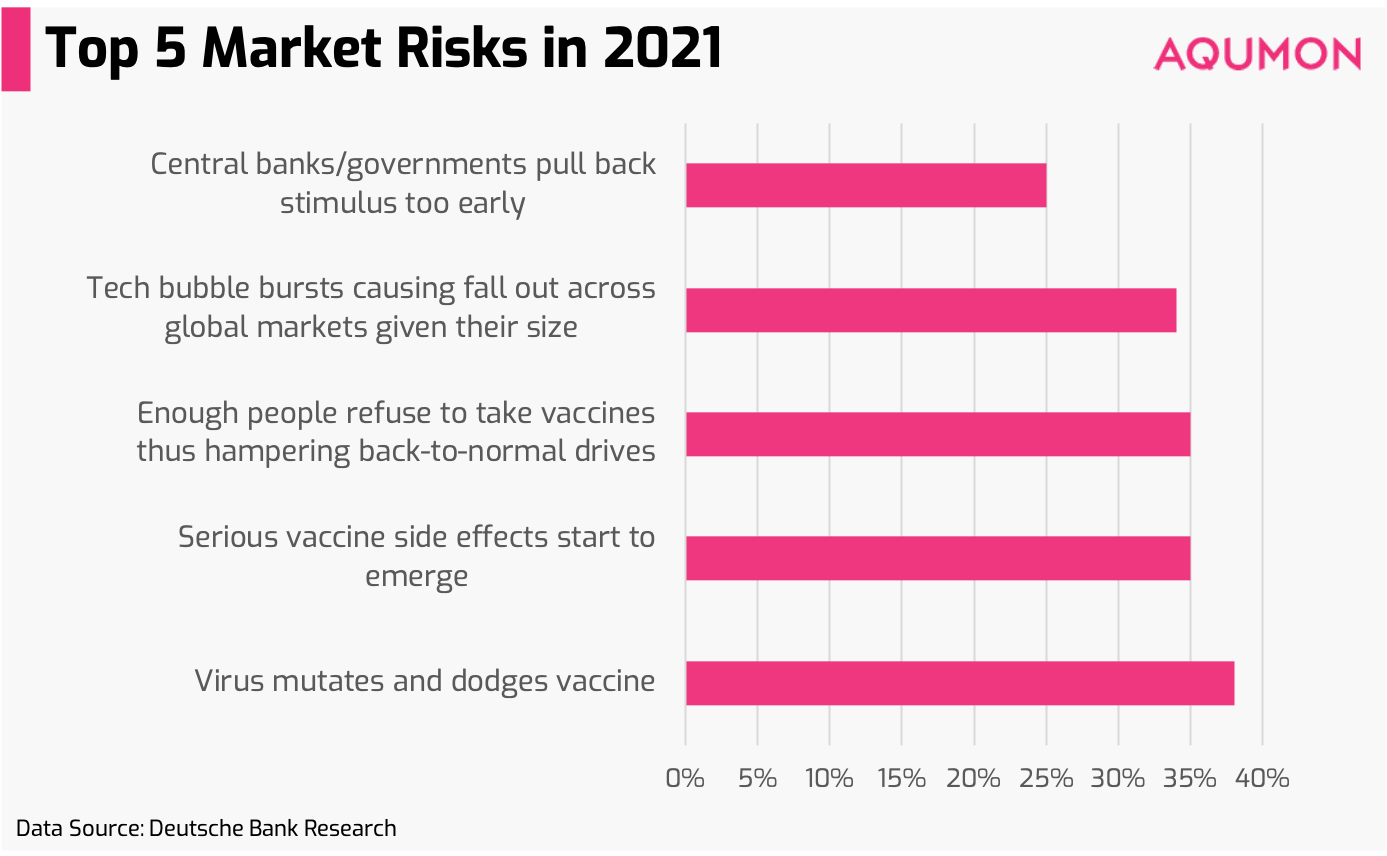

It logically goes without saying that COVID-19 is the top market risk continually concerning investment professionals in 2021 and has been for the past 8 months according to Bank of America’s monthly Fund Manager Survey. Unfortunately, this actually doesn’t tell investors very much. For example specifically what about COVID-19 concerns the investment community? The research team over at Deutsche Bank attempted to answer this week by surveying 984 investment professionals and the results below quite telling (we’ve listed the top 5 out of 19):

Even though there has been a lot of positive vaccine news the past 2 weeks over 30% of investment professionals surveyed feel setbacks in both the vaccine’s effectiveness and implementation may be cause for concern. The risk on vaccine development related setbacks we think is easy to grasp for most investors. The risk of distribution and acceptance is where we feel most investors aren’t really thinking enough about. Why? In the US where we saw the earlier implementation of countrywide wearing of face masks also running into problems this could repeat itself when it comes to vaccine distribution and acceptance given the lack of trust decreasing towards government entities. Investors need to be aware that in order for the vaccine to achieve its desired effect, everyone on a city, country and even global level need to participate.

We clearly aren’t a pessimist (our market outlook for 2021 is still quite positive) but are also not oblivious to the odds that the development and rollout of COVID-19 will likely have more than a few bumps in the road. This is the top reason why investors need to better prepare their investment portfolios to ride out the volatility and also have exposure to both growth and cyclical sectors to account for setbacks in our economies reopening from COVID-19.

But a word of caution about the US technology sector. Given the sustained IPO euphoria with names like Doordash (DASH) and AirBnB (ABNB) both surging +85.79% and +112.81% on their first day of trading this week the US technology sector does feel ‘frothy’ even though valuations are only elevated (but not in bubble territory). With further investor rotational into market laggers extending into 2021 coupled with potential profit taking pressure in tech we would not be surprised to see more pullbacks (not an outright crash) ahead for the sector in the next few months.

Shorter term investors obviously should be a little more cautious and longer term investors like ourselves will carefully accumulate when we see pullbacks. As we continually communicate to our investors, we are still constructive with financial markets in 2021 (particularly in Asia stocks and cyclical sectors but investors may need to hold a little more cash in the place of bonds with bond correlations heightened against stocks).

If you have any questions, please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON. Stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.